38 understanding your paycheck worksheet

Hint: A way to double check your work is to add your deductions and your net income. If they do not equal your gross income, then you need to recalculate. Joe works the same amount of hours each month. Joe worked 80 hours in the last pay period and he earns $12 per hour. Joe's gross pay= 80 hours x $12.00 1. $_____ across from "Regular Pay" and have the students do the same on their copies. • Explain that because this is his first paycheck, the amount that John received for this pay period is the same as the year-to-date (YTD) amount. • Under "YTD," enter $240 across from "Regular Pay" and have the students do the same.

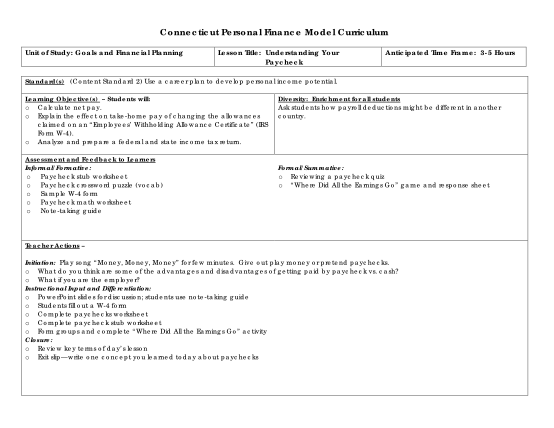

Showing top 8 worksheets in the category - Understanding Your Paycheck. Some of the worksheets displayed are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen ...

Understanding your paycheck worksheet

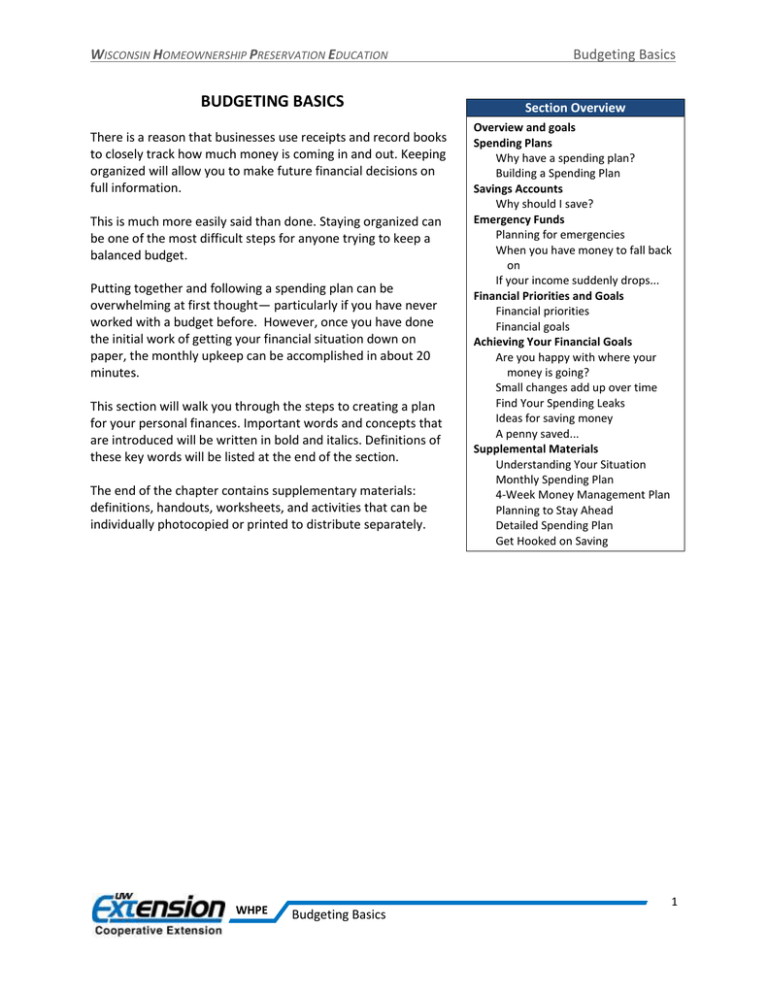

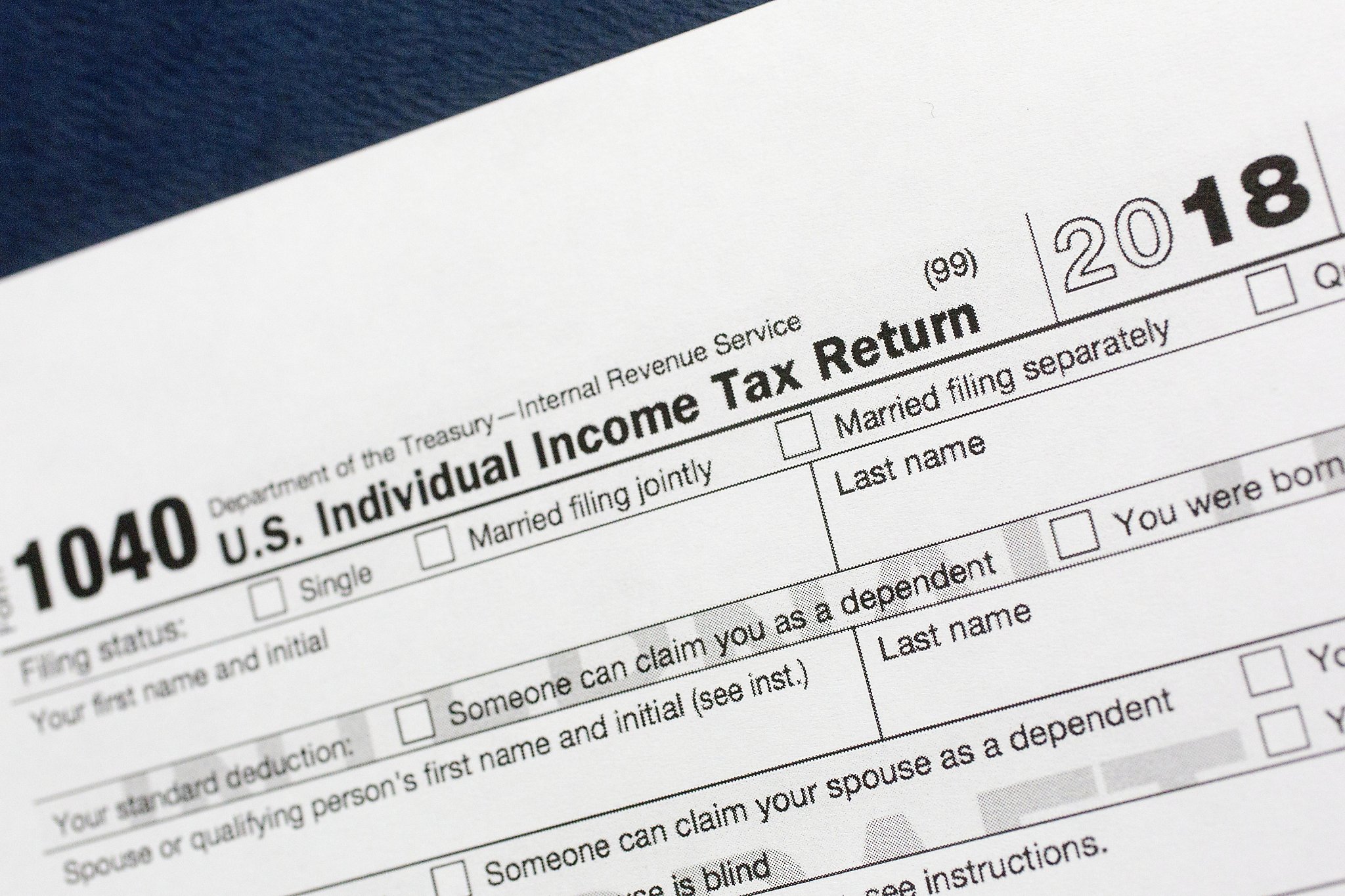

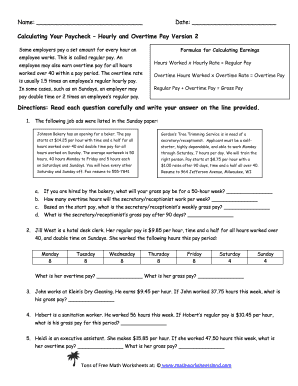

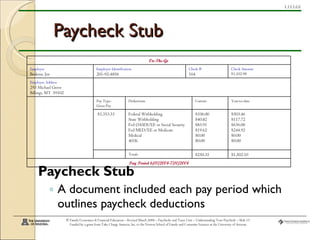

Understanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Employers withhold (or deduct) some of their employees' pay in order to cover . payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits. The amount of money you Directions: Answer the following questions to help provide the information for the paycheck. Hint: A way to double check your work is to add your deductions and your net income. If they do not equal your gross income, then you need to recalculate. Joe works the same amount of hours each month. Top 10 Tips for (1) Understanding Your Paycheck 1. Examine your gross pay. 2. Study the types of deductions. 3. Identify federal income tax deductions. 4. Identify Social Security deductions. 5. Identify state income tax deductions. 6. Identify local income tax deductions. 7. Identify retirement deductions. 8. Identify insurance deductions. 9.

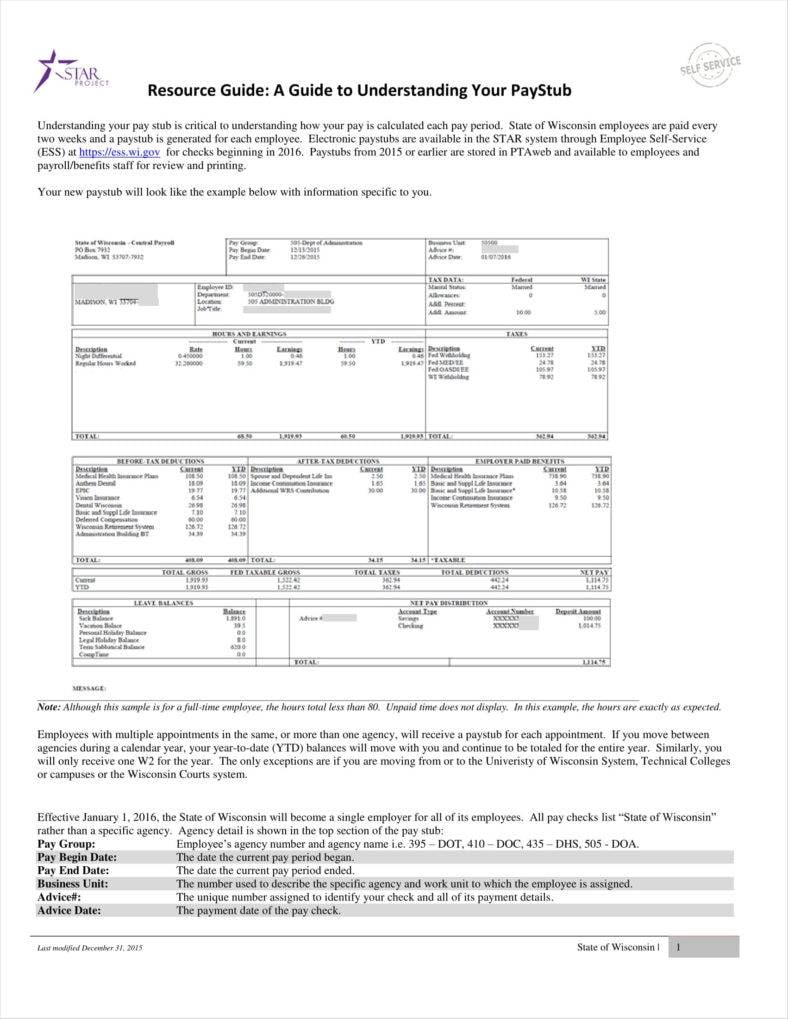

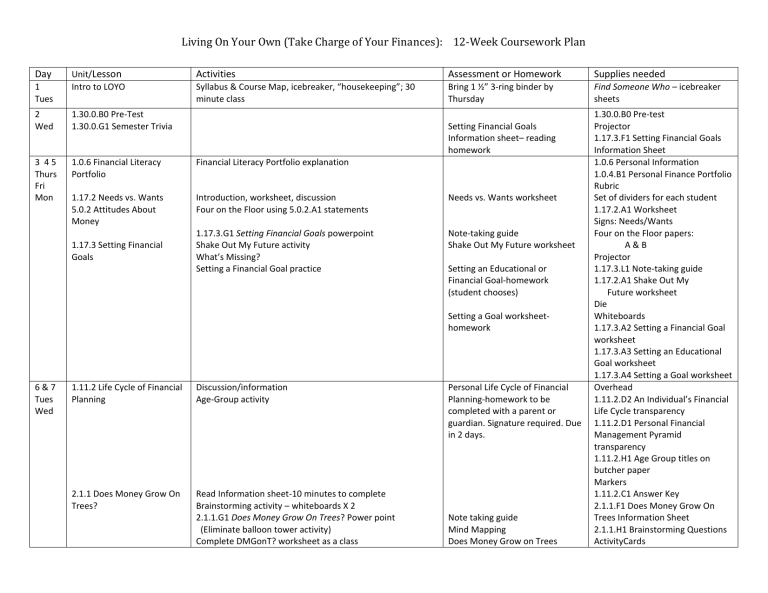

Understanding your paycheck worksheet. Your pay can be calculated in a number of ways – make sure you know which way it ... A document included each pay period which outlines paycheck deductions ... 5. Pass out Understanding Your Paycheck Worksheet information sheet 1.13.1.F1. 6. Have student’s correct their note taking guides using the Understanding Your Paycheck information sheet 1.13.1.F1. 7. Use a transparency of Paycheck Stub 1 1.13.1.A2 and fill out the parts as a class. For additional practice pass out Paycheck Stub 2 1.13.1.A3. 8. Family Economics & Financial Education Paychecks and Tax Forms Take Charge of your Finances Where Does My Money Go? Almost 31% of an individual’s paycheck is deducted Taxes are the largest expense most individuals will have Therefore, it is important to understand the systematic deductions U.S. tax system operates on an ongoing payment system Taxes are immediately paid on income earned ... Gross pay is your earnings before deductions, and it should always correspond with your salary amount. 3. Net Pay: The net pay is the amount of money you earn after deductions are subtracted from the gross pay. The net pay is the amount paid with your paycheck, whether by direct deposit or with an actual check. 4. Taxes: The taxes deducted from ...

It's Your Paycheck! is designed for use in high school personal finance classes. The curriculum contains three sections-"Know Your Dough," "KaChing!" and "All About Credit." The lessons in each of these sections employ various teaching strategies to engage students so that they have opportunities to apply the concepts being taught. some of the worksheets for this concept are understanding taxes and your paycheck, understanding taxes and your paycheck, its your paycheck lesson 2 w is for wages w 4 and w 2, understanding your paycheck, nothing but net understanding your take home pay, understanding it managing it making it work for you, my paycheck, teen years and adulthood … 1.13.1.A2 Worksheet © Family Economics & Financial Education – Revised May 2010 – Paychecks and Taxes Unit – Understanding Your Paycheck – Page 14 Consumer Financial Protection Bureau

People also ask understanding your paycheck worksheet answer key. What are deductions on pay stub? Payroll taxes and other deductions reduce their earnings. The pay stub itemizes deductions so that employees can see amounts taken from their gross pay. Like gross pay, taxes and deductions are separated into two categories. Explain to students that they'll work in teams to complete the worksheet, determining whether each statement is true or false. ▫ Let students know that if they ... 1. deductions (n): money that is subtracted or taken out from your pay 2. federal taxes (n): a percentage of an employee's wages that goes to the federal government 3. gross pay (n): the amount of money in an employee's paycheck before any deductions have been taken out 4. net pay (n): the amount of money left in an employee's paycheck after all the TAKE A TOUR OF YOUR PAY STUB COMMON ABBREVIATIONS Your pay stub is more than just proof of income. It allows you to better understand your personal nances and to make informed decisions when it comes to budgeting and tax time. Your pay stub may look a little di erent. Although all pay stubs contain the same basic information, the layout and wording

understand paycheck deductions taken out of a paycheck and what they are used for. The first step to understanding a paycheck is to understand the vocabulary associated with paychecks and the paycheck process. Employers pay their employees on a regular schedule known as a pay period. Most businesses pay

Understanding Your Pay Statement. Did you know that there is no standard form that employers must use to report pay information to their employees? Although there is a minimum amount of information that must be included, each company chooses its own format, abbreviations, and level of detail in reporting employee pay information.

1. Identify paycheck deduc-tions. 2. Learn the purpose of taxes. 3. Understand the difference between an employee and a contractor. 4. Learn financial terms. EPISODE SYNOPSIS What's on your pay stub? The Biz Kid$ learn about taxes and other deductions that are taken out of your paycheck. Meet some entre-preneurs who are independent

Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill

Joe worked 80 hours in the last pay period and he earns $12 per hour. Joe's gross pay= 80 hours x $12.00 1. $_____ Calculate Joe's Social Security deduction, which is 6.2% of his gross pay. Gross pay 2. $_____ (answer to #1) x .062= 3. $_____ Social Security deduction

Adulting — Lesson 125. Understanding Your Paycheck. Students receive a sample earnings statement and break down the different categories of information.

worker's paycheck is an important step toward gaining financial knowledge. Instructions. 1.Determine whether each statement is true (T) or false (F). 2.Provide an example or explanation with each answer. 3.If you're not sure, you can research the answers on the following webpages: §The consumer.gov webpage on taxes: https://www.consumer.gov/articles/1025-your-paycheck#!what-it-is

Gross pay is the larger of the two. Your gross pay is what you make before taxes and deductions. If you are an hourly employee, your gross pay is simply your hourly rate multiplied by the number of hours you worked. For a salaried employee, your gross pay is your annual salary divided by the number of paychecks you receive in a year (typically 26).

When you view your pay stub, you'll find two notable figures: your earnings (or gross pay) and your net pay. Your earnings is the amount of money you make based on your pay rate. After a number of taxes and deductions are applied, you're left with your net pay, or the money that's available to you on your paycheck.

Pay Stub Explanation Worksheet Attached to your paycheck is a pay stub that details what exactly happened to your salary. Items on the stub below have numbers that correspond to the explanations that follow. Strategy #7 • orking It Out: Take-Home Pay, Benefits, and TaxesW ORKSHEET 85 2 1. No.of regular hrs.worked: 40 Rate of pay:$8/hr. 2.

Comply with our easy steps to get your Pay Stub Worksheets For Students prepared quickly: Choose the template in the library. Complete all required information in the required fillable fields. The easy-to-use drag&drop interface makes it easy to... Check if everything is filled out properly, without ...

some of the worksheets for this concept are understanding taxes and your paycheck, understanding taxes and your paycheck, its your paycheck lesson 2 w is for wages w 4 and w 2, understanding your paycheck, nothing but net understanding your take home pay, understanding it managing it making it work for you, my paycheck, teen years and adulthood …

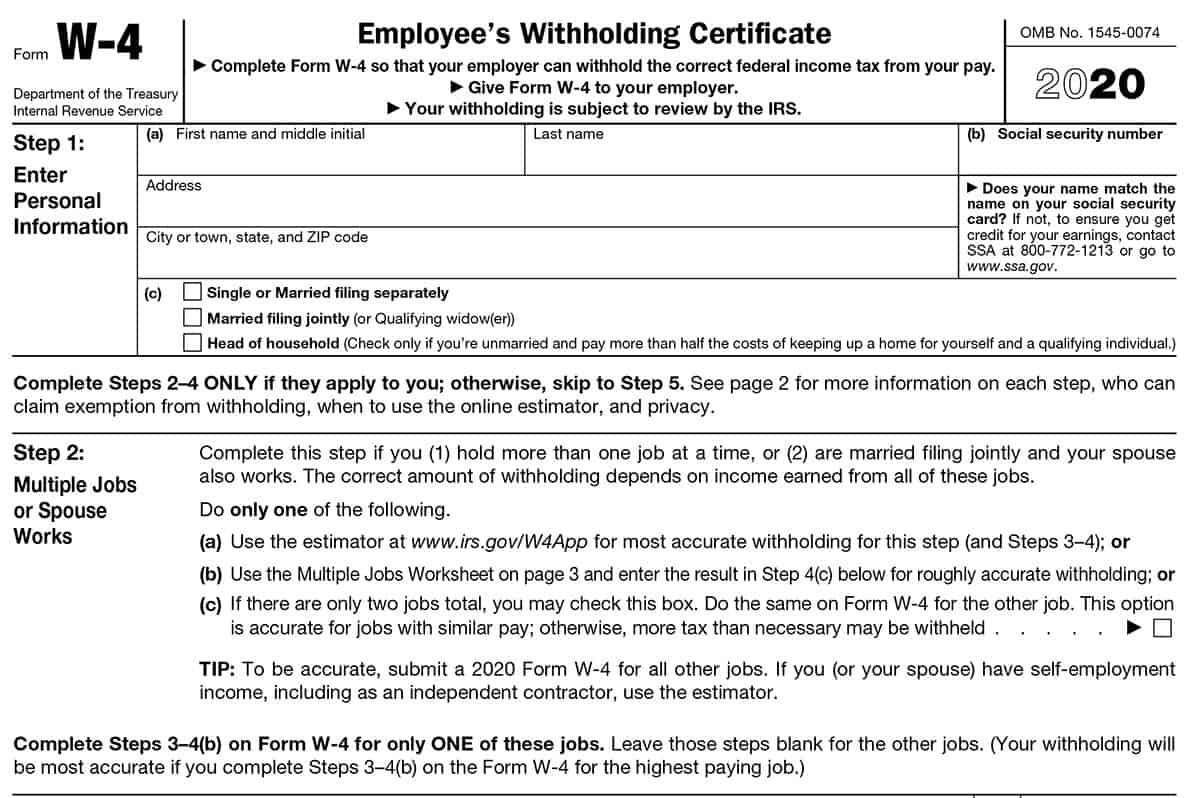

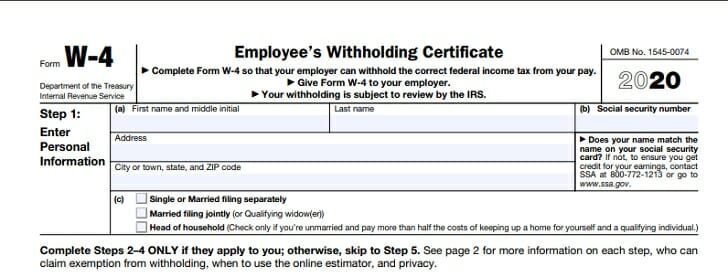

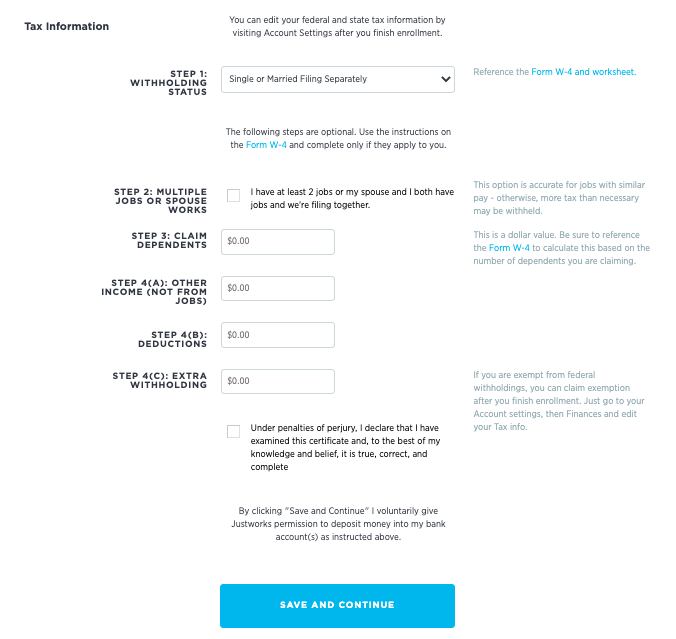

To receive a paycheck, an employee must: Complete a Form W-4 •Employee'sWithholding Allowance Certificate •Determines the amount of money withheld for taxes • Provides information your employer needs to determine proper amount to withhold from a paycheck • Required by law • The amount of income tax you owe depends on

§ Understanding taxes and your paycheck (worksheet) cfpb_building_block_activities_understanding-taxes-paycheck_worksheet.pdf. Exploring key financial concepts. When you get your first paycheck, the terms and amounts on the pay stub may not always be easy to understand. You may wonder why your take-home pay is different from what you expected,

Student materials. Calculating the numbers in your paycheck (worksheet) How to read a paystub (handout) Cómo calcular las cifras de su cheque de pago (hoja de ejercicios) Note: Please remember to consider your students' accommodations and special needs to ensure that all students are able to participate in a meaningful way.

PDF. Compatible with. Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill.

Top 10 Tips for (1) Understanding Your Paycheck 1. Examine your gross pay. 2. Study the types of deductions. 3. Identify federal income tax deductions. 4. Identify Social Security deductions. 5. Identify state income tax deductions. 6. Identify local income tax deductions. 7. Identify retirement deductions. 8. Identify insurance deductions. 9.

Directions: Answer the following questions to help provide the information for the paycheck. Hint: A way to double check your work is to add your deductions and your net income. If they do not equal your gross income, then you need to recalculate. Joe works the same amount of hours each month.

Understanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Employers withhold (or deduct) some of their employees' pay in order to cover . payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits. The amount of money you

/what-is-included-on-a-pay-stub-2062766-FINAL-5104896c92544bc6b8bc04fbe310e62c.png)

0 Response to "38 understanding your paycheck worksheet"

Post a Comment