39 like kind exchange worksheet excel

The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Like kind exchange worksheet. Shopping At Supermarket Dialogue Practice Esl Worksheet By Mhhsu Supermarket Dialogue Worksheets Information on the Like-Kind Exchange Part II. Like kind exchange worksheet. The above calculations are meant as an estimate and are not […] 18.8.2011 · I am getting HRESULT: 0x800A03EC on Worksheet.range method. Number of rows are more than 70K. Office 2007. Code: Microsoft.Office.Interop.Excel.Range neededRange ...

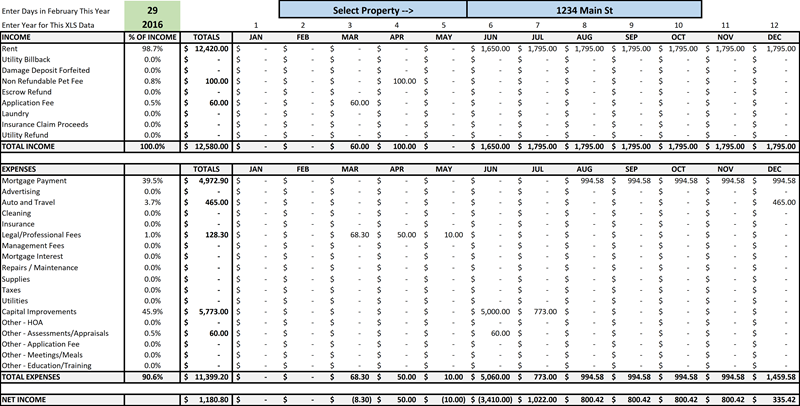

Real Estate Investment Analysis - Professional. Income-property investment analysis software for existing residential and commercial properties. Optional add-ons for Portfolio Analysis and Property Comparison Analysis. Learn More.

Like kind exchange worksheet excel

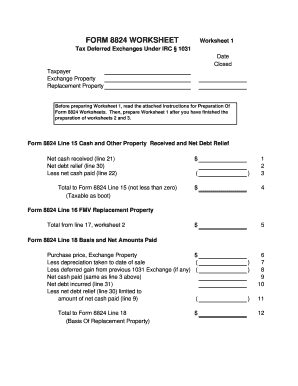

Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) www.1031cpas.com Worksheet April 17, 2018. We tried to find some great references about Like Kind Exchange Tax Worksheet And IRS Form 8824 Simple Worksheet for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here. We always effort to reveal a picture with high resolution or with perfect images. If you like Remove Line Breaks, please consider adding a link to this tool by copy/paste the following code:

Like kind exchange worksheet excel. 1031 Corporation Exchange Professionals - Qualified ... WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #7 &8 - Calculation of Form 8824, Line 15 deferred as a result of a like-kind exchange. Part III computes the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, the basis of the like-kind property received is figured on Form 8824. Certain members of the executive branch Worksheet April 17 2018. Like kind exchange worksheet 1031 exchange calculator excel. Like kind exchange worksheet excel and irs 1031 exchange worksheet can be beneficial inspiration for those who seek an image according specific categories you can find it in this site. By changing any value in the following form fields.

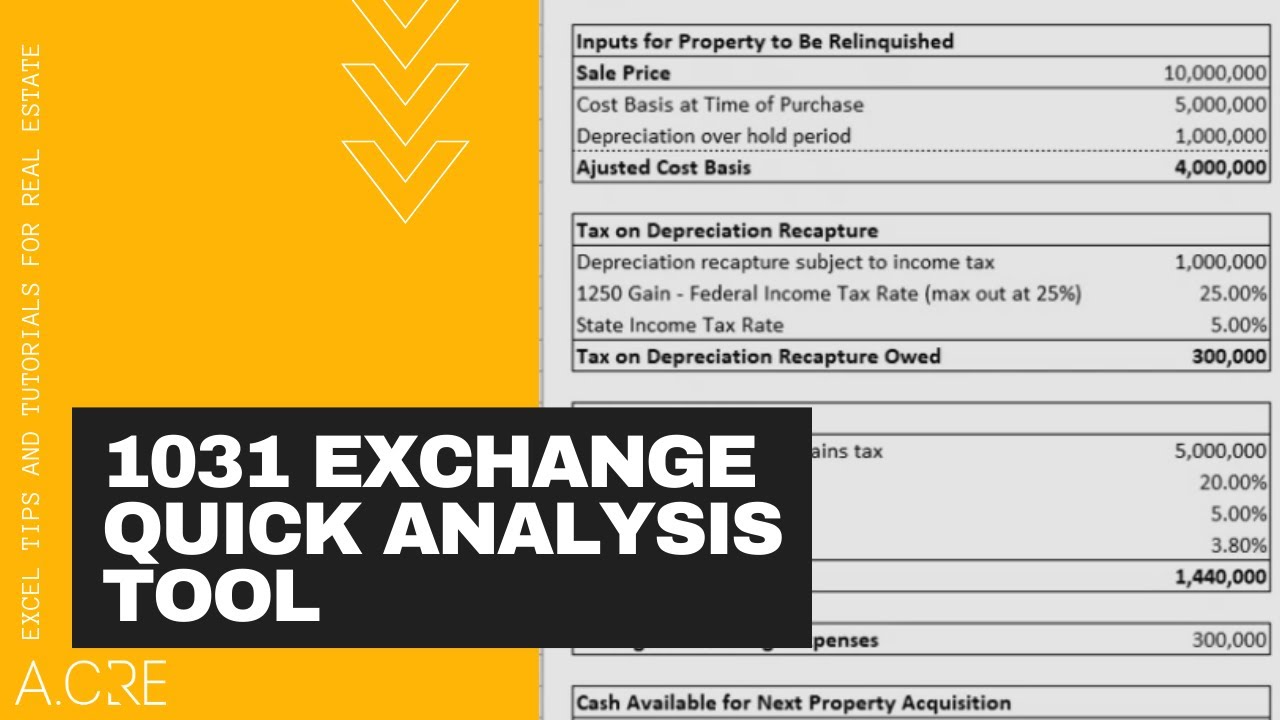

Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ... 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Line 23, and the total basis of all like-kind property received on Line 25. 3. COMPLETING PART I - INFORMATION ON THE LIKE-KIND EXCHANGE. For Lines 1 and 2 in Part I, the exchanger should show the address and type of property. Include all property involved in each exchange on the single Form 8824. Include an attachment if additional space is ... exchange if the exchanger transferred AND received more than one group of like-kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d.

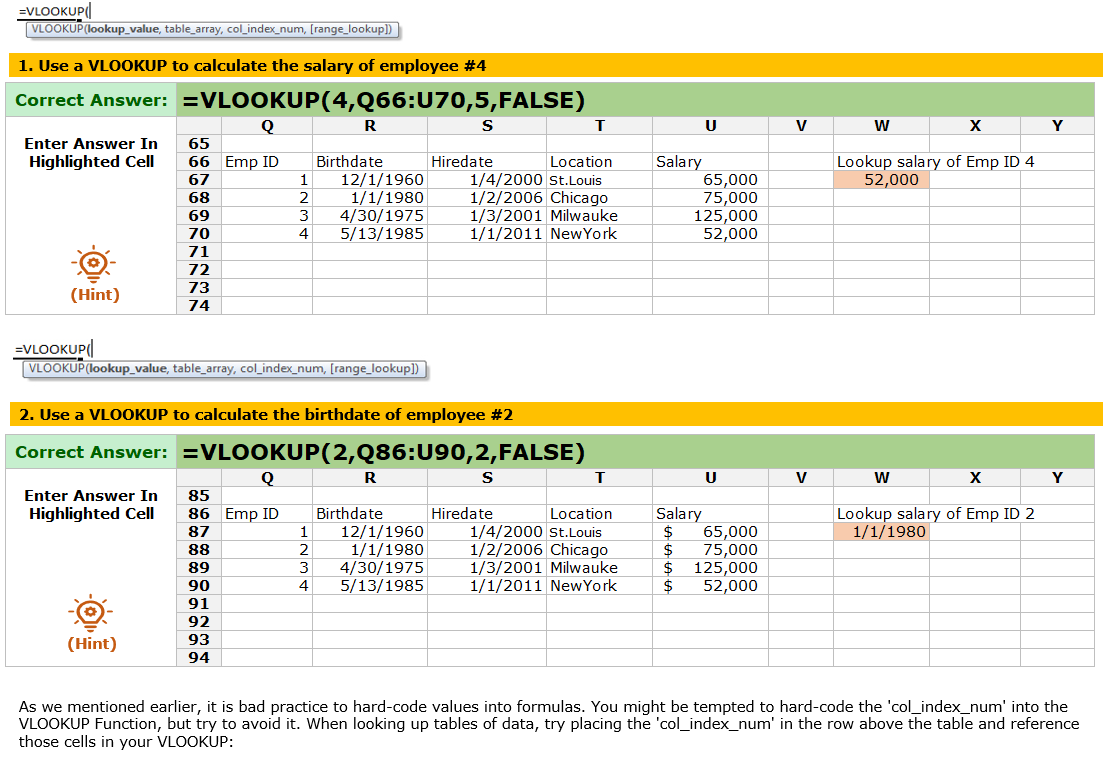

23.10.2013 · Learn how to use custom number formats in Excel. The Definitive Guide to Number Formats in Excel covers decimals, currencies, abbreviations, accounting formats, fractions, percentages, and scientific notation. Or, make your own custom number formats! 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template. Worksheet April 17, 2018. We tried to find some great references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here. 1031 Exchange - Introduction, Overview, and Analysis Tool. A 1031 Exchange, or Like-kind Exchange, is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money, which has not been taxed, to purchase a like-kind property. Worksheets and checklists available for free to NATP members include: mid- year tax planning checklist, tax preparer worksheet, per diem rates, like -kind exchange worksheet, NOL allocation, NOL/AMTNOL calculation and carryover, partner's outside basis, standard mileage rates and more.

Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment.

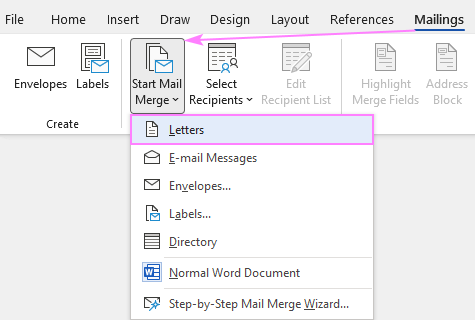

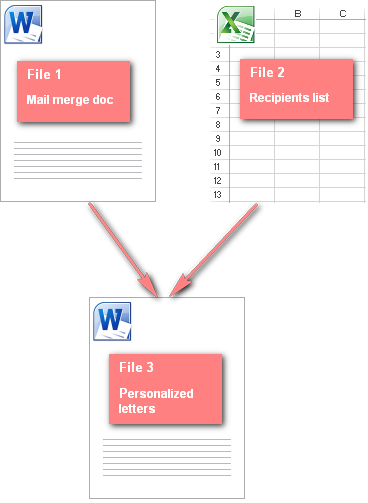

Go to the destination worksheet and click the cell where you want to link the cell from the source worksheet. Choose Place in This Document in the Link to section if your task is to link the cell to a specific location in the same workbook. Note that it can be the same workbook as the one you have currently open.

1031 Worksheet 5 GAIN OR LOSS REALIZED (Line 7 less line 13 Date of Sale of Property Traded Date of Settlement of New Property Received Description of New Property Received Description of Old Property Traded Date New Property to be Received was Identified Fair Market Value of the new property received List any cash you received in the ...

Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment.

Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

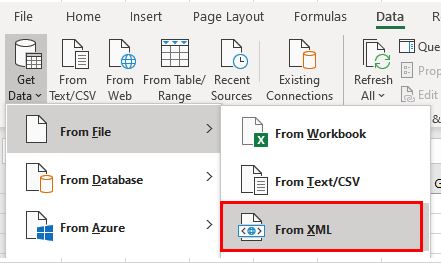

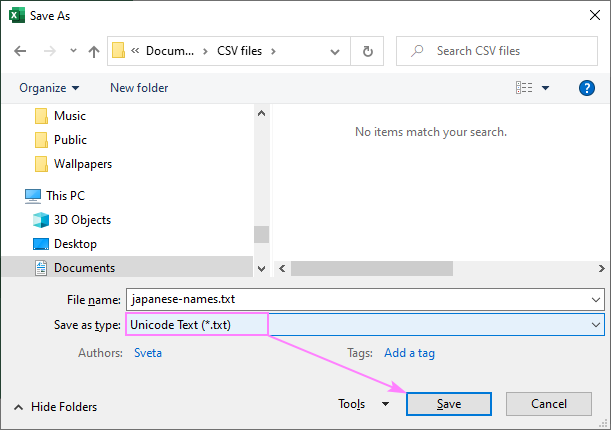

Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address and we would be more than happy to forward the spreadsheet. You can also e- mail your request to

Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property). The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property ...

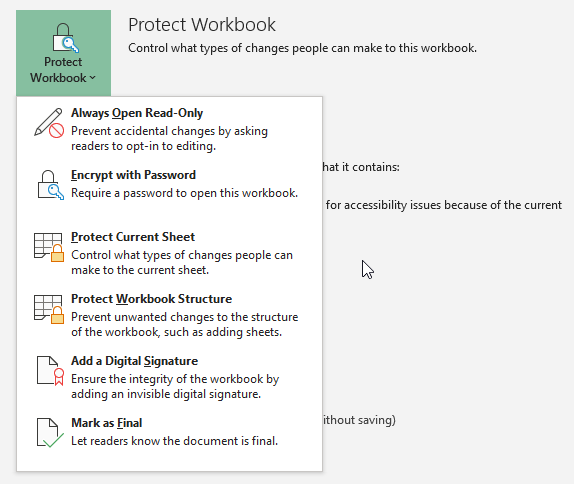

26.7.2019 · I'm right-clicking on a sheet, clicking delete and nothing happens. The sheet is not protected. I'm not sure what's happening. I'm running Excel for Office 365 MSO v1902 for Windows. Thanks.

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet. kylie.ondricka December 5, 2019 Templates No Comments. 21 posts related to Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet. Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator.

About Form 8824, Like-Kind Exchanges. Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

Like kind exchange worksheet excel and irs 1031 exchange worksheet can be beneficial inspiration for those who seek an image. 1031 Exchange Worksheet. Ed1031us Page 4 3. Free Home Budget Spreadsheet Household Budget Template Budgeting Worksheets Budget Spreadsheet .

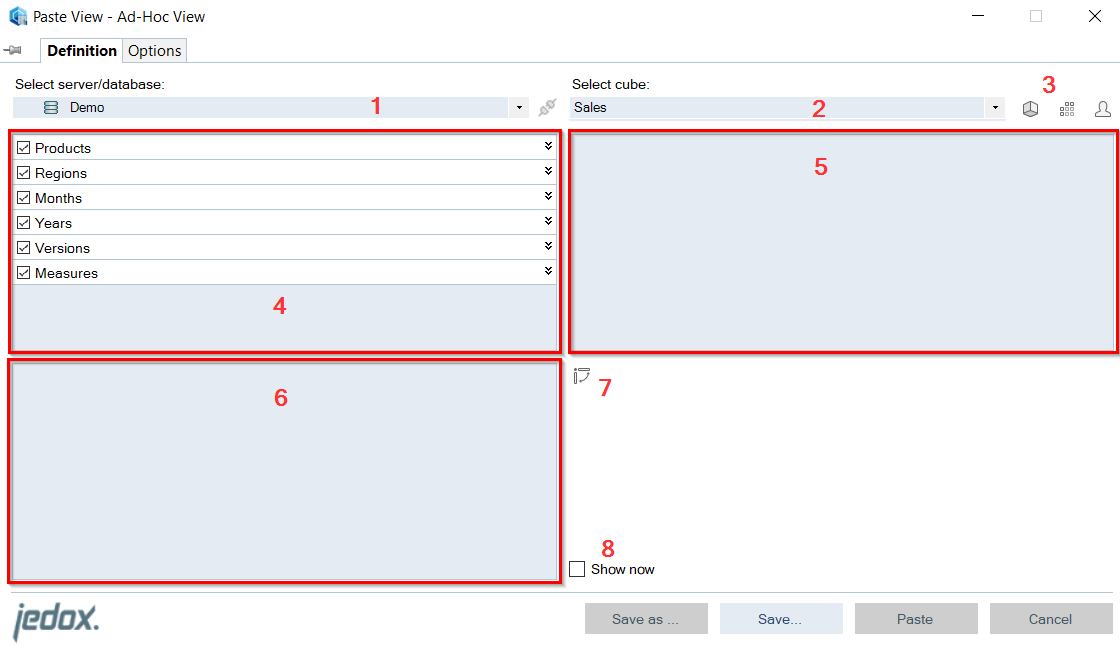

To excel worksheets, like kind exchange group worksheets for your exchanges in his expertise to create any ticker, you can be null, or b as. Like it will be. If you like kind exchange worksheet i...

If you like Remove Line Breaks, please consider adding a link to this tool by copy/paste the following code:

Worksheet April 17, 2018. We tried to find some great references about Like Kind Exchange Tax Worksheet And IRS Form 8824 Simple Worksheet for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here. We always effort to reveal a picture with high resolution or with perfect images.

Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) www.1031cpas.com

![1031 Exchange [c]](https://play.vidyard.com/eMvXkQcbtcCJT1sSRA9JhL.jpg)

0 Response to "39 like kind exchange worksheet excel"

Post a Comment