39 non cash charitable donations worksheet

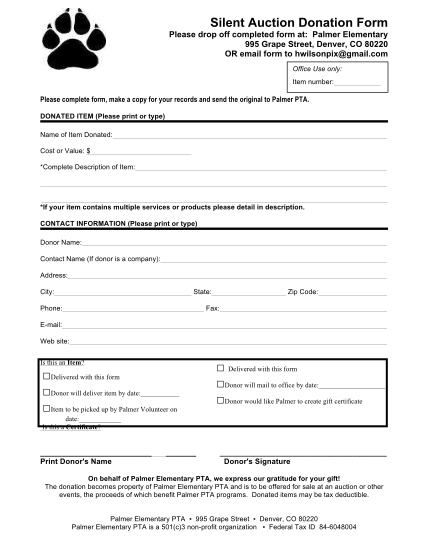

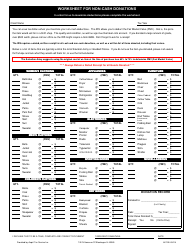

Title: Noncash charitable deductions worksheet. Author: P. Keokham "adonis" Revised by: P. A. Moore Last modified by: Staff1 Created Date: 2/10/2003 7:35:53 AM Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

Missi n g lnformation : Non-cash charita ble contri butions worksheet Name: Tax Year: Home Telephone:Work Cell: The following is a guideline for valuation of non-cash charitable contributions.When valuing items, take into consideration the condition of the items, lf the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the ...

Non cash charitable donations worksheet

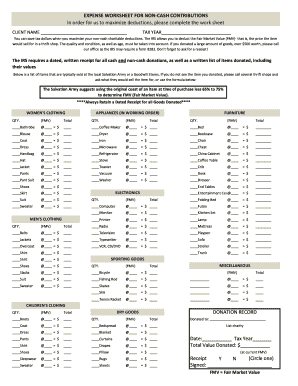

Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00 If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

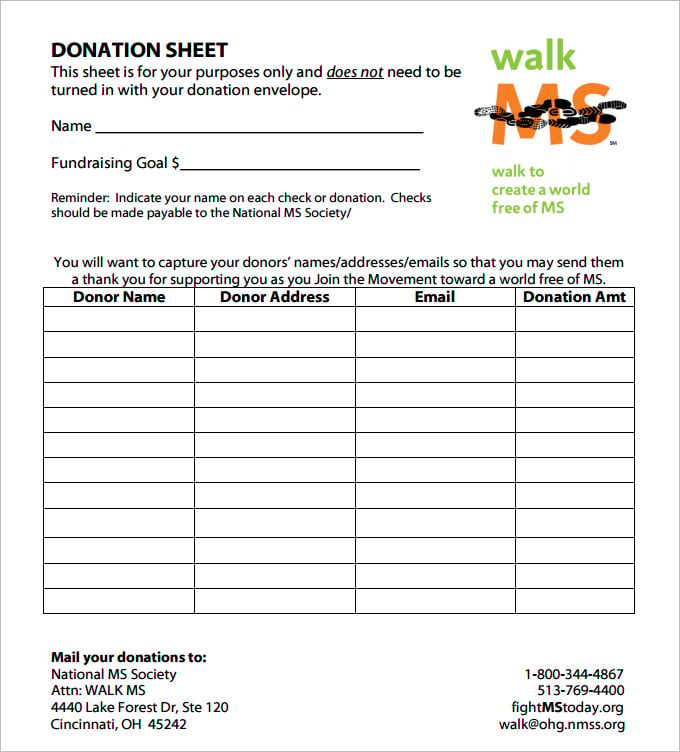

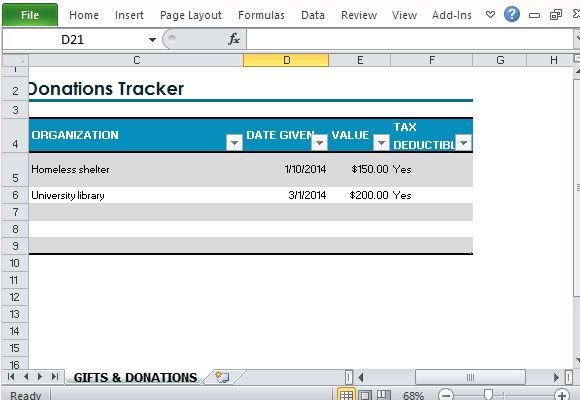

Non cash charitable donations worksheet. 1-800-SA-TRUCK (1-800-728-7825) The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. It includes low and high estimates. Please choose a value within this range that reflects your item's relative age and quality. The Salvation Army does not set a valuation on your ... Non-cash donations of $5,000 or more. If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000. 1, non cash charitable contributions / donations worksheet. 2, taxpayers name(s):, insert tax year ===>. 3, entity to whom donated: insert date given ===>. You change to the cash method of accounting and choose to account for inventoriable items in the same manner as non-incidental materials and supplies for the 2021 tax year. IMPORTANT! One should prepare a list for EACH separate entity and date donations are made. For example: If one made a donation Boitnott & Schaben LLC www.botetourtcpas.com Phone 540-966-0114 For more information about Charitable Contributions & Non-Cash Donations see IRS Publication 526: $2.00 $7.00 2.00 $12.00 $0.00 $5.00 $10.00 2.00 $15.00 $0 ...

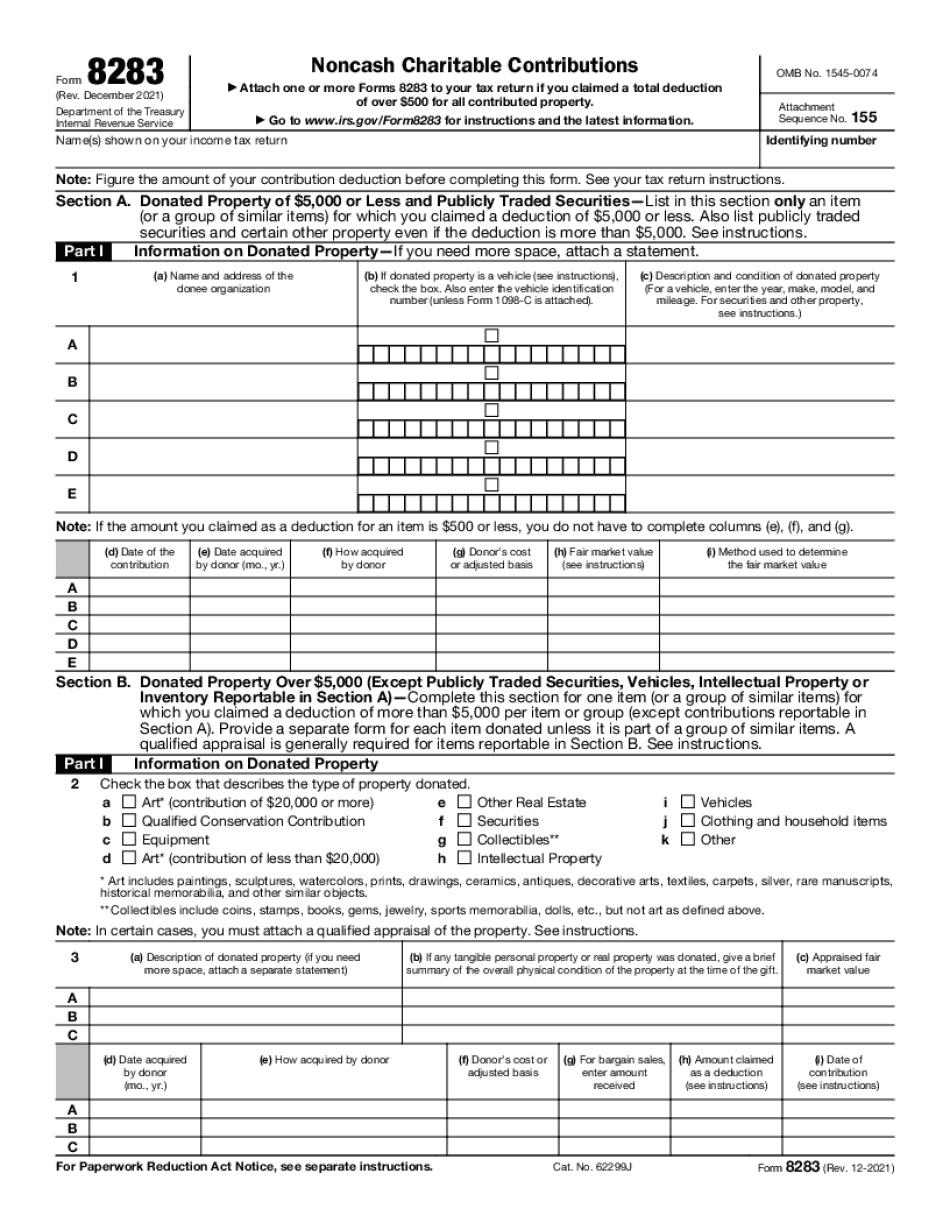

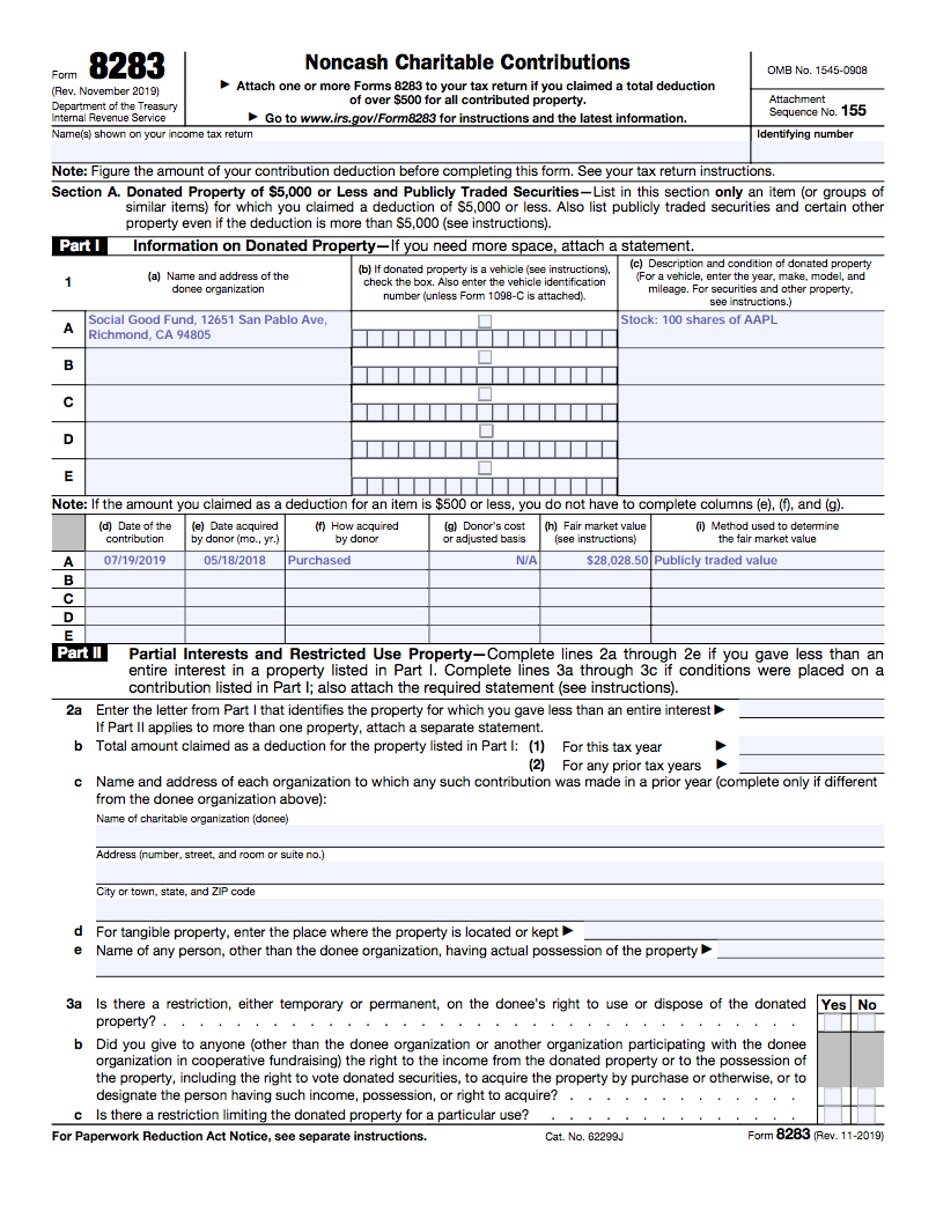

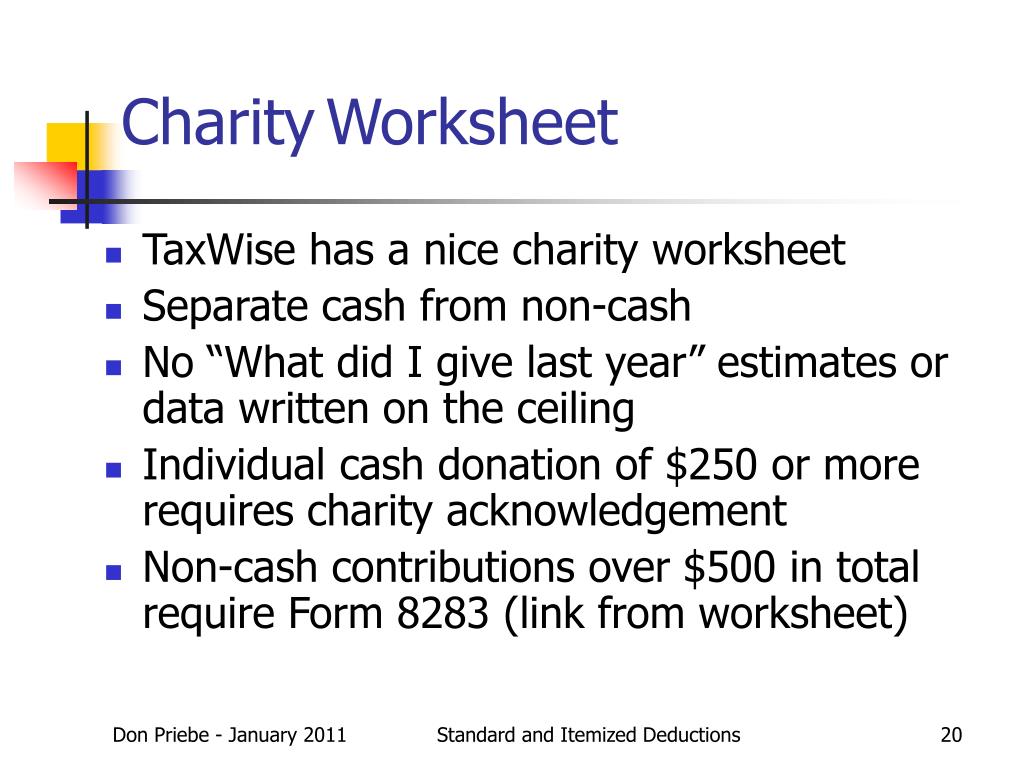

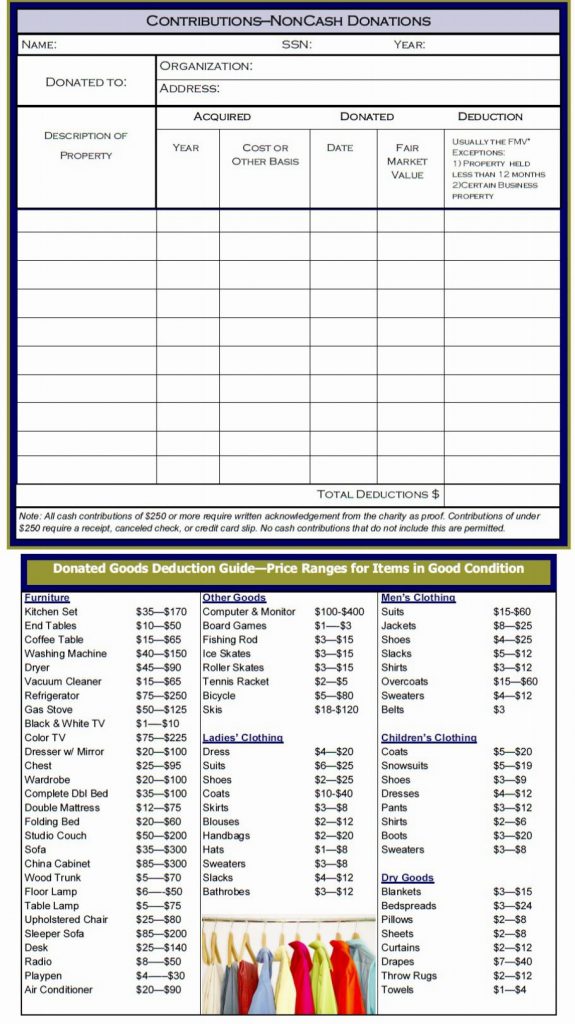

Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. deduct your charitable contributions if you don't itemize deductions and not every non-profit organization is a tax-qualified charitable organization.2 pages Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. However, you can browse the sheet to find values. the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you acknowledge that you have

Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. Describe your Donations on simple worksheets. this is space. Find the best value in the ItsDeductible database of thousands of commonly donated items. this is space. Transfer the information to TurboTax and continue with your tax return. ... A: For any non-cash charitable contribution of $250 or more, you must maintain a receipt from the qualified organization. 2 In addition to providing a description of the donation, this receipt must also state whether any goods or services were provided in exchange for the donation as well as the value of such goods/services. For-profit businesses, individuals and government are not considered charitable or religious and are not eligible to apply for a licence. How to apply To apply for approval to conduct raffle licenses fill out the Eligibility for Raffle Licence (Total Ticket Value $20,000 and Less Only) which includes an Internet Account Request Form to get your ...

Jan 13, 2022 · For non-cash contributions and gifts to non-qualifying organizations—which include private non-operating foundations, supporting organizations, donor-advised funds, and other charitable ...

This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Sheets 200 800 Throw Rugs 150 1200 Towels 050 400 Total Furniture Low High Qty Total Bed Complete. When valuing items take into consideration the condition of the items.

Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions

non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal

Title: Noncash charitable deductions worksheet. Author: P. Keokham "adonis" Revised by: P. A. Moore Last modified by: Lynn Created Date: 2/10/2003 7:35:53 AM

A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ...

Fill Non Cash Charitable Donation Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now! Rating: 4.8 · 120 votes

Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

This worksheet has been provided to help you determine the value of your noncash contributions. The values on this worksheet are based on valuation ranges provided by the Salvation Army 1 and are intended to be used as general guidelines. Amounts should be adjusted upward or downward based on your actual assessment of condition of each item.

The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can't exceed $300 ($1,000 donation - $700 state tax credit). The reduction applies even if you can't claim the state tax credit for that year.

Other than cash contributions of up to $300, you can only deduct charitable contributions if you itemize your personal deductions instead of taking the standard deduction. The Tax Cuts and Jobs Act nearly doubled the standard deduction for individual taxpayers.

NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits ...

Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00

0 Response to "39 non cash charitable donations worksheet"

Post a Comment