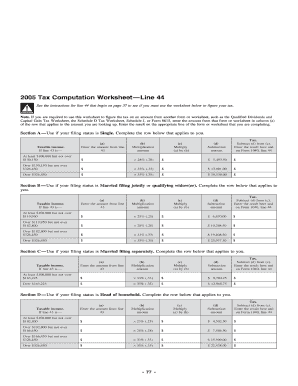

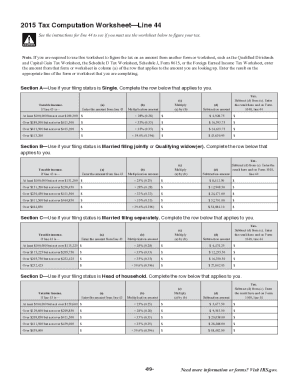

41 2015 tax computation worksheet

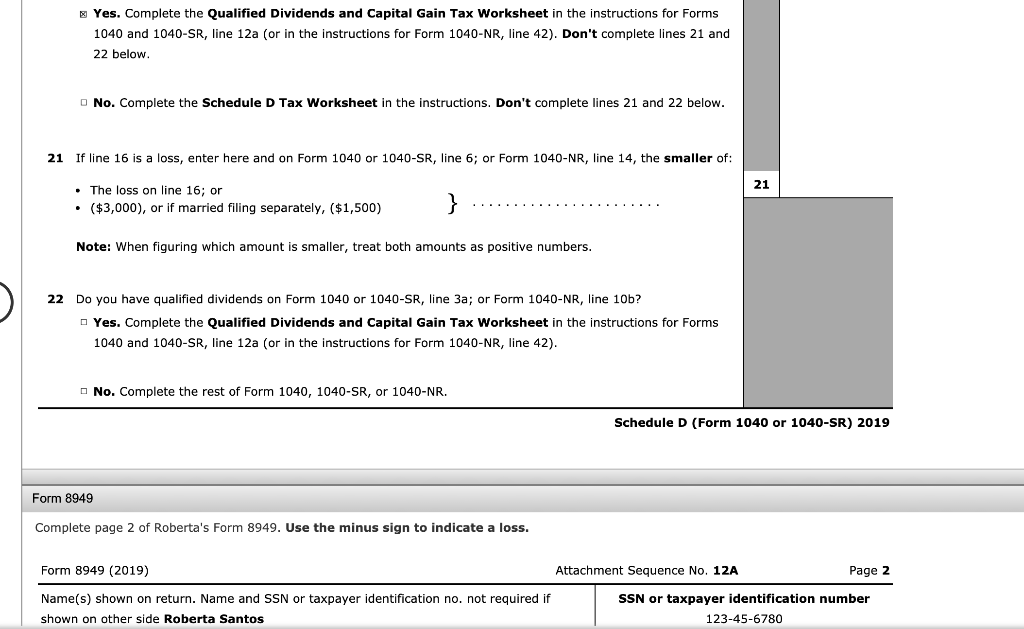

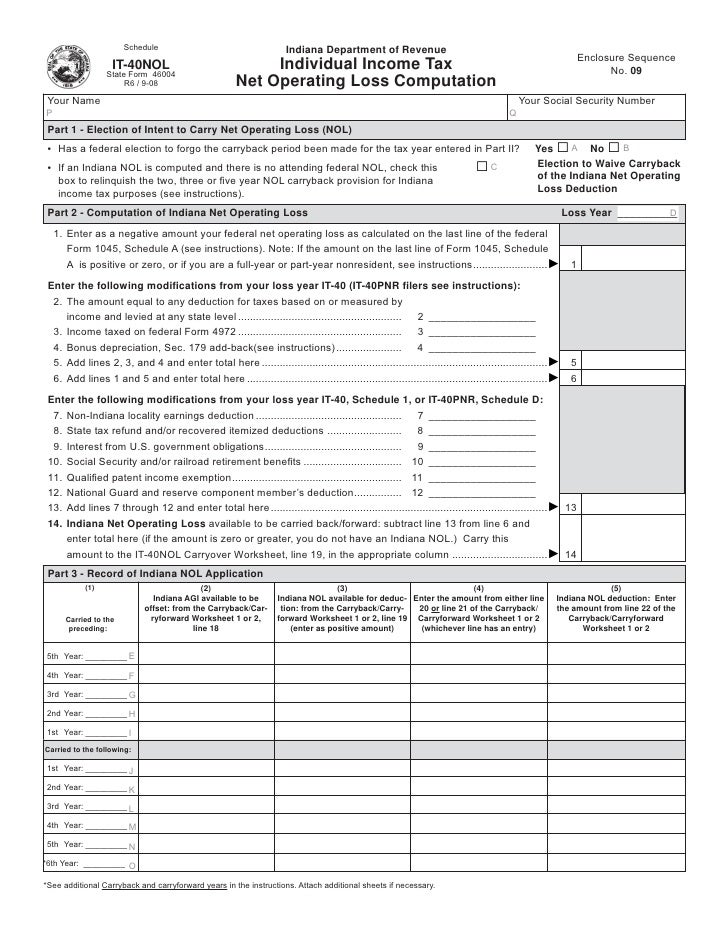

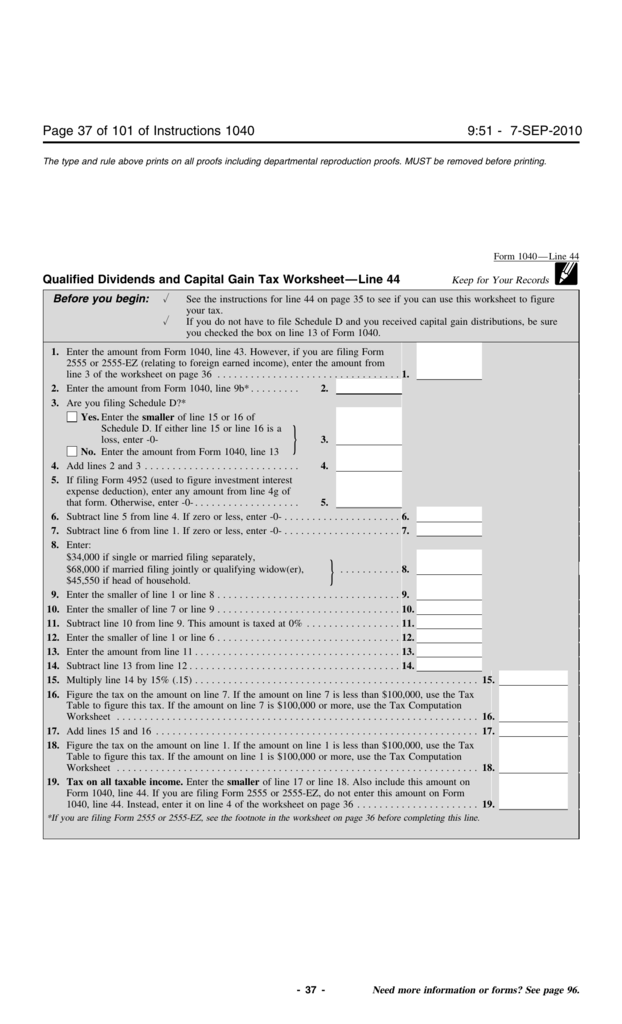

2015. Attachment Sequence No. 32. Name(s) shown on Form 1040 or Form 1040NR. ... Tax Computation Using Maximum Capital Gains Rates ... for Form 1040, line 44, or the amount from line 19 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the Yes. □ No. Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet ...

The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Accordingly, the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers.

2015 tax computation worksheet

Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Tax Computation Worksheet 2018 (Line 11a) On average this form takes 13 minutes to complete. The Form 1040 Tax Computation Worksheet 2018 form is 1 page long and contains: 2015 Federal Withholding Computation—Quick Tax Method1, 2 Use this worksheet instead of the withholding tables from IRS Notice 1036 or Pub. 15 to compute federal withholding for an employee. Note: This method is based on the 2015 percentage method from IRS Notice 1036 and Pub. 15. This worksheet and the following tables are for use in 2015 Departing alien income tax return 2021 01 15 2021 inst 1040 nr. 2020 tax computation worksheet. Tax Computation Worksheet 2015 If You Re Thinking Of Buying A Digital Camera And Haven T Done Any Preliminary Work It S Really Hard There Are Dozens Of Mode Department of the treasury internal revenue service united states federal […]

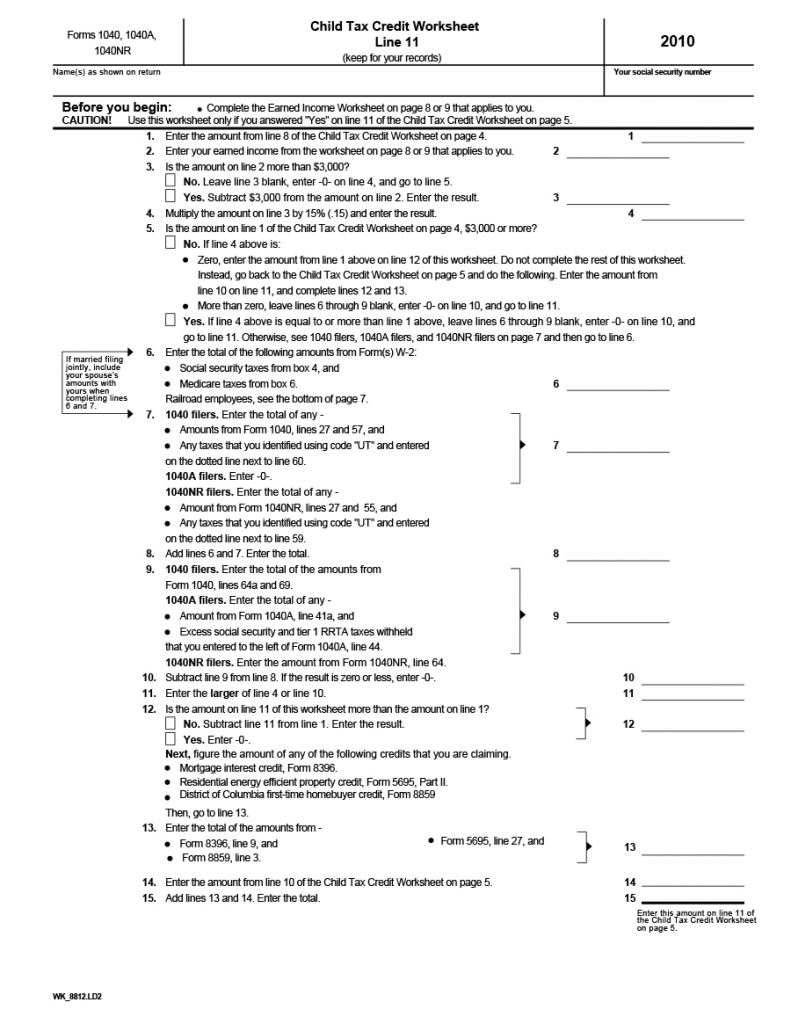

2015 tax computation worksheet. Note: If you are claiming a tax credit generated prior to 1/1/2015 and have generated the same tax credit on or after 1/1/2015 you cannot include the amount of carry over from the credit generated prior to 1/1/2015 in the com-putation for the credit generated on or after 1/1/2015. You will be required to complete Worksheet 1 and/or Worksheet 2 ... The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail.. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts. Chapter 11. Taxes. Chapter 12. Other Itemized Deductions. Part Four. Figuring Your Taxes, and Refundable and Nonrefundable Credits. Chapter 13. How To Figure Your Tax. Chapter 14. Child Tax Credit and Credit for Other Dependents. 2021 Tax Table. 2021 Tax Computation Worksheet. 2021 Tax Rate Schedules. Your Rights as a Taxpayer. How To Get Tax Help Tax Computation Worksheet 2015 Malaysia. Tax Computation Worksheet India 2015. Tax Computation Worksheet Irs. Tax Computation Worksheet Is Used If. Computation With Whole Numbers Worksheet. Tax Computation Worksheet 2011. Tax Computation Worksheet 2012. Tax Computation Worksheet 2013. Tax Computation Worksheet 2014 Uk.

Resurgence Support Payment (RSP) Applications for 4 of the Resurgence Support Payments (RSPs) are still open. These include the 7th RSP, which is called the Transition Payment. Resurgence Support Payment. Individuals and families. Changes for individuals and families. Businesses and employers. Changes for businesses and employers. Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to Tax CompuTaTion WorksheeT (keep this worksheet for your records.) a Taxable income: Enter the amount from Form IT-540B-NRA, Line 11. a .00 B First Bracket: If Line A is greater than $12,500 ($25,000 if filing status is 2 or 5), enter $12,500 ($25,000 if filing status is 2 or 5). If Line A is less than $12,500 Tax Computation Worksheet India 2015. Tax Computation Worksheet In Excel. Tax Computation Worksheet 2014 In Excel. Tax Computation Worksheet Irs. Tax Computation Worksheet Is Used If. Computation With Whole Numbers Worksheet. Tax Computation Worksheet 2011. Tax Computation Worksheet 2012. Tax Computation Worksheet 2013.

the Tax Computation Worksheet on if you are filing Form 2555 or 2555-EZ, Tax page 86. you must use the Foreign Earned Income Include in the total on line 44 all of theHowever, do not use the Tax Table orTax Worksheet on page 36 instead. following taxes that apply. The Tax calculation summary notes (2017) have been updated so that you can calculate the best way to use your personal allowance. 6 April 2017. The form and notes have been added for tax year 2016 ... Home Office Tax Deduction Worksheet Excel. 1, 2019 to incorporate the new tax law. A fillable pdf (what you are viewing now) and an online digital form. Source : www.pinterest.com A home office deduction worksheet (excel) to calculate your tax claim. A home office deduction worksheet (excel) to calculate your tax claim. 2015 Tax Deductions Brief Comparison On How You Can Access the home office ... Please use the DC D-76 Estate Tax Instructions booklet regardless of the year prior to January 1, 2021. The DC D-76 Estate Tax Computation Worksheets contain the ...

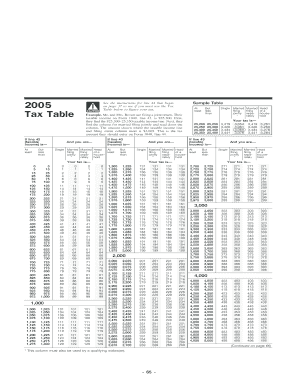

Form 1040 (Schedule R), Credit for the Elderly or the Disabled, 2015 ... Inst 1040 (Tax Tables), Tax Table and Tax Rate Schedules, 2015.

26th Jul 2015 12:18. From HMRC Online Tax Return Help: If you use a capital gains computation worksheet to work out the gain or loss on the disposal of an asset, the worksheet will be attached automatically to your return. If you do not use a worksheet, you will be able to attach your own computation or include it in additional information at ...

a year beginning in 2015. RI-1041 TAX COMPUTATION WORKSHEET 2015 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041, line 7 is: $0 $0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c) Enter here and on RI-1041, line 8 TAX $605.50 $2,312.36 $60,550

Rebasing computation - gain from 5 April 2015 to disposal: date of acquisition - 5 January 2011; ... To calculate the tax you owe for the first property or land you disposed of in the tax year

WORKSHEET C: Computation of Estimated Tax Base If the amount on Line 3 is $100 or less, estimated payments are not required. If the amount on Line 3 is greater than $100, enter 25% of the amount on ... 2015 NET PROFITS TAX RETURN Computation of apportionment factors to be applied to apportionable net income of certain nonresidents of Philadelphia.

Tax Computation Worksheet ..... 27 Electronic Options ..... 28 Tax Assist ance ..... 28. What’s New . DUE DATE FOR FILING. April 18, 2016 is the due date for . filing 2015 income tax returns. See page 4. LAWFULLY MARRIED COUPLES. For tax year 2015 and

Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2015 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) ...

Income Tax Calculator for FY 2013-14 / AY 2014-15. 5. Income tax Slab for FY 2012-13 / AY 2013-14. Income Tax Calculator FY 2012-13 / AY 2013-14. 6. Income Tax Slab from Assessment year 2001-2002 to A.Y. 2012-2013. Income tax calculator for FY 2006-07 to FY 2016-17. 7. Income Tax Slab Rates from AY 1992-93 to AY 2015-16.

However, what most people do is complete the worksheet on the form, ... Below is an example filled in with the 2015 information for someone filing as Single. ... This template is an estimator and is only intended to perform a quick and dirty calculation of your tax liability.

YOUR LOUISIANA INCOME TAX - See the Tax Computation Worksheet to calculate the amount of your Louisiana income tax. NONREFUNDABLE TAX CREDITS 13A FEDERAL CHILD CARE CREDIT - Enter the amount from your Federal Form 1040A, Line 31, or Federal Form 1040, Line 49. This amount will be used to compute your 2015 Louisiana Nonrefundable Child Care ...

Computation of Tax Preference Income Modification: Form and instructions for an individual or fiduciary of an estate or trust to use for reporting items of tax preference in excess of $10,000 ($20,000 for a joint return). 502UP: Underpayment of Estimated Maryland Income Tax by Individuals

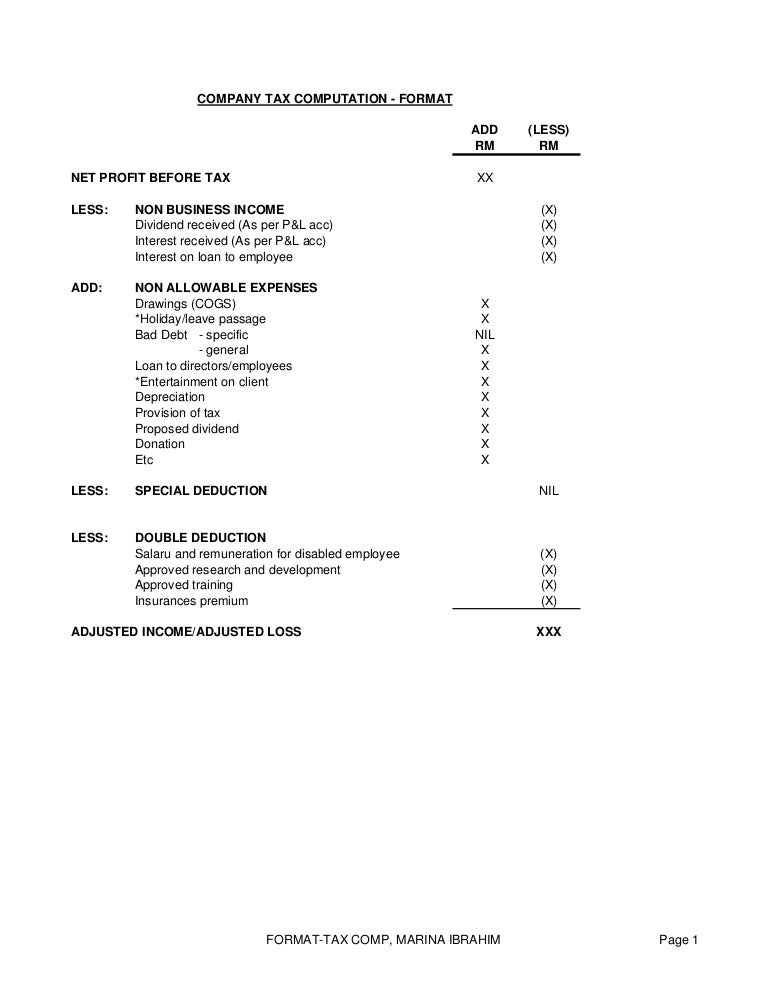

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Tax adjustments include non-deductible expenses, non-taxable receipts, further deductions and capital allowances. Your company should prepare its tax computation annually before completing its Form C-S/ Form C ...

estimate or to begin making estimated tax payments after April 15, 2021. Use the Amended estimated tax worksheet on page 10 of these instructions to amend your original estimate. If you are required to begin making payments after April 15, 2021, the payment due dates are as follows: If the requirement is met after: Payment due date is:

Rhode Island income tax from the RI Fiduciary Tax Computation Worksheet. Line 9 - Allocation: Nonresident estates or trusts enter the amount from page 2, Schedule II, line 34. Resident estates or trusts enter 1.0000. Line 10 - RI Income Tax After Allocation: Multiply the amount on line 8 by the percentage on line 9.

Schedule d tax worksheet 2015. Complete form 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d. Before completing this worksheet complete form 1040 through line 43. 2015 tax computation worksheet. Tax computation worksheet form 1040 instructions html. This form may be easier to complete if you round off cents to whole dollars.

Cat. No. 24327A 1040 TAX TABLES 2015 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only. NOTE: THIS BOOKLET DOES NOT CONTAIN TAX FORMS

A Tax Computation Worksheet 2015 is several short questionnaires on a special topic. A worksheet can there will be any subject. Topic generally is a complete lesson in one or perhaps small sub-topic. Worksheet can be utilized for revising the niche for assessments, recapitulation, helping the students to be aware of this issue more precisely so they can improve the information in the matter.

Departing alien income tax return 2021 01 15 2021 inst 1040 nr. 2020 tax computation worksheet. Tax Computation Worksheet 2015 If You Re Thinking Of Buying A Digital Camera And Haven T Done Any Preliminary Work It S Really Hard There Are Dozens Of Mode Department of the treasury internal revenue service united states federal […]

2015 Federal Withholding Computation—Quick Tax Method1, 2 Use this worksheet instead of the withholding tables from IRS Notice 1036 or Pub. 15 to compute federal withholding for an employee. Note: This method is based on the 2015 percentage method from IRS Notice 1036 and Pub. 15. This worksheet and the following tables are for use in 2015

Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Tax Computation Worksheet 2018 (Line 11a) On average this form takes 13 minutes to complete. The Form 1040 Tax Computation Worksheet 2018 form is 1 page long and contains:

0 Response to "41 2015 tax computation worksheet"

Post a Comment