41 funding 401ks and iras worksheet answers

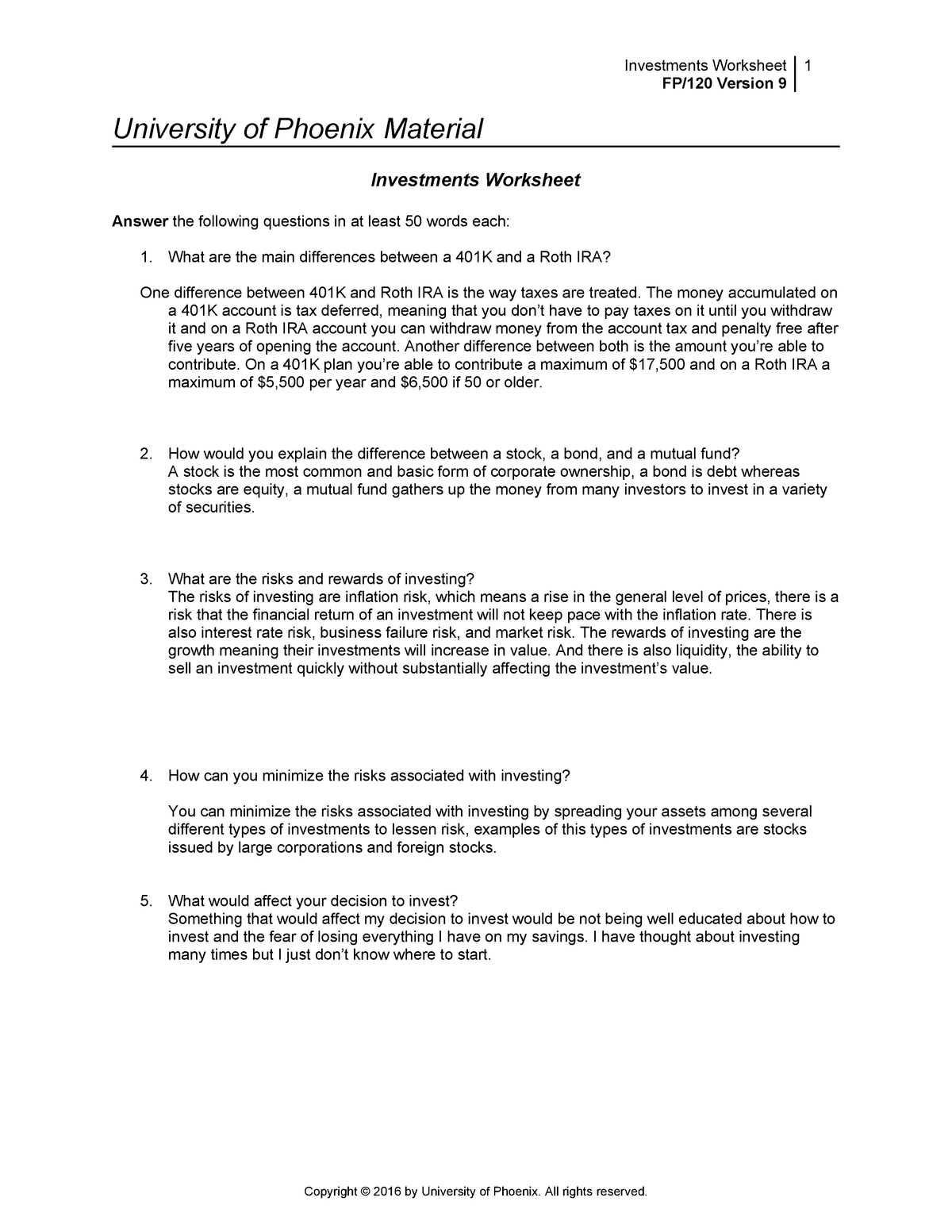

But generally, no, you cannot use leverage within an IRA and you cannot borrow against an IRA, unlike a 401(k) -- if your plan allows it. Then, Mark, the train operator, says: "I'm finding many ... Jan 03, 2022 · Funding 401 K S and Roth IRAs Worksheet Answers There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. Funding 401ks and roth iras worksheet work extremely well from a teachertutorparent to enrich the content an understanding of their studentchild.

Summative Assessment: Education Funding and Retirement Planning Worksheet Complete Parts 1 and 2 below. Part 1: Education Funding Follow these steps to access your financial plan and repayment information for this assignment: 1. Access and log into your MyPhoenix account. 2. Access the account section. 3. Locate your Financial Plan and Repayment information. 4. Use...

Funding 401ks and iras worksheet answers

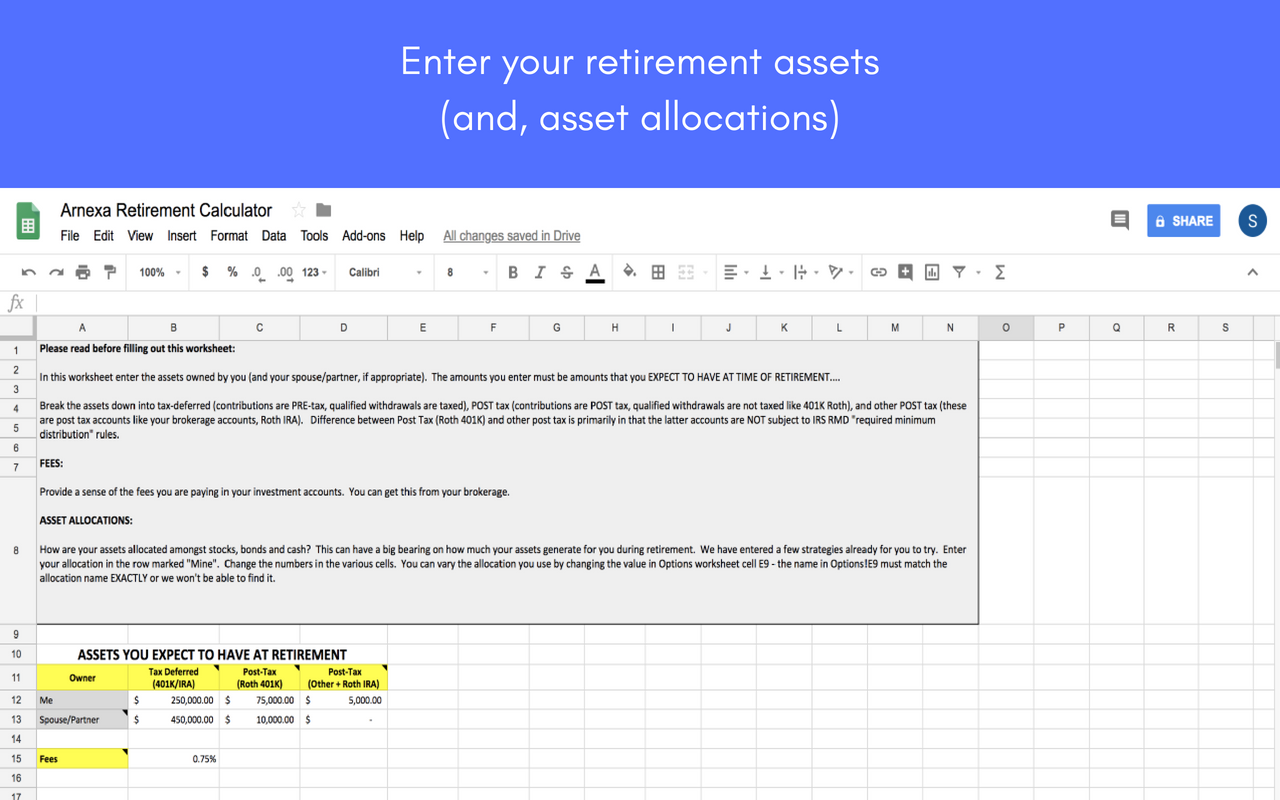

The maximum amount of salary that an employee can defer to a 401 (k) plan, whether traditional or Roth, is $19,500 for 2021 and $20,500 for 2022. Employees aged 50 and older can make additional ... A 401(k) and a Roth IRA are both great tax-saving vehicles for your retirement ... (IRS) until the funds are withdrawn (whereas Roth IRAs are never taxed, ... Answers in the middle column apply to traditional IRAs. ... You can open an IRA at a bank or other financial institution or with a mutual fund or life ...

Funding 401ks and iras worksheet answers. You won't be able to stash these funds in a 401 (k), but you could put the money into an IRA. Just don't exceed the $6,000 annual contribution limit ($7,000 if you're 50 or older). Or you could... What would you do if you were not eligible for a Roth because you make too much money? put it into 401k. Rating: 3 · 1 review Cons. Fidelity Go fee is $3 per month for balances between $10,000 and $49,999; 0.35% for balances over $50,000. Fidelity Personalized Planning & Advice requires $25,000 minimum balance and has a ... The Roth IRA has income rules for contributions. For 2021, the amount you can contribute begins to phase down when your annual income hits $125,000 for single filers and $198,000 for married ...

A spousal IRA is a type of retirement savings that allows a working spouse to contribute to an individual retirement account (IRA) in the name of a non-working spouse. Usually, an individual must ... Used car and truck prices are up 31% over the previous year. AP Photo/David ZalubowskiConsumer prices jumped 6.8% in November 2021 from a year earlier - the fastest rate of increase since 1982, according to Bureau of Labor Statistics data published on Dec. 10, 2021. The biggest jumps during the month were in energy, used cars and clothing. The Conversation U.S. asked University of South ... Money-Purchase Provisions: The terms of a registered pension plan that detail the specific amounts that an employer and employee contribute to the plan. The amounts may be stated in dollars or ... 5 Unexpected Sources of Retirement Income When the "three-legged stool" of a pension, Social Security, and personal savings isn't enough, you'll need to cover your costs somehow.

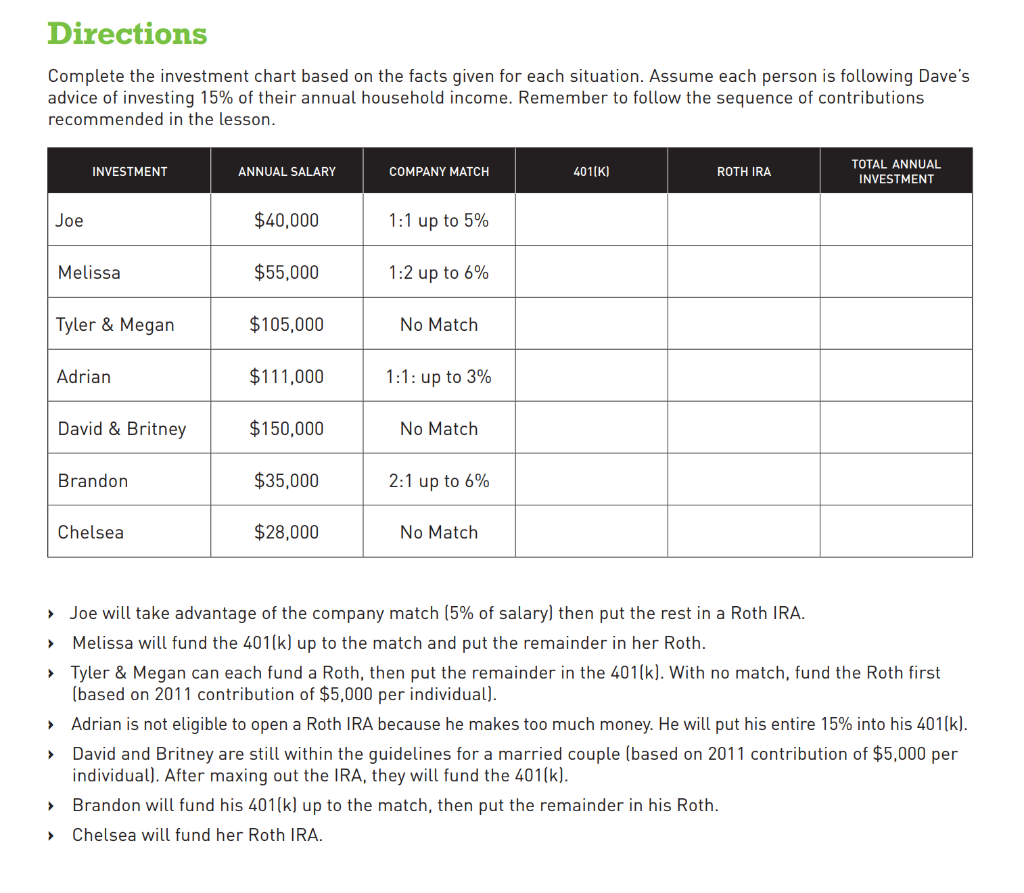

Dec 12, 2019 - A Funding 401 K S And Roth Iras Worksheet Answers is a few short questionnaires on a certain topic. A worksheet can be prepared for any ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on ... Jul 11, 2018 · Funding 401ks and Roth Iras Worksheet with Preschool Printable Worksheets Free Super Teacher Workshee. Download by size: Handphone Tablet Desktop (Original Size) Your 401k is all about saving money. It provides a good amount of income, if you were to hold onto it until retirement. Typically, in order to keep it open, you have to pay fees, and ... The IRS points out on its website page for IRA FAQs in answer to the ... (Use Worksheet 2-1 in IRS Publication 590-A for ... down the differences between a Roth IRA, a designated Roth 401(k) and a ...

The worksheets have many uses. A 401k worksheet is a good resource for determining the amount you need to contribute in order to fund a Roth IRA. A 401k worksheet is useful for funding a Roth IRA. For more information about funding a 401k, visit the official website. The Funding 401ks and Roth IIRAs Worksheet is a very useful tool for employees.

If your FRA is 67 but you delay your filing until age 70, your Social Security income will increase by 24%. Or, to put it another way, a monthly benefit of $2,000 at age 67 could become $2,480 ...

Every extra dollar will help your Social Security benefits later. The only exception to this is for those making more than $142,800 in 2021 or $147,000 in 2022. This is the maximum income subject ...

If you have access to a 401 (k) plan through your employer, you have a prime opportunity to sock away a nice amount of money for retirement. That's because 401 (k)s come with generous contribution...

1. Retirement accounts. The good news: The value of your 401(k) and Roth and traditional IRA accounts are not counted at all when determining your EFC.; The bad news: Although you can take a penalty-free withdrawal from a Roth IRA to pay for college, the entire amount you withdraw will count as untaxed income on the FAFSA*.

Mar 17, 2021 — IRA vs. 401(k): The quick answer ; Bottom line, Fund a 401(k) first if your company offers matching dollars. Fund an IRA or Roth IRA first if ...

Assume each person is following Dave's advice of investing 15% of. This problem has been solved! See the answer ...

Oct 20, 2021 · Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 Overview. Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as ...

For 2021 and 2022, you can contribute up to $6,000 to a Roth or traditional IRA. If you're 50 or older, the limit is $7,000. 1. The most you can contribute to a 401 (k) in 2021 is $19,500, or ...

Here are five facts to know about banking in 2022 and actions you can take to boost your finances in the new year. 1. Your emergency fund is still a top priority. With the COVID-19 pandemic, you ...

At Ramsey, we love Roth IRAs and Roth 401(k)s because the money you invest in them grows tax-free and you won't be taxed when you take out money in retirement. Your goal is to consistently invest for retirement as you focus on other financial obligations, such as funding college for your kids or paying off your home early.

Aug 09, 2019 · Funding 401 K S and Roth IRAs Worksheet Answers – There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. A worksheet, Get Sheet Name A workbook includes a selection of worksheets. It will be pictorial. The estimating worksheet was made to direct you.

A Roth IRA (Individual Retirement Arrangement) is a retirement savings account that allows you to pay taxes on the money you put into it up front. The growth in your Roth IRA and any withdrawals you make after age 59 1/2 are tax-free, as long as you've had the account more than five years. We filter out sleazy advisors.

Unlike a traditional IRA or Roth 401(k), which require RMDs, a Roth IRA doesn't require any distributions at all. That means the money can stay—and grow tax-free—in the Roth IRA for as long ...

Liz: You can have a 401(k) and a Roth IRA. You can have a SEP and a Roth or a traditional IRA. You can have a SEP and a Roth or a traditional IRA. There's a lot of different ways to put this together.

Roth 401(k) accounts have the same contribution limits as traditional 401(k) accounts. If your employer offers a 401(k) match and you contribute to a Roth 401(k), you are still eligible to receive ...

The 2021 maximum contribution limit for traditional 401(k)s is $19,500 ($26,000 if you're 50 or older) and the 2021 max for traditional and Roth IRAs is up to $6,000 ($7,000 if you're 50 or ...

Nov 21, 2017 · If you want to download the image of Funding 401 K S and Roth Iras Worksheet Answers or A Sure Way to An Unsure Future is to Put Off Planning for Retirement, simply right click the image and choose “Save As”. Download by size: Handphone Tablet Desktop (Original Size) Back To Funding 401 K S and Roth IRAs Worksheet Answers

Roth IRA contributions are capped at $6,000, or $7,000 if you are at least age 50 by the end of the year. However, the following two factors also determine how much you may contribute to your Roth ...

But generally, no, you cannot use leverage within an IRA and you cannot borrow against an IRA, unlike a 401(k) -- if your plan allows it. Then, Mark, the train operator, says: "I'm finding many ...

Aug 10, 2015 — He invested 5% in his 401K which is (0.05)*($40,000) = $2000. He put the rest (10%) in a Roth IRA which totals (0.10)*($40,000) = $4000.1 answer · Top answer: Joe invested 15% of his income, so his total annual investment is 15% of $40,000 = (0.15)*($40,000) = $6000 He invested 5% in his 401K which is (0.05)*($40,000 ...

How to Make a 401(k) and Roth IRA Work Together. At this point, you may ask whether you should put your money in a 401(k) or a Roth IRA. The answer is yes.. If you're eligible for a 401(k) and a Roth IRA, the best-case scenario is that you invest in both accounts (and if you can max them both out—go for it!).That way, you're taking advantage of your employer match and getting the tax ...

He also discusses his new book, 401(k)s and IRAs for Dummies, including why he thinks Roths are over-sold and his recommendations for retirement plans for small business and the self-employed.

Both IRAs and 401 (k) plans allow you to start taking withdrawals beginning at age 59 1/2. And to be clear, the only stipulation with these plans is that you wait that long to touch your money....

The answer is yes—up to $20,500 in 2022 (up from $19,500 in 2021), with catch-up contributions of $6,500 allowed if you're 50 or over. 2 If you have the money to spare, you also may also want to open and contribute to an individual retirement account, also called an individual retirement arrangement (IRA). Traditional or Roth 401 (k)?

Answers in the middle column apply to traditional IRAs. ... You can open an IRA at a bank or other financial institution or with a mutual fund or life ...

A 401(k) and a Roth IRA are both great tax-saving vehicles for your retirement ... (IRS) until the funds are withdrawn (whereas Roth IRAs are never taxed, ...

The maximum amount of salary that an employee can defer to a 401 (k) plan, whether traditional or Roth, is $19,500 for 2021 and $20,500 for 2022. Employees aged 50 and older can make additional ...

0 Response to "41 funding 401ks and iras worksheet answers"

Post a Comment