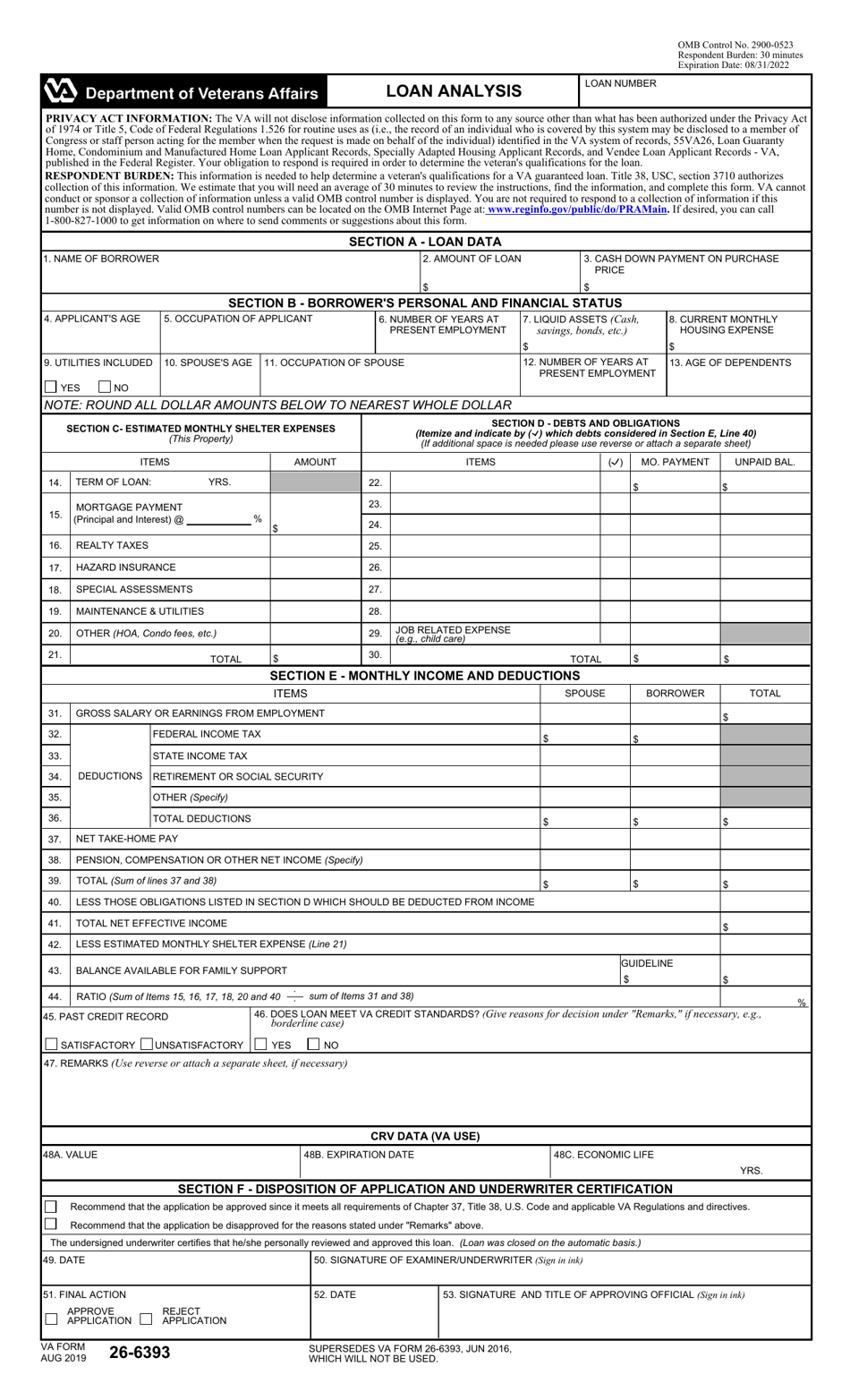

43 mortgage credit analysis worksheet

With all the talk in the news of the main banks unfairly and needlessly cracking down on mortgage lending due to CCCFA, and its likely impact on the housing market, why do the articles not entertain the idea that maybe the banks have been making been making unsustainable, unaffordability or even predatory lending decisions? Is nobody else troubled that people complain and statistics show that houses are unaffordable, but people are still able to get mortgages from banks? Metavante's Loan Origination Studio supports the EHA Loan Transmittal, the Maximum Mortgage Worksheet for 203 (k) and 203 (k) Streamline Loans and the Mortgage Credit Analysis worksheets, according to Cy Brinn, president of Metavante Lending Solutions.

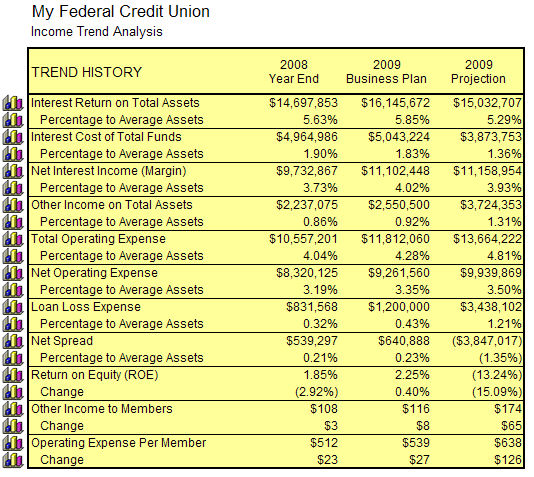

Federal Reserve & Bureau of Economic Analysis Reports Analysis & The Inevitability of the 2021 Real Estate & Stock Market Crash; Credit Default Swaps & Mortgage Securities up 5000%, Mortgage Backed Securities 3600%, 9 States have Unemployment almost 8%, Americans LOST $2 TRILLION in Q1 2021 ALONE !! Video Analysis; [https://youtu.be/TQ\_qwTWfX7o](https://youtu.be/TQ_qwTWfX7o) Video Analysis; Federal Reserve Bank Asset & Liabilities report H8 released 8/20/21 \* Office...

Mortgage credit analysis worksheet

May 10, 2009 — Required Documents for Mortgage Credit Analysis . ... Mortgage Worksheet in the closing package, placed behind Form HUD-.368 pages Mortgage Credit Analysis Worksheet c. Sales Concession (subtract this amount) d. Acquisition costs (sum of lines 14a + b - c) Form HUD-50132 (1/01/14) Streamline with Appraisal Refinances b. Interest Due to payoff d. Subordinate Mortgage(s) Interest Due or (line 12) x 0.9875 if <= $50,000 b. Interest Due to payoff d. Hey Everyone, Canadian citizen with Australian PR here and currently living in Canada. Looking to buy a house and move to Brisbane. This is my first time applying for a mortgage in Australia and it seems the debt servicing calculations are done quite differently than Canada. My broker is telling me that because I have a large credit card limit (40k) that it’s an open liability and will reduce the mortgage amount I qualify for. I only spend 1-2k on my card monthly and always pay back in full ev...

Mortgage credit analysis worksheet. About 5 years ago I had a 10k credit card that I was dumb enough not to pay off for three years. Fast forward 6 years and my credit score took a real beating however I’m debt free. I now work in the mines but and have a secure and solid work history for 2 years+. Do I have to wait the whole seven years for my credit score to clear or is it even possible to get a home loan with 70k as an upfront payment but horrible credit rating. Thanks Mortgage Bond. A long-term bond secured by the payments on one or more mortgages. For example, a mortgage corporation may issue a bond backed by payments it receives from clients. This provides the issuer with working capital while providing a relatively safe investment for bondholders. mgic income analysis worksheet (2021) mgic income calculator 2020; How to Edit Your Self employed income worksheet Online. When dealing with a form, you may need to add text, complete the date, and do other editing. CocoDoc makes it very easy to edit your form in a few steps. Let's see how to finish your work quickly. MCAW - Mortgage Credit Analysis Worksheet. Looking for abbreviations of MCAW? It is Mortgage Credit Analysis Worksheet. Mortgage Credit Analysis Worksheet listed as MCAW. Mortgage Credit Analysis Worksheet - How is Mortgage Credit Analysis Worksheet abbreviated?

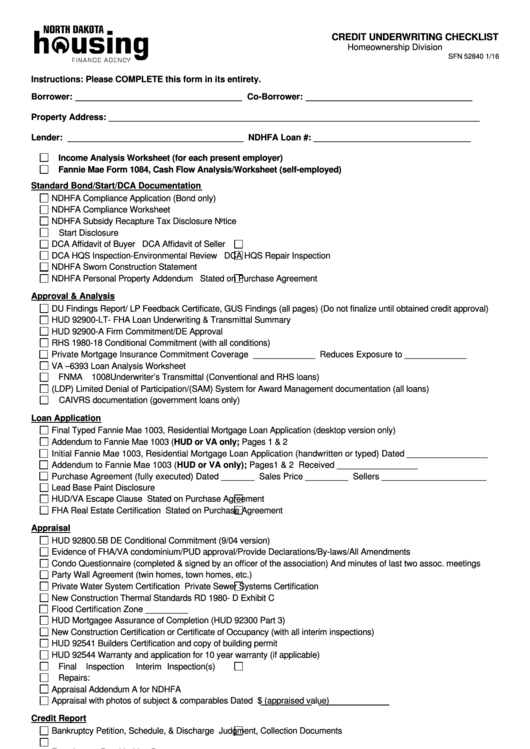

Hello, I am trying to find good credit unions in Nashville that would offer lower rates & fees for mortgage. My credit score is great and going for conventional with 20% down. Does anyone here have experience using them? Any data points are appreciated! This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. The Mortgage Credit Analysis Worksheet has been revised to reflect changes to the percentage of financeable closing costs. Several of the more important changes are discussed below: Line 5 Closing Costs: On line 5a, show the total buyer's closing costs of the transaction. On line 5b, subtract any amount of buyer's closing costs paid by the seller. HUD 4155.1 Table of Contents i HUD 4155.1, Mortgage Credit Analysis for Mortgage Insurance Chapter 1. Underwriting Overview Section A. General Information on the Underwriting Process

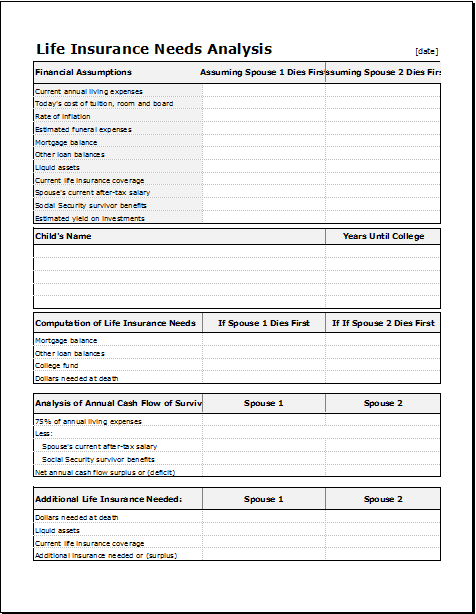

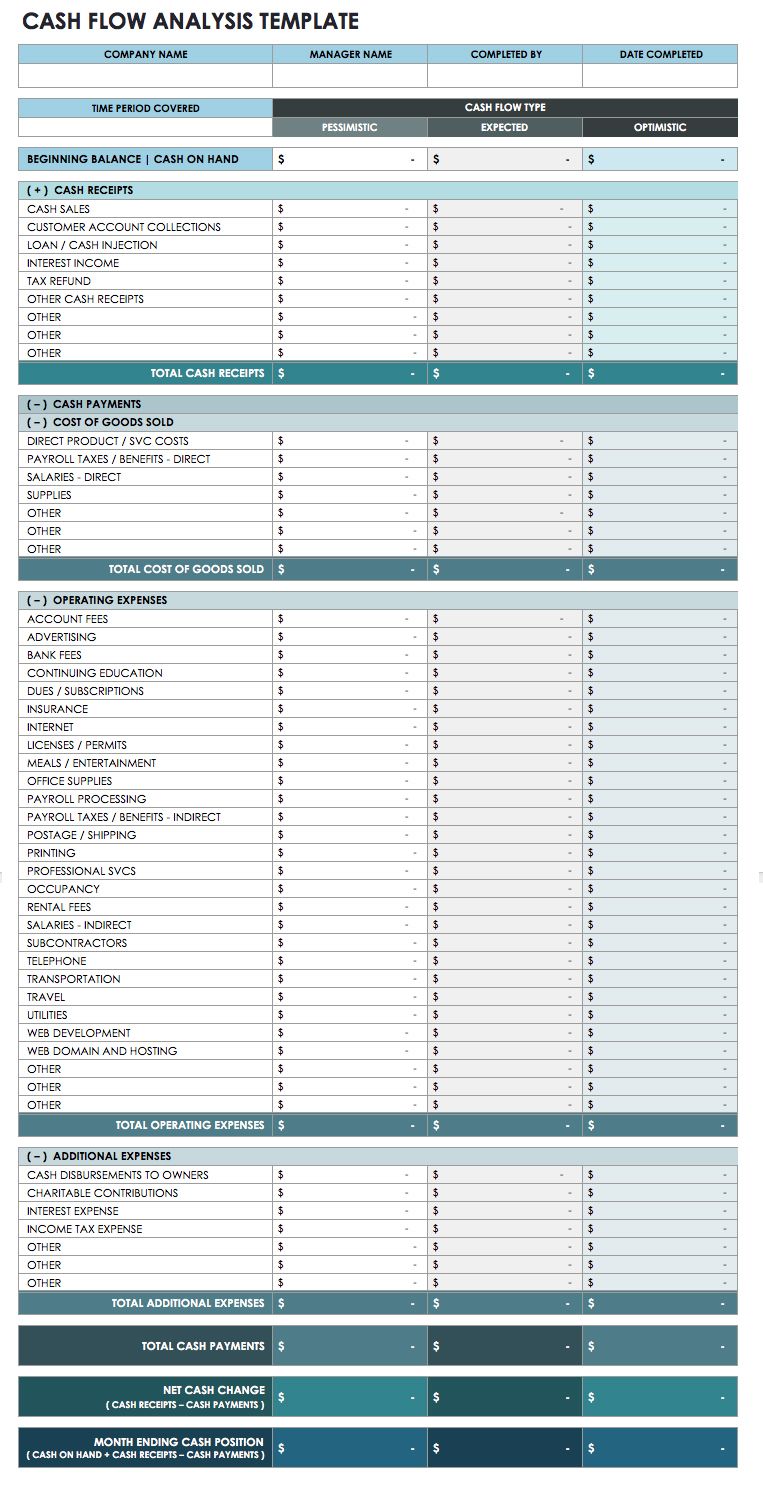

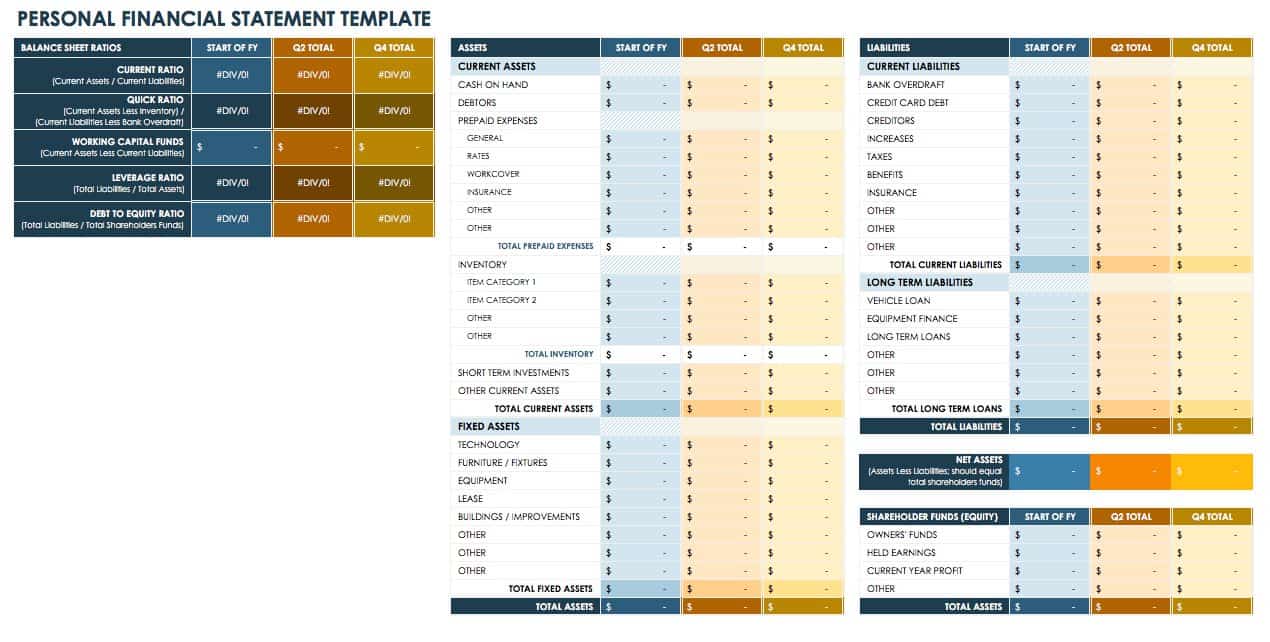

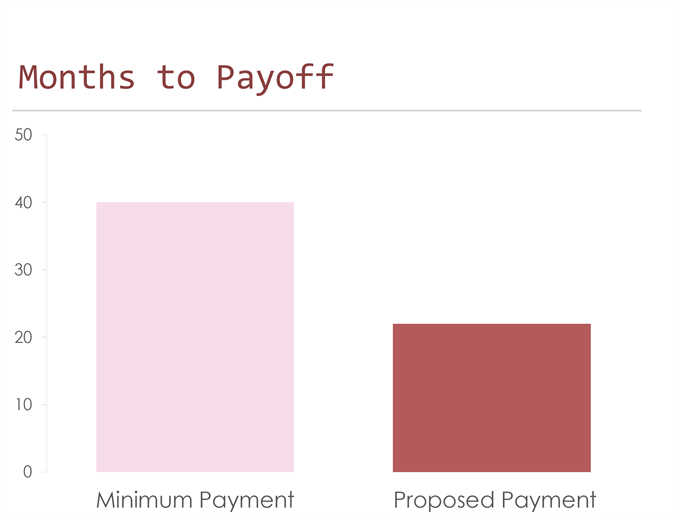

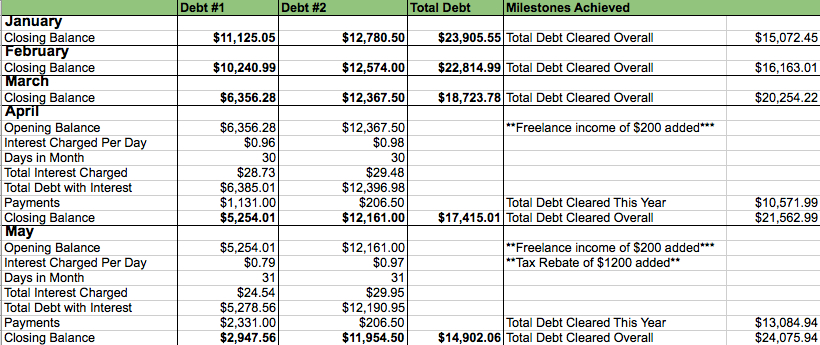

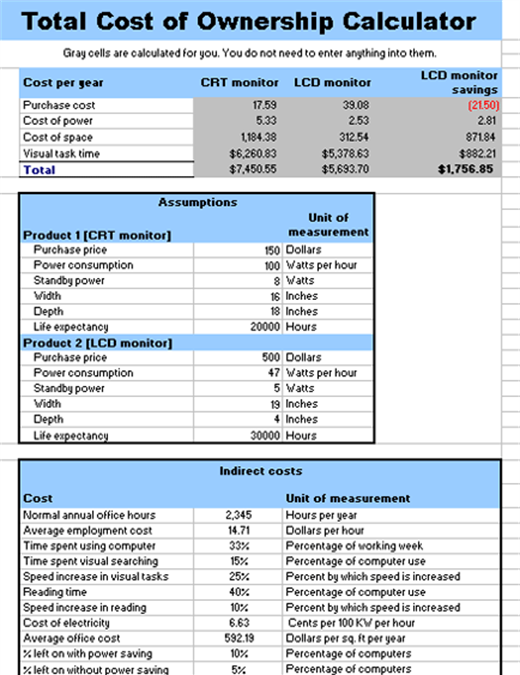

Loan Analysis Worksheet offers a thorough set of tables of rates of a loan through the years for different standings of loans; mortgage, installment, and etc. Our template gives an assortment of little and huge tables for comparison. Make use of this worksheet format to dissect different loan situations. Enter the investment rate, credit term ... Ralph has agreed to assume a mortgage payoff of $74,350 at 7% interest. The monthly P&I payment is $615.40 and closing is set for April 19th. How will the interest proration appear on the closing statement if the parties use the 30 day month/360 day year method? A. $159.06 Debit-Seller, Credit-Buyer B. $159.06 Debit-Buyer, Credit-Seller Analysis Method Worksheet on page 5, not both. ... LOC (Line of Credit): Line of Credit (LOC) interest-only payments are simply 'rent' on a short-term use of credit. ... * Some secondary-market mortgage lenders do not add back interest or subtract business debt. Say, if the husband has 800 and the wife has 750, 750 is used to calculate the interest rate. Is that right?

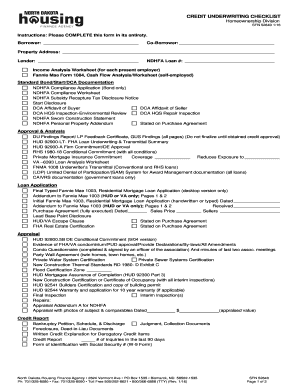

This number is entered by the lender (underwriter) on the Mortgage Credit Analysis Worksheet, form HUD-92900-PUR (or form HUD-92900-WS). FHA claim information is reported to CAIVRS for 36 months after a claim is paid. If the borrower has a delinquent Federal debt or has had a claim paid on a Federally insured loan, use the telephone referral ...

The Mortgage Credit Analysis Worksheet (MCAW) (HUD-92900-PUR) has been revised to reflect changes to FHA's treatment of closing costs. Line 10c Unadjusted Acquisition: This reflects the amount the buyer has agreed to pay for the property as well as any closing c osts to be paid by the borrower from Line 5c.

A technician performing an RNA-sequencing experiment on the Life Technologies 5500XL sequencer at the Advanced Technology Research Facility (ATRF), Frederick National Laboratory for Cancer Research, National Cancer Institute.

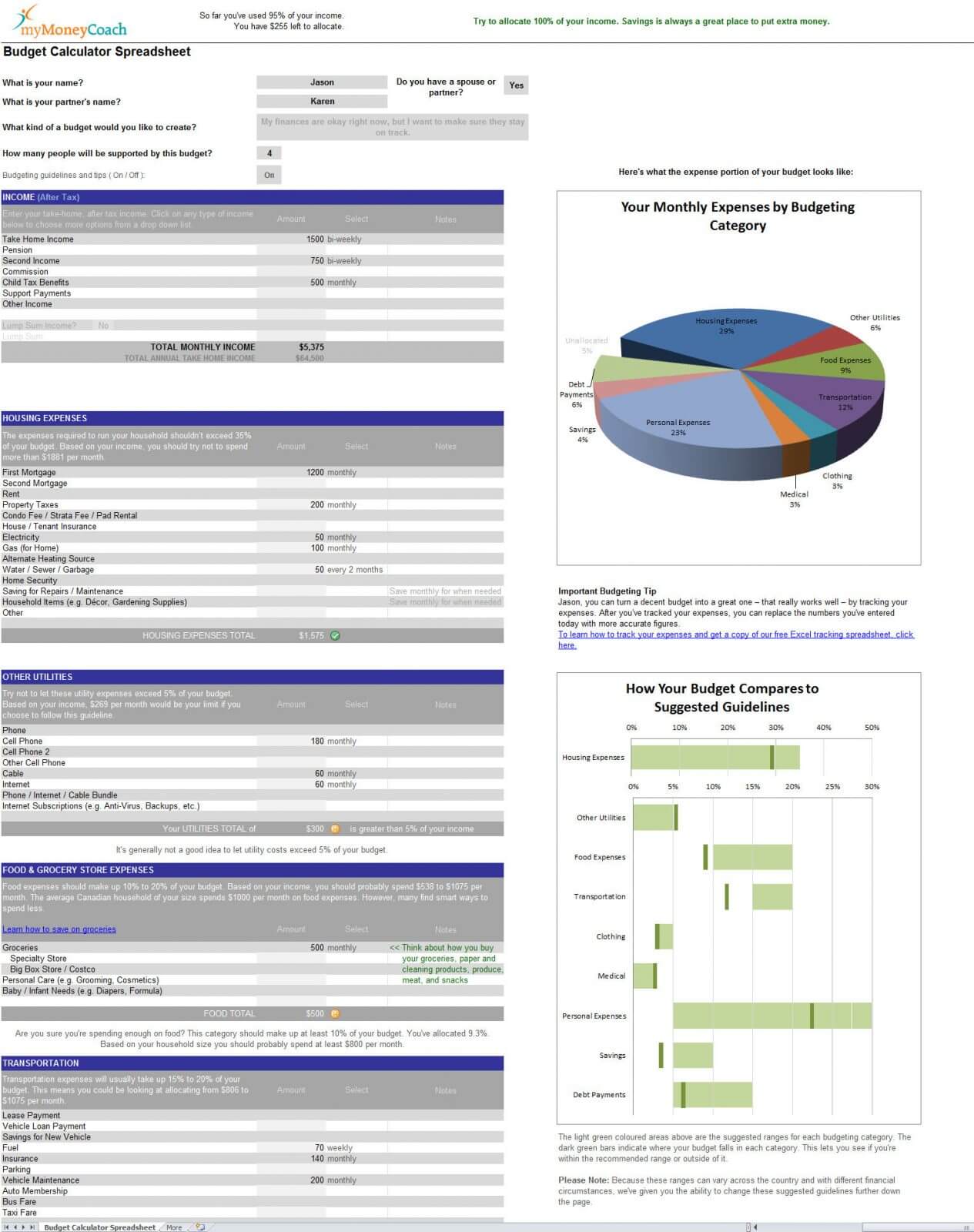

Below is a worksheet you can use to start to do some economic analysis to compare mortgages. The first seven lines set the basis for the analysis and the remaining lines track the balance of the mortgage from the initial loan balance until the loan is paid off, a process known as amortization.

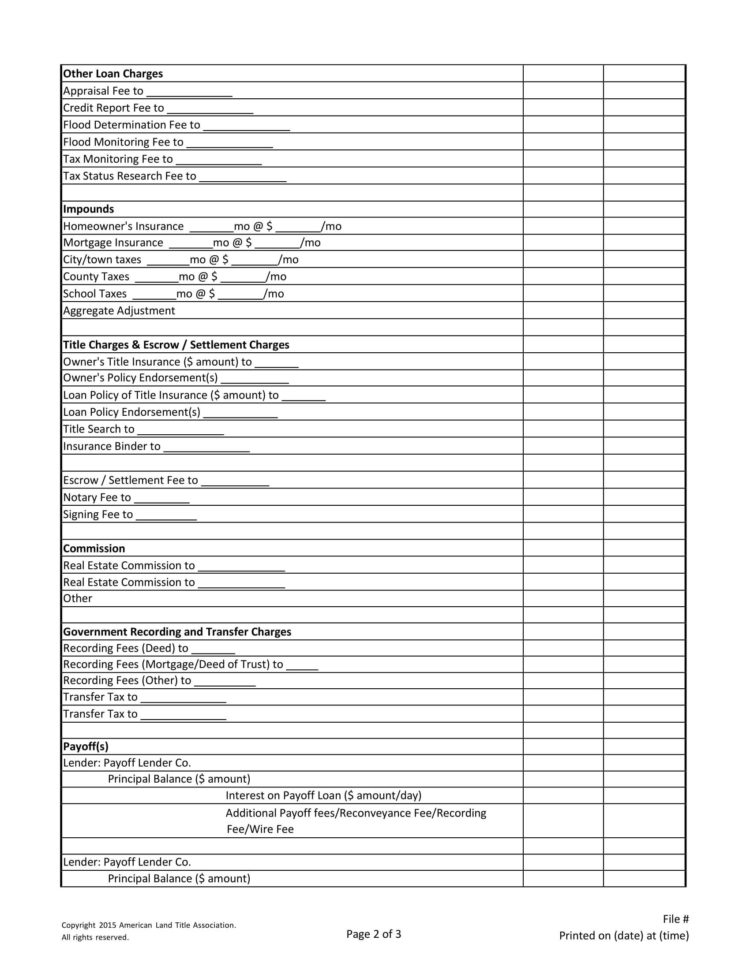

Credit Report Fee This is a report to get your credit history and score. Costs up to $75. Appraisal Fee This is paid to the appraisal company to conirm the fair market value of the home. A single-family home costs between $450 - $650. Building Inspection Inspector fees typically range from $450 - $1,000. Survey

Related: Alternatively you to this free mortgage Excel template design for Loan Analysis you can download financial PowerPoint templates and slide designs to present to a mortgage agency or make presentations on mortgage and loan analysis. Aside from this, the loan analysis worksheet template can help you determine how much of your monthly payments go towards your loan and how much goes ...

The National Cancer Institute's Natural Products Branch at the Frederick National Laboratory for Cancer Research is the largest program to collect materials worldwide from marine, plant, and microbial sources so they may be studied for possible medical uses. The fermentation lab grows fungal and bacterial cultures in liquid media. These materials are extracted using organic solvents, and eventually tested in the NCI cancer screens.

The following is a description of the steps to be taken when completing any of the Section 184 Mortgage Credit Analysis Worksheets (MCAWs). Determine the type of transaction you are working with. Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction.

Score has dropped 15 points just through equifax due to the number of hard pulls. I didn’t notice until this week when I was told the rate has increased because the score dropped , do I have any options here? As I would think authorizing a credit pull would be in good faith and for it not to be abused like this. They are actually making more money due to the 25 a month increase in payments now

Download the Commercial Mortgage Loan Analysis Model. To make this model accessible to everyone, it is offered on a "Pay What You're Able" basis with no minimum (enter $0 if you'd like) or maximum (your support helps keep the content coming - typical real estate Excel models sell for $100 - $300+ per license).

Mortgage term. The interest rate on the loan. Employment details. Credit score. The total amount of down payment. The total amount of tax to be paid. There can be many other details depending on which tool you use for checking mortgage qualification. File: Excel (.xlsx) 2007+ and iPad Size 45 Kb | Download.

A Caucasian male technician preparing tissue to be stained and studied histologically in a laboratory. 1950

At my last refix, for the first time I split off 40k of my mortgage and made it a Flexi. So my cheque account went -40k into OD. I had 20k savings doing practically nothing other than act as a quick access to cash if I need it for travel/emergencies. I put 10k of this straight into my cheque account so OD is roughly -30K. Before this change, the day I get paid I would instantly move money to credit card and savings. Usually to the tune of a few grand moving out of my cheque account on pay day...

I remember posting on here a few years ago asking if a 800+ credit score will be better than a score within the 750-800 range in terms of mortgage rates, and I recall everyone saying that anything above 750 gives the same rates. It seems this is not actually true and lender-dependent because I've seen some lenders have a lower rate for 800+ compared to 750+. Has this changed recently?

45. PAST CREDIT RECORD 48A. VALUE. 48B. EXPIRATION DATE €47. REMARKS€ (Use reverse or attach a separate sheet, if necessary) 48C. ECONOMIC LIFE YRS. CRV DATA (VA USE) €46. DOES LOAN MEET VA CREDIT STANDARDS?€ (Give reasons for decision under "Remarks," if € necessary, e.g., € borderline case) SATISFACTORY UNSATISFACTORY. YES AMOUNT ...

If a borrower's credit history was evaluated by using nontraditional credit or a nontraditional mortgage credit report, the lender must reverify each of the credit references on that report. If the lender obtained written references from creditors, the lender's QC review process must include reverification of each of the credit references.

and Underwriting Analysis reports ... Rental income calculation worksheet, if used by lender *Component required for all loan applications. All other components, as used. ... histories not on the credit report Verification of mortgage or other documentation to verify mortgage payment history not on the credit report

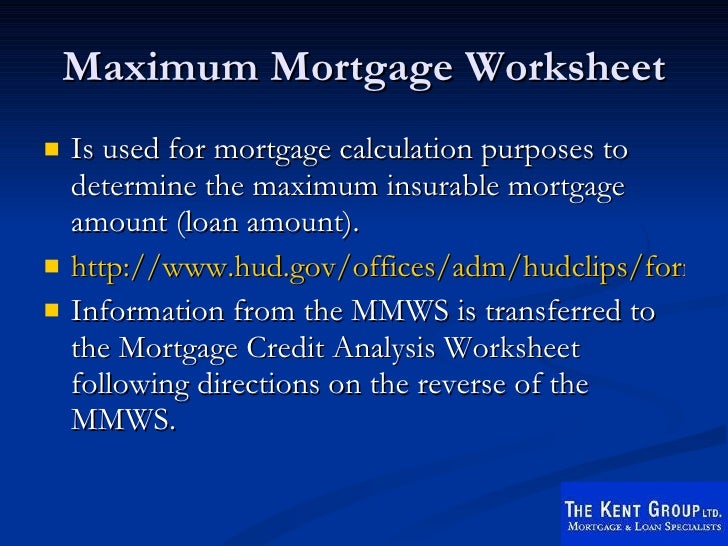

Mortgage Credit Analysis Worksheet. Business » Mortgage. Add to My List Edit this Entry Rate it: (1.00 / 1 vote) Translation Find a translation for Mortgage Credit Analysis Worksheet in other languages: Select another language: - Select - 简体中文 (Chinese - Simplified)

Mortgage Credit Analysis Worksheets (MCAWs). 1) Determine the type of transaction you are working with. 2) Select the appropriate tab at the bottom of the excel worksheet to display the MCAW designed for your specific transaction. Some types of transactions may require the completion of more than one form.

It kills me to watch 80k sit in the bank as cash. It will take a year or two for my credit to recover so I can qualify for a mortgage. Considering half in Bitcoin and half in crypto. Thoughts?

>It kills me to watch 80k sit in the bank as cash. It will take a year or two for my credit to recover so I can qualify for a mortgage. Considering half in Bitcoin and half in crypto. Thoughts? At least many (most ?) of the folks in the linked thread are saying "don't do it" or "don't risk it all in crypto", or "only risk 5-15% in crypto" or similar. This is in stark contrast to past times, when the vast majority of the replies would have been "yes, go all in". Ref: * [https://www.re...

Below is the analysis Radar Lender Services uses to determine how much draw is required from the subject business. You do not have to use this analysis, but you need to show and explain how you determined you draw requirement. Monthly Annual Monthly Annual Income Expenses Required Draw $0 $0 Personal Mortgage (P&I) $0 $0

A technician using a nano-spectralizer (fluorescence microscope) at the Advanced Technology Research Facility (ATRF), Frederick National Laboratory for Cancer Research, National Cancer Institute.

Title of Proposal: Application for FHA Insured Mortgage (Addendum to Unoform Residential Loan Application/Mortgage Credit Analysis Worksheet). OMB Approval Number: 2502-0059. Form Numbers: HUD-92900—A, HUD-92900-B, HUD-92900-WS, HUD-92900-PUR, HUD-92561, HUD-92544.

Loan analysis worksheet. Use this accessible template to analyze various loan scenarios. Enter the interest rate, loan term, and amount, and see the monthly payment, total payments, and total interest calculated for you. Other interest rates and loan terms are provided for comparison to help you make the choice that's right for your situation.

I recently found out that my parents years ago were given bad financial advice and told to pay off their mortgage with a line of credit. Now because they haven't been paying a principal for years they've just been paying off the min payment and interest. They both just turned 60 and I want to help them fix this the best I can. They bought the house 30 years ago around $120k can they get a new mortgage? I have zero expertise in this whatsoever. All I know is that there must be something they can ...

The Mortgage Tax Credit Certiicate (MCC) program was established by the Deicit Reduction Act of 1984 and was modiied by the Tax Reform Act of 1986. 8 . Under the law, states can convert a portion of their federal allocation of private activity bonds (PABs) to MCC authority on a four-to-one basis. Mortgage

FHA Mortgage Credit Analysis Worksheet. Determines the appropriate amount for an FHA loan. Term Source: LDD. Categories: Document. Hash Tags: #Origination. ©2020 The Mortgage Industry Standards Maintenance Organization.

Hey Everyone, Canadian citizen with Australian PR here and currently living in Canada. Looking to buy a house and move to Brisbane. This is my first time applying for a mortgage in Australia and it seems the debt servicing calculations are done quite differently than Canada. My broker is telling me that because I have a large credit card limit (40k) that it’s an open liability and will reduce the mortgage amount I qualify for. I only spend 1-2k on my card monthly and always pay back in full ev...

Mortgage Credit Analysis Worksheet c. Sales Concession (subtract this amount) d. Acquisition costs (sum of lines 14a + b - c) Form HUD-50132 (1/01/14) Streamline with Appraisal Refinances b. Interest Due to payoff d. Subordinate Mortgage(s) Interest Due or (line 12) x 0.9875 if <= $50,000 b. Interest Due to payoff d.

May 10, 2009 — Required Documents for Mortgage Credit Analysis . ... Mortgage Worksheet in the closing package, placed behind Form HUD-.368 pages

Drosophila Wing Cells. The human CBFA2T3-GLIS2 fusion protein is a key driver of pediatric acute megakaryoblastic leukemia (AMKL), and confers a poor prognosis. Researchers found a way to express CBFA2T3-GLIS2 (red) in larval Drosophila (fruit fly) wing disc cells, confirming a major role for the BMP signaling pathway. This pathway may provide a target for new therapies. Nuclei (green) and actin filaments (purple) are also shown.

0 Response to "43 mortgage credit analysis worksheet"

Post a Comment