43 usda income calculation worksheet

Income Calculation: Worksheet For Calculating Income – Attachment A FEMA Form 81-93, “Standard Flood Determination Form” Note: Properties located in flood plains will require additional documentation. Confirmation the base flood … 05-29-20 CMG Bulletin 2020-34 Assessing the Impact of COVID-19, Business Income Calculation Adjustment, Business Assets: 05-28-20 CMG Bulletin 2020-33 Reminder of Critical Details of GSE Refinance and Home Purchase Eligibility for Borrower in Forebearance, Reminder- Borrowers Returning to Work, Reminders- Appraisal Flexibilities

• Zero Income – RD’s policy is to not accept a tenant certification for an applicant or tenant with zero income unless all income is specifically exempted. • If applicant or tenant states they have no household income, they will need to demonstrate financial …

Usda income calculation worksheet

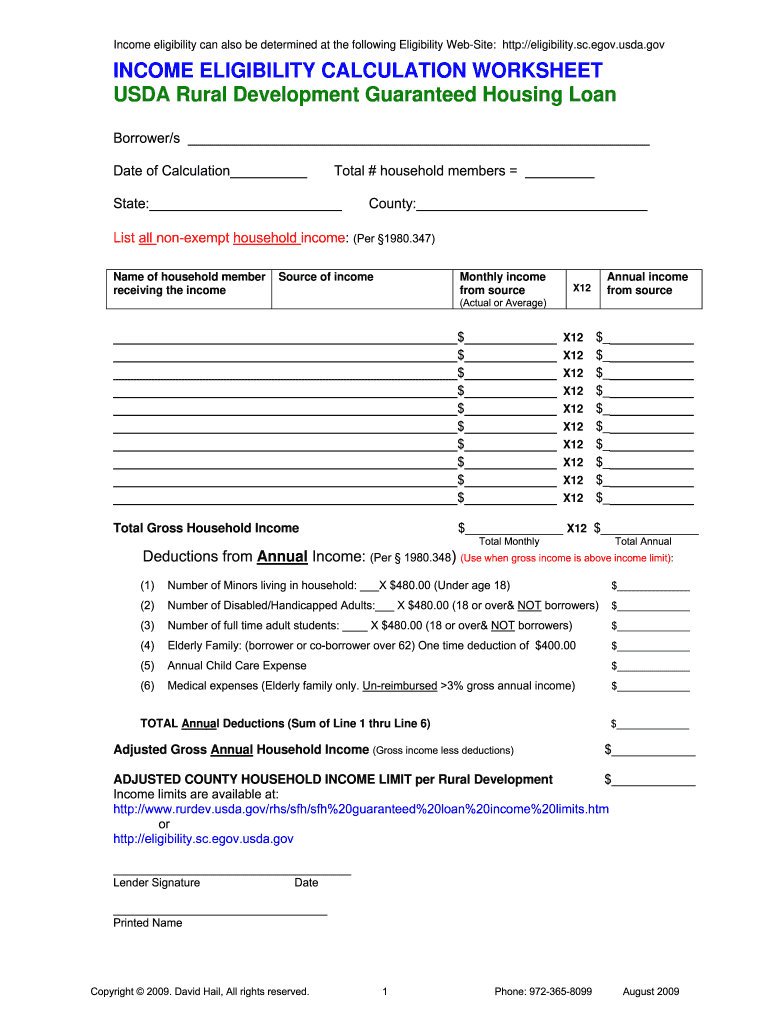

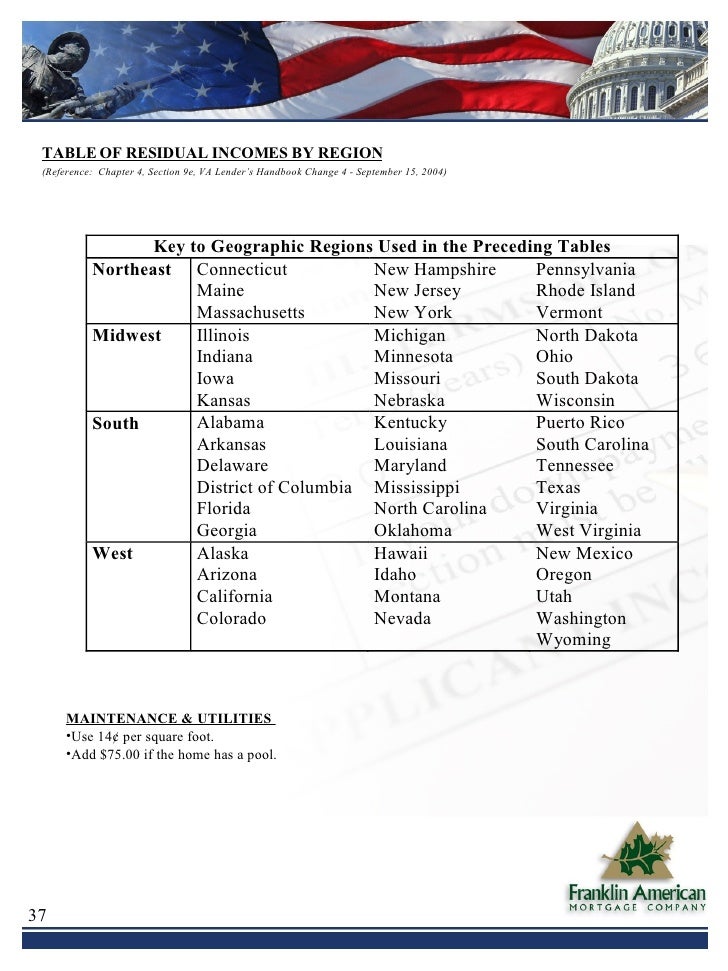

VA Residual Income Calculator. Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck(s). Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income This workbook has 3 different worksheets to check the borrower's promissory note history records and/or to calculate the amount of interest assistance subsidy owed the lender. Select which worksheet to use based on how the Daily Interest Accrual is determined (360/365, 360/360, or 365/365).

Usda income calculation worksheet. We would like to show you a description here but the site won’t allow us. For example, say year one the business income is $80,000 and year two $83,000. The income used for qualifying purposes is $80,000 + $83,000 = $163,000 then divided by 24 = $6,791 per month. Declining Self-Employed Income: But the lender also looks at something else when reviewing years one and two: consistency. The example above showed ... • Income sources that will not be received for the entire ensuing 12 months must continue to be included in annual income unless excluded under 3555.152(b)(5). Examples include, but are not limited to, child support, alimony, maintenance, Social Security, etc. Annual income is the total of all income sources for a 12- month timeframe. Be sure the info you fill in Usda Income Calculation Worksheet is updated and accurate. Indicate the date to the template using the Date tool. Click on the Sign tool and make an e-signature. You can use three available options; typing, drawing, or capturing one. Make sure that each and every field has been filled in correctly.

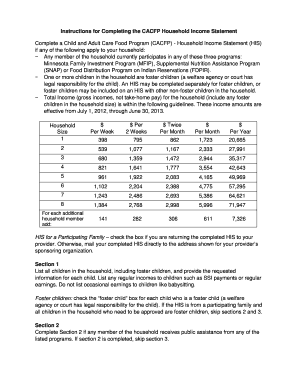

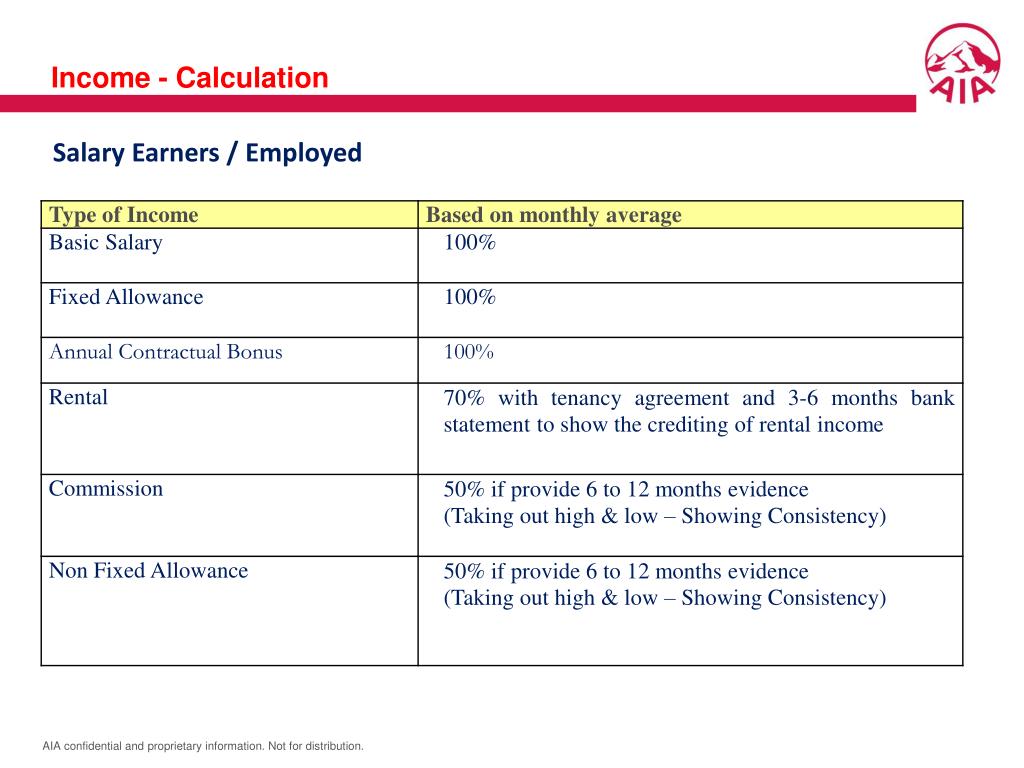

INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1) Hourly: See Part II, Section 1a, 1b, 1c or 1d (seasonal worker) 2) Weekly: See Part II, Section 2 3) Bi-Weekly: See Part II, Section 3 4) Semi-Monthly: See Part II, Section 4 5) Overtime/Bonuses: See Part II, Section 5a or 5b 6) Commissioned: See Part II, Section 6 Welcome to the USDA Service Center Agencies eForms. eForms allows you to search for and complete forms requesting services from Farm Service Agency (FSA), Natural Conservation Service (NRCS), and Rural Development (RD). There are 2 ways to use the eForms site. Much of the information on the Income Worksheet is populated from information previously entered on pages 2 and 6 of the Rural Assistance URLA tab. 1 Click an Edit icon to edit the value in a field. 2 In the Annual Income Calculation and Adjusted Income Calculation sections, use the Calculate and Record fields to enter the values and formulas ... Welcome to the USDA Income and Property Eligibility Site. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. In order to be eligible for many USDA loans, household income must meet certain guidelines. Also, the home to be purchased must be located in an eligible rural area as ...

Lunch Worksheets. Grades K-5. Grades K-8. Grades 6-8. Grades 9-12. 10/17/2013. USDA Guidance for Conducting Analyses Under the Principles, Requirements, and Guidelines for Water and Land Related Resources Implementation Studies and Federal Water Resource Investments, January, 2017; CIRCULAR 390-21-1, updates to Title 390, National Watershed Program Manual (NWPM) USDA Food Plans: Cost of Food The Thrifty Food Plan, 2021 was released on August 16, 2021. The TFP represents the cost of a nutritious, practical, cost-effective diet. Attachment A Page 2 of 3 Rev 1/2013 Applicant(s): ADJUSTED INCOME CALCULATION (Consider qualifying deductions as described in §1980.348 of RD Instruction 1980-D) 7. Dependent Deduction ($480 for each child under age 18, or full-time student attendi ng school or disabled family member over the age of 18) - #_____ x $480 8. Annual Child Care Expenses (Reasonable expenses for children 12 and under).

This workbook has 3 different worksheets to check the borrower's promissory note history records and/or to calculate the amount of interest assistance subsidy owed the lender. Select which worksheet to use based on how the Daily Interest Accrual is determined (360/365, 360/360, or 365/365).

Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income

VA Residual Income Calculator. Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck(s).

.JPG)

0 Response to "43 usda income calculation worksheet"

Post a Comment