43 truck driver expenses worksheet

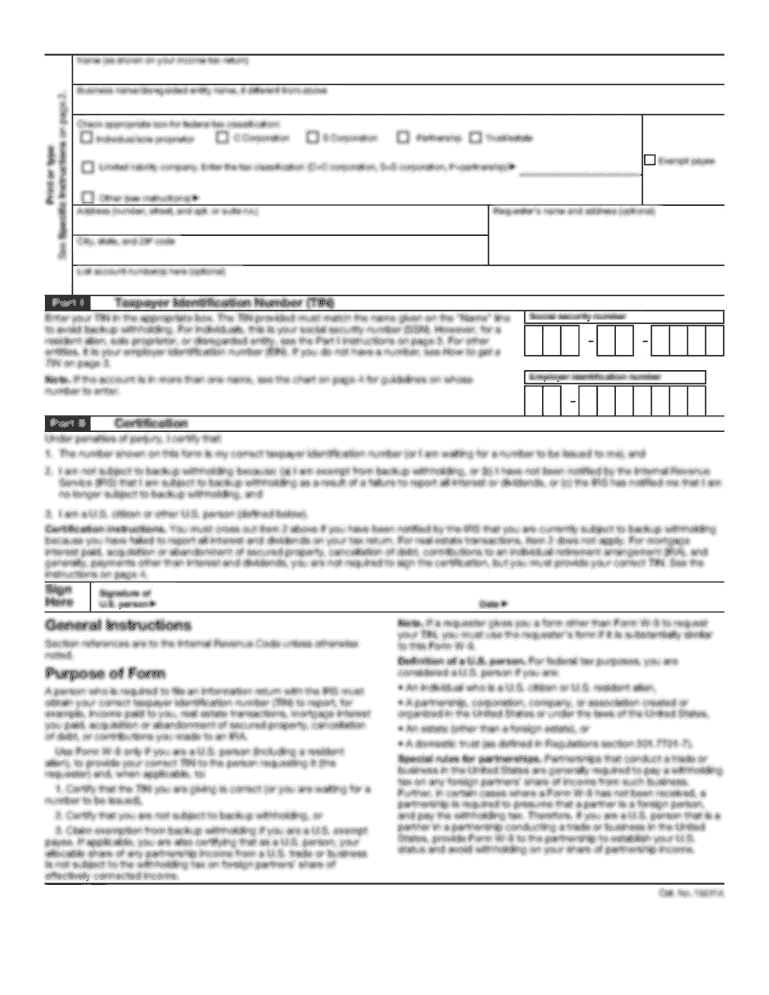

TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) - Possible Deductions From Checks- Licenses & Permits Bobtail Fees Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions- Get and Sign Truck Driver Tax Deductions Worksheet Form Expenses are deductible only if you itemize deductions. You will benefit from deducting employee business expenses only to the extent your total miscellaneous itemized deductions exceed 2 of your adjusted gross income AGI.

TRUCKER’S INCOME & EXPENSE WORKSHEET!!!!! YEAR_____ NAME ... Continue only if you take actual expense (must use actual expense if you lease) Mfg. gross vehicle weight ... Truck Driver Tax Deductions Visit WWW.CB39.ORG for more CDL Truck Driver Solutions

Truck driver expenses worksheet

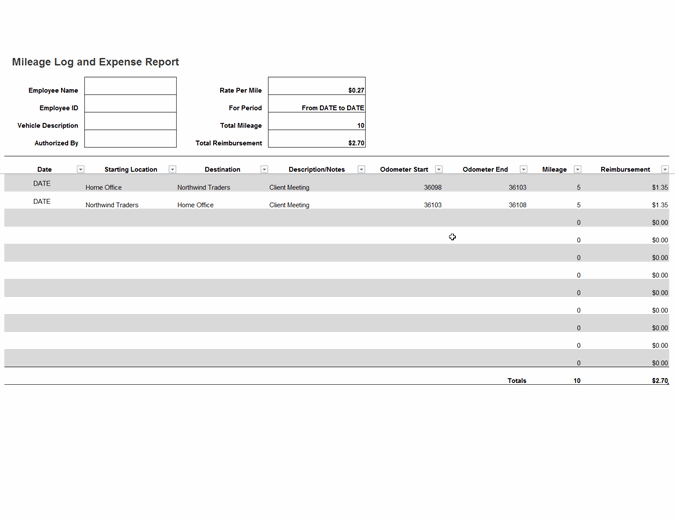

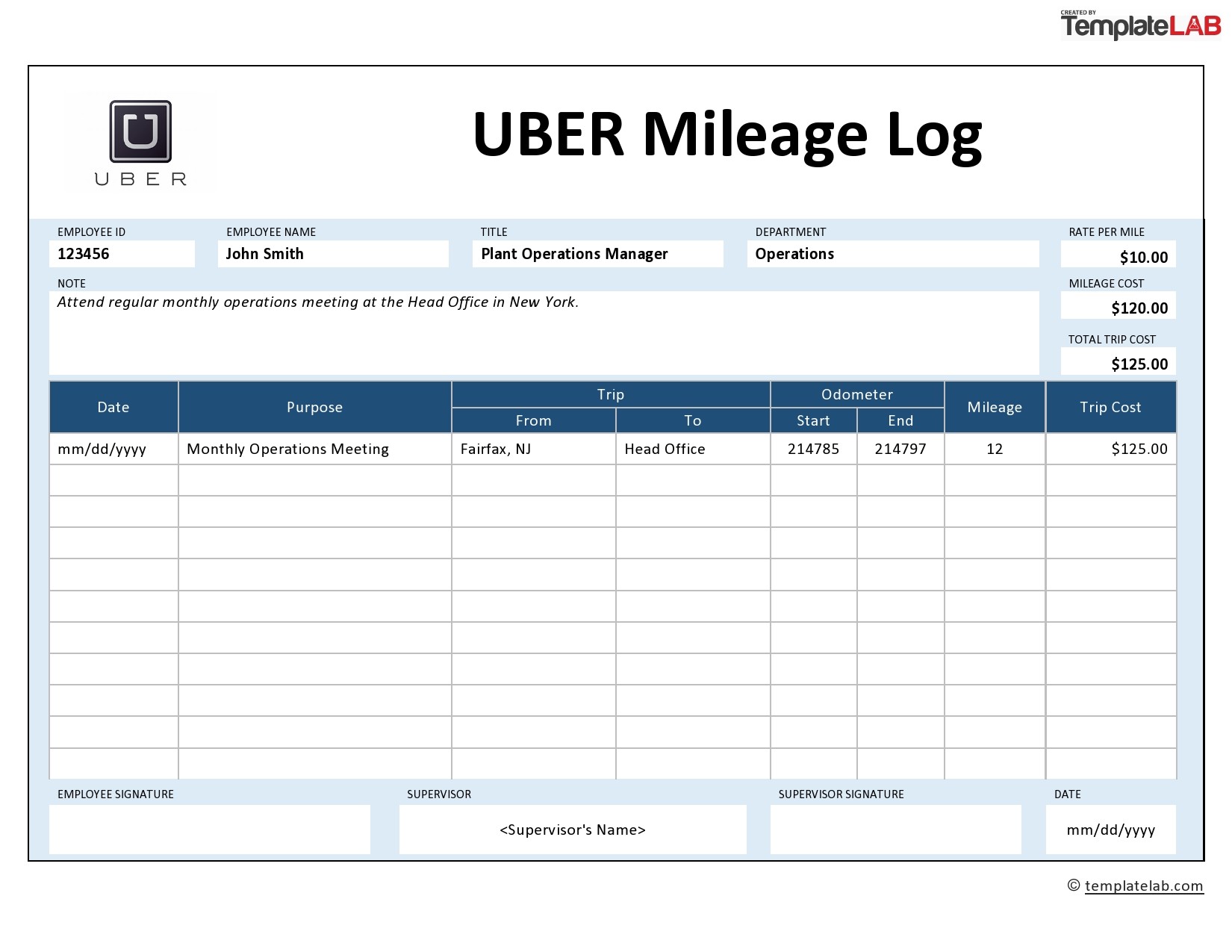

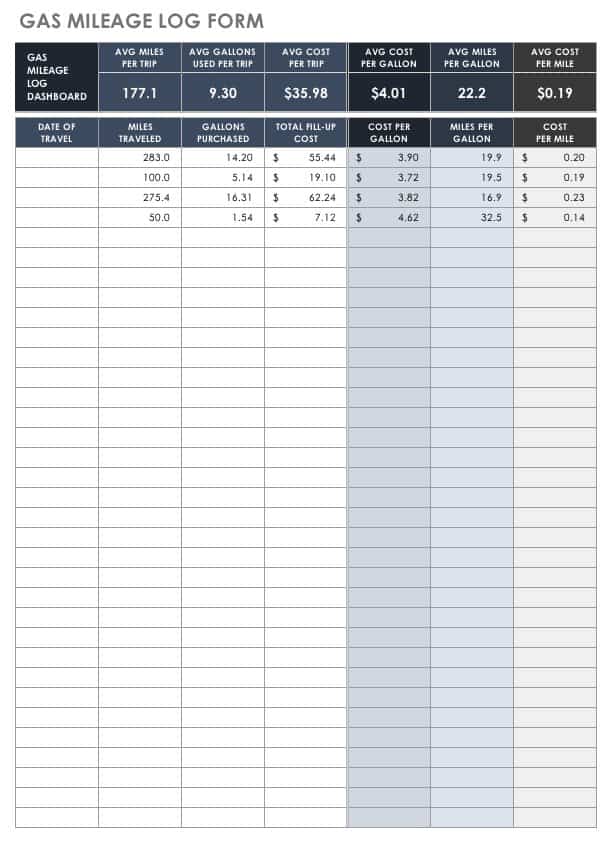

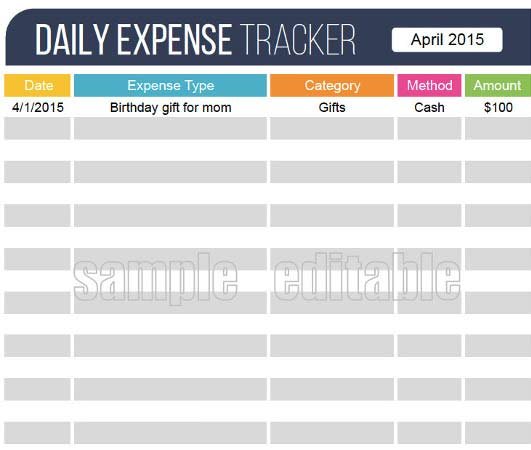

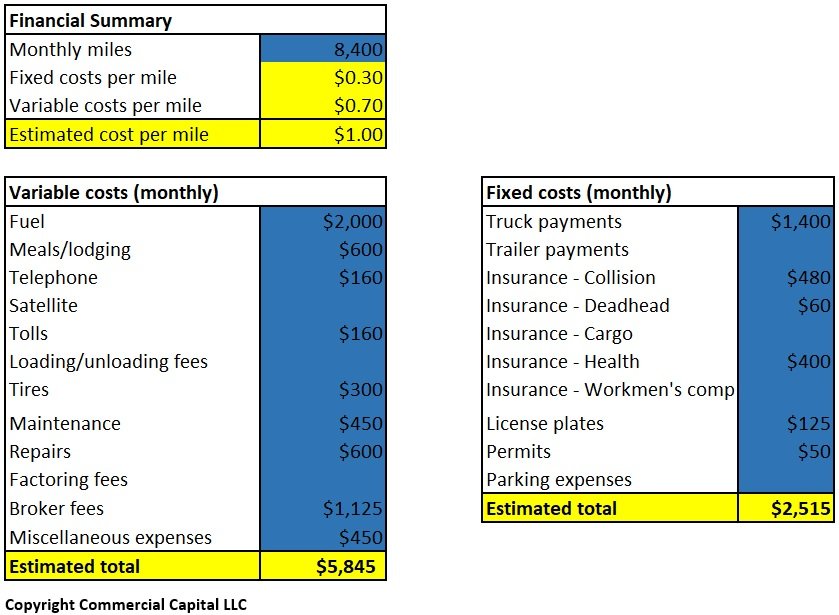

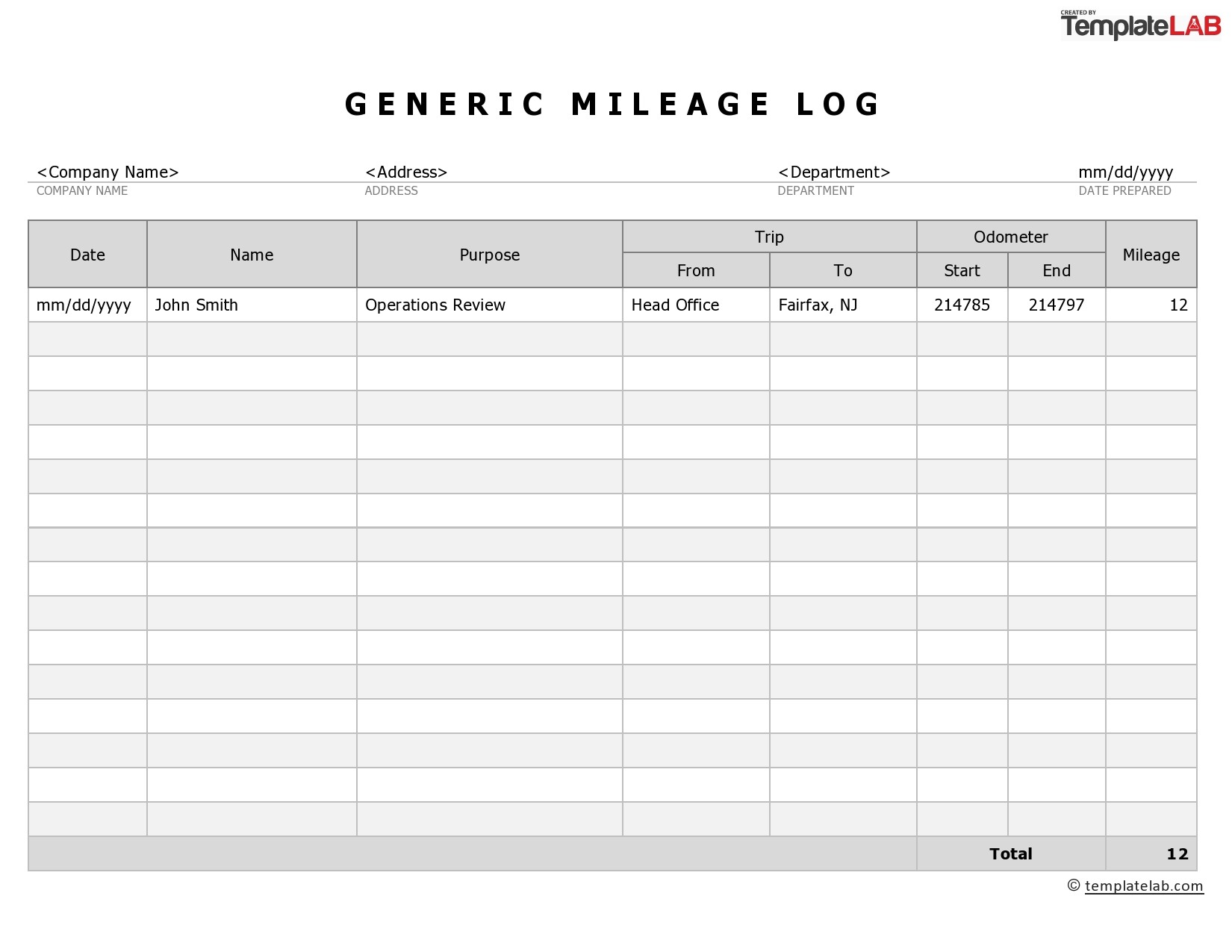

In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report. Back to trucking expenses spreadsheet. Folks aren’t likely to acquire. Get the free 2020 truck driver tax deductions worksheet form. Get Form. Show details. Hide details. LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered. Trucker's Income & Expense Worksheet Form TW-1216 Stetzer Accounting W23082 State Road 35 • Trempealeau, WI 54661-9202 • (608) 534-6558 • Fax (888) 519-9175 Name Name of Business Address of Business How many months was the business in operation during the year?

Truck driver expenses worksheet. Format : jpg/jpeg. As a spreadsheet entry worker, you must have good computer skills, especially with using spreadsheets. It is also important that you have a good typing speed, including attention to detail. You can begin this work as a high school graduate; however, to advance and apply for higher salaried jobs, you need to train yourself in ... Other expenses related to truck drivers in particular do include things like cargo losses and damage claims if cargo costs were included in income and pay to other drivers who assist you with your job. If these drivers are your employees (instead of independent contractors), you may be (and are likely to be) responsible for paying ... TRUCKER'S INCOME & EXPENSE WORKSHEET YEAR ----- ... TRUCK RENTAL FEES OTHER INCOME FULL TIME OR # of hours ---YES NO 1099-MISC. Bring in ALL 1099s received. Do your records agree with YESQ ... T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees

Trucker's Income & Expense Worksheet Form TW-1216 Stetzer Accounting W23082 State Road 35 • Trempealeau, WI 54661-9202 • (608) 534-6558 • Fax (888) 519-9175 Name Name of Business Address of Business How many months was the business in operation during the year? Get the free 2020 truck driver tax deductions worksheet form. Get Form. Show details. Hide details. LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered. In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report. Back to trucking expenses spreadsheet. Folks aren’t likely to acquire.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

.png)

0 Response to "43 truck driver expenses worksheet"

Post a Comment