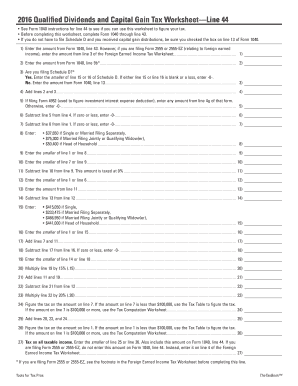

40 qualified dividends and capital gain tax worksheet 2015

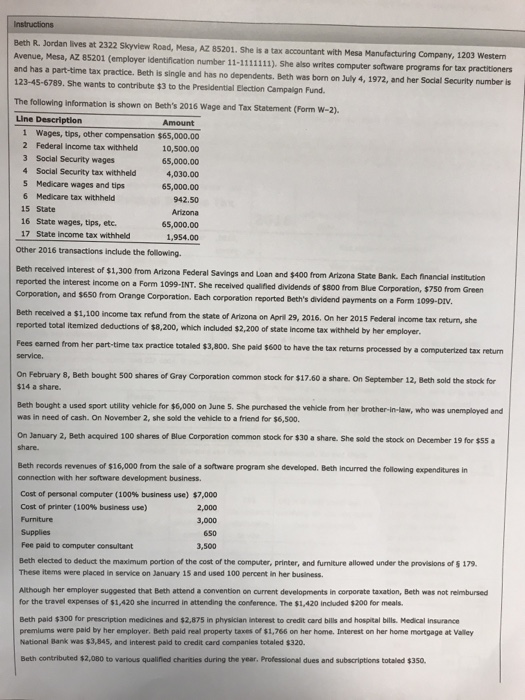

2015 tax return - eFile.com Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). X ...45 pages Qualified Dividends and Capital Gain Tax Worksheet. | Chegg.com Finance questions and answers. Qualified Dividends and Capital Gain Tax Worksheet. How do you calculate the taxes? The total amount of income from line 7 of the 1040 is $173,182 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the...

Breaking Down a Qualified Dividends and Capital Gain Tax... By definition, a qualified dividend is that particular type that gets taxed at the capital gains tax rate. If you are not sure about the way in which you need to complete the Qualified Dividends and Capital Gain Tax Worksheet, ask for instructions Read More Dividend Income Update - June 2015.

Qualified dividends and capital gain tax worksheet 2015

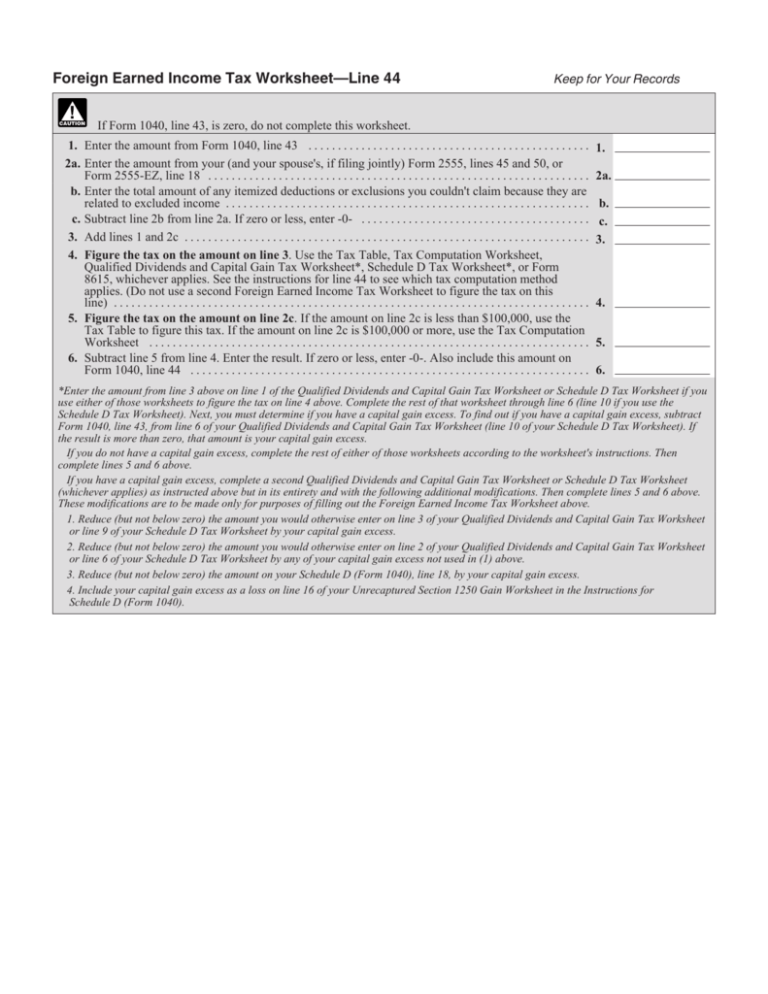

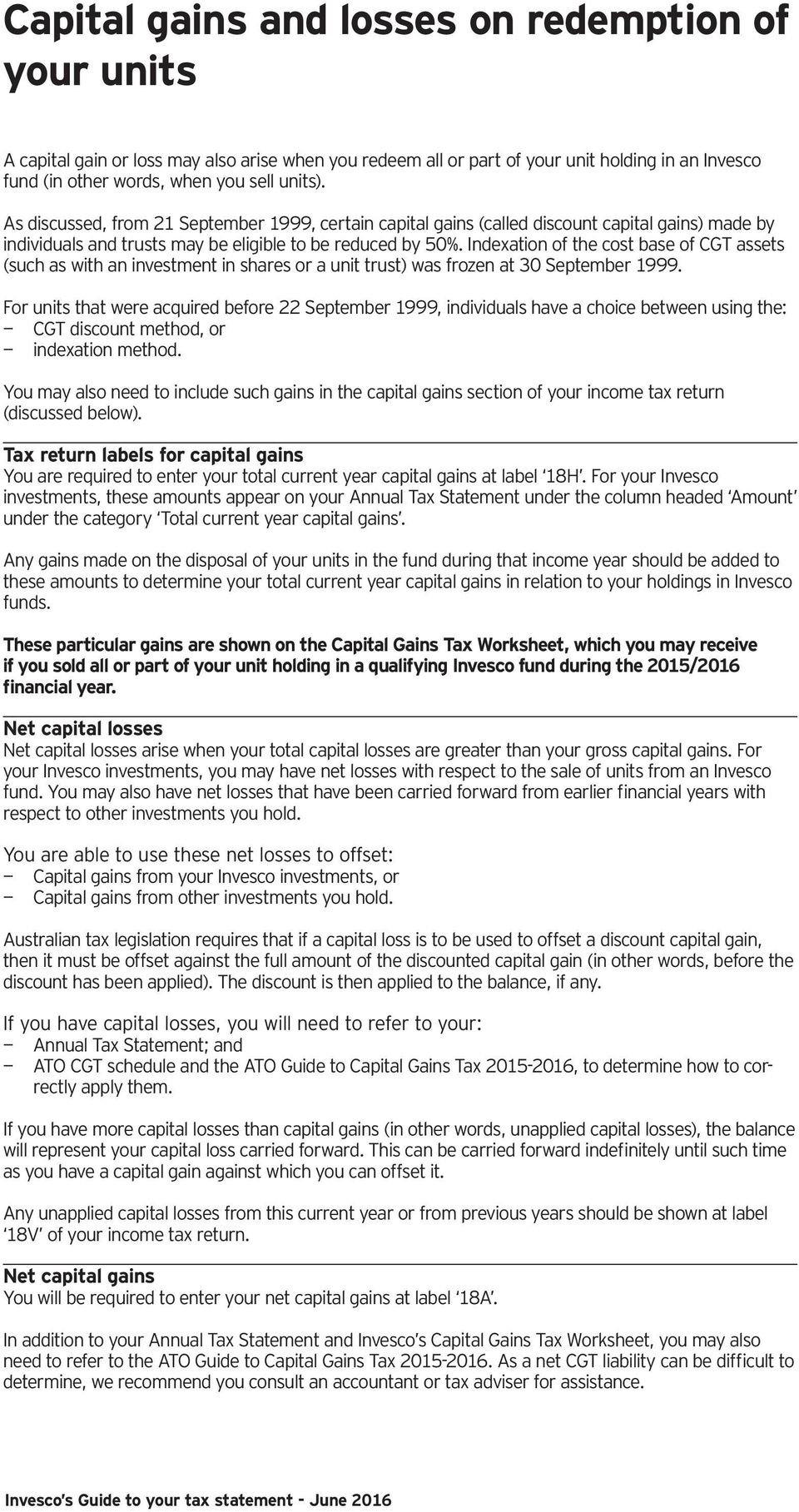

PDF You, your shares and Capital Gains Tax (CGT) • "CGT" means capital gains tax, being the portion of normal tax attributable to the inclusion in taxable income of a taxable capital gain They do not qualify for the annual exclusion, and must include 80% of any net capital gain4 in taxable income. The effective tax rate on a capital gain for a... Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Form 1040 — Line 44 Qualified Dividends and Capital Gain Tax If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. 2013 Tax Computation Worksheet—Line 44. 2015 Instruction 1040 Schedule D. › file › 19860381capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... View full document. 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Qualified dividends and capital gain tax worksheet 2015. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Qualified Dividends and Capital Gain Tax Worksheet Qualified Dividends And Capital Gains Worksheets - showing all 8 printables. Showing top 8 worksheets in the category - Qualified Dividends And Capital Gains . Qualified Dividends and Capital Gain Tax Worksheet - Learny Kids Qualifed Dividends Capital Gains Worksheets - total of 8 printable worksheets available for this concept. gain tax work, 2014 schedule d tax work, 2015 tax computation work line 44, Qualified dividends and capital gain tax work, Unrecaptured section 1250 gain work, 2016 instructions for... Qualified Dividends And Capital Gain Tax Worksheet Even though both dividend income and capital gains are different, the U.S. tax code gives similar treatment to both dividends and ... This video continues with sample problem one we'll go over the qualified dividends and capital gains tax worksheet to help us fill ...

› pub › irs-prior2015 Form 6251 - IRS tax forms Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 19 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the How Dividends Are Taxed and Reported on Tax Returns Qualified dividends are taxed at long-term capital gains tax rates, which can be much kinder than ordinary income tax rates. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred... Qualified Dividends and Capital Gain Tax Explained — Taxry However, qualified dividends are taxed as capital gains instead of income. Since there is a lot of confusion about capital gains tax, a tax In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends. PDF Tax Guide 2015 Form 1099-DIV Edition, Jan 2016 | Qualified Dividends Fund Capital Gain Distributions An overview of what they are and how they are treated for tax purposes. Foreign Tax Information An overview of foreign tax distributions, including foreign tax credit, and worksheets showing funds that distributed foreign income and foreign qualified dividend...

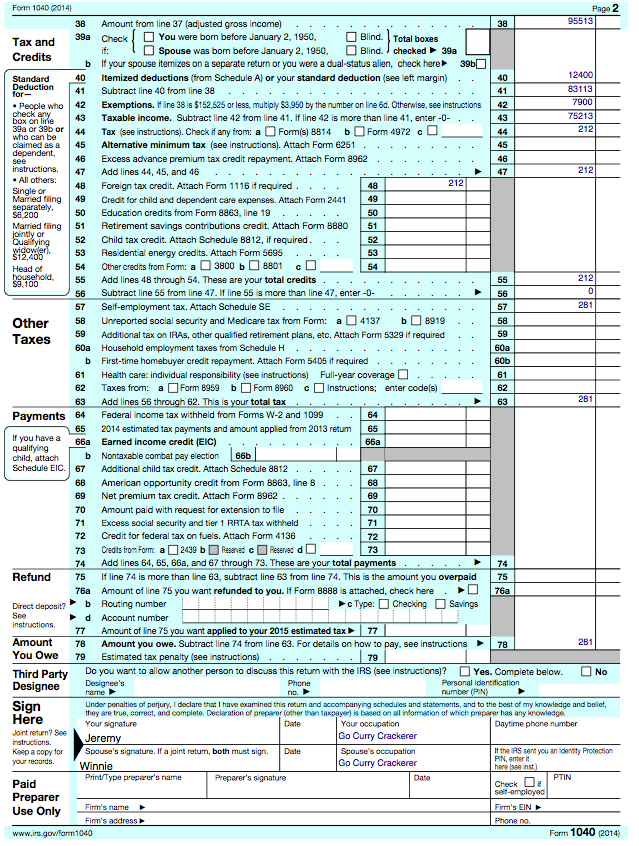

Qualified Dividends and Capital Gains Worksheet | PDF | Irs Tax... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax... Fill qualified dividends tax worksheet 2015-2017 form irs instantly, download blank or editable online. 2016 Qualified Dividends and Capital Gain Tax WorksheetLine44 See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. Solved: How can I find the " Qualified Dividends and Capital Gain..." The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet. Why does it not say "Qualified Dividends and Capital Gain Tax Worksheet" TurboTax p[lease fix that... PDF U.S. Individual Income Tax Return 65 2015 estimated tax payments and amount applied from 2014 return ~~~~ 65. 56,300. If you have a qualifying child, attach Schedule EIC. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42).

How Capital Gains and Qualified Dividends Are Taxed Short-term capital gains are taxed at ordinary marginal rates, while long-term gains are taxed more favorably, depending on the type of property and the Example 3: Capital Gains Tax as Determined on the Qualified Dividends and Capital Gains Tax Worksheet (based on the 2013 tax year).

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... 2020 qualified dividends and capital gain tax worksheetreate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

› pub › irs-priorand Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

qualified dividends and capital gain worksheet 2021 - Search Nov 02, 2021 · IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. Showing 8 worksheets for Qualified Dividends And Capital Gain Tax 2015.

Qualified Dividend Definition A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Qualified dividends must meet special requirements put in place by the IRS. The maximum tax rate for qualified dividends is 20...

How Your Tax Is Calculated: Qualified Dividends and Capital Gains... Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. Two individuals with the same amount of qualified income could easily face different qualified tax rates because their...

› Capital-Gain-Tax-WorksheetCapital Gain Tax Worksheet - 2015 Form 1040Line 44 Qualified ... View full document. 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

How to Figure the Qualified Dividends on a Tax Return - Zacks Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Do not include as qualified dividends any capital gains; payments in lieu of dividends; or dividends paid on deposits with mutual savings banks, cooperative...

2021-22 Capital Gains Tax Rates and Calculator - NerdWallet Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less. The short-term capital gains tax rate equals your ordinary income tax Rather than reinvest dividends in the investment that paid them, rebalance by putting that money into your underperforming investments.

2019 Instructions for Schedule D (Form 1041) - Tax.ny.gov Capital gains and qualified diviƖ dends. For tax year 2019, ... return after July 31, 2015, must provide ... extraordinary dividends, any loss on the.12 pages

2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet... Qualified dividends and capital gains tax worksheet complete. 2018 Form 1040—Line 11a. Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

2015 Form 1099-DIV instructions - Vanguard A guide to reporting Vanguard mutual fund dividends and capital gains distributions ... and Capital Gain Tax Worksheet included in the Form 1040 or 1040A.6 pages

Qualified Dividends | Regular Dividends | Holding Period Qualified dividends and ordinary dividends have different holding periods requirement for taxes and different dividend tax rates, which can affect your tax Regular dividends paid to shareholders are usually qualified dividends and are subject to the lower capital gain taxes while ordinary dividends...

What is a Qualified Dividend Worksheet? | Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without...

Qualified Dividends And Capital Gain Tax 2015 Worksheets Displaying 8 worksheets for Qualified Dividends And Capital Gain Tax 2015. To download/print, click on pop-out icon or print icon to worksheet to print or download. Worksheet will open in a new window.

Qualified Dividends and Capital Gains Worksheet.pdf - 2016... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.

Qualified and ordinary dividend understanding | Forum The Qualified Dividends and Capital Gain Tax Worksheet gets ordinary capital gains and dividends at higher rates ( typically 15%) than qualified dividends ( which can be as low as 0%). There is an equivalent Schedule D worksheet...

Qualified Dividends and Capital Gain Tax Worksheet 2012 Federal Tax. Qualified Dividends and Capital Gain Tax Worksheet. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040.

› file › 19860381capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... View full document. 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Form 1040 — Line 44 Qualified Dividends and Capital Gain Tax If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. 2013 Tax Computation Worksheet—Line 44. 2015 Instruction 1040 Schedule D.

PDF You, your shares and Capital Gains Tax (CGT) • "CGT" means capital gains tax, being the portion of normal tax attributable to the inclusion in taxable income of a taxable capital gain They do not qualify for the annual exclusion, and must include 80% of any net capital gain4 in taxable income. The effective tax rate on a capital gain for a...

0 Response to "40 qualified dividends and capital gain tax worksheet 2015"

Post a Comment