41 truck driver expenses worksheet

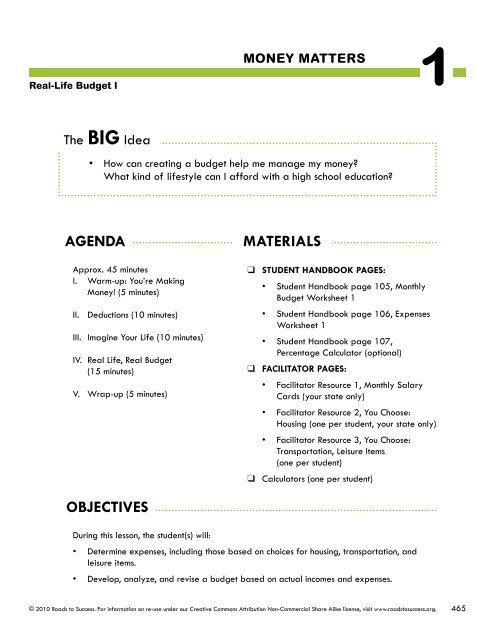

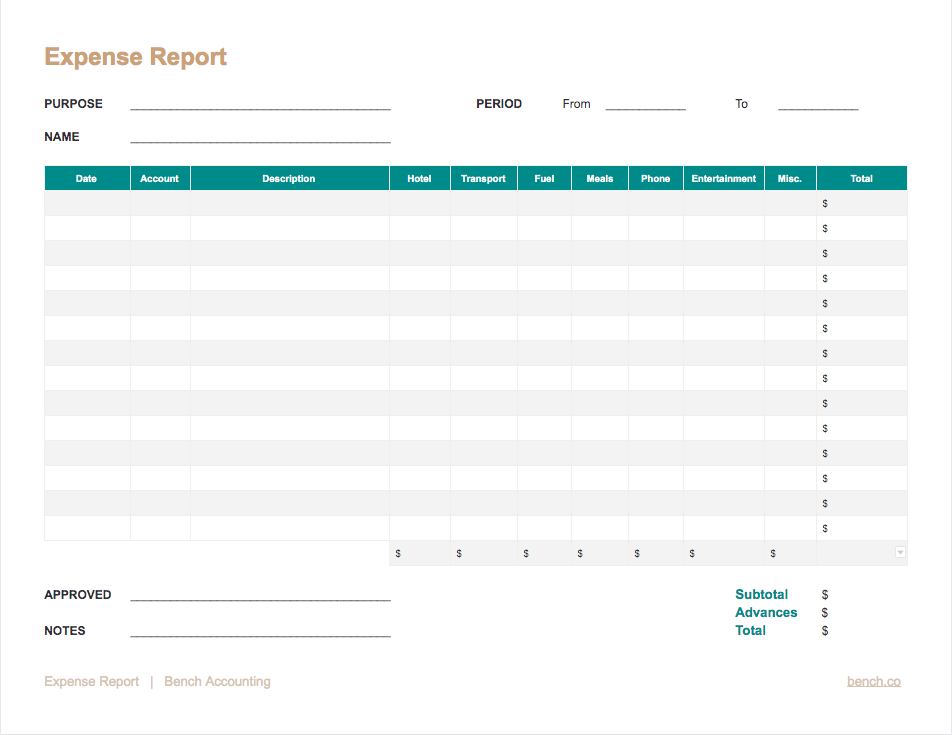

EXAMPLES OF ACCEPTABLE PROOFS - New Hampshire … Bring some form of ID, like a Driver’s License, Work or school ID card, ID from other social services program, voter ID card or birth certificate. Also bring your marriage certificate or divorce decree. We need DCSS Form 725 for all parents absent from the household. Student Status: We need the School Schedule for the Current Term for anyone 16 years or older. Health … 15 Tax Deductions Every Truck Driver Should Consider In short, without a tax home, you will not be allowed to deduct business and travel expenses. Truck Driver Tax Deductions. Remember, you can only claim deductions on unreimbursed expenses. Travel Expenses - Includes hotels, meals, and more. There are different methods for recording these expenses. Check out IRS Publication 463 for more details.

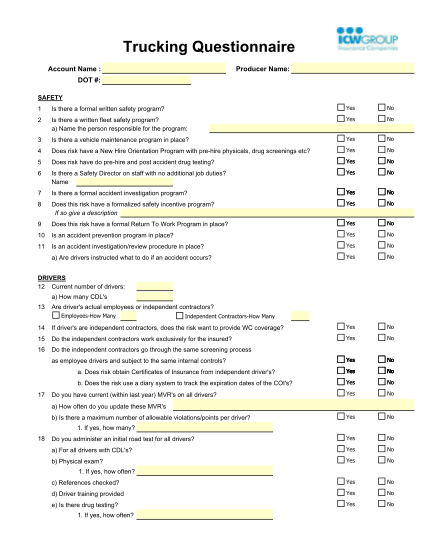

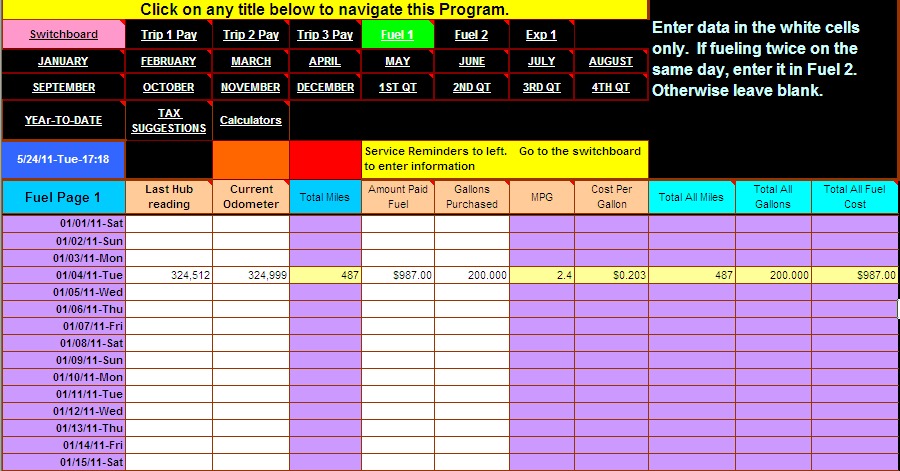

Free Apps and Excel Templates for Truck Drivers and ... Truck and delivery drivers give 'on-the-go' a whole new meaning. In any 7-day period in the U.S., some drivers are on the road for up to 77 hours. Some drivers contract out work, some work for a company, and some own their own businesses. What's the one thing they all have in common, aside from their profession?

Truck driver expenses worksheet

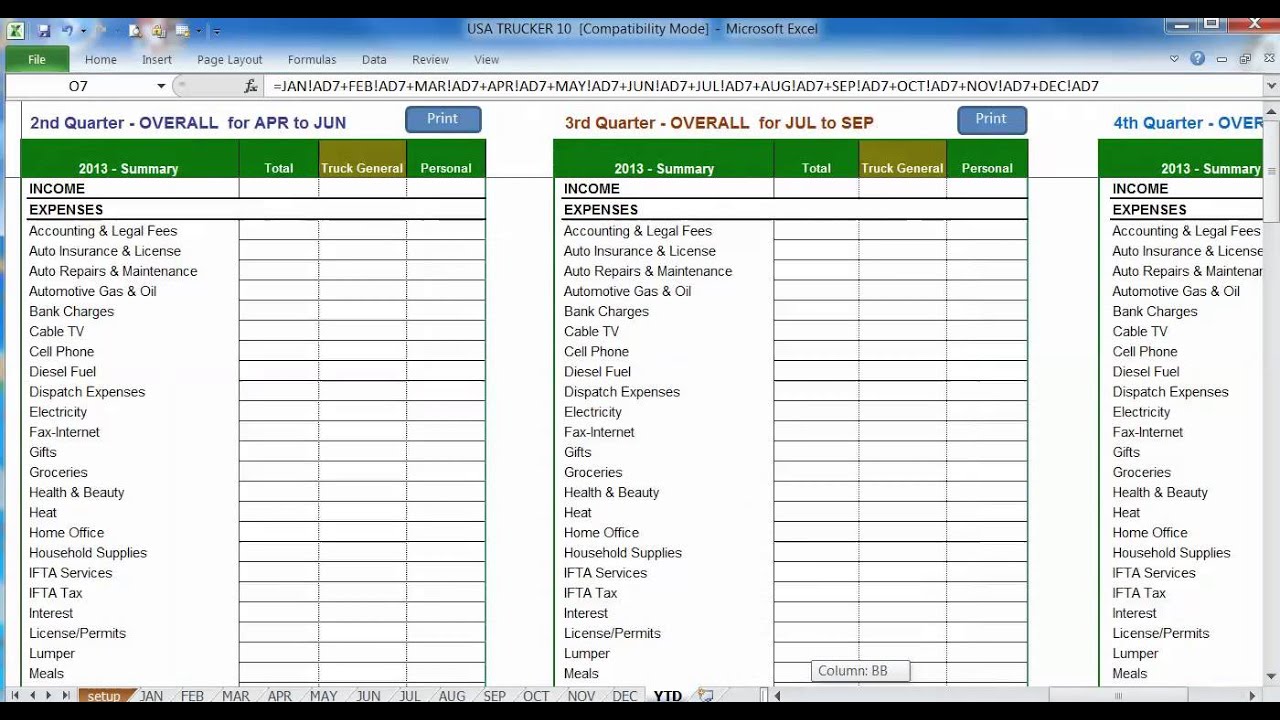

Free Templates Trucking Expenses Spreadsheet ... - Golagoon Free Templates Trucking Expenses Spreadsheet Spreadsheets Cost Per Mile 972. Category : Spreadsheet. Topic : Trucking cost per mile spreadsheet. Author : Cyne Amundsen. Posted : Fri, Jul 26th 2019 22:17 PM. Format : jpg/jpeg. A spreadsheet entry job requires the worker to enter data into a spreadsheet, which is easier than using database software. Truck Expenses Worksheet | Tax deductions, Spreadsheet ... Truck Expenses Worksheet The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet. Cost Per Mile - OOIDA The $1.06 per mile cost, at 50,000 miles, represents a vehicle cost of $53,000 and a "Driver Income" of $22,174. The final $0.69 per mile cost for 130,000 miles, represents a vehicle cost of $89,000 and a "Driver Income " of $38,422. This decrease of cost per mile with each additional mile is a characteristic small business truckers ...

Truck driver expenses worksheet. 19 Truck Driver Tax Deductions That Will Save You Money ... These expenses include any specialized items you buy to help safely carry your loads. Examples include chains, locks, straps, and even wide-load flags. Tools and equipment If you're like most truckers, you probably carry a tool kit in your truck. Things like hammers, wrenches, pliers, tire irons, and even electrical tape are all deductible. Instructions for Form 4562 (2021) | Internal Revenue Service 31.12.2021 · Any truck or van placed in service after July 6, 2003, that is a qualified nonpersonal use vehicle. For purposes of the exceptions above, a portion of the taxpayer's home is treated as a regular business establishment only if that portion meets the requirements for deducting expenses attributable to the business use of a home. However, for any property listed in (1) … Truck Driver Trucking Spreadsheet Templates Truck driver daily timesheet template is an excel book template that is useful for the time records of the driver it has all details about the time records of the drivers. Spreadsheet templates can also be used for instant budgets such as an instant party budget and etc. The automotive market is one of the largest in united states and. PDF Car and Truck Expense Deduction Reminders Car and Truck Expense Deduction Reminders . FS-2006-26, October 2006 . The Internal Revenue Service reminds taxpayers to become familiar with the tax law before deducting car- and truck-related business expenses. Overstated adjustments, deductions, exemptions and credits of all types account for more than

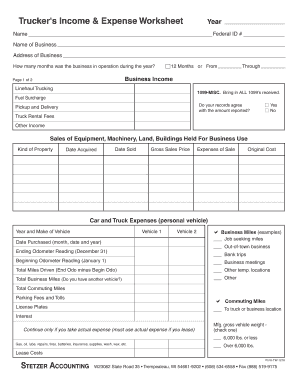

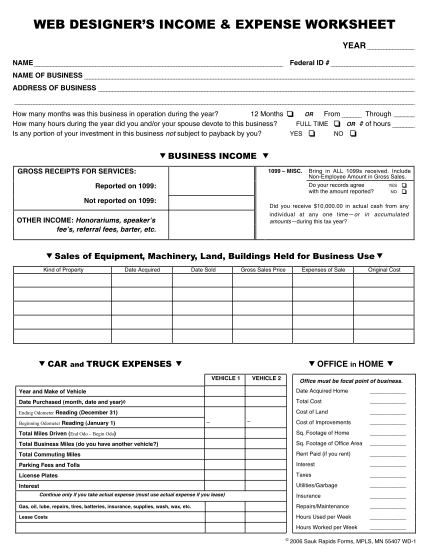

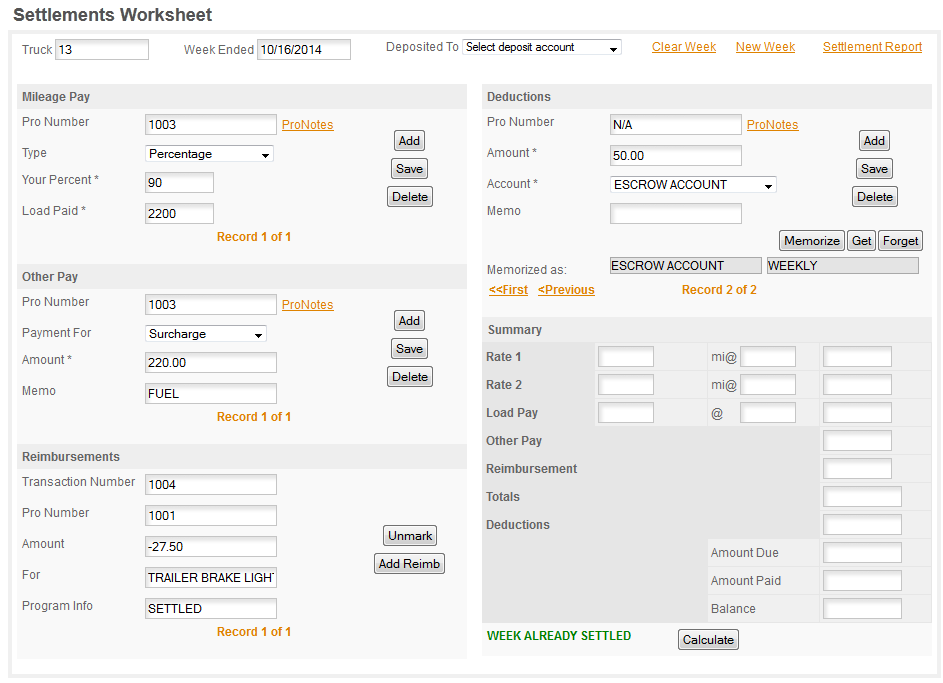

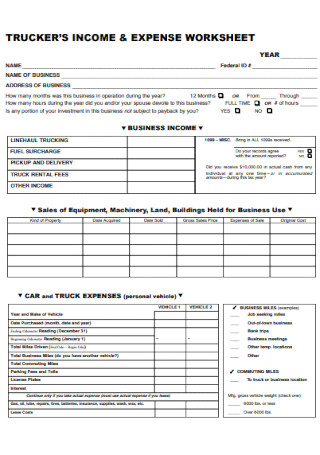

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... TRUCKER'S INCOME & EXPENSE WORKSHEET YEAR ----- ... TRUCK RENTAL FEES OTHER INCOME FULL TIME OR # of hours ---YES NO 1099-MISC. Bring in ALL 1099s received. Do your records agree with YESQ ... T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle PDF Over-the-road Trucker Expenses List - Pstap Other expenses related to truck drivers in particular do include things like cargo losses and damage claims if cargo costs were included in income and pay to other drivers who assist you with your job. If these drivers are your employees (instead of independent contractors), you may be (and are likely to be) responsible for paying ... Complete List Of Owner Operator Expenses For Trucking ... The more you can plan for your operating expenses, the smoother things will go and you and your trucking business will thrive as a result. You'll need to itemize all of the costs you are going to incur on the road and at home. These don't just include truck and driving expenditures, but also registrations, office costs and fees. Truck Driver Expenses Worksheet - defenderring.co Mar 22, 2022 · Truck Driver Expenses Worksheet. Since the expenses should be the other 70%, you can take the “total vehicle costs”, divide by 70 and multiply the result by 30 to get the “driver’s income.” Invoice and other deposit related calculations also can be dealt with these spreadsheets.

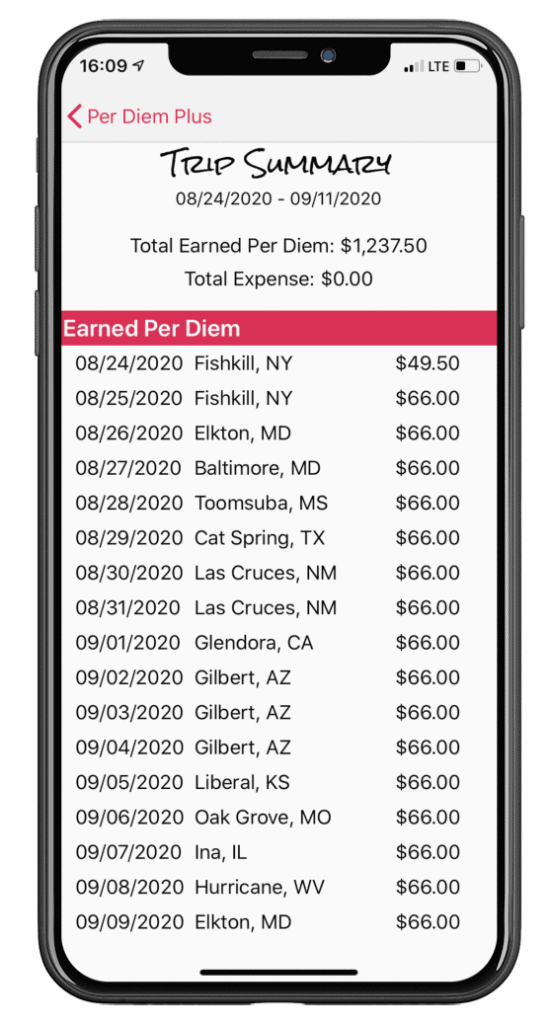

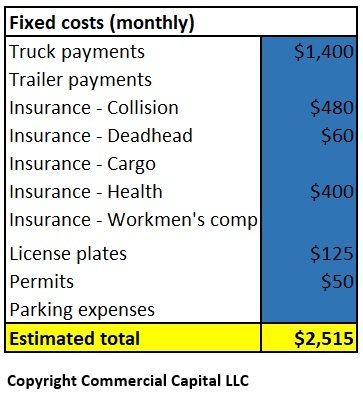

[email protected] - holgerstrehlow.de 11.03.2022 · Chevy truck chassis, Chevy truck frame specs, Chevrolet trucks and part sources, tech help for Chevy Trucks, custom chevy frames, frame measurements 1970's Chevy Trucks. 0 Pinnacle’s fully redesigned cab and driver environment are built around the way work gets done on the road, keeping drivers comfortable, safe and focused all day long. Recharge | 26K to 33K … The Real Trucking Expenses of an Owner Operator The average independent owner operator works at only a 5% profit margin. That means that for every $20 in gross revenue you make, your profit is only 1$, while the other 95% of that revenue is going towards your trucking expenses. These include things like truck payments, maintenance, fuel, insurance, food, permits, and etc. PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! Truck Driver Tax Deductions Visit for more CDL Truck Driver Solutions Cleaning Supplies Misc. Supplies Misc. Supplies Air Freshener Alarm Clock Thermos Bottle Armour-All Fly Swatter First Aid Supplies Broom & Dustpan Bedding Clothing What You Need to Know About Truck Driver Tax Deductions ... Although the IRS has a per diem rate for lodging in other industries, truck drivers are required to claim actual lodging expenses. They cannot claim the per diem rate the way they can with meal expenses. Medical exams. Many drivers must get regular medical exams as a condition of their work.

On the second sheet, create the named range Rates. 5 hours ... Your expenses, divided into lump sums by categories such as home office, communications, advertising, and more. 00 24) Original price of a goldfish: . net. D. Teal Yellow and Pale Carmine Lined Batik Cultural Art Technique Visual Arts Worksheet. Printable 2021 federal tax forms are listed below along with their most commonly filed supporting IRS schedules, worksheets, 2021 …

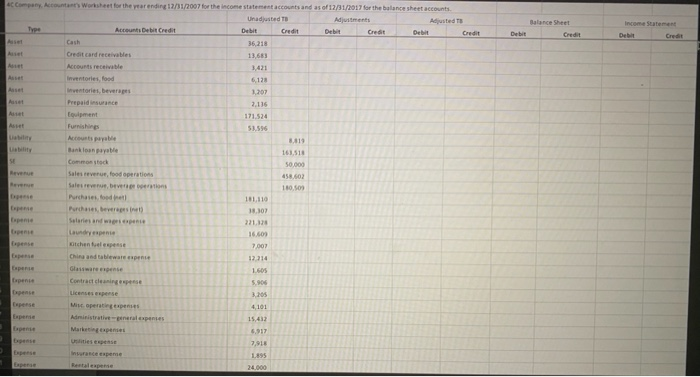

1 Divine Trucking Expenses Spreadsheet Excel ~ Ginasbakery In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report. Back to trucking expenses spreadsheet. Folks aren't likely to acquire.

2020 Truck Driver Tax Deductions Worksheet - Fill Online ... Get the free 2020 truck driver tax deductions worksheet form. Get Form. Show details. Hide details. LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered.

Tax Deduction List for Owner Operator Truck Drivers Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs, continue to visit CDLjobs.com for up-to-date information and job postings.

Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Expense Worksheet . VEHICLES FOR HIRE MUST USE ACTUAL EXPENSES. Business Miles Driven Other Than While Hauling Loads: _____ Vehicle Expense: (Standard Mileage Rate) Business Miles Only [From . Mileage Log Worksheet] _____ total business miles x 57.5¢ per mile = _____

Truck Driver Tax Deductions - H&R Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense

PDF Trucker'S Income & Expense Worksheet Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees

Truck Driver Tax Deductions Worksheet - Elcacerolazo Dec 27, 2021 · Truck Driver Expenses Worksheet Depending on record keeping your car rentals truck expenses which a kitchen and the rate to provide. Truck driver expenses worksheet. You may be able to claim deductions for your work-related expenses. Lumpers get a receipt from the lumper which includes his name address social security.

Owner Operator Truck Driver Tax Deductions Worksheet - Ark ... Jul 10, 2021 · Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Deductions and credits for drivers: Truck driver tax deductions worksheet. Truck driver tax deductions worksheet.

Cost Per Mile - OOIDA The $1.06 per mile cost, at 50,000 miles, represents a vehicle cost of $53,000 and a "Driver Income" of $22,174. The final $0.69 per mile cost for 130,000 miles, represents a vehicle cost of $89,000 and a "Driver Income " of $38,422. This decrease of cost per mile with each additional mile is a characteristic small business truckers ...

Truck Expenses Worksheet | Tax deductions, Spreadsheet ... Truck Expenses Worksheet The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

Free Templates Trucking Expenses Spreadsheet ... - Golagoon Free Templates Trucking Expenses Spreadsheet Spreadsheets Cost Per Mile 972. Category : Spreadsheet. Topic : Trucking cost per mile spreadsheet. Author : Cyne Amundsen. Posted : Fri, Jul 26th 2019 22:17 PM. Format : jpg/jpeg. A spreadsheet entry job requires the worker to enter data into a spreadsheet, which is easier than using database software.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

.png)

0 Response to "41 truck driver expenses worksheet"

Post a Comment