43 fannie mae rental income worksheet

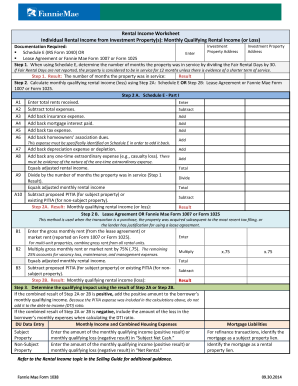

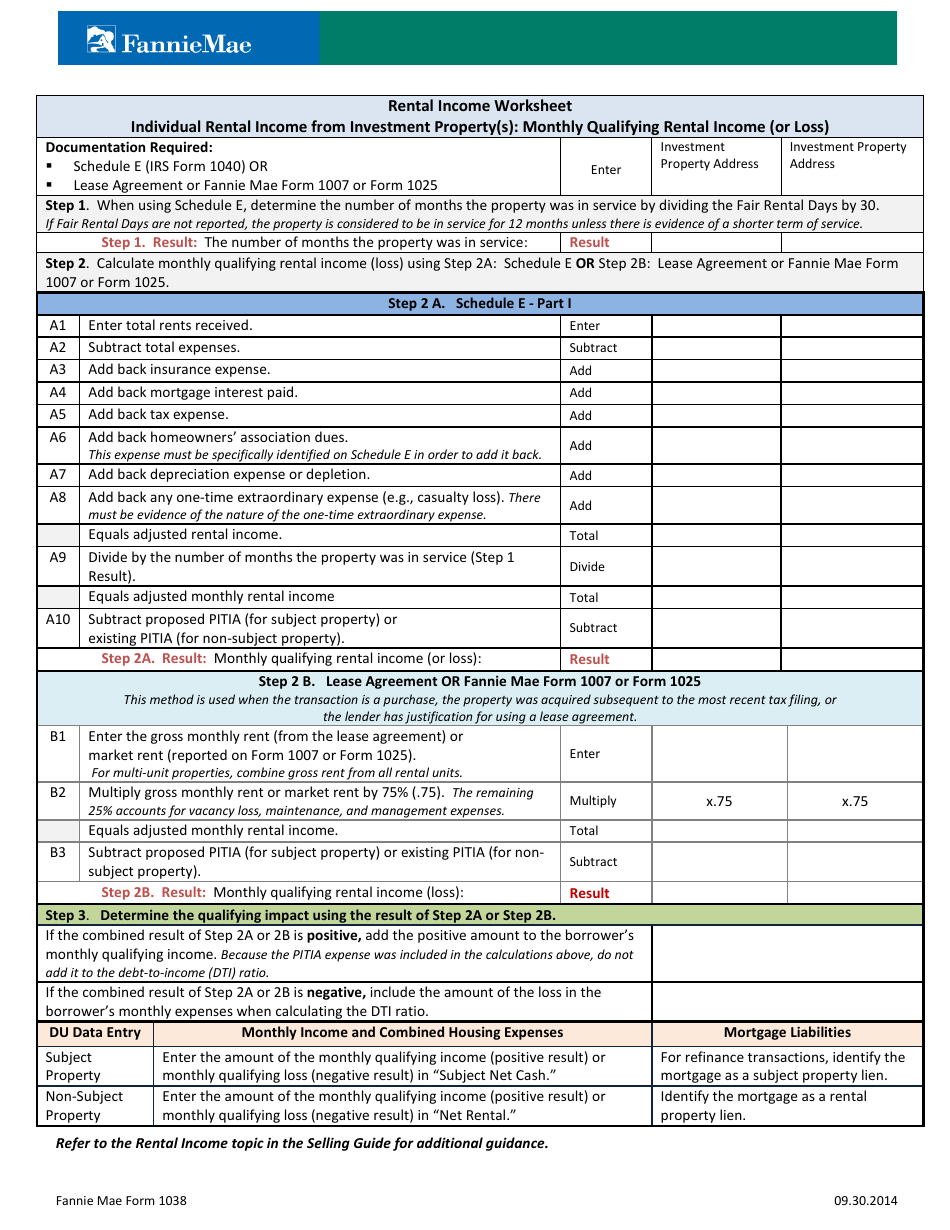

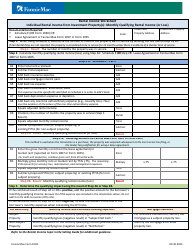

Tpo Go Fannie Mae HomeReady; Ready, Set, Go… FHA. Low down payment, higher debt to income ratios and flexible credit requirements makes FHA a great option for first time homebuyers and those who may not qualify for a conventional product. Pair this with our TPO GO 100 Chenoa product and make sure every borrower can get a loan. Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ...

XLSX House Loan Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair ...

Fannie mae rental income worksheet

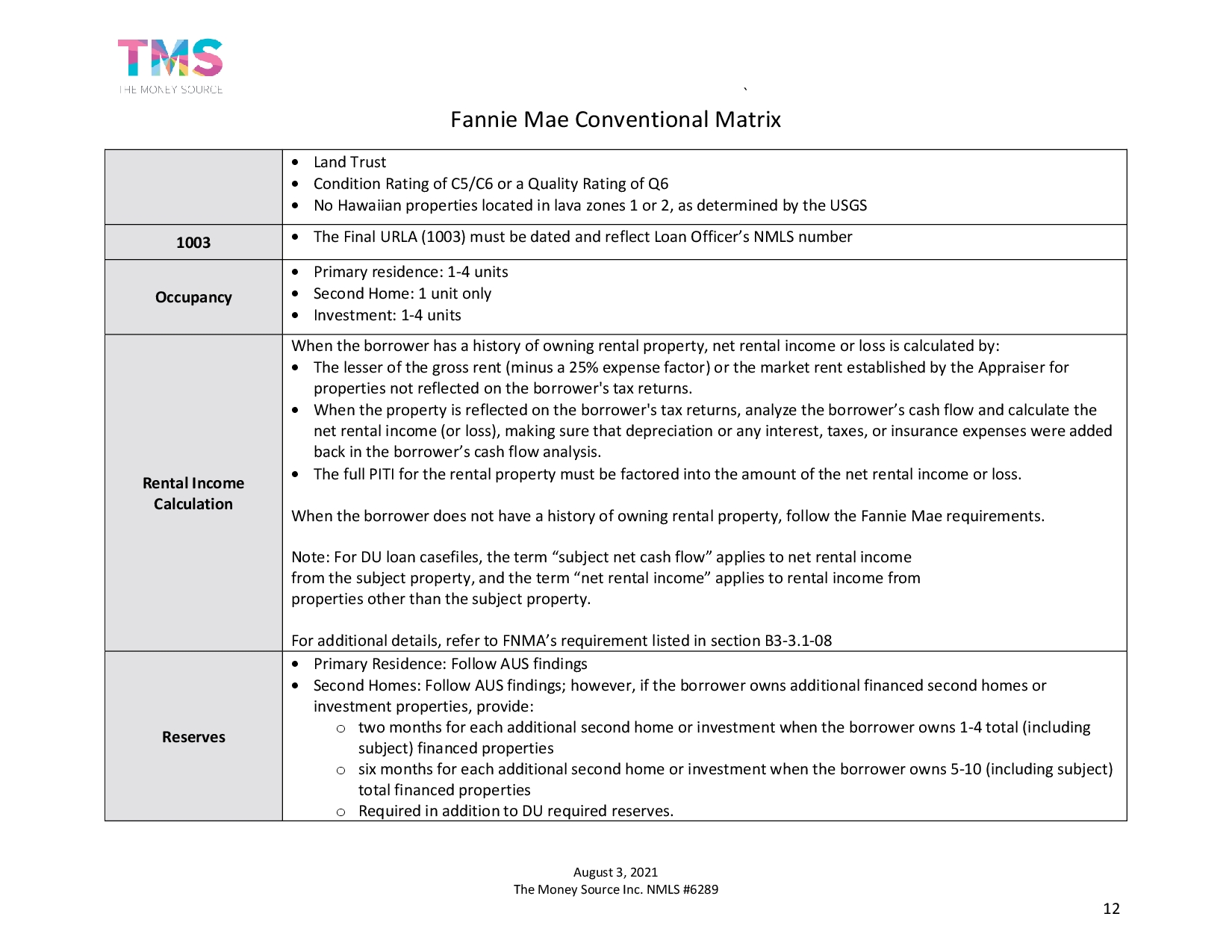

Fannie Mae Net Rental Calculator Details: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss)reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. › Verified 9 days ago Fannie Mae Form 1076 Fillable - XpCourse Fannie Mae Form 1003 is a loan application form designed by Fannie Mae and Freddie Mac that is used by lenders to obtain financial and personal information from borrowers who apply for a mortgage loan secured by a one to four unit residential real estate. Form 1003 is also known as the Uniform Residential Loan Application (URLA). Rental Income Worksheet Fannie Mae Fannie Mae Rental Income Worksheet - Fill Out and Sign . Rentals Details: Step 1.Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received* A2 Subtract total expenses.

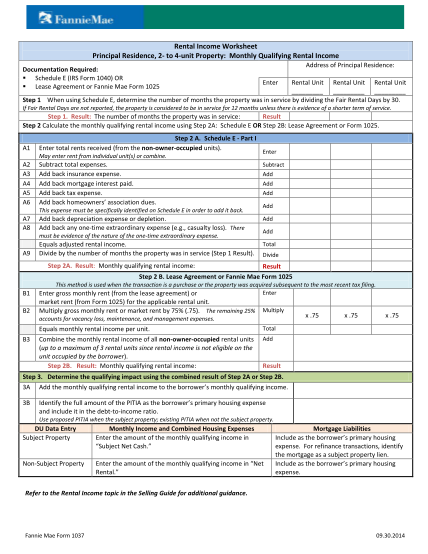

Fannie mae rental income worksheet. Fannie Mae Rental Income Worksheet Pdf - Real Estate ... Discover Fannie Mae Rental Income Worksheet Pdf for getting more useful information about real estate, apartment, mortgages near you. Washington DC. Jobs At The White House Washington Dc Cvs 17th Street Washington Dc Rv Campgrounds Near Washington Dc ... XLSX Cornerstone Home Lending, Inc. Rental Income Worksheet Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income ... Lease Agreement or Fannie Mae Form 1025 Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. If Fair Rental Days are not reported, the property is considered to be ... Fannie Mae Rental Worksheet - Rental Services 2021 ... Fannie Mae. Posted: (4 days ago) Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ... PDF Rental Income Calculator - Genworth Financial Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E. It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines.

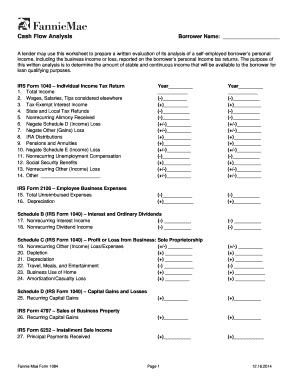

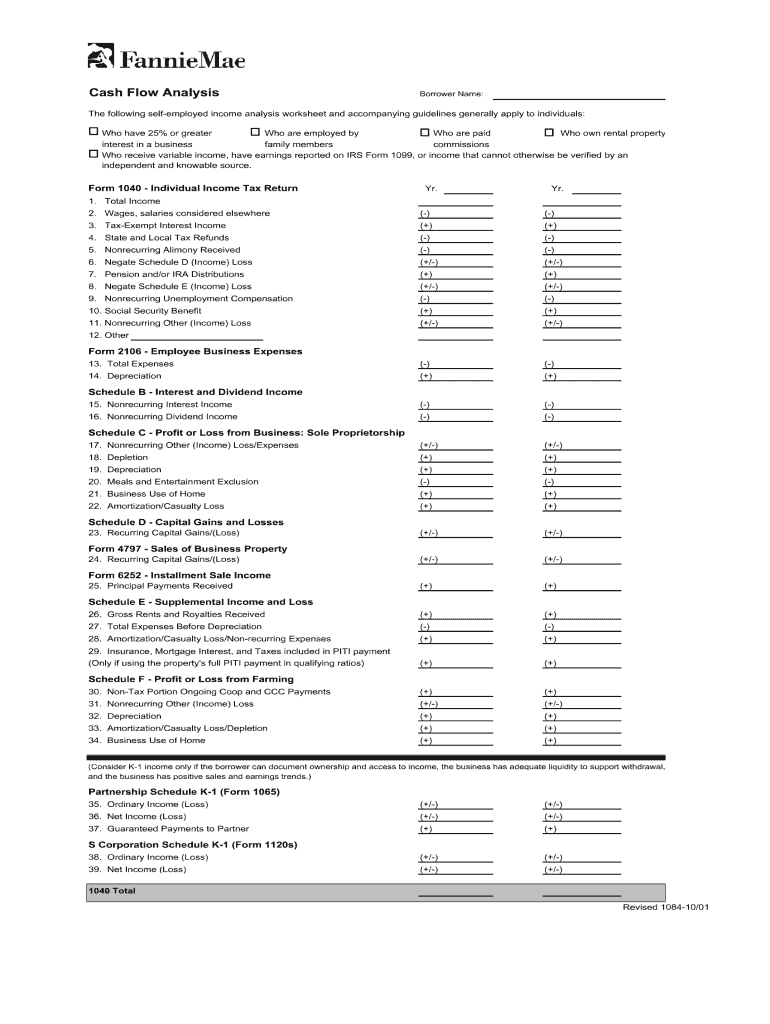

B3-3.1-08, Rental Income (06/03/2020) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), PDF For full functionality, download PDF first before entering ... Rental Income Worksheet Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income Add back homeowners' association dues. Check Schedule E, Line 19 This expense must be specifically identified on Schedule E in order to add it back. Fannie Mae Form 1037 09.30.2014 Fannie Mae Fannie Mae Form 1039 02/23/16 Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide PDF Processing, Underwriting and Closing Forms | 12/31/2021 COR 0602 Rental Income/Schedule E Calculation Worksheet 10/02/2015 COR 1404 Salaried/Hourly Income Calculation Worksheet 08/07/2020 Fannie Mae Form 1084 Fannie Mae Cash Flow Analysis 06 /20 1 9 Freddie Mac Form 91 Freddie Mac Income Calculations(Income Analysis Form) 05/01/2019 .

Fannie Mae Income Analysis Worksheet and Similar Products ... Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), More › Fannie Mae Rental Income Worksheet - Fill Out and Sign ... Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received* A2 Subtract total expenses. Subtract A3 Add back insurance expense. PDF Fannie Mae Cash Flow Analysis Calculator Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E - Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

PDF Rental Income Schedule E Calculation Worksheet THESE CALCULATIONS''b3 3 1 08 rental income 02 28 2017 fannie mae may 7th, 2018 - general requirements for documenting rental income if a borrower has a history of renting the subject or another property generally the rental income will be reported on irs form 1040 schedule e of the borrower's personal tax returns or on rental

XLSX Genworth Financial A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F - Profit or Loss from Farming a. Net Farm Profit or Loss (Line ...

Fannie Mae Rental Income Worksheet and Similar Products ... Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), More ›

PDF Rental Income Worksheet Individual Rental Income from ... Fannie Mae Form 1038 09.30.2014 Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter ...

Free Customizable Fannie Mae Rental Income Worksheet - PDF ... Draw Up your Fannie Mae Rental Income Worksheet online is easy and straightforward by using CocoSign . You can simply get the form here and then put down the details in the fillable fields. Follow the guides given below to complete the document. Fill out the editable areas Revise the form using our tool Email the completed form

Self-Employed Borrower Tools by Enact MI Fannie Mae Rental Guide (Calculator 1037) Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1038)

Fannie Mae Rental Income Worksheet - Fill Out and Sign ... fannie mae income calculation worksheet 2021 an iPhone or iPad, easily create electronic signatures for signing a fannie mae rental income worksheet in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

Single-Family Homepage | Fannie Mae Fannie Mae Form 1037 02/23/16 Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

Fannie mae rental income worksheet: Easy to Customize and ... How to Edit Your Fannie mae rental income worksheet Online On the Fly. Follow the step-by-step guide to get your Fannie mae rental income worksheet edited for the perfect workflow: Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like adding checkmark, erasing, and other tools in the top ...

Single-Family Homepage | Fannie Mae Monthly qualifying rental income (loss): Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I

PDF Form 1038: Rental Income Worksheet - Genworth Financial Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1.

Rental Income Worksheet Fannie Mae Fannie Mae Rental Income Worksheet - Fill Out and Sign . Rentals Details: Step 1.Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received* A2 Subtract total expenses.

Fannie Mae Form 1076 Fillable - XpCourse Fannie Mae Form 1003 is a loan application form designed by Fannie Mae and Freddie Mac that is used by lenders to obtain financial and personal information from borrowers who apply for a mortgage loan secured by a one to four unit residential real estate. Form 1003 is also known as the Uniform Residential Loan Application (URLA).

Fannie Mae Net Rental Calculator Details: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss)reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. › Verified 9 days ago

0 Response to "43 fannie mae rental income worksheet"

Post a Comment