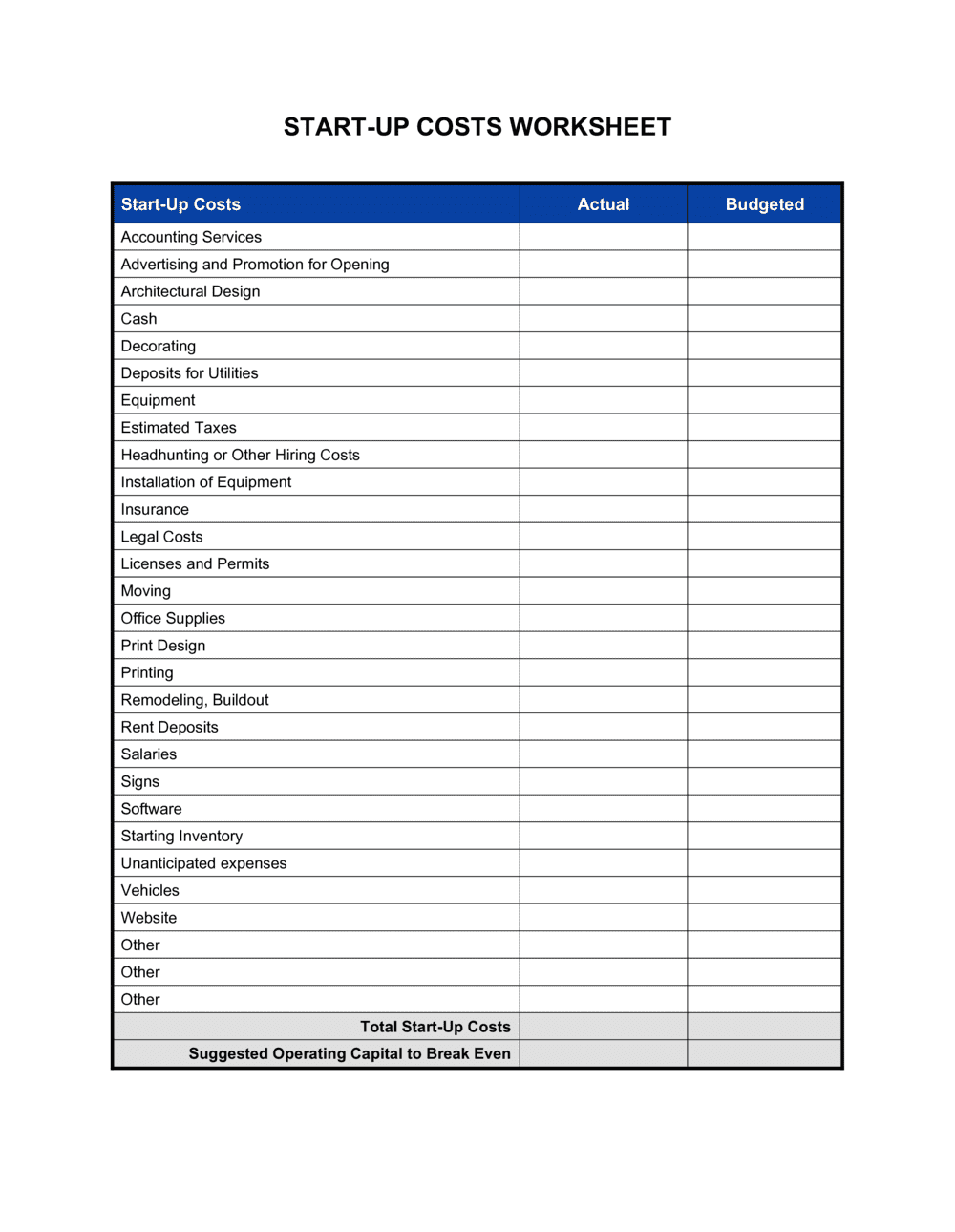

40 self employed business expenses worksheet

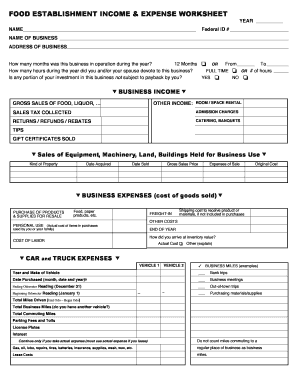

Self Employed Tax Deductions Worksheet - SignNow The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details. PDF Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C's Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes

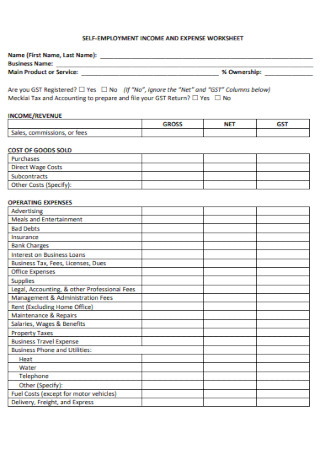

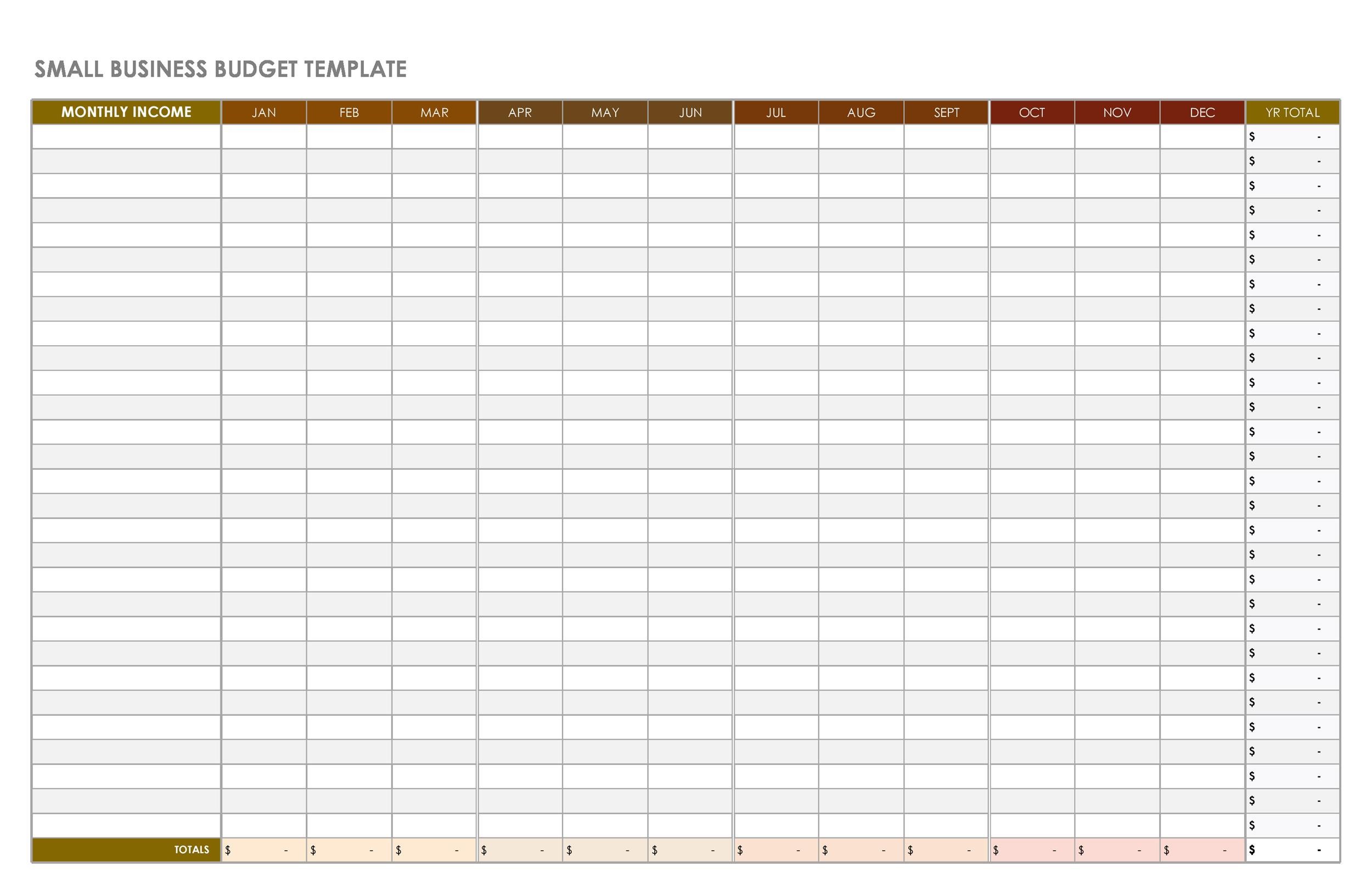

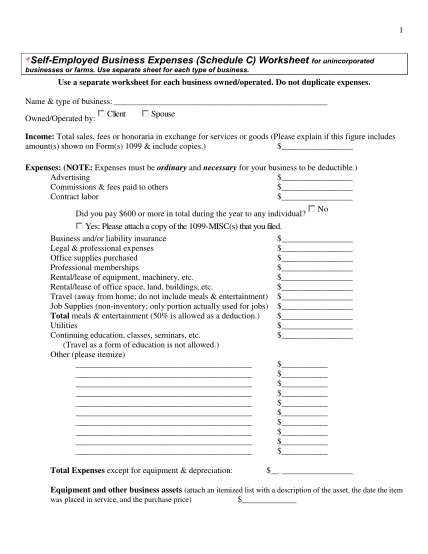

PDF small business/self-employed income and expense worksheet business name federal id # or ssn income gross receipts refunds/returns cost of goods sold -inventory boy / eoy -purchases, labor, materials and supplies other income total gross income expenses advertising car & truck expenses commissions & fees contract labor

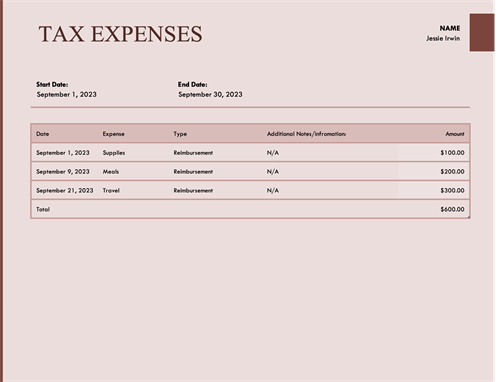

Self employed business expenses worksheet

PDF 2020 Sched C Worksheet - Alternatives Schedule C Worksheet for Self-Employed Filers and Contractors - tax year 2020 This document will list and explain the information and documentation that we will need in order to file a tax return for a self-employed person, a contract worker, or a sole-proprietor of a business. PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, PDF Self Employment Monthly Sales and Expense Worksheet - Wa If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page. (Sign the back page.)

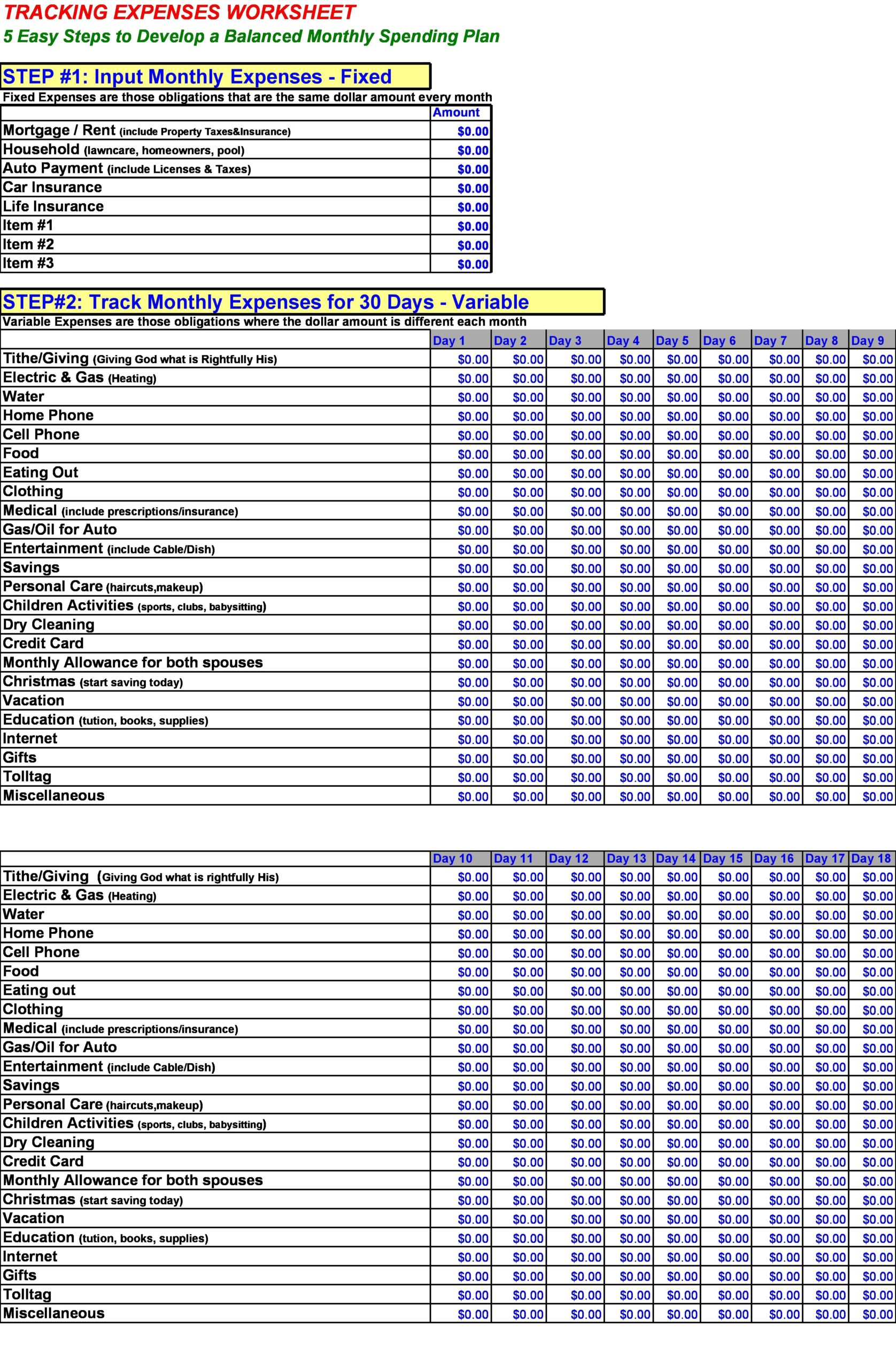

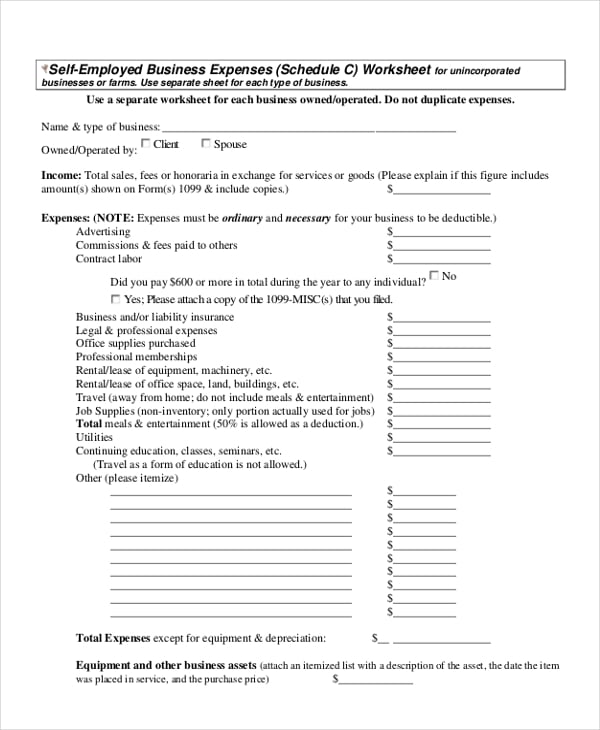

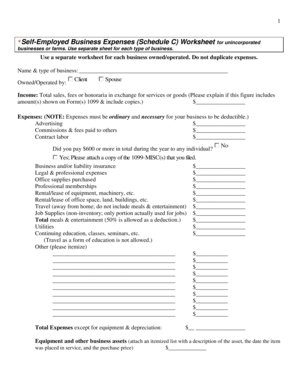

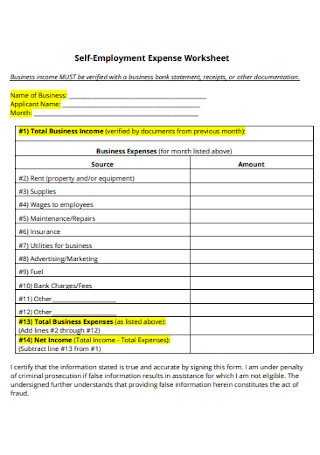

Self employed business expenses worksheet. PDF Self-Employed/Business Monthly Worksheet - OA Tax Partners Self-Employed/Business Name of Proprietor. Social Security Number: Monthly Worksheet: ... Auto & Truck Expense Bank Charges Business Contributions; Business Taxes Commissions; Delivery & Freight Dues & Subscriptions; Equipment Rental Gifts; Insurance Interest. PDF Self-employed Tax Organizer Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit. PDF (Schedule C) Self-Employed Business Expenses Worksheet for ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

Home Office Deduction Worksheet (Excel) - Keeper Tax Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it is usually better for them to choose the actual expense method. Our worksheet assumes that you will be filing using the actual expense method because the simplified method bases the size of the home office deduction on the amount of space in ... Self-Employed Individuals Tax Center | Internal Revenue ... Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior year's annual tax return in order to fill out Form 1040-ES. Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. 15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ... Tax Worksheets - Brent Financial Employee Business Expenses: For employees with unreimbursed job-related expenses. (Self-employed individuals should use the Self Employment Worksheet instead.) Educator Expenses: For teachers, aides, instructors, counselors, or principals. You must be employed at a grade school or high school, work at least 900 hours during the school year, and ...

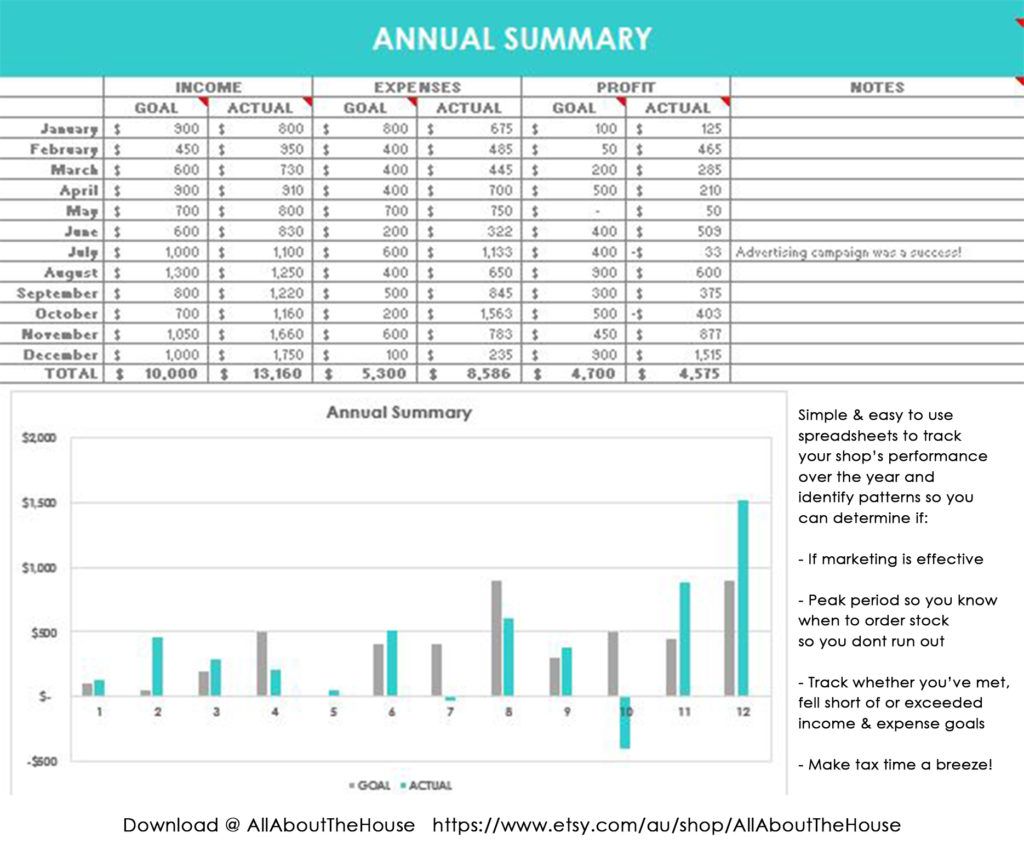

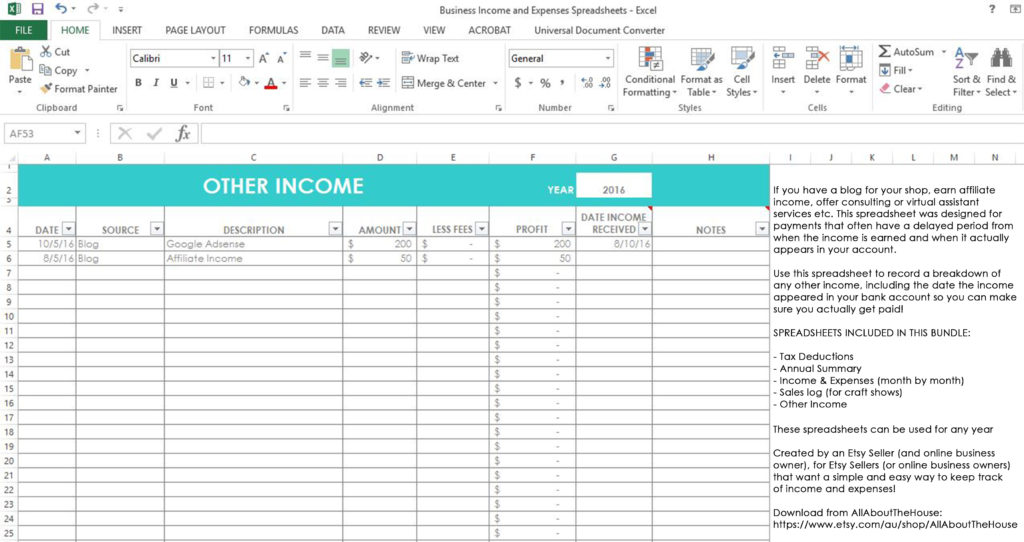

PDF 2021 Self-Employed (Sch C) Worksheet - cotaxaide.org 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business. Publication 535 (2021), Business Expenses | Internal ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... If you are self-employed ... PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... Free expenses spreadsheet for self-employed - Bonsai Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

12+ Business Expenses Worksheet Templates in PDF | DOC self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your ...

Printable Self Employed Tax Deductions Worksheet Self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. Quick guide on how to complete printable self employed tax deductions worksheet Forget about scanning and printing out forms.

Self Employment Worksheet - First Choice Tax Service Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person.

PDF Schedule C -- Self Employed Business Income and Expense ... Schedule C -- Self Employed Business Income and Expense Worksheet. Complete this form if you were self-employed during this tax year. A Small Business Questionnaire and a 1099 and Sales Tax Questionnaire is required in addition to this worksheet. Additional worksheets may be required to report home office and vehicle expenses.

Business expenses - Canada.ca When you claim the GST/HST you paid or owe on your business expenses as an input tax credit, reduce the amounts of the business expenses by the amount of the input tax credit. Do this when the GST/HST for which you are claiming the input tax credit was paid or became payable, whichever is earlier.. Similarly, subtract any other rebate, grant, or assistance from the expense to which it applies.

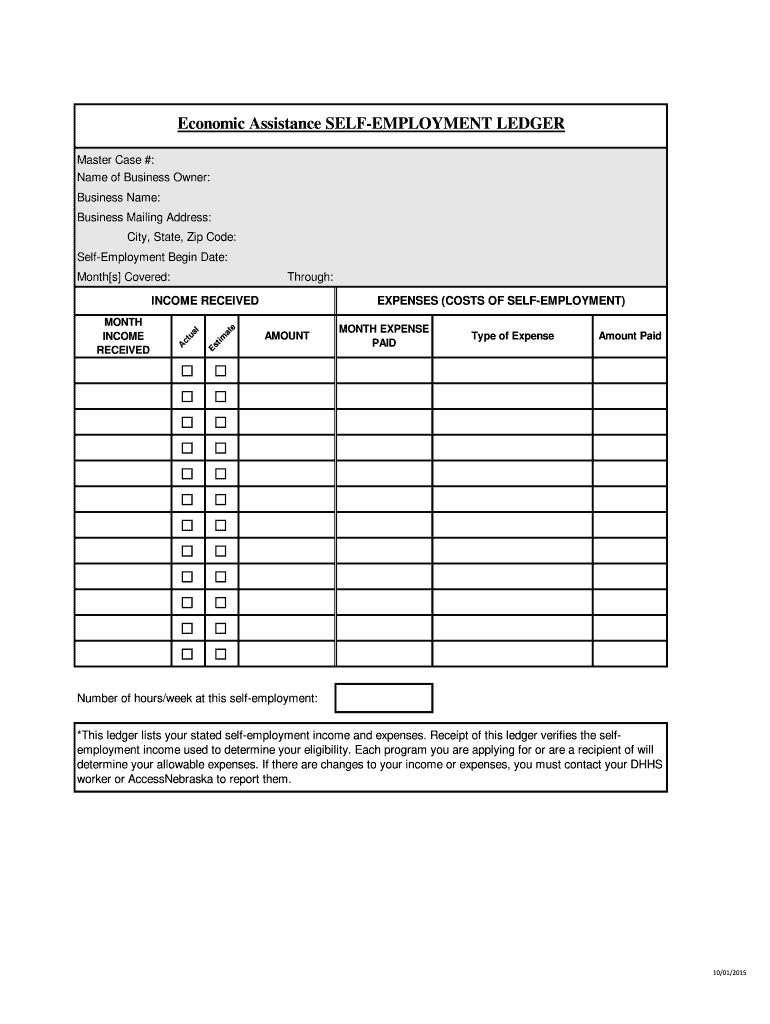

Self-Employment Ledger: 40 FREE Templates & Examples Expenses. For further completing the self-employment ledger form, write down all accepted business expenses, monthly expenditure. Accepted business expenses could be deducted from your self-employment income. It includes payments on major purchases. Tools, machinery, or equipment used and other long-lasting commodities and the rate of real work ...

PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $

PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

PDF Self Employment Monthly Sales and Expense Worksheet - Wa If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page. (Sign the back page.)

PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here,

PDF 2020 Sched C Worksheet - Alternatives Schedule C Worksheet for Self-Employed Filers and Contractors - tax year 2020 This document will list and explain the information and documentation that we will need in order to file a tax return for a self-employed person, a contract worker, or a sole-proprietor of a business.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

0 Response to "40 self employed business expenses worksheet"

Post a Comment