41 funding 401ks and roth iras worksheet

Roth vs. Traditional 401(k) Worksheet - Morningstar p Roth 401(k): Multiply the maximum allowable amount by 1 plus your tax rate (for example, 1.24 if you’re in the 24% tax bracket). Then divide that amount by your total salary to arrive at your ... 2020 Funding a 401k and Roth IRA (2).pdf - NA ME: DAT E View 2020 Funding a 401k and Roth IRA (2).pdf from FIN PERSONAL F at Lutheran High School. N A ME: DAT E: Name_ Funding 401(k)s and Roth IRAs CHAPTER 3 ...

Funding 401 K S and Roth Iras Worksheet Answers Funding 401 K S and Roth Iras Worksheet Answers. A Funding 401 K Sage IRA Worksheet answers some common questions of IRA conversions and IRA custodians. The worksheet answers the following questions: "What is a Conversion?". A conversion is an IRA investment in a non-qualified or non-elective account that is converted to a qualified plan ...

Funding 401ks and roth iras worksheet

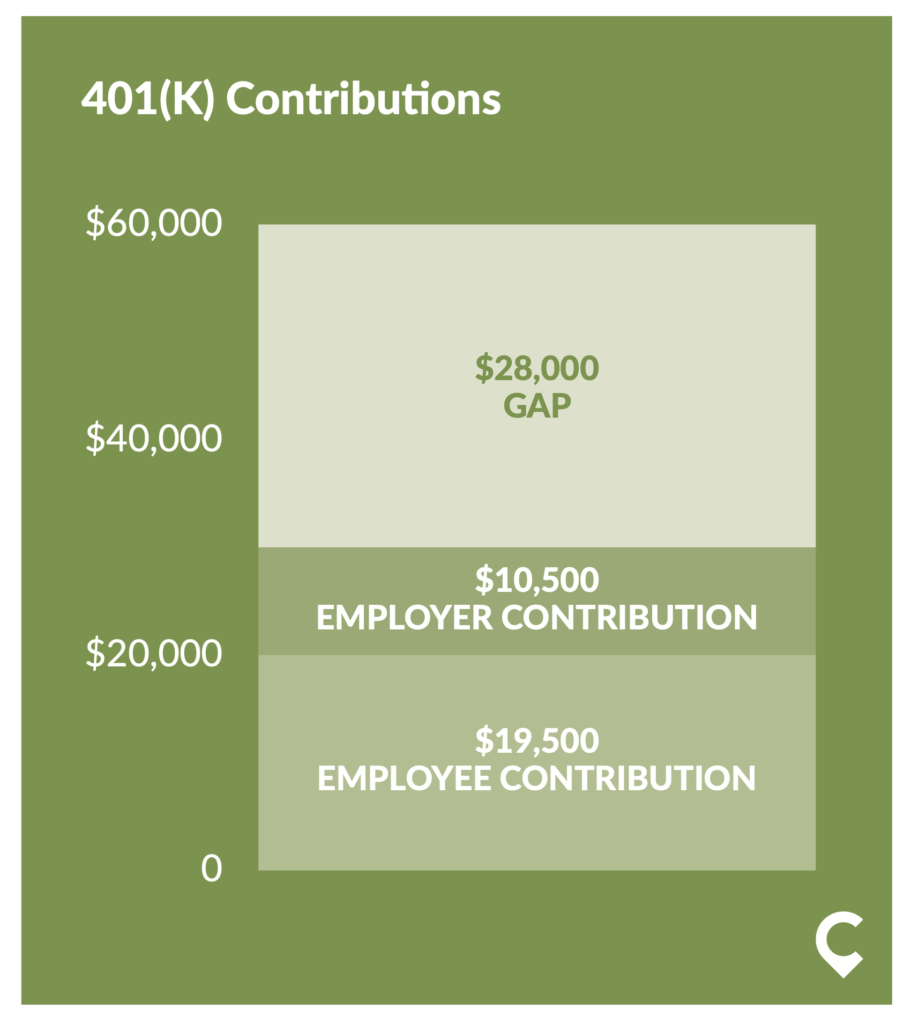

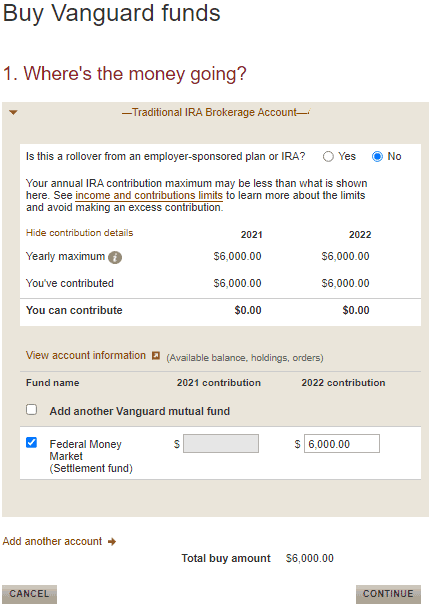

401(k) and roth ira Flashcards | Quizlet steps for investing in roth ira or 401k. 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match. 3. Above the match, fund roth ira. 4. complete 15% of income by going back to 401(k) single- $___________; salary max $_____________. $5000; $110,000. Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k) (continued from not above) max contribution to a ROTH IRA if $5,000 per person * If the person is not eligibile to contribute to ROTH IRA, put all of it into 401 (k) Backdoor Roth IRA 2022: What Is It & How to Do It | Facet ... Enter the backdoor Roth IRA. How a Regular Roth IRA Works. With a Roth IRA, you contribute after-tax dollars as opposed to before-tax dollars like you would contribute to a traditional IRA or 401(k). You elect to pay taxes today so you don't have to pay them in the future. Once your money is in the Roth IRA, you can invest it however you choose.

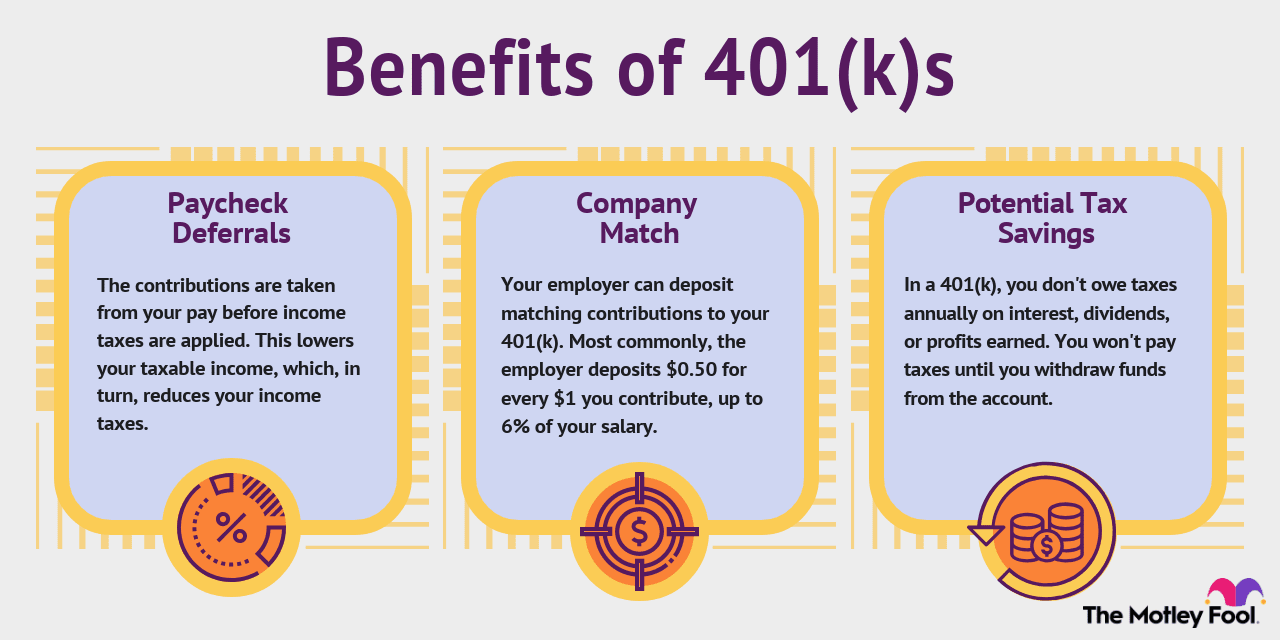

Funding 401ks and roth iras worksheet. Funding 401(k)s and Roth IRAs Directions... - Course Hero Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. Funding a 401 K and Roth - financial lit Flashcards | Quizlet 401 (K) defined contribution plan offered by a corporation to its employees, which allows employees to set aside tax-deferred income for retirement purposes; in some cases, employers will match their contributions. 403b. same as 401k but is used for nonprofit organizations such as schools, hospitals, and churches. Copy of Funding 401(k)s and Roth IRAs - Course Hero Funding 401(k)s and Roth IRAs Directions: Complete the investment chart based on the facts given for. ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. PDF Roth 401(k) Contributions Questions and answers to help ... The new Roth 401(k) feature in your plan allows you to invest after-tax dollars (allowing them to grow on a tax- deferred basis) and take qualifying distributions tax-free. The following questions and answers will help you decide if Roth 401(k) contributions are right for you.

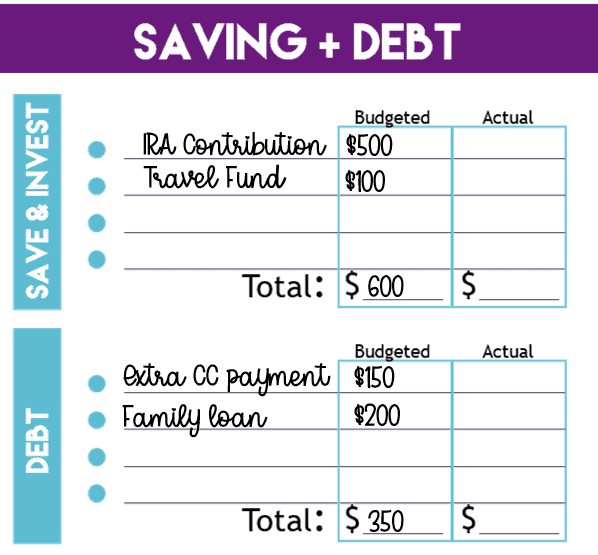

Quiz & Worksheet - Roth IRA Rules & Benefits | Study.com In order to pass the quiz, you will need to know characteristics of Roth IRAs and different publication numbers that should be reviewed prior to funding a Roth IRA. Quiz & Worksheet Goals Use this ... Funding 401K And Roth Ira Worksheet – Free Gold IRA Rollover ... Oct 23, 2021 · Funding 401K And Roth Ira Worksheet Overview. Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as “protocol shares.” Funding 401ks and Roth Iras Worksheet - Semesprit Funding 401ks and Roth Iras Worksheet with Preschool Printable Worksheets Free Super Teacher Workshee Download by size: Handphone Tablet Desktop (Original Size) Your 401k is all about saving money. It provides a good amount of income, if you were to hold onto it until retirement. 401(k) and IRA Contributions: You Can Do Both Learn about our editorial policies. You can still contribute to a Roth IRA and/or traditional IRA even if you participate in a 401 (k) plan at work—as long as you meet the IRA's eligibility ...

How to Calculate Your Roth Contribution ... - Marotta On Money Line 11 is the amount you are allowed to contribute to your Roth IRA based on your other IRA funding decisions. For example, with an under-age-50 married filing jointly 2019 AGI of $196,000, you are $3,000 of the way over $193,000 or 30% of the way through the phaseout. Activity_Funding_A_401k_And_... Review the steps to follow when funding a 401(k) and Roth IRA, located in theworkbook:1Always take advantage of a match and fund 401(k).2Above the match, ... Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Activity: Funding 401 (k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of ... PDF The Fidelity Self-employed 401(K) Contribution Worksheet ... 1 Your salary deferral amount must be in accordance with your 401(k) Salary Reduction Agreement election made prior to your plan year-end. 2 If you are age 50 or older, or will turn age 50 during the calendar year for which you are making the contribution, you may be able to make an additional contribution up to the limits outlined on this worksheet. ...

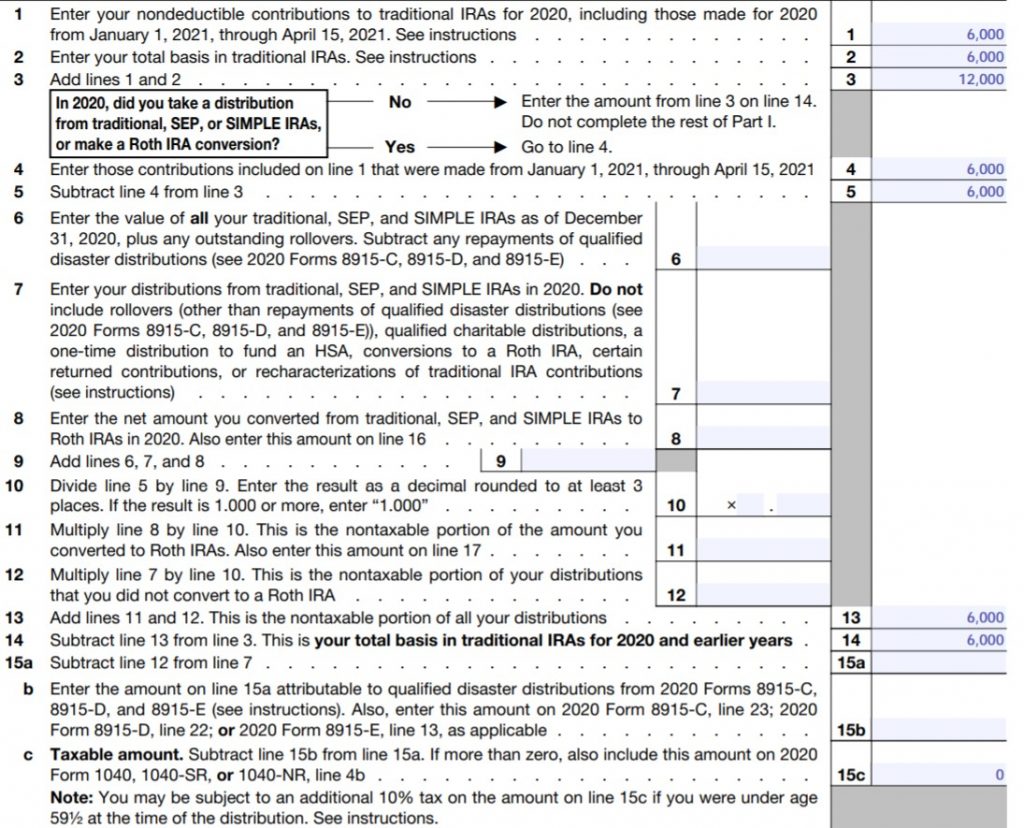

Instructions for Form 8606 (2021) | Internal Revenue Service If you took a Roth IRA distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2021 in excess of your basis in regular Roth IRA contributions, see the Basis in Roth IRA Conversions and Rollovers From Qualified Retirement Plans to Roth IRAs chart to figure the amount to enter on line 24.

Funding 401ks And Roth Iras Worksheet Answers - Nidecmege Funding 401ks and iras worksheet and best 25 retirement savings amp. We think it bring interesting things for funding 401 k s and roth iras worksheet answers along with assignment create a roth ira assignment create a. Excel 2007 along with the newest 2010 improve break the previous hurdles about the range of columns and rows available.

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 ... Oct 20, 2021 · Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as “protocol shares.”. It works like a standard IRA, only it holds bullion bars or coins instead of holding paper investments.

Funding 401(k)s & Roth IRAs Chart.docx - Course Hero Funding 401(k)s & Roth IRAs Directions: Complete the investment chart based on the facts given for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Act-Ch12-L03-S.pdf - Funding 401(k)s and Roth IRAs ... Funding 401(k)s and Roth IRAs CHAPTER 12, LESSON 3 DATE NAMES DIRECTIONS Complete the investment ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Amount of Roth IRA Contributions That You Can Make For ... Amount of your reduced Roth IRA contribution. If the amount you can contribute must be reduced, figure your reduced contribution limit as follows. Start with your modified AGI. $125,000 for all other individuals. Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing a separate return and ...

Bill Nye Waves Worksheet Answers - Studying Worksheets Worksheet Funding 401ks And Roth Iras Worksheet. In the Roth version of IRAs and 401k plans contributions are made after taxes are paid. Funding 401ks and roth…

Roth IRAs and 401(k)s: Answers to Readers' Questions - WSJ Roth IRAs and 401(k)s: Answers to Readers' Questions By Laura Saunders. Updated Jan. 7, 2015 8:42 am ET A recent Weekend Investor cover story asked, "Is a Roth Account ...

Funding 401ks And Roth Iras Worksheet - Studying Worksheets Feb 06, 2022 · Funding 401ks and roth iras worksheet work extremely well from a teachertutorparent to enrich the content an understanding of their studentchild. Funding 401ks and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Funding 401ks and roth iras worksheet answers chapter 8.

Funding a 3-Year-Old's Roth IRA - Marotta On Money 2. Open a Custodial Roth IRA. Once your child has earned the income, then your child is eligible for an amount of Roth IRA funding. The first step is to open the Roth IRA. I opened my daughter's Custodial Roth IRA at Charles Schwab, because that is where my other finances are held.

Amazing Funding 401ks And Iras Worksheet - The Blackness ... The main difference between 401 ks and iras is that employers. Worksheets bring all subjects for example math geography etc and limited one topic like funding 401ks and roth iras worksheetin teaching and learning worksheet usually concentrates one specific part of learning and is often used to employ a particular.

Funding 401 K S and Roth IRAs Worksheet Answers Funding 401 K S and Roth IRAs Worksheet Answers - There are lots of worksheets on the internet to aid individuals to comply with the treatments for an identity theft instance. A worksheet, Get Sheet Name A workbook includes a selection of worksheets. It will be pictorial. The estimating worksheet was made to direct you.

PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

Funding 401(k) and Roth IRAs (1).pdf - NA ME: DAT E Funding 401(k)sand Roth IRAsDirectionsComplete the investment chart based on the facts given for each ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume Study Resources

Backdoor Roth IRA 2022: What Is It & How to Do It | Facet ... Enter the backdoor Roth IRA. How a Regular Roth IRA Works. With a Roth IRA, you contribute after-tax dollars as opposed to before-tax dollars like you would contribute to a traditional IRA or 401(k). You elect to pay taxes today so you don't have to pay them in the future. Once your money is in the Roth IRA, you can invest it however you choose.

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k) (continued from not above) max contribution to a ROTH IRA if $5,000 per person * If the person is not eligibile to contribute to ROTH IRA, put all of it into 401 (k)

401(k) and roth ira Flashcards | Quizlet steps for investing in roth ira or 401k. 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match. 3. Above the match, fund roth ira. 4. complete 15% of income by going back to 401(k) single- $___________; salary max $_____________. $5000; $110,000.

/istock-91516278.jygallery.retirement.funds.cropped-f1d476c6cdaf464b863fa9eb76d3f727.jpg)

0 Response to "41 funding 401ks and roth iras worksheet"

Post a Comment