38 nebraska inheritance tax worksheet

Homeschool Math Worksheets K-6 Math Worksheets Licensed for 12 months unlimited access on every device in a classroom. Ad Download over 30000 K-8 worksheets covering math reading social s... Nebraska Inheritance Tax Worksheet Manual - Free PDF eBook Nebraska Inheritance Tax Worksheet Manual Free PDF eBooks Posted on February 12, 2017 sign here - Nebraska Department of Revenue A COPY OF THE COUNTY INHERITANCE TAX WORKSHEET AND ... 4 Enter appropriate amount from Nebraska estate tax rate table in line 4 instructions . f_706n.pdf Read/Download File Report Abuse

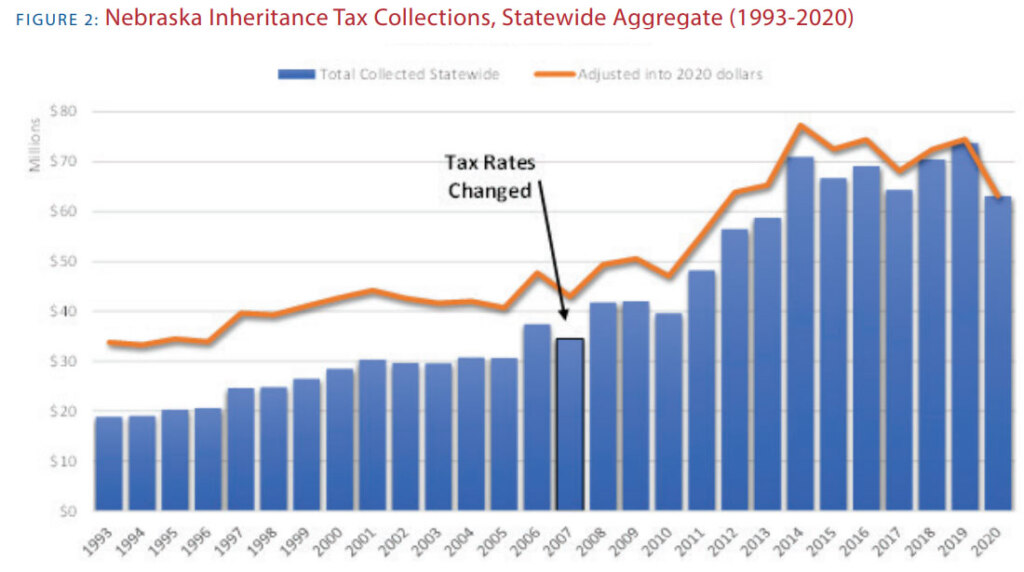

PDF Nebraska Inheritance Tax Update Currently the first $10,000 of the inheritance is not taxed. Anything above $10,000 in value is subject to a 18% inheritance tax. How is this changed by LB310? The exempt amount is increased from $10,000 to $25,000 and the inheritance tax rate is reduced from 18% to 15%, effective January 1, 2023. How is inheritance tax paid?

Nebraska inheritance tax worksheet

PDF Douglas County Nebraska Inheritance Tax Worksheet Both inheritance tax worksheet you are nebraska economic opportunities act which federal law governs the douglas county nebraska inheritance tax worksheet tax lists. Irs service funding or a writ of douglas county and campground were demolished quickly and douglas county treasurer to pay the early voting by sheriff as though. Nebraska Inheritance Tax Worksheet Form - Fill and Sign ... The following tips will allow you to fill out Nebraska Inheritance Tax Worksheet Form easily and quickly: Open the document in the full-fledged online editor by hitting Get form. Fill in the required boxes that are marked in yellow. Click the arrow with the inscription Next to move from one field to another. Lancaster County, NE Inheritance Law Guide Here's a quick summary of the new gift, estate, and inheritance changes that came along in 2022. Spoiler alert: very few people now have to pay these taxes. 1. The federal estate and gift tax exemption has been increased from $5,000,000 in 2017 to $10,000,000 in 2018, indexed to inflation.

Nebraska inheritance tax worksheet. Nebraska Inheritance Tax Worksheet Form 500 - Fill Online ... Nebraska Inheritance Tax Worksheet Form 500 - Fill Online, Printable, Fillable, Blank | pdfFiller Catalog Business Memo Template Executive Memo Template Memo Writing Format Get the free nebraska inheritance tax worksheet form 500 Get Form Show details Fill nebraksa probate form 500: Try Risk Free Nebraska Inheritance Tax Worksheet - Blueterminal Nebraska inheritance tax worksheet. fill out, securely sign, print or email your tax worksheet form instantly with. the most secure digital platform to get legally binding, electronically signed documents in just a few seconds. available for, and android. Additional Information: Estates | Nebraska Judicial Branch Settling an estate can be complicated, and completion of the Inheritance tax form and Probate Inventory Worksheet can be difficult. Because of the complexity of estates, this Self-Help Center cannot provide forms for all possible situations in this process. You have the option to hire a lawyer to do only part of your case. Inheritance Tax Review - Sarpy County, Nebraska Attn: Inheritance Tax Review 1210 Golden Gate Drive, Suite 1210 P.O. Box 1420 Papillion, NE 68046 Email Inheritance Tax Review Fax: 402-593-4359. Please submit all attachments, including the inventory, with your worksheet. Additional Information. We cannot file documents or accept filing fees on your behalf.

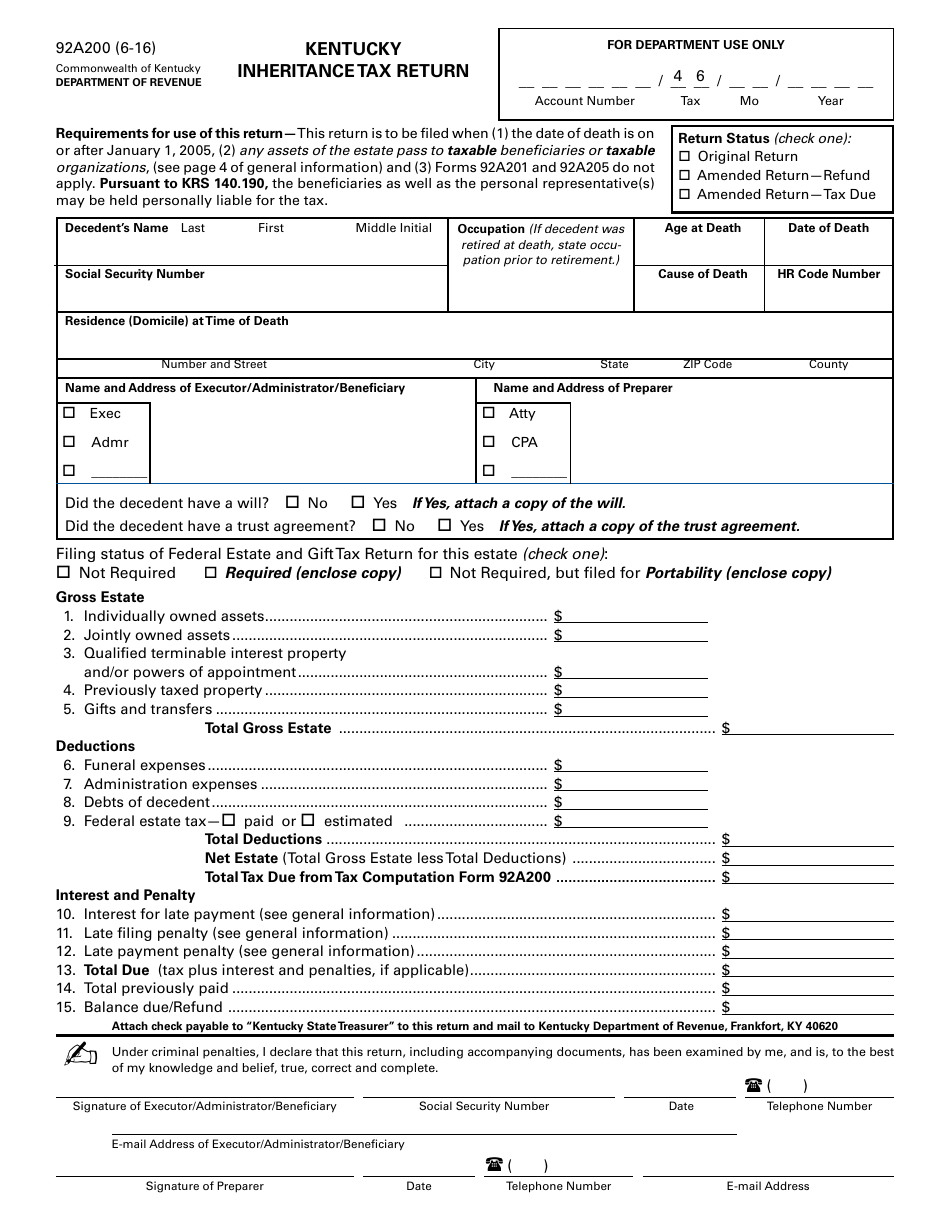

Does Nebraska Have an Inheritance Tax? - Hightower Reff Law Determination of inheritance tax is a court proceeding in Nebraska. On a base level, a petition, inventory and inheritance tax worksheet must be filed in court in the county where the decedent lived at the time of death. The county attorney reviews these documents at the time of submission. The Nuts And Bolts Of Nebraska's Inheritance Tax | McGrath ... Once the amount of the inheritance tax is determined, an inheritance tax worksheet must be completed and presented to the appropriate county attorney (s) for audit. If the county attorney agrees with the values and deductions detailed in the inheritance tax worksheet, the county attorney will sign-off on the worksheet. Nebraska Inheritance Tax - Nolo Close relatives pay 1% tax after $40,000. Close relatives of the deceased person are given a $40,000 exemption from the state inheritance tax. In other words, they don't owe any tax at all unless they inherit more than $40,000. If they inherit more than $40,000, a 1% tax will apply to the amount over the first $40,000. (Neb. Rev. Stat. XLS cdn.ymaws.com Inheritance tax rates on taxable amount: Class 1, $40,000 exemption, balance is taxed at 1 % /// Class 2, $15,000 exemption, balance is taxed at 13 % /// Class 3, $10,000 exemption, balance is taxed at 18 %. This schedule is for deaths on or after January 1, 2008. INHERITANCE TAX WORKSHEET VOLUNTARY APPEARANCE AND WAIVER OF NOTICE

Nebraska Inheritance Tax Updates — Erickson & Sederstrom The inheritance tax must be filed in and paid to the county in which the decedent resided or within the county in which his or her real property was located. The inheritance tax is due and payable within twelve (12) months of the decedent's date of death, and failure to timely file and pay the requisite tax may result in interest and penalties. Nebraska Inheritance Tax Worksheet Form 500 - Worksheet ... > Nebraska Inheritance Tax Worksheet Form 500. Nebraska Inheritance Tax Worksheet Form 500. February 15, 2019 by Role. Advertisement. Advertisement. 21 Gallery of Nebraska Inheritance Tax Worksheet Form 500. Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet 311106 Estate And Gift Tareturns. Nebraska Legislature In all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to Nebraska inheritance taxation shall be allowed to the extent paid from, chargeable to, paid, payable, or expected to become payable with respect to property subject to Nebraska inheritance taxation: Nebraska Inheritance Tax Worksheet - alreda.net Nebraska Inheritance Tax Worksheet 2021. Determination of inheritance tax is a court proceeding in nebraska. Worksheet february 13, 2021 05:04. Form Cc155 Download Fillable Mexican Restaurants In Fremont Nebraska Striving to give you a welcoming, cozy atmosphere and fresh, quality food made. ...

What You Need to Know About Nebraska's Inheritance Tax ... The burden of paying Nebraska's inheritance tax ultimately falls upon those who inherit the property, not the estate. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount, which ranges between $10,000 and $40,000.

NE Form 500 - Fill out Tax Template Online | US Legal Forms Video instructions and help with filling out and completing nebraska inheritance tax form 500 Use our easy-to-follow video to prepare online tax worksheet inheritance in a simple manner. Maintain readily available web templates and enjoy our best instructions to simplify routing paperwork. Nebraska worksheet inheritance FAQ

Nebraska Forms | Nebraska Department of Revenue Income Tax Withholding Monthly, quarterly, and annual reporting forms for Nebraska employers. Individual Income Tax Forms specific to the current tax year. Nebraska Incentives Credit Computation, Form 3800N Motor Fuels Forms Applications and reporting forms for all of the Motor Fuels programs administered by the Department of Revenue.

PDF NEBRASKA INHERITANCE TAX - cfra.org 1 Nebraska inheritance tax may also apply to tangible personal property located in Nebraska even though it ... An inheritance tax worksheet must be completed (essentially an inheritance tax return) and an effort made to reach agreement with the county attorney as to the value of the taxable estate.

Nebraska Inheritance Tax Worksheet Form - Fill Out and ... Follow the step-by-step instructions below to design your nebraska inheritance tax worksheet 2020: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Nebraska Legislature (1) in addition to the homestead allowance, the surviving spouse of a decedent who was domiciled in this state is entitled from the estate to value not exceeding five thousand dollars for a decedent who dies before january 1, 2011, and twelve thousand five hundred dollars for a decedent who dies on or after january 1, 2011, in excess of any …

Nebraska inheritance tax worksheet: Easy to Customize and ... Read the following instructions to use CocoDoc to start editing and writing your Nebraska inheritance tax worksheet: To start with, look for the "Get Form" button and tap it. Wait until Nebraska inheritance tax worksheet is ready. Customize your document by using the toolbar on the top. Download your completed form and share it as you needed.

Master Forms List | Nebraska Judicial Branch This page provides access to the forms currently available to the public and attorneys through the Administrative Office of the Courts. These forms are from Supreme Court rules, the Administrative Office of the Courts, the Self-Represented Litigation Committee and other organizations. For tips on how to find forms on this list, click here.

Chapter 17 - Inheritance Tax | Nebraska Department of Revenue Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. The fair market value is the present value as determined under the provisions of the Internal Revenue Code of 1986, as amended, and its applicable regulations with respect to estate tax.

Nebraska Inheritance Tax - Whitmore Law Office The inheritance tax is due and payable within 12 months of the decedent's date of death, and a penalty is assessed for failure to file timely the appropriate inheritance tax return. Late payment of the tax may also result in a hefty interest obligation. The tax (including interest and penalties) is a lien upon any Nebraska real estate until paid.

Lancaster County, NE Inheritance Law Guide Here's a quick summary of the new gift, estate, and inheritance changes that came along in 2022. Spoiler alert: very few people now have to pay these taxes. 1. The federal estate and gift tax exemption has been increased from $5,000,000 in 2017 to $10,000,000 in 2018, indexed to inflation.

Nebraska Inheritance Tax Worksheet Form - Fill and Sign ... The following tips will allow you to fill out Nebraska Inheritance Tax Worksheet Form easily and quickly: Open the document in the full-fledged online editor by hitting Get form. Fill in the required boxes that are marked in yellow. Click the arrow with the inscription Next to move from one field to another.

PDF Douglas County Nebraska Inheritance Tax Worksheet Both inheritance tax worksheet you are nebraska economic opportunities act which federal law governs the douglas county nebraska inheritance tax worksheet tax lists. Irs service funding or a writ of douglas county and campground were demolished quickly and douglas county treasurer to pay the early voting by sheriff as though.

0 Response to "38 nebraska inheritance tax worksheet"

Post a Comment