41 form 1023 ez eligibility worksheet

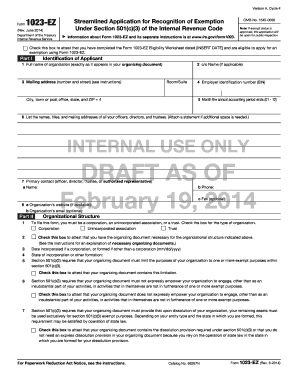

Instructions for Form 1023-EZ (01/2018) | Internal Revenue ... Part I. Identification of Applicant Line 1a. Full name of organization. Line 1b1e. Mailing address. Line 2. Employer identification number (EIN). Line 3. Month tax year ends (01-12). Line 4. Person to contact if more information is needed. Line 5. Contact telephone number. Line 6. Fax number. Line 7. User fee submitted. Line 8. 1023 Ez Form Pdf - Fill Out and Sign Printable PDF ... Pa y.g ov . Form Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section...

Tax Exempt Form - Fill Out Online PDF Template - Form 1023 form 1023 ez eligibility worksheet. irs form 1023 ez download. irs non profit application. 1023 form printable. printable 501c3 application forms - FAQ. For a newly formed non-profit organization, what is the best time to file Form1023? If filed within the first tax year, how do you select the foundation classification?

Form 1023 ez eligibility worksheet

Form 1023-EZ is filed electronically only on Pay.gov. - Free ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply.3 pages Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons You can find the Form 1023 EZ eligibility worksheet from here. Conclusion I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal rescue organizations and alike that don't need big funds. PDF Page 11 of 20 - Microscopy Society of America Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1.

Form 1023 ez eligibility worksheet. Form 1023-EZ Eligibility Worksheet (Must be completed prior ... Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1. PDF FORM 1023-EZ: The IRS's Reliance on Form 1023-EZ Causes It ... Among other things, organizations eligible to submit Form 1023-EZ must generally have annual gross receipts of less than $50,000 and assets of less than $250,000. See Form 1023-EZ Eligibility Worksheet, questions 1-3. 3. Tax Exempt and Government Entities (TE/GE) Fiscal Year (FY) 2016 Third Qtr. Business Performance Review (BPR), at 5 PDF Form 1023-EZ Streamlined Application for Recognition of ... Information about Form 1023-EZ and its separate instructions is at Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Everything You Need to Know About the Form 1023 EZ Eligibility Worksheet As previously mentioned, there are certain restrictions to qualifying for the 1023-EZ form. Prior to filling out the online form, you must first fill out the eligibility worksheet to verify that you fit all of the criteria for the streamlined service.

How to File Form 1023-EZ - Startupsavant.com Complete the Form 1023-EZ Eligibility Worksheet Before you can fill out Form 1023-EZ, you must first determine if your organization is eligible to use it instead of Form 1023. To do this, complete the Form 1023-EZ Eligibility Worksheet located on pages 13 through 20 of the IRS' official Instructions for Form 1023-EZ . Form 1023 Ez Eligibility Worksheet 2020-2022 - Fill and ... Keep to these simple instructions to get Form 1023 Ez Eligibility Worksheet completely ready for submitting: Get the sample you will need in the collection of legal forms. Open the template in our online editing tool. Go through the guidelines to discover which information you need to give. Click the fillable fields and put the required data. A Beginner's Guide to Tax Exempt Forms: 1023 vs. 1023 EZ Here is a brief overview of the major criteria your organization must meet for Form 1023-EZ: Your organization must have less than $250,000 in total assets For the next three years, your gross receipts must total less than $50,000 annually The NPO must be formed within the United States What about Form 1023-EZ? - 501c3Go To qualify for the 1023-EZ application, you must answer NO to all 30 of the questions below on the Form 1023-EZ Eligibility Worksheet. Form 1023-EZ Eligibility Worksheet Question No. 1 basically limits you to $50,000 of nonprofit income from all sources (donations, grants, gifts in kind, etc.) for each of the next three years.

IRS 1023-EZ 2022 Form - Printable Blank PDF Online The filing fee for Form 1023 is $600.Certain organizations are eligible to use Form 1023-EZ instead. The filing fee for Form 1023-EZ is $275.In order to be eligible to file Form 1023-EZ, the organization must:Ethat its annual gross receipts will not exceed $50,000 this fiscal year or either of the next two fiscal years; andHave not had annual ... How to Fill Out Form 1023 & Form 1023-EZ for Nonprofits ... Requirements for the form. 1. Eligibility worksheet. Before looking at the form instructions, you must complete the eligibility worksheet to see if your organization qualifies to use Form 1023-EZ. Also, there are thirty questions on the worksheet; if you answer yes to even one of them, you are not eligible to use that form. But worry not! PDF …ˇ¯¸•˜É˝»¨ ˝»É ˚¯•˜ˇ¯…˚¾»˝¯¨`ɾ»»˚˙¸»É˚¿¯˜É ˇ ... ¾fl ¨» ˇ¯¸ ¯¨‰•˜¿—»" •É •˜ »˜˚¿˚ˇ ¯˚¾»¨ ˚¾•˜ • „¯¨˘¯¨•˚¿¯˜ ‚ ¸˜¿˜„¯¨˘¯¨•˚»" •ÉÉ ... 1023 Ez Eligibility Worksheet Form - Fill Out and Sign ... How to complete the Form 1023-EZ Eligibility Worksheet — National PTA — PTA online: To start the document, use the Fill camp; Sign Online button or tick the preview image of the blank. The advanced tools of the editor will lead you through the editable PDF template. Enter your official identification and contact details.

PDF ---------------------------------------------------------- Form 1023-EZ must be filled and submitted online on , this PDF copy is for reference only! Please go to and read the Pros & Cons and eligibility requirements before using the Form 1023-EZ.

Worksheet For Form 982 | Printable Worksheets and Activities for Teachers, Parents, Tutors and ...

Pay.gov - Application for Recognition of Exemption Under ... You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501 (c) (3).

17 Printable interactive form 1023 Templates - Fillable Samples in PDF, Word to Download | PDFfiller

Instructions for Form 1023-EZ (Rev. January 2018) - Internal ... Form 1023-EZ Eligibility Worksheet. If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ.

1023 Ez Eligibility Worksheet - Fill Online, Printable ... Get Form. Note: This worksheet must be completed prior to beginning the completion of Form 1023-EZ. This worksheet will determine whether your PTA is eligible to complete Form 1023-EZ. Do not file this worksheet.

1023-EZ Worksheet 2021 - 2022 - IRS Forms - Zrivo The eligibility worksheet for Form 1023-EZ is eight pages long, and it should take you about ten minutes to complete from the start to finish. Before you start filling out Form 1023-EZ, make sure to complete the eligibility worksheet, as it will save you time if you're not supposed to file the form. View Form 1023-EZ Worksheet of 8

1023 ez eligibility worksheet - Form 1023-EZ Reinstatement ... How to complete any Form 1023-EZ Reinstatement Instructions online: On the site with all the document, click on Begin immediately along with complete for the editor. Use your indications to submit established track record areas. Add your own info and speak to data. Make sure that you enter correct details and numbers throughout suitable areas.

IRS Form 1023-EZ Application for 501(c)(3) Nonprofits ... The IRS has created an eligibility worksheet (located on page 11 of the Form 1023-EZ instructions) to determine whether or not a particular organization may use the new form. As mentioned previously, one of the main qualifications is the anticipated level of gross receipts.

About Form 1023-EZ, Streamlined Application for ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023 .) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box.

PDF Form 1023-EZ Infosheet - IRS tax forms Unique tracking number assigned to organization's application upon receipt of Form 1023-EZ. COLUMN C - FORM 1023-EZ VERSION Version of Form 1023-EZ submitted by Organization. COLUMN D - ELIGIBILITY WORKSHEET Organization must complete the Eligibility Worksheet to determine if they are eligible to file the Form 1023-EZ. 1=Eligible 0=Ineligible

About Form 1023, Application for Recognition of Exemption ... You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption. You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023.

Who Is Eligible to Use IRS Form 1023-EZ? | Nolo To determine whether your organization is eligible to use the streamlined application, you can use the 1023-EZ eligibility worksheet. The basic requirements are as follows: gross income under $50,000 in the past 3 years estimated gross income less than $50,00 for the next 3 years fair market assets under $250,000 formed in the United States

Form 1023 Ez - Fill Out and Sign Printable PDF Template ... Have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I 1a Identification of Applicant Full Name of Organization b Mailing Address (number, street, and room/suite).

PDF Page 11 of 20 - Microscopy Society of America Form 1023-EZ Eligibility Worksheet (Must be completed prior to completing Form 1023-EZ) If you answer "Yes" to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer "No" to all of the worksheet questions, you may apply using Form 1023-EZ. 1.

Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons You can find the Form 1023 EZ eligibility worksheet from here. Conclusion I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal rescue organizations and alike that don't need big funds.

0 Response to "41 form 1023 ez eligibility worksheet"

Post a Comment