41 self employment expenses worksheet

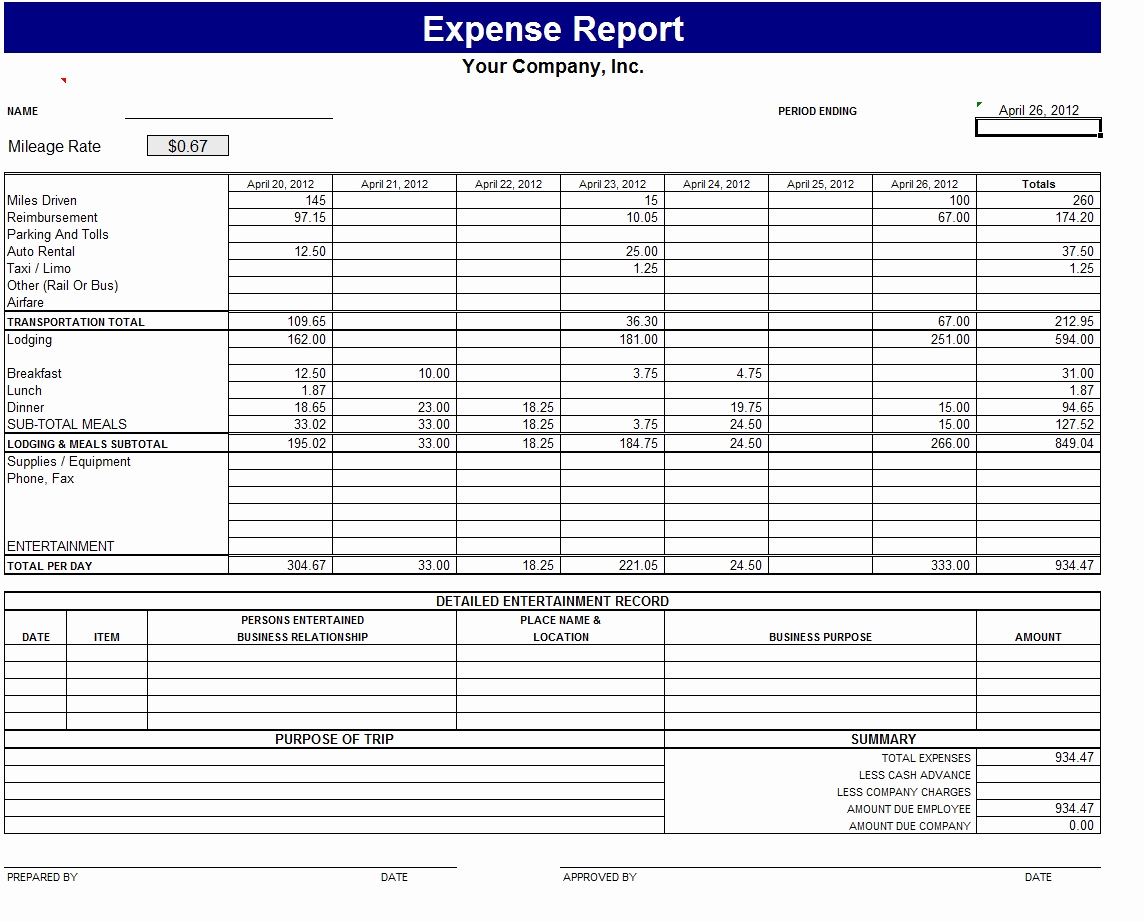

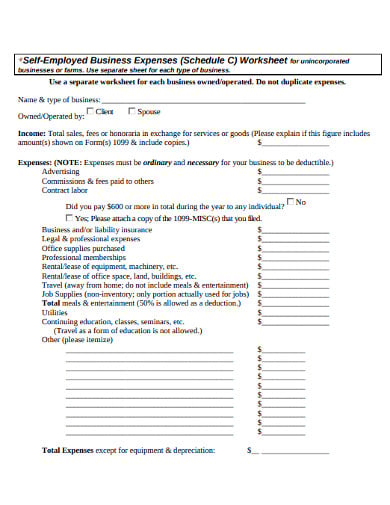

PDF Self Employment Income Worksheet - Kcr - Personal (non-business) Work-Related Expenses INCOME: 1. Gross Business Revenue - Depreciation, Depletion, and Amortization (for medical plans established under this business) 8. Professional Fees 9. Office Supplies 10. Equipment 4. Cost of Goods Sold 5. Advertising 6. Business Insurance, Licenses, and Permits 7. Medical Insurance Premiums PDF SELF-EMPLOYMENT INCOME AND EXPENSE WORKSHEET - Loren Nancke All expenses should be totaled from actual receipts that can be presented to the CRA in the event of an audit. Need more info? Call or email us, or visit our website at lorennancke.com. Title: Microsoft Word - Worksheet - Self employment income and expenses 2017 (brand typeface).docx

PDF Self-employment Expense Worksheet SELF-EMPLOYMENT EXPENSE WORKSHEET Applicant's name: _____ Name of self-employed person: _____ ... WAGES (Paid to employee(s)) $ MAINTENANCE REPAIRS ( Business car/ property) $ SUPPLIES $ ADVERTISING/MARKETING $ UTILITIES FOR BUSINESS $ FUEL $

Self employment expenses worksheet

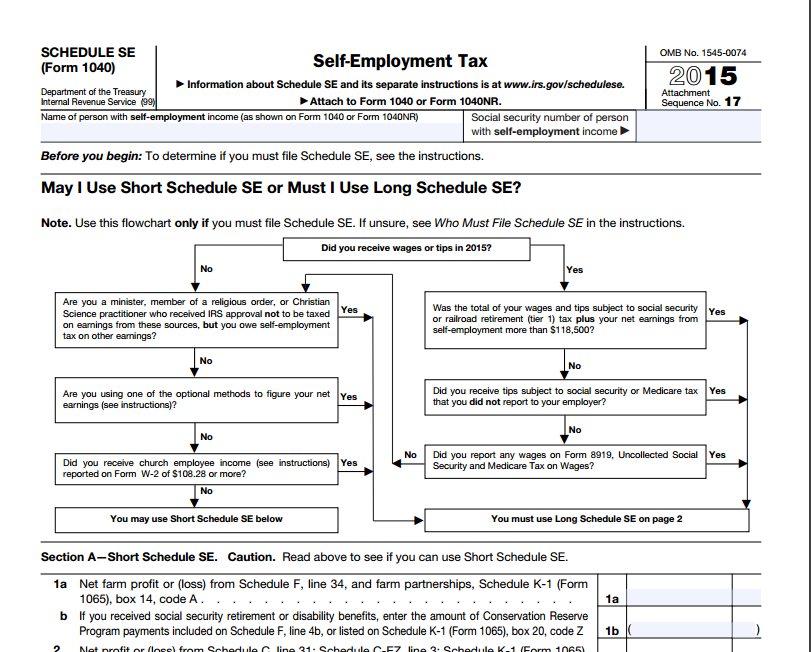

Tracking your self-employed income and expenses - Viviane Ayala Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software Guide On Self-Employed Bookkeeping With FREE Excel Template In the example, the sales are 40175.34 and expenses 36754.74 - 8400 = 28354.74. The total profit for the company is 40175.34 - 28354.74 = 11820.60. The business owner will need to pay taxes on the profit. There are self-employed tax calculators which will calculate the taxation that is due. The best calculator is employed and self-employed. Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

Self employment expenses worksheet. PDF Self Employment Income Worksheet Self Employment Income Worksheet . Self Employed Applicants Name: _____ Home Address: _____ ... Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. PDF Business Income/Expense Worksheet BUSINESS INCOME/EXPENSE WORKSHEET ... EXPENSES 1099-MISC / SELF-EMPLOYMENT W2 OTHER 1099-MISC / SELF-EMPLOYMENT W2 Income Received (List all self-employed income in 1099 / Self Employment column) Sales Tax Collected (If included in income above - only if you charge sales tax) Total Production Costs (Direct costs to make products) Free expenses spreadsheet for self-employed - Bonsai Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

Self-Employment Ledger: 40 FREE Templates & Examples Examples of self-employed individuals are self-sufficient contractors, sole proprietors of businesses and those with partnerships in businesses. A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledger. This is an error-free, detailed record showing self-employment cash returns ... PDF Self Employment Monthly Sales and Expense Worksheet - Wa SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) 3. Expenses List your business expenses for the month. See instruction on page 1 for information on business expenses and what we do not count as a business expense. List additional expenses on a separate sheet of paper if needed. DATE PAID TO EXPENSE TYPE Self-Employed Tax Deductions Worksheet (Download FREE) After all, a self-employed taxpayer will owe 15.3% on their earnings from self-employment or Social Security and Medicare taxes. After you calculate your net earnings from self-employment, multiply it by the self-employed tax rate and you'll see how much you'll owe Uncle Sam. If you are concerned with how much you'll owe, don't worry. PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... Income: Office Expense Office Supplies Outside Services Parking & Tolls Expenses: Postage Accounting Printing Advertising Rent, Business Equipment Business Cards Rent, Office Rent Magazines/Newspaper Repairs Automobil e ... PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your...

15 Tax Deductions and Benefits for the Self-Employed The self-employment tax rate is 15.3%: 12.4% for Social Security and 2.9% for Medicare. 8 Employers and employees share the self-employment tax. Each pays 7.65%. 9 People who are fully...

12+ Business Expenses Worksheet Templates in PDF | DOC Self-Employed Business Expenses Worksheet. polarengraving.com. Details. File Format. PDF; Size: 12.5 KB. Download. The business and the self-employed business expenditure are the worksheets that the business organization either might be the expenses or the expenditure in the business should also be maintained and taken care of. The business ...

PDF RIDESHARE OR DELIVERY Self Employment Worksheet Were you self‐employed as a RideShare/Delivery driver? Did you receive Form 1099‐NEC and/or Form 1099‐K (or 1099‐MISC for 2019 and earlier? PART 1: SCREENING QUESTIONS Check the statements below that apply to you: _____ I had more than $35,000 in business expenses.

Publications and Forms for the Self-Employed Publication 15-A, Employer's Supplemental Tax Guide PDF. Publication 225, Farmer's Tax Guide. Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C) Publication 463, Travel, Gift, and Car Expenses. Publication 505, Tax Withholding and Estimated Tax.

PDF SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all self ... ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs

PDF Self Employment Income and Expense Worksheet 4-4677 Kingsway Burnaby BC V5H 2B3 604 269 4012 hello@rocketaccounting.ca rocketaccounting.ca SELF EMPLOYMENT INCOME & EXPENSE WORKSHEET Name (First Name, Last Name):

PDF Home | Clifford & Associates, LLC Home | Clifford & Associates, LLC

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes.

PDF I certify that the information contained in this worksheet is true and ... BUSINESS EXPENSES DEDUCTIONS DEDUCTIONS DEDUCTIONS 4. Telephone $ $ $ 5. Supplies 6. Heat I Utilities 7. Advertising 8. Interest 9. Insurance 10. Bank Charges 11. Repairs ... INSTRUCTIONS ON HOW TO COMPLETE THE SELF-EMPLOYMENT WORKSHEET TO BE COMPLETED BY ALL SELF-EMPLOYED APPLICANTS APPLICANT INFORMATION ENTER: 8 name 8 business name 8 address ...

How to Make Estimated Tax Payments - investopedia.com The first step in making estimated tax payments is to calculate what you owe. The reason it is an "estimated" tax payment is because you do not know exactly what your tax bill will be by the ...

Hair Salon Expense Spreadsheet With Self Employed Hair Stylist Taxes New Self Employed Expense ...

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

16 Best Images of Budget Worksheet Self-Employed - Make a Budget Worksheet, Hair Salon Business ...

Guide On Self-Employed Bookkeeping With FREE Excel Template In the example, the sales are 40175.34 and expenses 36754.74 - 8400 = 28354.74. The total profit for the company is 40175.34 - 28354.74 = 11820.60. The business owner will need to pay taxes on the profit. There are self-employed tax calculators which will calculate the taxation that is due. The best calculator is employed and self-employed.

Tracking your self-employed income and expenses - Viviane Ayala Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

0 Response to "41 self employment expenses worksheet"

Post a Comment