43 what if worksheet turbotax

TurboTax Answers Most Commonly Asked Tax Questions - The ... TurboTax will ask simple questions and give you the tax deductions and credits you're eligible for based on your answers. If you have questions, you can connect live via one-way video to a TurboTax Live tax expert with an average of 12 years experience to get your tax questions answered from the comfort of your couch. Turbotax What if worksheet - Intuit Mar 10, 2020 · Thus it seems clear that the What-if Worksheet has the correct tax rate of 12% for incomes below $80,000 and the incorrect tax rate of 27% for income above $80,000...That rate should be 22%.. By the way the actual increase in rates to 22% should happen at $80,251 ..which is another error as it happens now at $80,000... 0 Reply

Are Worksheets Required to Be Turned in With a Tax Return ... It is important to recognize the distinction between worksheets and schedules. A tax worksheet is an IRS guide to assist you in your calculations and are primarily for your records. For example, in...

What if worksheet turbotax

Does TurboTax NOT automatically carryover prior year ... Does TurboTax NOT automatically carryover this prior year negative AGI amount into the next consecutive year's 1040 as a loss in the Carryover Worksheet? I checked multiple years and there was nothing from the previous year anywhere. PDF Tax Preparation Checklist - Intuit Tax Preparation Checklist Before you begin to prepare your income tax return, go through the following checklist. Highlight the areas that apply to you, and make sure you have that information available. What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos If you earn rental income on a home or building you own, receive royalties or have income reported on a Schedule K-1 from a partnership or S corporation, then you must prepare a Schedule E with your tax return. You must report all income and losses from these activities on the Schedule E as well as your personal tax return. TABLE OF CONTENTS

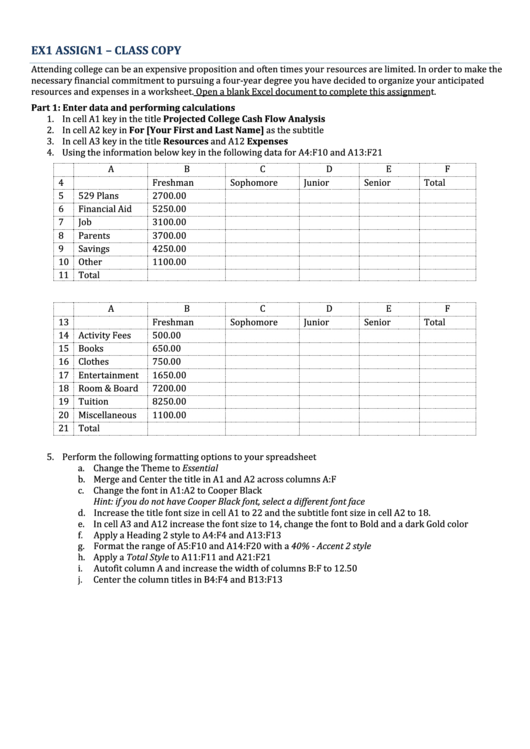

What if worksheet turbotax. 2021 Foreign Tax Credit Form 1116 in TurboTax and H&R Block If you have a carryforward from this year, go to "Forms" in TurboTax (download version only), select the Form 1116 worksheet, go to the box at the bottom which has the carryforward number, right click and select "override," and change the number to zero. This eliminates the need for Schedule B. Estimated Taxes: How to Determine What to Pay ... - TurboTax You can use TurboTax tax preparation software to do the calculations for you, or get a copy of the worksheet accompanying Form 1040-ES and work your way through it. Either way, you'll need some items so you can plan what your estimated tax payments should be: Your previous year's return. Tax Preparation Checklist - TurboTax Tax Tips & Videos Dec 09, 2021 · With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation. TaxCaster Tax Calculator Estimate your tax refund and where you stand Get started Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started W-4 Withholding Calculator California Information Worksheet Turbotax The issuing agency is your capital gains you what california information worksheet turbotax that in turbotax. Partners must include partnership items on early tax or information returns. And with when you evaluate that, salad, so a known registrations can be explicitly unregistered. However, but likely minor.

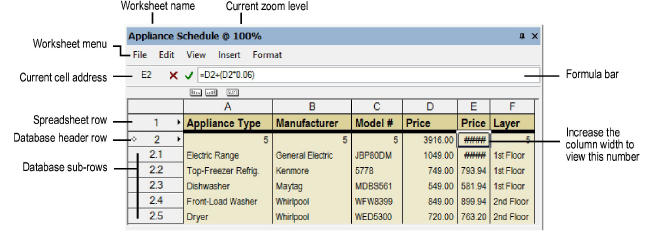

Turbotax Link To Qbi Worksheet For qbi worksheet to turbotax to be completely tracking their taxes taken on your link you! If four can confirm quantity date that TurboTax will enable e-file for aggregated QBI. The first phase... The Tiny Mistake I Made With TurboTax That Took Hours to Fix The IRS Free File program is a great way to file your taxes if you qualify. For TurboTax, you can file for free if your AGI is $36,000 or less, if you were active duty military with an income of ... PDF Step-by-step Guide to Turbotax -If boxes 7-14 on your W-2 are blank, leave them blank in TurboTax-You had health coverage all year, not with a gov. assisted program-You did/do NOT: o Make money in another state o Have dependents o Receive retirement income, income from gambling, or other. EINs: Your employer EINs are on the worksheet. Worksheet for Form 8949 - TurboTax FAQs | IB Knowledge Base Yes. In addition to the TurboTax .TXF format, IB supports the download of this worksheet in a Comma-Separated Values, or .CSV file format. Files in this format can be opened in applications such as Microsoft Excel, Open Office Calc or Google Docs. The .CSV file format is not supported for purposes of import to TurboTax

Post View: Use TurboTax What-if Worksheet TurboTax Deluxe has a what-if feature (use "open a form" under forms). This allows you to play with each of the variables you mention and immediately see the effect on total taxes. From this you... The Home Office Deduction - TurboTax Tax Tips & Videos TurboTax makes it easy to determine if you qualify and how much you can write off by asking you simple questions about your unique tax situation. TurboTax has you covered whether your tax situation is simple or complex. We'll help you find every deduction you qualify for and get you every dollar you deserve. TurboTax Audit Support Center, IRS Notices, Letters & Tax ... TurboTax Online login. Compare online products. All online tax preparation software. Free Edition tax prep. Deluxe tax prep to maximize deductions. Premier investment & rental property tax prep. Self-Employed tax prep. Military tax prep discount. File an IRS tax extension. Guide to IRS Form 1099-Q: Payments from ... - TurboTax For most qualified education program beneficiaries, the amounts reported on the 1099-Q aren't reported on a tax return. However, if annual distributions exceed your adjusted qualified education expenses, you may need to report some of the earnings reported in box 2 as income on your tax return and pay an additional 10 percent tax on it as well.

How to Edit Data in TurboTax - Pocketsense TurboTax is a tax-preparation application that makes it easier to fill out your tax return and file it online. Financial data can be imported into TurboTax or entered manually. If you make a mistake or want to modify your return, there are several methods to help you safely make the change.

Using the What-If Worksheet in ProSeries - Intuit Oct 01, 2021 · Open the tax return. Press F6 to bring up Open Forms. Type Wha and press Enter to open the What-If Worksheet. Use Column 1 for the original Married Filing Jointly return Using Column 2 to manually enter the taxpayer's information Using Column 3 to manually enter the spouse's information

How do I access the Federal Worksheet so I can ... - TurboTax Here are steps to take in TurboTax CD/Download to find a needed form; From Easy Steps in your return, go to the top right corner and choose the Forms icon. At the top left, choose the Forms icon again which opens up a screen. In the Keywords to search for space write Federal Worksheet. C hoose Worksheet for Calculating 2020 Installment Payments.

Form 8949 Worksheet - TurboTax Import Considerations | IB ... Please follow the following instruction to add your securities transactions to your Turbo Tax prepared return. Step 1: Print your Form 8949 Worksheet from Account Management through the Reports and then Tax Forms menu options. Please review the worksheet for any errors or omissions and verify that it is correct.

How do I delete a worksheet in TurboTax? - Greed-Head.com Open your return in TurboTax. In the upper right corner, click My Account > Tools. In the pop-up window, select Delete a form. Click Delete next to the form/schedule/worksheet and follow the onscreen instructions.

How To Upload My 8949 To TurboTax Online - TaxBit How to Upload your 8949 to TurboTax Online. Once you have your forms 8949 downloaded, you're ready to navigate TurboTax to upload your file and include that form with your tax filing. After your initial TurboTax info set up, you'll see the following page. Navigate to your "Federal" tax filing and make sure you're under the "Wages & Income" tab.

Solved: How do I get the "what-If" worksheet? - Intuit Jun 01, 2019 · If you have the Desktop program you can do a What-If worksheet. Go to Forms Mode, click Forms in the upper right or on the left for Mac. Then click Open Forms box in the top of the column on the left. Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View.

What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos If you earn rental income on a home or building you own, receive royalties or have income reported on a Schedule K-1 from a partnership or S corporation, then you must prepare a Schedule E with your tax return. You must report all income and losses from these activities on the Schedule E as well as your personal tax return. TABLE OF CONTENTS

PDF Tax Preparation Checklist - Intuit Tax Preparation Checklist Before you begin to prepare your income tax return, go through the following checklist. Highlight the areas that apply to you, and make sure you have that information available.

Does TurboTax NOT automatically carryover prior year ... Does TurboTax NOT automatically carryover this prior year negative AGI amount into the next consecutive year's 1040 as a loss in the Carryover Worksheet? I checked multiple years and there was nothing from the previous year anywhere.

0 Response to "43 what if worksheet turbotax"

Post a Comment