45 capital gains tax worksheet

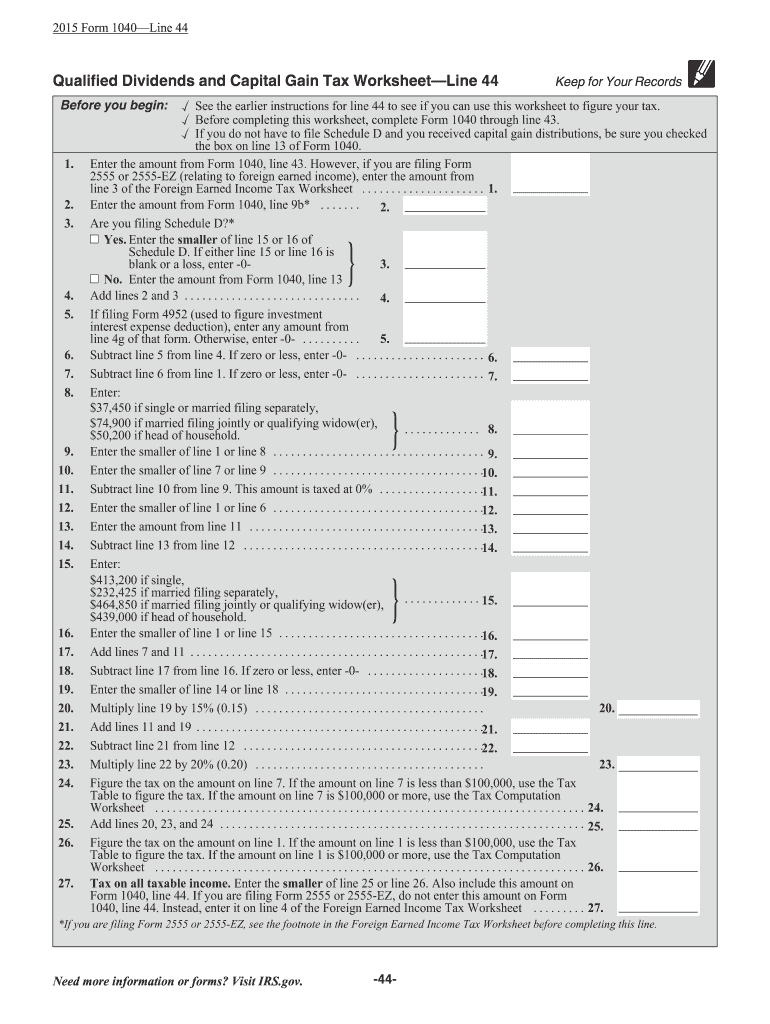

Worksheet: Calculate Capital Gains | Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

Capital gains tax worksheet

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet In 2021 and 2022, the capital gains tax rates are either 0%, 15% or 20% on most assets held for longer than a year. Capital gains tax rates on most assets held for a year or less correspond to... PDF Schedule D, Form N-35, Rev 2016, Capital Gains and Losses and ... - Hawaii as appropriate. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13. Capital losses on the sale of this stock do not need to be added back to income. Lines 5 and 14 - Section 235-7(a)(14), HRS, Short-Term and Long-Term Capital Gain Exemp - tion—For tax years beginning after 2007 and end- How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Capital gains tax worksheet. Capital Gain Tax Calculator For 2021 & 2022 The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 (filing in 2023)and 2021. As you know, everything you own as personal or investments- like your home, land or household furnishings, shares, stocks or bonds- will fall under the term " capital asset". IRS will charge you tax on the gains ... PDF and Losses Capital Gains - IRS tax forms from its net realized long-term capital gains. Distributions of net realized short-term capital gains aren't treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary divi-dends. Enter on Schedule D, line 13, the to-tal capital gain distributions paid to you during the year, regardless of how long you held your investment. 2021 Instructions for Schedule D (2021) - Internal Revenue ... 14 Dec 2021 — Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed ... Qualified Dividends and Capital Gains Worksheet - t6988 - SNHU - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

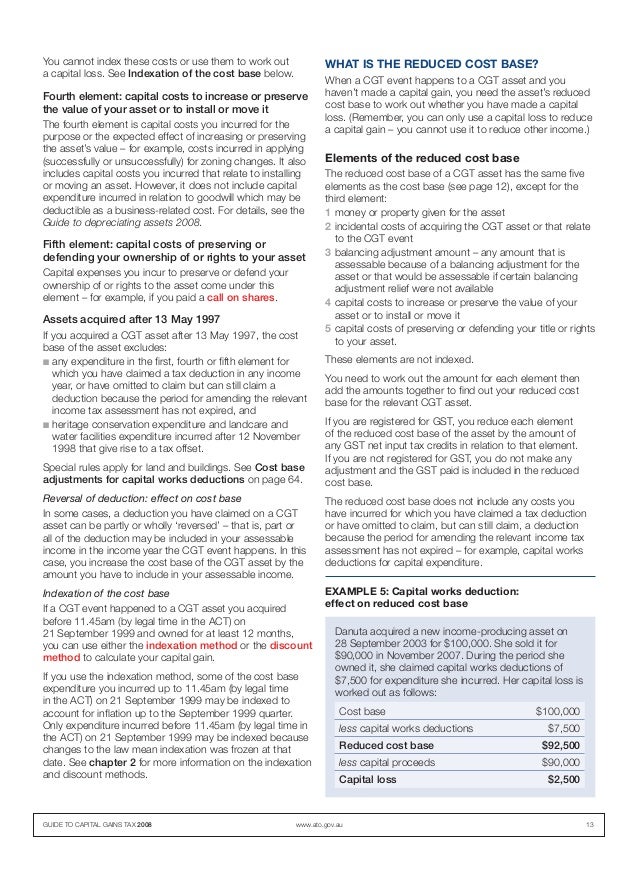

Capital Gains Tax Calculation Worksheet - Monaco Ambassador Capital gain or capital loss worksheet this worksheet helps you calculate a capital gain for each cgt asset or any other cgt event1 using the indexation method2, the discount method3 and the 'other' method (cgt asset held less than 12 months). If The Amount On Line 1 Is $100,000 Or More, Use The Tax Computation Worksheet: About Schedule D (Form 1040), Capital Gains and Losses Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit. Qualified Dividends And Capital Gain Tax Worksheet Line 12A Qualified dividends and capital gain tax worksheet 2019 form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer s tax. Convert them into templates for multiple use insert fillable fields to. In this way the size of your ordinary income can change in which qualified bracket your qualified ... Self Assessment forms and helpsheets for Capital Gains Tax

How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Schedule D contains different worksheets that you may need to complete, including the Capital Loss Carryover Worksheet, 28% Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. Each of... Forms and Publications (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains 1121 11/29/2021 Using the capital gain or loss worksheet | Australian Taxation Office The Capital gain or capital loss worksheet (PDF 143KB) calculates a capital gain or capital loss for each separate capital gains tax (CGT) event. Remember that: you show the type of CGT asset or CGT event that resulted in the capital gain or capital loss, and if a capital gain was made, you calculate it using the indexation method Qualified Dividends and Capital Gain Tax Worksheet You open your tax file...you have to be inside it somewhere. Then you go to the Tax Tools menu on the left side and open n it. Then you click on the Print Center, and save/print a PDF copy ....with ALL the worksheets. Yep...got to pay for the software with a Credit Card in order to print.

Where do you calculate your long-term Schedule D c... - Intuit The worksheet used to calculate your taxes when taking capital gains into account is found in the IRS Instructions for Form 1040. It is called the Qualified Dividends and Captial Gains Tax Worksheet . You can find it on page 33 of the PDF document at this link: 2019 Form 1040 Instructions. March 2, 2020 5:36 AM.

PDF Capital Gain or Capital Loss Worksheet This worksheet helps you calculate a capital gain for each CGT asset or any other CGT event1 using the indexation method2, the discount method3 ... to capital gains tax 2021. 2 Indexation method* For CGT assets acquired before 11.45am AEST on 21 September 1999, the indexation

IRS Form 1040 Qualified Dividends And Capital Gain Tax Worksheet | 2021 Tax Forms 1040 Printable

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Capital Gains and Losses ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021: Title: 2021 Schedule D (Form 1040) Author: SE:W:CAR:MP

long term capital gains question. Long-term gains are taxed at 15% or 20% except for taxpayers in the 10% or 15% bracket. For low-bracket taxpayers, the long-term capital gains rate is 0%. There are exceptions, of course, since this is tax law. Long-term gains on collectibles—such as stamps, antiques and coins—are taxed at 28%, unless you're in the 10% or 15 % or 25% ...

qualified dividends and capital gain tax worksheet 2021 Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42) If the corporation sells the asset, 50% of the gain is taxable in the corporation and the other 50% goes into the capital dividend account from which tax free dividends can be distributed If you have . Also ...

2014 Capital Gains Worksheet | Printable Worksheets and Activities for Teachers, Parents, Tutors ...

2022 Capital Gains Tax Calculator - See What You'll Owe - SmartAsset That means you pay the same tax rates you pay on federal income tax. Long-term capital gains are gains on assets you hold for more than one year. They're taxed at lower rates than short-term capital gains. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top ...

1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. Ordinary Dividends. Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on line 3b. This amount should be shown in box 1a of Form(s ...

Qualified Dividends And Capital Gain Tax Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at … Read more 2017 Instruction 1040 … Use the Qualified Dividends and Capital Gain Tax Work- sheet or the Schedule D Tax.

Qualified Dividends And Capital Gain Tax Worksheet 2019 The tax summary screen will then indicate if the tax has been computed on the schedule d worksheet or the qualified dividends and capital gain tax worksheet. Ordinary dividends are taxed at conventional federal income tax rates, whereas qualified dividends are taxed at capital gains tax rates.

Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock.

PDF Capital Gain Worksheet Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) ... Tax Due at Maximum Capital Gains Rate - 25% rate gain x 25% (line 9 x 25%) $ (12) 15% rate gain x 15% (line 10 x 15%) (13) ...

How to Calculate Capital Gains Tax | H&R Block The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for — adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

PDF Schedule D, Form N-35, Rev 2016, Capital Gains and Losses and ... - Hawaii as appropriate. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13. Capital losses on the sale of this stock do not need to be added back to income. Lines 5 and 14 - Section 235-7(a)(14), HRS, Short-Term and Long-Term Capital Gain Exemp - tion—For tax years beginning after 2007 and end-

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet In 2021 and 2022, the capital gains tax rates are either 0%, 15% or 20% on most assets held for longer than a year. Capital gains tax rates on most assets held for a year or less correspond to...

0 Response to "45 capital gains tax worksheet"

Post a Comment