45 family economics and financial education worksheet answers

Money Lesson Plans - Take Charge America Money Lesson Plans. Grades 1-5. Personal finance skills - like how to save and spend wisely - need to be taught at a young age. Teaching good financial habits now means fewer problems with debt and credit later. Take Charge America is pleased to provide lesson plans for teachers to use with students from grades one to five. PDF Language of the Stock Market Lesson Plan 1.12.2 - BreitLinks Directions: Complete the following worksheet in conjunction with the Language of the Stock Market information sheet 1.12.2.F1 or PowerPoint presentation. 1. What is the definition of a stock? (1 point) 2. What are two reasons companies like to issue stock? (2 points) 3. What is the definition of a dividend? (1 point) 4.

Student Printables - FITC - Finance in the Classroom Goals Worksheet (pdf) Financial Goals 8-12 Grades Talking to Your Kids About the News: Money and the Economy 10-12 Grades Financial Values, Attitudes and Goals (pdf) Financial Values Inventory (pdf) Goal Tracking Record (pdf) Values and Goals (pdf) Identify your personal financial values and goals. General Student Information 10-12 Grades

Family economics and financial education worksheet answers

PDF Checking Account & Debit Card Simulation and Student Worksheet Checking Account & Debit Card Simulation and Student Worksheet Understanding Checking Accounts and Debit Card Transactions Checking Account and Debit Card Simulation Subtotal—The total amount of cash and checks. 7. Less Cash Received—The amount of cash back being received. 8. Net Deposit—The amount being deposited into the account. To calculate the amount, subtract the cash received from the subtotal. A deposit slip contains the account holder's account number and allows money (cash or check) to be Free Financial Literacy Lesson Plans for High School Teachers The teaching curriculum consists of fourteen lesson plans & worksheets designed to augment a semester course in life skills and personal finance management. The Teacher's Guide, compiled in a separate, easy-to-use notebook, includes an outline of the curriculum: Goals. Lesson objectives.

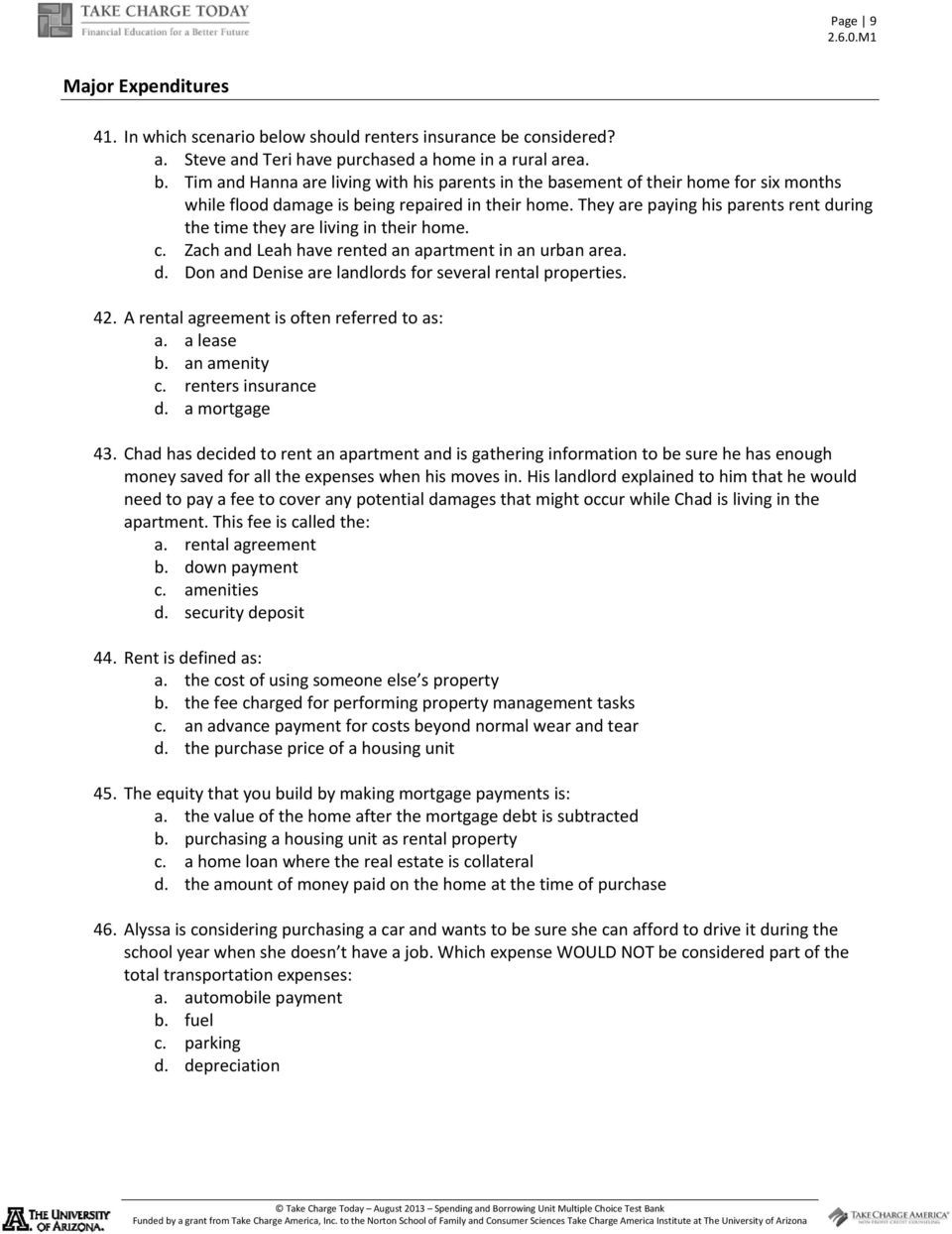

Family economics and financial education worksheet answers. catch_me_if_you_can_5.0.43 - Catch Me If You Can Grade ... The educator should first watch this movie and decide if it is appropriate for the participants in his/her class. 1. Instruct participants to break into groups of two. 2. Within their groups of two, instruct them to answer the following questions: a. What types of identity theft have you or your family experienced or heard about? b. Economics Personal Finance Teaching Resources | Teachers ... Teach students about economics, financial literacy, and personal finance with this Economics Powerpoint lesson.I created these lesson to be easily incorporated in your classroom. The PowerPoint lesson includes 108 slides filled with information, pictures, discussion questions, videos, and interactive websites to engage students. PDF Career vs. Job - Personal Finance Digital Portfolio 1.1.2.L1 Note taking guide © Family Economics & Financial Education - Revised May 2009 - Career Development Unit - Career Research - Page 5 PDF Mrs. Grenz - Home Family Economics & Financial Education — Updated May 2011 — Spending Plan Unit— Spending Plans Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

Understanding Your Paycheck Worksheet Answer Key - Fill ... Fill family economics and financial education understanding your paycheck: Try Risk Free. Form Popularity family economics and financial education worksheet answers form. Get, Create, Make and Sign 1 13 1 a5 crossword answer key Get Form eSign Fax Email Add Annotation ... PDF What should I look for? © Family Economics & Financial Education - Revised December 2004 - Transportation Unit - Researching an Automobile - Slide 2 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Transportation Part of everyone's life 15 - 20% of an individual's budget PDF Grade Level 10-12 "Take Charge of Your Finances" Directions: Complete the following questions while watching the movie "Catch Me If You Can." 1. Write two examples of ways that Frank Abagnale, Jr. successfully obtained identity information to commit identity theft. (2 points) 2. Write two precipitating factors in Frank's home life that may have led him to his early life in crime. (2 points) 3. PDF Part 1 - What Do I Want/Need in a Vehicle? 1.16.2.A2 Worksheet © Family Economics & Financial Education - Revised November 2004 - Transportation Unit - Researching an Automobile - Page 10

Front Page | Take Charge Today - University of Arizona Formerly Family Economics & Financial Education, Take Charge Today provides a consistent framework for thinking through financial choices in order to improve well-being. LEARN MORE Introductory Level Engage individuals with limited finance knowledge using this set of lessons which utilize fast-paced facilitation and activity-based learning methods. 15 Financial Literacy Activities for High School Students ... Students can use one of these worksheets to work through a business idea, product ideation, calculating profit, and much more. For example, Scholastic has a great set of free Shark Tank PDFs and lesson plans to use in high school classrooms. 9. Create a Savings Comic Strip. PDF Spending Plan Essentials 7.15 - Windsor C-1 School District Spending Plan Essentials 7.15 - Windsor C-1 School District ... 2 PDF Family Economics Financial Education - Call 550.66.40920.626.4209 or email fefe@cals.arizona.edu and we will correct it immediately COMING SOON… • Specific to each lesson plan, a list of - Other FEFE resources you may be interested in that relate to the specific lesson - Online resources which may enhance the lesson • Web based games, videos, etc. - Articles to integrate into a course

PDF Understanding Your Paycheck - Ms. Christy Garrett Ann ... Directions: Complete the following questions. 1. Approximately what percentage of a person's paycheck is deducted? (1 point) 2. What are the three methods an employer may use to pay his/her employees? (3 points) 3. How does direct deposit work? (1 point) 4. How does a payroll card work? (1 point) 5.

VDOE :: Economics and Personal Finance, Resources The toolkit addresses five core competencies of financial education: earning, spending, saving, borrowing and protecting against risk. The toolkit can be used to help prepare students for the challenge's voluntary online exam but also for year-round classroom instruction. Top of Page

PDF Renting vs. Owning a Home - Springfield Public Schools Class__________________ Directions: Answer the following questions based upon the renting vs. owning information. 1. Housing is approximately _______________ of a person's income. (1 point) 2. What is renting? (1 point) 3. Who is the landlord? (1 point) 4. When moving into a rental, what two things are people usually required to do? (2 points)

PDF Understanding Your Paycheck Lesson Plan 1.13 Directions: Answer the following questions to help provide the information for the paycheck. Hint: A way to double check your work is to add your deductions and your net income. If they do not equal

PDF Confessions of a Shopaholic - Mr. Blankenship 5..41.A1 Worksheet © Family Economics & Financial Education -Revised April 2010 - Active Learning Tools - Confessions of a Shopaholic - Page 2

0 Response to "45 family economics and financial education worksheet answers"

Post a Comment