38 section 125 nondiscrimination testing worksheet

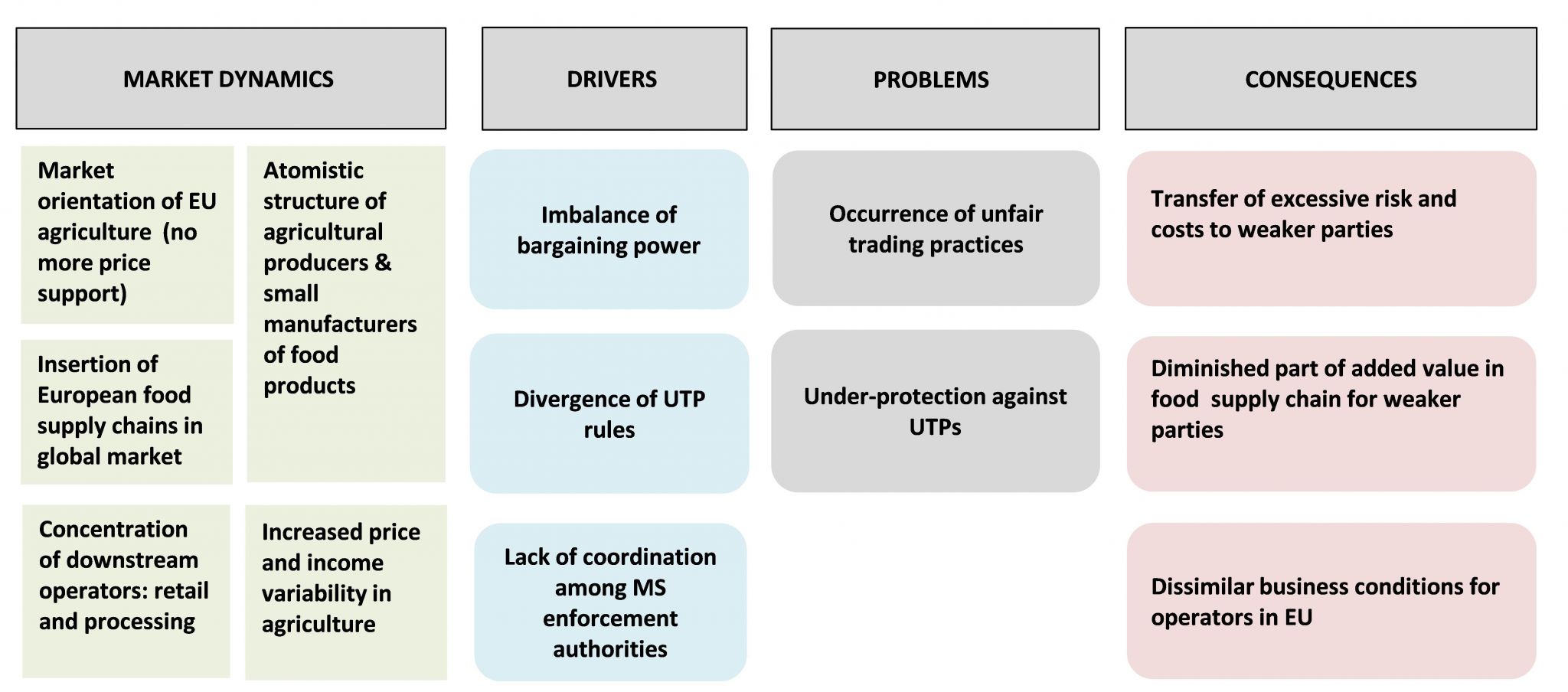

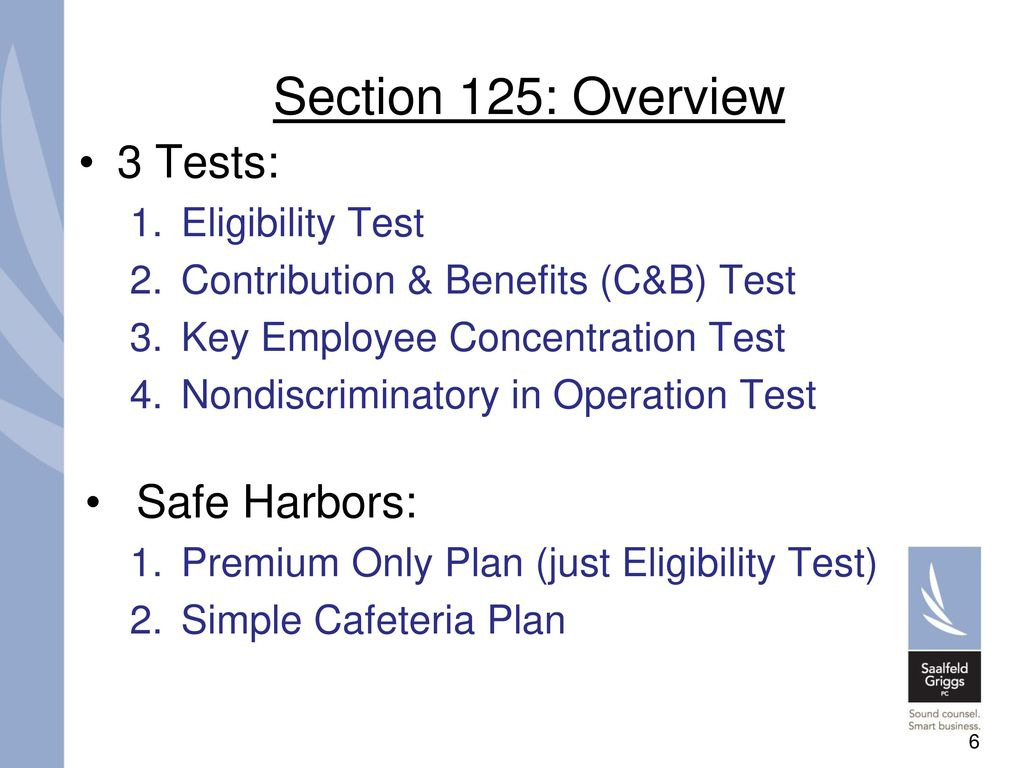

PDF Section 125 Cafeteria Plans Nondiscrimination Testing Guide and ... - Basic The nondiscrimination tests can be complicated but boil down to three basic themes: 1. Eligibility. If too many non-HCEs are excluded from participation in the plan, then it will be discriminatory. 2. Availability of Benefit. The plan will not pass the tests if the HCEs/KEYs can access more or better benefits than the non-HCEs/KEYs. Nondiscrimination Rules for Section 125 Plans and Self-funded ... - VCG Section 125 Plans There are three categories of nondiscrimination rules, which potentially apply to a Section 125 plan. Category 1 - Plan as a Whole. Three nondiscrimination tests apply to the plan as a whole: the eligibility test, the contributions test, and the 25% concentration test.

Section 125 FAQ - CBIA In 2007 IRS guidelines simplified nondiscrimination testing for POP plans by stating that if all employees can participate and can elect the same salary reductions for the same benefits, the plan is deemed to satisfy the Code §125 nondiscrimination rules because it passes the Eligibility Test, and does not need to satisfy the Contributions ...

Section 125 nondiscrimination testing worksheet

PDF NONDISCRIMINATION TESTING GUIDE - amben.com nondiscrimination testing guide Source: Thomson Reuters Checkpoint (EBIA) 2 American Benefits Group • PO Box 1209, Northampton, MA 01061-1209 • Tel: 800-499-3539 • Fax: 877-723-0147 • Learning About Section 125 POP Plan Nondiscrimination Testing Non-discrimination tests A Section 125 POP offered must not show any discrimination in order to be granted tax privilege status. According to the Internal Revenue Code, the plan must not discriminate in favor of "highly paid employees" (HCE) and "key employees" in terms of eligibility, contributions and benefits. Nondiscrimination Testing - Wrangle 5500: ERISA Reporting and Disclosure For purposes of Code Section 105 (h) tests, 25% of the employer's top-paid employees Key Employee: An officer of the employer with annual compensation in excess of a specified dollar threshold ($180,000 for 2019; $185,000 for 2020) >5% owner of the employer >1% owner of the employer with annual compensation in excess of $150,000 (not indexed)

Section 125 nondiscrimination testing worksheet. PDF Nondiscrimination Tests for Cafeteria Plans - Sullivan Benefits A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. To receive this tax advantage, the cafeteria plan must generally pass the following three nondiscrimination tests: Eligibility to participate test; PDF Section 105(h) Nondiscrimination Testing - Acadia Benefits The two nondiscrimination tests are the Eligibility Test and Benefits Test. The Eligibility Test answers the basic question of whether there are enough regular employees benefitting from the plan. Section 105(h) provides three ways of passing the Eligibility Test: 1. The 70% Test - 70 percent or more of all employees benefit under the plan. 2. Nondiscrimination Testing - Section 125 - Employer Help Center Nondiscrimination Testing - Section 125 What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes. PDF Nondiscrimination Testing - Benefit Strategies Nondiscrimination Testing In order to retain tax-favored status, the IRS Code requires that section 125, 105(h) and 129 plans pass a series of nondiscrimination test each year. The plans must not discriminate in favor of highly compensated employees (HCEs) and/or key employees with respect to the benefits provided under

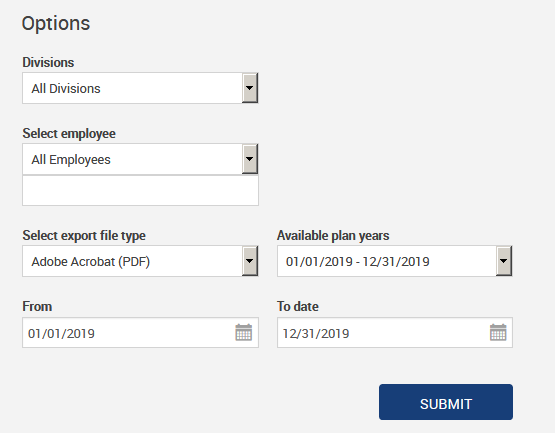

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits purposes of non-discrimination testing. What is Required The IRS requires that these tests are performed on an annual basis, once the plan year is complete. This requirement include short plan years as well. Unlike other benefits testing, the Section 125 and FSA tests are not filed with any government agency. Cafeteria Plan Nondiscrimination Testing: Calculating Annual ... Section 125 pre-tax deductions for premiums, flexible spending account and health savings accounts; transportation benefits deducted pre-tax for parking and/or transit; retirement plan deductions (i.e. 401k, 403(b)) ... If you are an Employee Benefits Corporation client and completing the nondiscrimination testing worksheet, the methods above ... How to identify key employees and HCEs for 2021 nondiscrimination testing For sponsors of Section 125 Premium Only Plans and/or Health Reimbursement Arrangements , to conduct 2021 nondiscrimination testing is not required until the end of the plan year — but it is usually a good idea for employers to conduct a sample test mid-year. That leaves time to adjust anything that might be starting to head in the wrong direction. Section 125 Nondiscrimination — ComplianceDashboard: Interactive Web ... This is referred to as cafeteria plan nondiscrimination testing under section 125 of the IRS code. Plans Subject to Testing Section 125 testing must be performed on self-insured benefit programs that are paid on a pre-tax basis as a component of the cafeteria plan. This test is often performed after these programs pass 105 (h) testing.

Section 125 Nondiscrimination Testing Suite - Sentinel Benefits If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health Flexible Spending Account (FSA) or Dependent Care FSA benefits, there are additional tests to complete. All of the possible tests are listed below. Simply click on the test (s) that pertain to your plan to learn more. Cafeteria Plan Tests Section 125 and 105(h) Testing — ComplianceDashboard: Interactive Web ... Section 125 Testing Because Section 125 Cafeteria plans have favorable tax benefits, they are subject to annual testing to confirm that non-highly compensated participants and non-key employees are not discriminated against in favor of highly-compensated or key employees with respect to benefits or eligibility to participate. Nondiscrimination Testing | Employee Welfare And Benefits | Buck Cafeteria plan nondiscrimination testing. Section 125 of the Code provides an exception to the "constructive receipt" rule — without Section 125, wages that employees forgo to pay for nontaxable benefits through a cafeteria plan would be included in income. For highly compensated and key employees to take advantage of the exclusion, an ... PDF Section 125 Flexible Benefit Plan DISCRIMINATION TESTING DATA Testing Plan Year Begin Date:_____ End Date:_____ Testing Date:_____ INSTRUCTIONS Tax savings from an IRC Section 125 Flexible Benefit Plan are available to Highly Compensated Employees and Key Employees ONLY if they are provided and utilized on a non-discriminatory basis when compared to other employees.

The Five Ws, and One H of Section 125 Cafeteria Plan Nondiscrimination ... Section 125 requires testing to be performed on the last day of the plan year. However, ideally nondiscrimination tests would be run at the beginning, during and on the last day of the plan year which would allow employers to make adjustments before the end of the plan year, if it appears one or more of the tests may not pass.

Benefits Consulting | Cafeteria Nondiscrimination Testing | Buck The Section 125 proposed regulations state that the nondiscrimination tests must be performed as of the last day of the plan year taking into account all nonexcludable employees or former employees who were employed on any day of the plan year. But ideally, the tests would be run before, during and immediately after the close of the plan year.

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits Section 125 Nondiscrimination Testing What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

Section 125 Nondiscrimination Testing Worksheet 2021 - signNow Follow the step-by-step instructions below to design your section 125 plan document template: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Nondiscrimination Testing - American Benefits Group A 5% (or greater) shareholder in the current or prior year; An employee paid $130,000 in 2021 or $135,000 in 2022 An employee whose salary is in the top 20% of all employees. How Can You Prevent Discrimination Problems? Nondiscrimination Testing Guide Please complete our Nondiscrimination Testing Request Form and email it to ndx@amben.com

Understanding Section 125 Cafeteria Plans - SHRM Apr 22, 2021 — Key Employee Concentration Test: The nontaxable benefits provided to key employees may not exceed 25 percent of the nontaxable benefits provided ...

PDF Section 125 Plan Nondiscrimination Testing - SIMA Financial Group Section 125 Plan Nondiscrimination Testing A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. Employees who participate in a cafeteria plan can pay for qualified benefits, such as group health

Non-Discrimination Testing: What You Need to Know - WEX Inc. The IRS requires non-discrimination testing for employers who offer plans governed by Section 125, which includes a flexible spending account (FSA). And though they aren't part of Section 125, testing is also required for health reimbursement arrangements (HRAs) and self-insured medical plans (SIMPs). Why does non-discrimination testing matter?

Nondiscrimination Testing - Wrangle 5500: ERISA Reporting and Disclosure For purposes of Code Section 105 (h) tests, 25% of the employer's top-paid employees Key Employee: An officer of the employer with annual compensation in excess of a specified dollar threshold ($180,000 for 2019; $185,000 for 2020) >5% owner of the employer >1% owner of the employer with annual compensation in excess of $150,000 (not indexed)

Learning About Section 125 POP Plan Nondiscrimination Testing Non-discrimination tests A Section 125 POP offered must not show any discrimination in order to be granted tax privilege status. According to the Internal Revenue Code, the plan must not discriminate in favor of "highly paid employees" (HCE) and "key employees" in terms of eligibility, contributions and benefits.

PDF NONDISCRIMINATION TESTING GUIDE - amben.com nondiscrimination testing guide Source: Thomson Reuters Checkpoint (EBIA) 2 American Benefits Group • PO Box 1209, Northampton, MA 01061-1209 • Tel: 800-499-3539 • Fax: 877-723-0147 •

0 Response to "38 section 125 nondiscrimination testing worksheet"

Post a Comment