44 life insurance needs analysis worksheet pdf

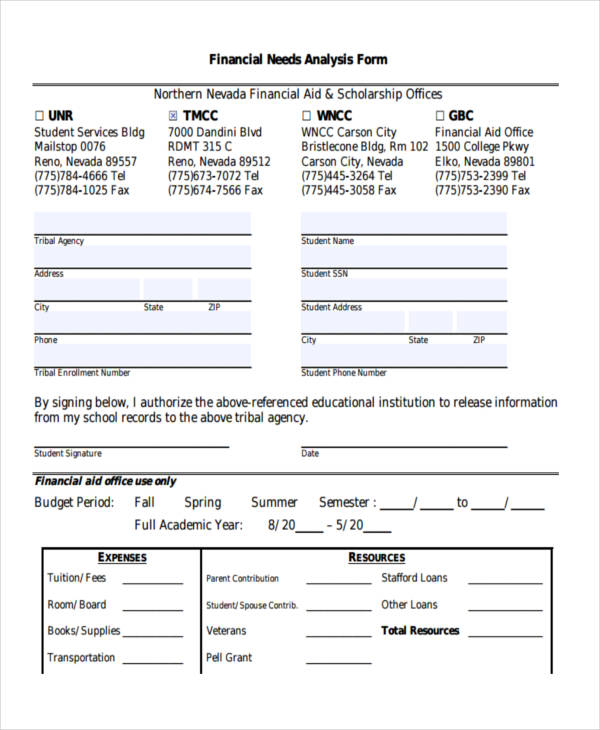

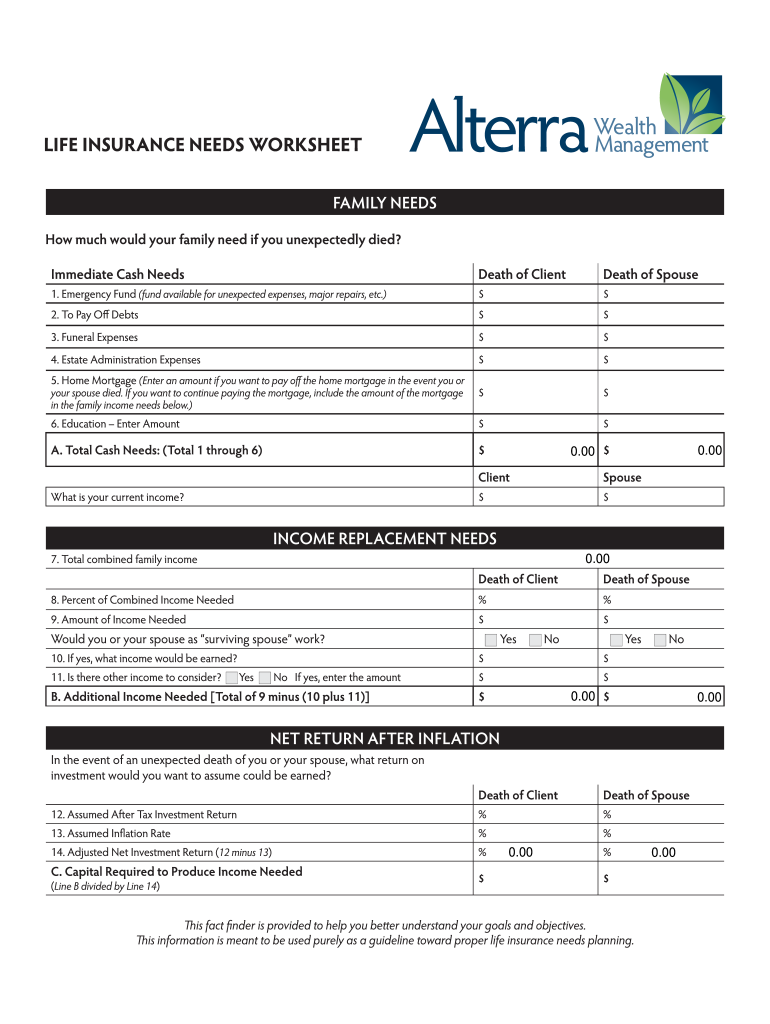

PDF Life Insurance Needs Analysis - Harvard Financial Educators LIFE INSURANCE NEEDS ANALYSIS Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000 Subtotal $8,000 1-9 Months Probate Expenses $2,000 Estate Taxes Mortgage Pay-Off $50,000 Subtotal $52,000 Beyond 9 Months Emergency Fund $10,000 College Funding $100,000 PDF LIFE INSURANCE NEEDS WORKSHEET - alterrawm.com LIFE INSURANCE NEEDS WORKSHEET. Death of Client Death of Spouse 15. Cash/Savings $ 16. Marketable Securities (Stocks, Bonds, Mutual Funds, etc.) $ 17. Other $ 18. Net After Tax Retirement Plan Balances $ Market Value Less Outstanding Loans & Transaction Costs 19. Real Estate #1 $ 20. Real Estate #2 $ 21. Real Estate #3 $

How to do a 'needs analysis' before you buy life insurance The best way to determine how much life insurance — if any — you should buy is with a needs analysis. A new study by the international insurance consulting group LIMRA finds that people are 1.5 times more likely to buy life insurance if they first do a needs analysis.

Life insurance needs analysis worksheet pdf

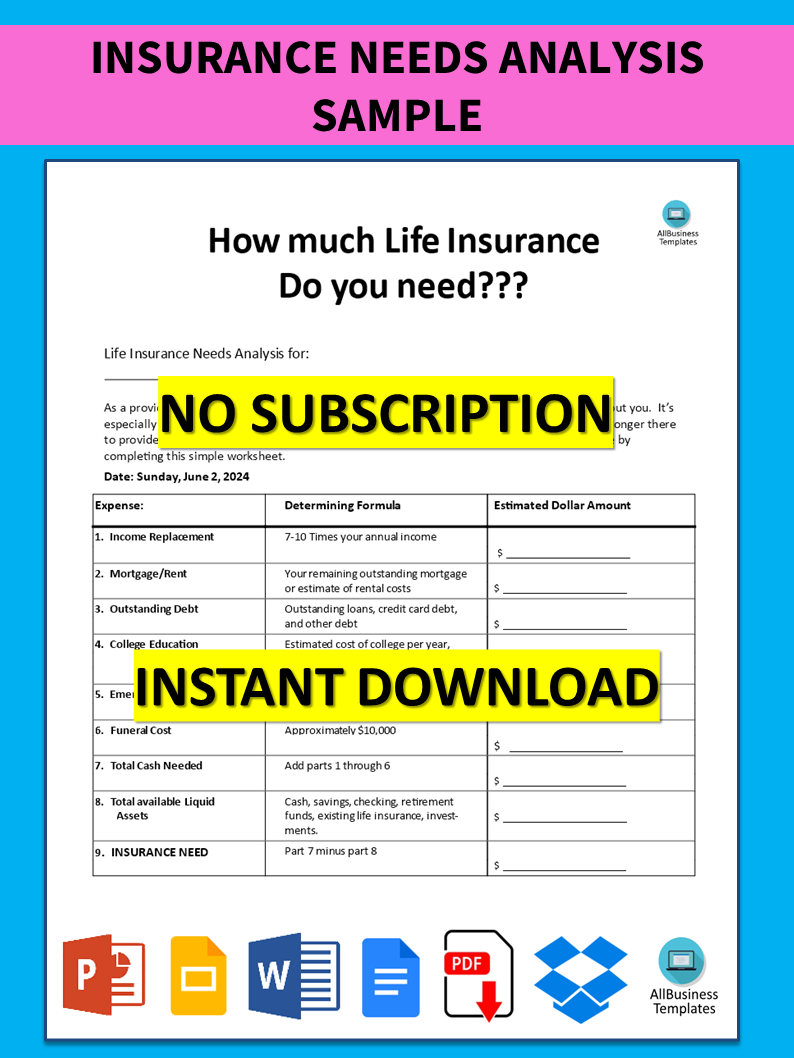

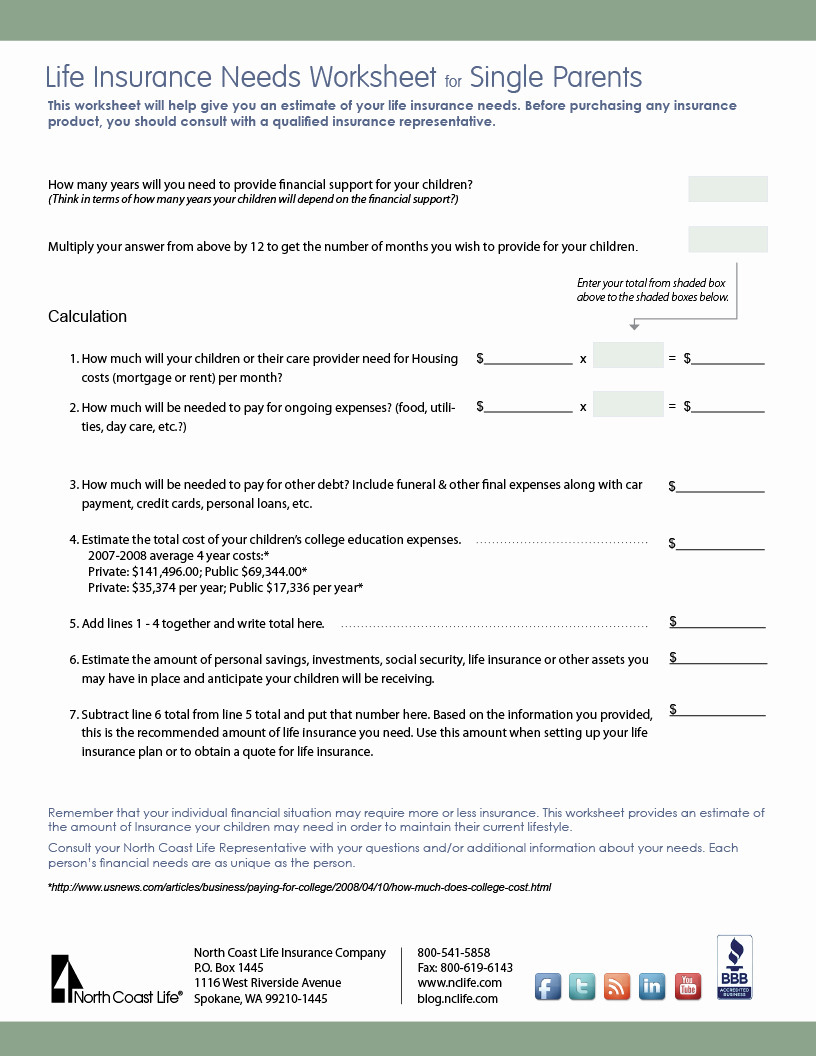

PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H ... FREE 9+ Sample Insurance Assessment Forms in PDF | Excel | MS Word PDF. Size: 28 KB. Download. Get this insurance risk assessment form downloaded for your insurance company and carry out a kind of thorough survey on your customer's insurance needs. This risk assessment form will enable you to explore complete information about associated risk with the client or his/her property. PDF A Short Version of A Financial Needs Analysis This work sheet will help you to estimate how much your estate would be worth if you were to die today, what income flow it can generate and what other sources of income are available to your survivors. [A] Estimating the Income-Producing Assets of Your Estate Life insurance (including employer-provided)

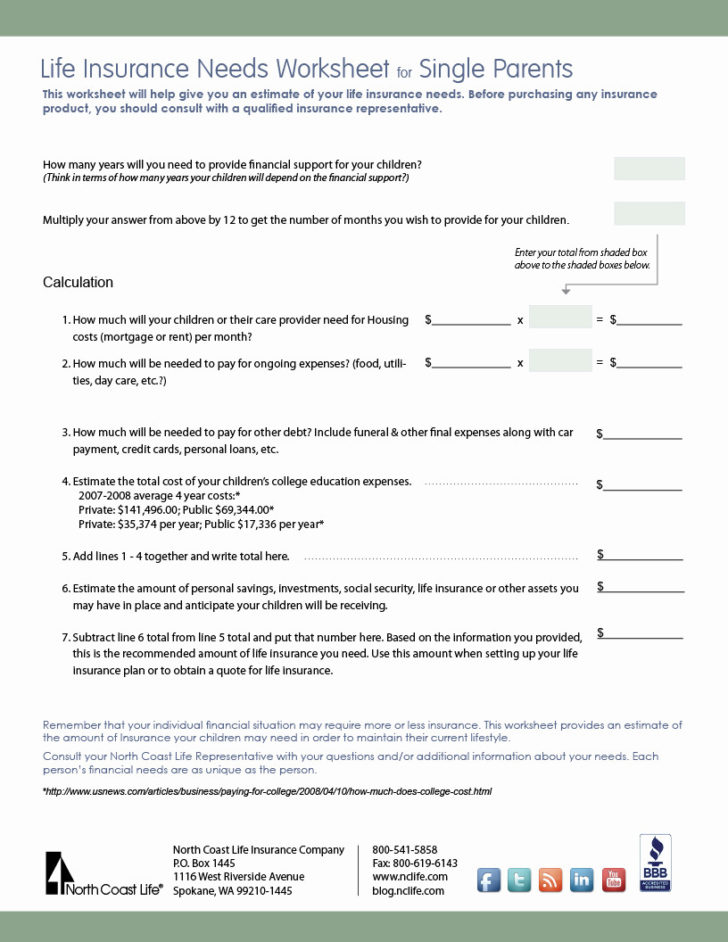

Life insurance needs analysis worksheet pdf. PDF Life insurance worksheet - Warren Ross Completing the worksheet Burial costs may range from $3,000 to $15,000.1Your advisor can help estimate additional fees. Total fees, including cost of living, may range from $10,000 to $20,000 per year, per child.2 Typically, the percentage of annual income your family will need if you die is 60% to 75% of your total family income PDF FINANCIAL NEEDS ANALYSIS WORKSHEET - Producers XL This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully. Life Insurance Needs Analysis Worksheet Form - signNow Follow the step-by-step instructions below to design your insurance needs analysis worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. PDF This worksheet can help you get a general sense of how much life ... Before buying any insurance products you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 1 Total annual income your family would need if you died today: What does your family need, before taxes, to maintain its current

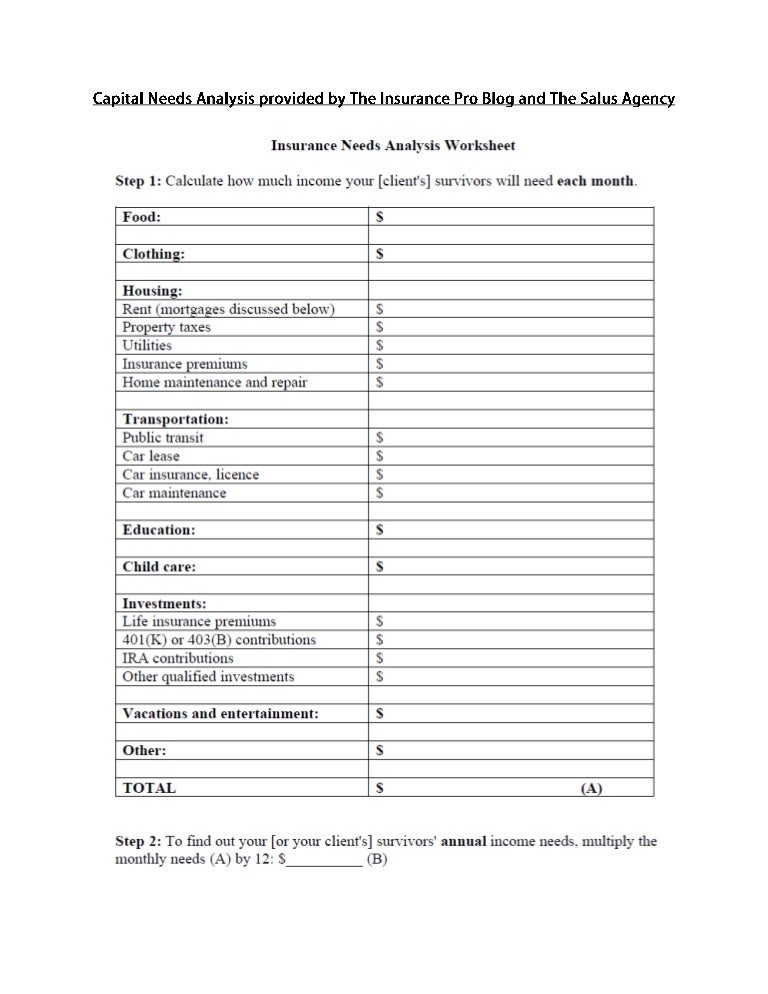

PDF CAPITAL NEEDS ANALYSIS - RBC Insurance Life Insurance Needs 3 IMMEDIATE CASH NEEDS AT DEATH CLIENTCO-CLIENT Mortgage (Payoff costs) Loans and Other Debts (Credit cards, consumer/auto/school loans, business debt, etc.) Final Expenses (Funeral, medical, administration costs, etc) Other Cash Needs (Emergency funds, property taxes, child care, charities) TOTAL Cash Needs PDF Easy Disability Insurance Needs Analysis - My Family Life Total Add'l Monthly Income Needs Applicant print name: Sign name: Date: As Spouse or Beneficiary, I understand that any changes to my estimated disability insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than what I require ... Life Insurance Needs Calculator Life Insurance Needs Calculator - Life Happens Life Insurance Needs Calculator Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. This is an estimate only. For a complete assessment, contact a qualified insurance professional. Question 1 of 7 Life Insurance Needs Analysis Worksheet - Calculators The life insurance amount needed to sustain your spouse's current standard of living is $800,000. Insurance in this amount allows for a sustained income of $40,000 per year for your family. You might notice that this figure does not consider inflation.

PDF Life Insurance Questionnaire G-Forms\GBS Insurance and Financial\GIFS Life Ins. Questionnaire Rev. 2/13/2019 Preliminary Inquiry—Not an application for life insurance. To help you obtain competitive life insurance quotes, please provide information on your medical history, doctors and other factors that may impact underwriting. PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date DIME worksheet - Life Insurance & Annuities - North American Company A needs analysis can provide a snapshot of your current and future needs to help answer the question, "How much life insurance do I need in the event of my spouse's death?" And the best part? This version is so simple, it can be done on the back of a napkin! Client name: D = Debts... How much debt do you wish to pay off? Debts $ I = Income... PDF Calculating your life insurance needs in 3 easy steps… - BMO A + B - C = Your Life Insurance Needs $ Client Signature: Date: Advisor Signature: Date: I understand that the values illustrated in this life insurance analysis are based on financial information that I have provided and my understanding of my future financial needs in the event of my death. The illustrated insurance coverage is subject to

How Much Life Insurance Do I Need? | State Farm® A simple way to determine the amount of life insurance needed is to multiply your current income by 10 to 15. Is my current life insurance coverage enough? Some people who have life insurance through work may assume that will be plenty for their family to live on - and that may be correct depending on your life stage.

PDF Life Insurance Needs Worksheet - SIUA Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1. Funeral expenses 10,000 2. Probate expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 Existing Debts 6. Credit cards 8,000 7. Auto loans 16,000 8. Mortgage 100,000 9.

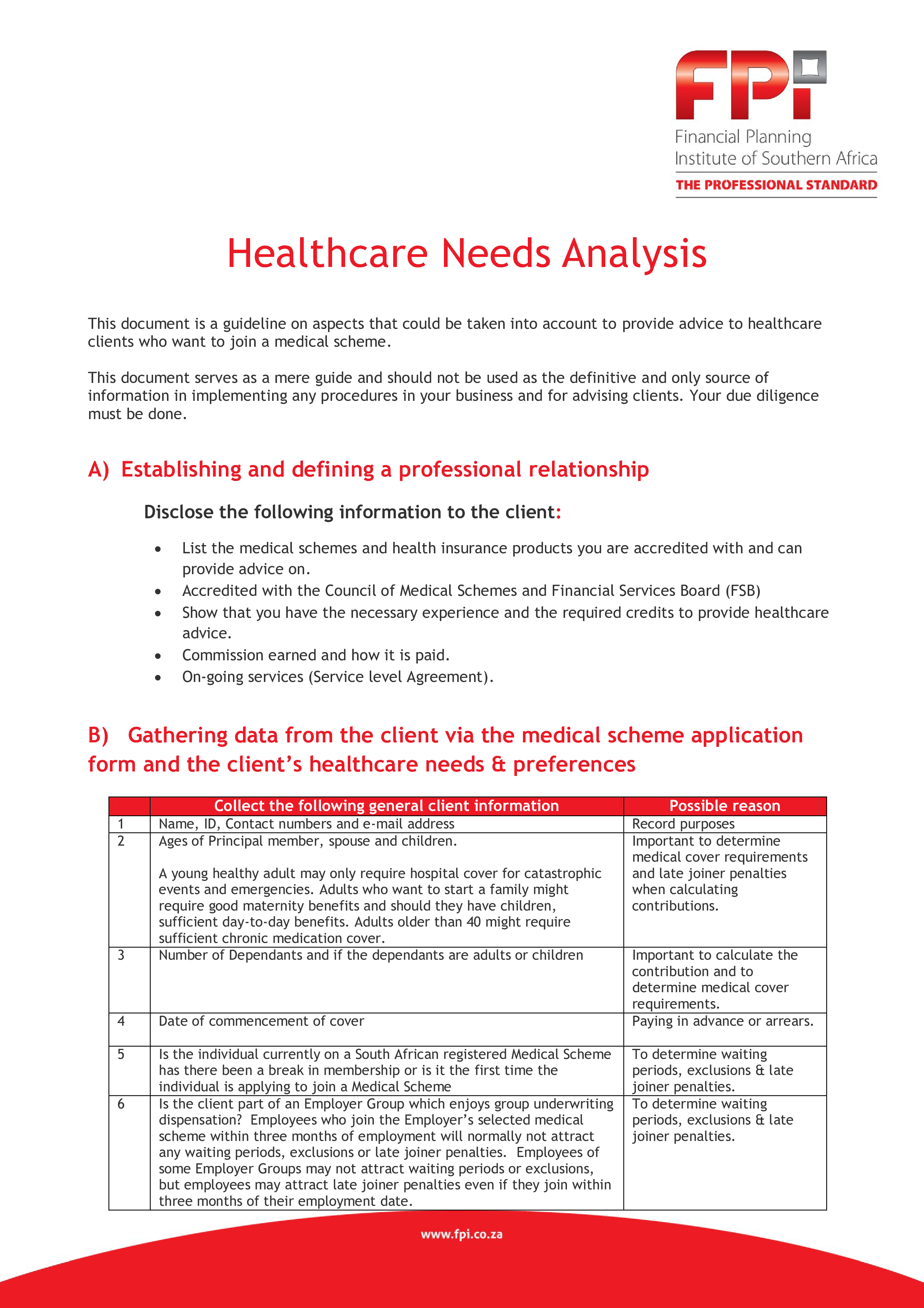

Needs Analysis Template - 20+ For (Word, Excel, PDF) Download. With regard to the internal efficiency of an organization, an organizational needs analysis template comes in handy. This one is required to make the best use of organizational space and to grow the organization. It may require a restructuring in certain instances, but for the most part, there will be minor tweaks here and there.

INSURERIGHT Life insurance worksheet - CIBC Wood Gundy COMPLETING THE WORKSHEET 1. Burial costs may range from $3,000 to $15,000.1 Your advisor can help estimate additional fees. 2. Total fees, including cost of living, may range from $10,000 to $20,000 per year, per child.2 3. Typically, the percentage of annual income your family will need if you die is 60% to 75% of your total family income

PDF Life Insurance Needs Analysis Worksheet LIFE INSURANCE NEEDS ANALYSIS WORKSHEET 1. Final Expenses (May include burial, medical, attorney fees, taxes) 2. Debt Payment Less any existing coverage: (May include credit card debt, personal loans, etc.) 3. Mortgage/Rent (Mortgage balance or rent to keep loved ones in their home) 4. Education/Legacy Fund

PDF Insurance Needs Analyzer - BMO Insurance Needs Analyzer - BMO

PDF Life Insurance Needs Analysis This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs 1. Annual income your family would need if you die today Enter a number that's typically 10%-80% of total income. Include all salaries, dividends, interest and any other sources of income. $ 2.

PDF Life Insurance Needs Analysis Fact Finder Life Insurance Needs Analysis Fact Finder. Income Needs. 1. Family Income Need $ (60-80% of total family income) 2. Income Available to Family $ (Spouse earnings, Social Security etc.) 3. Years Family Income Needed (Number of years —10,15,20,25,30,35,40,45,50) Expenses: 4. Funeral & Emergency Fund $

PDF Life Insurance Needs Worksheet - Independent Benefit Solutions This worksheet assumes you died today. Income 1. Total annual income your family would need if you died today What your family needs, before taxes, to maintain its current standard of living (Typically between 60% - 75% of total income) 2.

PDF Easy Life Insurance Needs Analysis Total Additional Life Insurance Needs $0 Applicant print name: Sign name: Date: As Surviving Spouse or Beneficiary, I understand that any changes to my estimated life insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than ...

PDF A Short Version of A Financial Needs Analysis This work sheet will help you to estimate how much your estate would be worth if you were to die today, what income flow it can generate and what other sources of income are available to your survivors. [A] Estimating the Income-Producing Assets of Your Estate Life insurance (including employer-provided)

FREE 9+ Sample Insurance Assessment Forms in PDF | Excel | MS Word PDF. Size: 28 KB. Download. Get this insurance risk assessment form downloaded for your insurance company and carry out a kind of thorough survey on your customer's insurance needs. This risk assessment form will enable you to explore complete information about associated risk with the client or his/her property.

PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H ...

0 Response to "44 life insurance needs analysis worksheet pdf"

Post a Comment