43 2015 tax computation worksheet

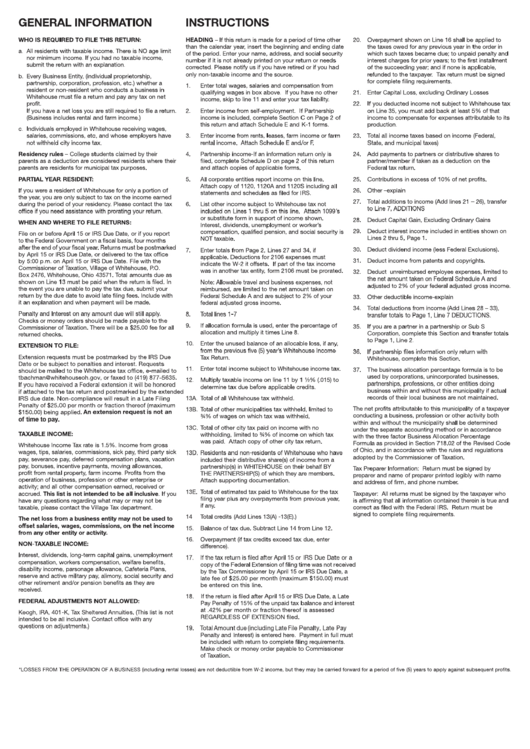

D-76 Estate Tax Instructions Booklet and Computation Worksheets for ... D-76 Estate Tax Instructions Booklet and Computation Worksheets for 2022 and Prior. Friday, February 25, 2022. Please use the DC D-76 Estate Tax Instructions booklet regardless of the year prior to January 1, 2022. The DC D-76 Estate Tax Computation Worksheets contain the information pertinent to the computation of tax for years after January 1 ... Fillable Form 1040 Tax Computation Worksheet 2018 Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Tax Computation Worksheet 2018 (Line 11a) On average this form takes 13 minutes to complete. The Form 1040 Tax Computation Worksheet 2018 form is 1 page long and contains:

1040 (2021) | Internal Revenue Service - IRS tax forms This credit is figured like last year's economic impact payment, EIP 3, except eligibility and the amount of the credit are based on your tax year 2021 information. See the instructions for line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount.

2015 tax computation worksheet

PDF QPE Table of Contents - Thomson Reuters 2015 Tax Computation Worksheet 2015 EIC Table Tab 2 2015 States Quick Reference State Individual Income Tax Quick Reference Chart (2015) General Alabama Alaska Arizona Arkansas ... Child Tax Credit Worksheet (2015) Donations—Noncash Donated Goods Valuation Guide Donations Substantiation Guide Earned Income Credit (EIC) Worksheet (2015) Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2015 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) ... What Is The Tax Table For 2015? (Correct answer) The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed. Each one has a range of taxable incomes. How much taxes do you pay on 30k?

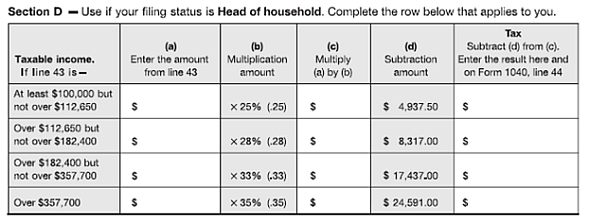

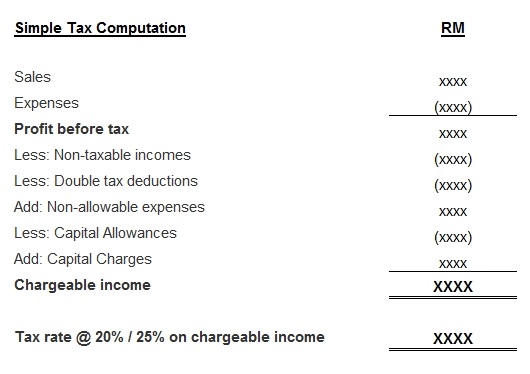

2015 tax computation worksheet. PDF 2015 State and Local Income Tax Refund Worksheet 2016 - 1040.com Multiply the number in the box on line 39a of your 2015 Form 1040 by: $1,250 if your 2015 filing status was MFJ or MFS or QW; $1,550 if your 2015 filing status was single or HOH 4 5 Add lines 3 and 4 5 6 Is the amount on line 5 less than the amount on line 2? No. STOP None of your refund is taxable. Yes. PDF Tax Computation Worksheet Tax Computation Worksheet A Taxable Income: Print the amount from Line 3. 0 A0 B First Bracket: If Line A is greater than $12,500 ($25,000 if filing status is 2 or 5), Print $12,500 ($25,000 if filing status is 2 or 5). If Line A is less than $12,500 ($25,000 if filing status is 2 or 5), print the amount from Line A. B00 C 1. Combined Personal Tax Computation Worksheet 2021 - 2022 - TaxUni The tax computation worksheet is for taxpayers with a net income of more than $100,000. Those with less than $100,000 in earnings can use the tax tables in order to figure out tax. However, not everyone needs to use the tax computation worksheet or the tax tables. Get and Sign Computation Worksheet 2015-2022 Form Use a computation worksheet 2015 template to make your document workflow more streamlined. Get form. ... 2019 tax computation worksheet fillable. 2021 tax computation worksheet. tax computation worksheet 2019 excel. 2019 tax computation worksheet calculator. Create this form in 5 minutes!

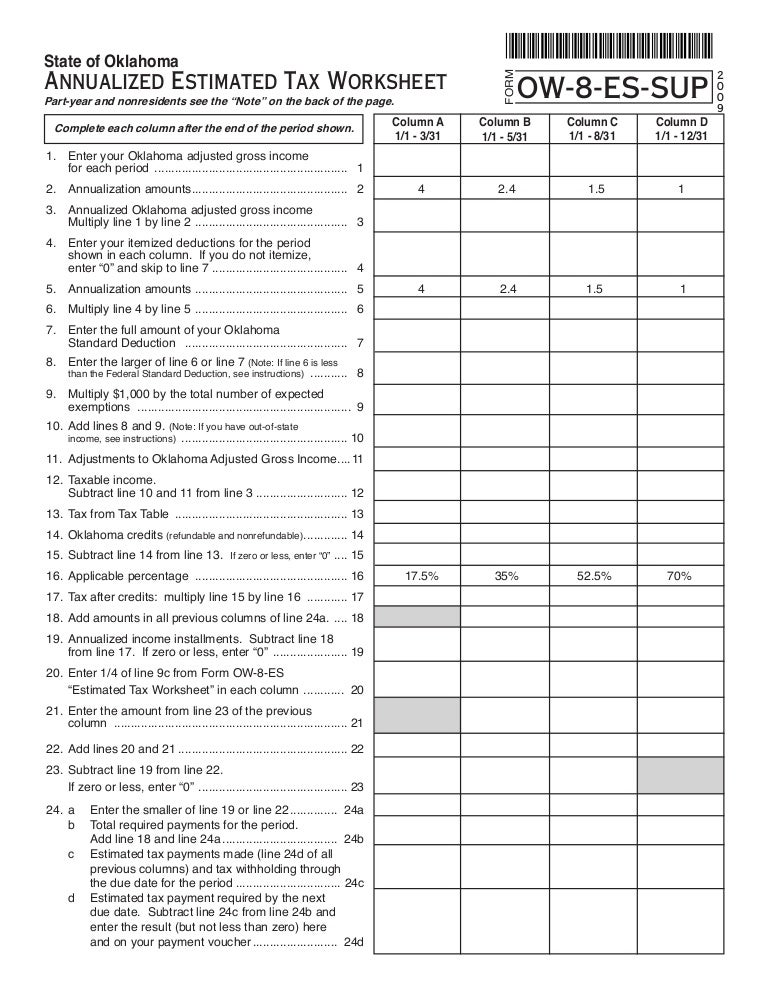

PDF 2015 Instructions for Form 540-ES -- Estimated Tax for Individuals Use the CA Estimated Tax Worksheet and your 2014 California income tax return as a . guide for figuring your 2015 estimated tax. Be sure that the amount shown on line 21 of the CA Estimated Tax Worksheet has been reduced by any overpaid tax on your 2014 tax return which you chose to apply toward your 2015 estimated tax payment. Note: 2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation Estimated Income Tax Brackets and Rates. In 2015, the income limits for all brackets and all filers will be adjusted for inflation and will be as seen in Table 1. The top marginal income tax rate of 39.6 percent will hit taxpayers with taxable income of $413,200 and higher for single filers. and $464,850 and higher for married filers. 2015 Sales & Use Tax Forms - Michigan 2015 Concessionaire's Sales Tax Return and Payment. 5092. 2015 Sales, Use and Withholding Taxes Amended Monthly/Quarterly Return. 5094. 2015 Sales, Use and Withholding Payment Voucher. 5095. 2015 Sales, Use and Withholding Monthly/Quarterly and Amended Monthly/Quarterly Worksheet. 151. Power of Attorney. PDF 2015 Individual Income Tax Instructions - ksrevenue.gov Tax Computation Worksheet ..... 27 Electronic Options ..... 28 Tax Assist ance ..... 28. What's New . DUE DATE FOR FILING. April 18, 2016 is the due date for . filing 2015 income tax returns. See page 4. LAWFULLY MARRIED COUPLES. For tax year 2015 and

PDF City of Seattle - Customer #: P.O. Box 34907 Seatt1e, WA 98124 (206 ... Tax Year/Qtr: _____ Annual 201. 5. Combined Square Footage Business Tax Computation Worksheet for Taxpayers . Businesses located outside Seattle or exempt businesses do not need to complete this worksheet. Businesses, with no business activity for the year, conducting business entirely within Seattle (no shipments PDF Form IT-201:2015:Resident Income Tax Return:it201 - Government of New York 201004150094 Your signature Your occupation Spouse's signature and occupation (if joint return) Date Daytime phone number E-mail: Page 4 of 4 IT-201 (2015) Payments and refundable credits (see page 28) Your refund, amount you owe, and account information (see pages 31 through 33) 79 Amount of line 77 that you want applied to your 2016 estimated tax(see instructions)..... 2015 Individual Income Tax Forms - Marylandtaxes.gov Maryland long form for full- or part-year residents claiming dependents. 502. Maryland Resident Income Tax Return. Maryland long form for full- or part-year residents. 502B. Maryland Dependents Information. Form to be used when claiming dependents. 502AC. Maryland Subtraction for Contribution of Artwork. PDF Form MO-1040 Book - 2015 Individual Income Tax Long Form - Missouri 2 2-D Barcode Returns-If you plan to file a paper return, you should consider 2-D barcode filing. The software encodes all your tax information into a 2-D barcode, which allows your return

PDF WORKSHEETS A, B and C These are worksheets only. 2015 NET PROFITS TAX ... WORKSHEET C: Computation of Estimated Tax Base If the amount on Line 3 is $100 or less, estimated payments are not required. If the amount on Line 3 is greater than $100, enter 25% of the amount on ... WORKSHEET NR-3 2015 NET PROFITS TAX RETURN Computation of apportionment factors to be applied to apportionable net income of certain ...

PDF 2015 Instruction 1040 (Tax Tables) - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2015 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only. NOTE: THIS BOOKLET DOES NOT CONTAIN TAX FORMS

PDF AND PART-YEAR RESIDENT You must enter your SSN below in the same YOUR LOUISIANA INCOME TAX - See the Tax Computation Worksheet to calculate the amount of your Louisiana income tax. NONREFUNDABLE TAX CREDITS 13A FEDERAL CHILD CARE CREDIT - Enter the amount from your Federal Form 1040A, Line 31, or Federal Form 1040, Line 49. This amount will be used to compute your 2015 Louisiana Nonrefundable Child Care ...

2015 Income Tax Forms | Nebraska Department of Revenue Form 4797N, 2015 Special Capital Gains Election and Computation. Form. Form CDN, 2015 Nebraska Community Development Assistance Act Credit Computation. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 1040XN, 2015 Amended Nebraska Individual Income Tax Return.

PDF 2015 Federal Withholding Computation—Quick Tax Method - Thomson Reuters 2015 Federal Withholding Computation—Quick Tax Method1, 2 Use this worksheet instead of the withholding tables from IRS Notice 1036 or Pub. 15 to compute federal withholding for an employee. Note: This method is based on the 2015 percentage method from IRS Notice 1036 and Pub. 15.

capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44... 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

PDF RI-1041 TAX COMPUTATION WORKSHEET 2015 - Rhode Island RI-1041 TAX COMPUTATION WORKSHEET 2015 BANKRUPTCY ESTATES use this schedule If Taxable Income- RI-1041, line 7 is: $0$0.00 (a) Enter Taxable Income amount from RI-1041, line 7 (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount (e) Subtract (d) from (c) Enter here and on RI-1041, line 8 TAX $605.50 $2,312.36 $60,550

2015 Income Tax Forms | C Corporations - Department of Revenue DR 0112EP - Corporate Estimated Income Tax Worksheet. DR 0112SF - Receipts Factor Apportionment Schedule. DR 0112X - Amended Return for C Corporations. DR 0205 - Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax. DR 0900C - C Corporation Income Tax Payment Form.

PDF 2019 Tax Computation Worksheet - cchcpelink.com appropriate line of the form or worksheet that you are completing. Section A—Taxable income.Use if your filing status is Single. Complete the row below that applies to you. If line 11b is— (a) Enter the amount from line 11b (b) Multiplication amount (c) Multiply (a) by (b) (d) Subtraction amount Tax. Subtract (d) from (c). Enter

PDF Forms & Instructions California 540 2015 Personal Income Tax Booklet Last day to file or e-file your 2015 tax return to avoid a late filing penalty and interest computed from the original due date : ... Worksheet for Dependents on page 11 to figure your standard deduction.) ... Tax Computation for Certain Children with Investment Income, to figure the tax on a separate Form 540 for your child . ...

PDF 2015 MICHIGAN Corporate Income Tax Penalty and Interest Computation for ... an estimated tax payment period of less than three months, the quarterly return for that period is due on the 15th day of the month immediately following the final month of the estimated tax payment period. Line 4: Divide the amount of the estimated tax required for the year on line 4 by four and enter this as estimated tax for each quarter.

What Is The Tax Table For 2015? (Correct answer) The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed. Each one has a range of taxable incomes. How much taxes do you pay on 30k?

Prior Year Products - IRS tax forms Tax Table, Tax Computation Worksheet, and EIC Table 2021 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2020 Inst 1040 (Tax Tables) ... 2015 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2014 Inst 1040 (Tax Tables) Tax Table and Tax Rate Schedules 2013 Inst 1040 (Tax Tables) ...

PDF QPE Table of Contents - Thomson Reuters 2015 Tax Computation Worksheet 2015 EIC Table Tab 2 2015 States Quick Reference State Individual Income Tax Quick Reference Chart (2015) General Alabama Alaska Arizona Arkansas ... Child Tax Credit Worksheet (2015) Donations—Noncash Donated Goods Valuation Guide Donations Substantiation Guide Earned Income Credit (EIC) Worksheet (2015)

0 Response to "43 2015 tax computation worksheet"

Post a Comment