39 understanding a credit card statement worksheet answers

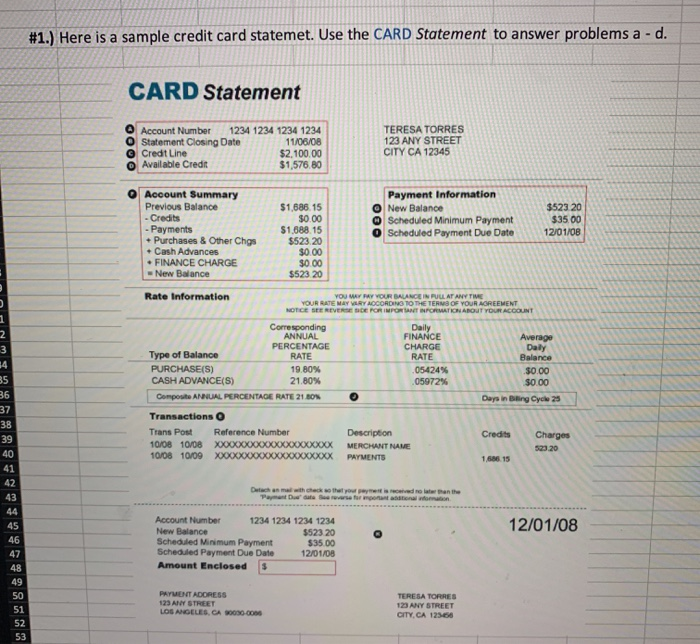

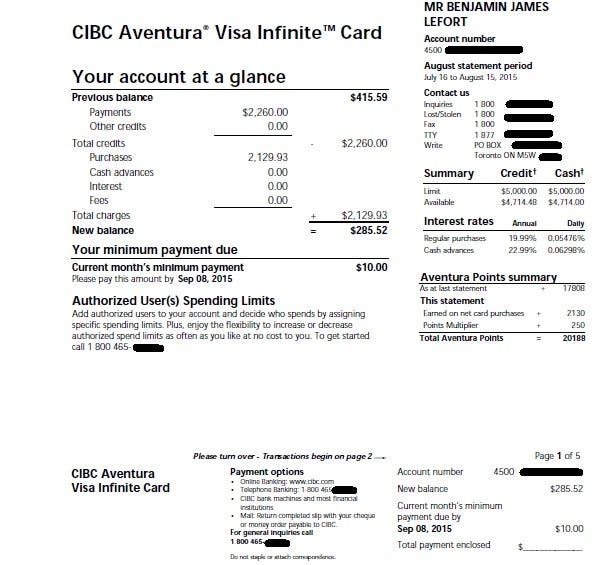

Understanding Credit Cards: A Beginner's Guide (2022) - CardRates.com Understanding Your Credit Card's APR Your card issuer will charge you interest for every day you carry a balance. Although the amount accumulates daily, it's typically expressed as an annualized percentage rate (APR). Many people who have credit cards find APRs and how they're calculated to be a complicated subject. It doesn't have to be. PDF Analyzing credit card statements - Consumer Financial Protection Bureau Analyzing credit card statements Understanding what's on a credit card statement can help you to remain financially responsible while paying your bills on time, paying the appropriate amount, and using a credit card as a tool to manage your money. Instructions Visit MyCreditUnion.gov's interactive credit card statement to answer the ...

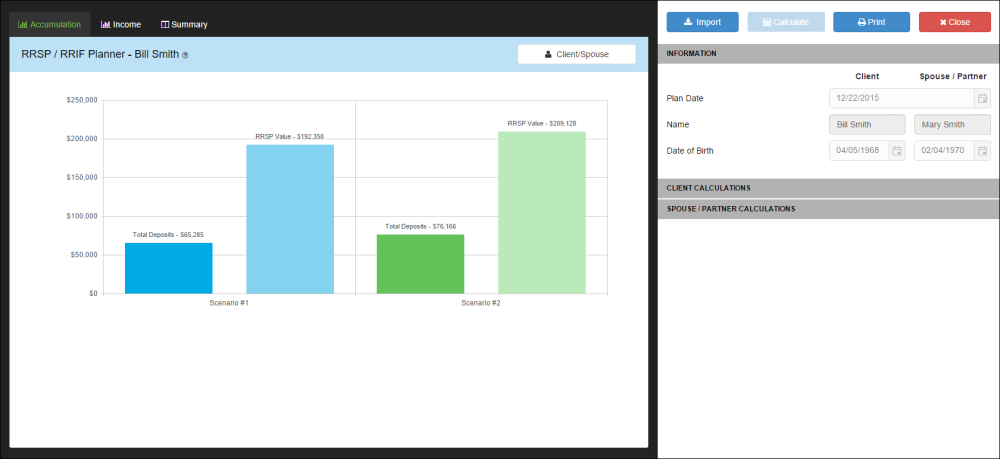

PDF Understanding Credit Cards Note Guide - Weebly Describe how an individual obtains a credit card. Describe each section of a credit card statement. Credit Card Statement Summary of Account Activity Payment Information Late Payment Warning Minimum Payment Warning Notice of changes to your interest rates Other changes to your account terms

Understanding a credit card statement worksheet answers

PDF Understanding a Credit Card Statement - personal finance Directions: Refer to the credit card statement to answer the following questions. Section What type of information is in this section? Why is this section important to review/understand? Summary of Account Activity Payment Information Late Payment Warning Minimum Payment Warning Notice of Changes to Your Interest Rates PDF Lesson Five Credit Cards - Practical Money Skills credit cards student activity 5-3b Marie just used her new credit card to buy a bike for $400. Her budget allows her to pay no more than $25 each month on her credit card. Marie has decided not to use the credit card again until the bike is paid off. The credit card she used has an Annual Percentage Rate of 21%. 16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. Introduction to Earning Interest Suggested Age: Middle School

Understanding a credit card statement worksheet answers. PDF Full Year Course: Answer Key Document - NGPF Key 3.2 Intro to Credit Cards - Sample Completed Student Activity Packet 9 CALCULATE: Shopping with Interest 13 RESEARCH: Credit Card Laws WebQuest Do More PROJECT: Budgeting for Your Credit Card Payments CQs Intro to Credit Cards Comprehension Questions *No Answer Key available - assignment is open-ended. B ack to Top Last updated: 4 ... › publications › p972Publication 972 (2020), Child Tax Credit and Credit for Other ... If you answered "Yes" on line 11 or line 12 of the Child Tax Credit and Credit for Other Dependents Worksheet in your Instructions for Forms 1040 and 1040-SR or Instructions for Form 1040-NR (or on line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in this publication) and line 1 of that worksheet is more than zero, use ... Credit Cards: Quiz & Worksheet for Kids | Study.com Print Worksheet. 1. When you buy something using a credit card, which of the following usually happens? You will receive a monthly bill and statement. You will immediately receive a bill and ... PDF Financial Literacy: Credit Basics U T D Directions: N W K S H E T N S The Basics of Credit 1. It is doubtful today's consumer would give up the convenience of carrying a credit card they can use at virtually any location. 2. Some people do it for the convenience of not carrying cash, while others use credit to make purchases they can't actually afford. 3.

Types of Credit Unit - NGPF 9-WEEK COURSE. FINANCIAL ALGEBRA COURSE. MIDDLE SCHOOL. USE CASE. Enough content to fill a full year or to build your own scope and sequence. 18 weeks of daily instruction to fit a traditional semester. Perfect for summer school or for schools on trimesters/quarters. Perfect for a semester-long elective or third-year math alternative. PDF Take Charge of Credit Cards Answer Key 1.6.1 - Get the CCPS FACS! • Pay the amount charged to a credit card in full every month • Pay credit card payments on time • Keep track of all charges by keeping receipts • Check the monthly credit card statement for errors • Make late credit card payments • Pay only the minimum payment due • Go over the card's credit limit PDF Reading a Credit Card Statement - Money Mentors Reading a Credit Card Statement Instructions: use the credit card statement on the attached sheet to answer the questions below 1. What was the dollar value of the item(s) purchased with the credit card on Feb. 17 20XX? 2. On what date were items purchased from a convenience store? cards: Find the Right Card For You at Creditcards.com Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at CreditCards.com.

Credit Card Statement Lesson Plan Worksheet This is a random worksheet that includes a person's credit card transactions for the month, and his or her monthly credit card statement. It is the student's task to answer the questions on identifying the parts of the credit card statement. Note: Transactions in this worksheet do not include "payments". ie. A payment is not a transaction. Credit and Credit Card Lesson Plans, Consumer Credit, Teaching Worksheets CREDIT AND Credit Cards. This section includes lessons on consumer credit cards, credit, and paying interest. Learn about credit with an introduction to credit cards, reading a credit card statement, and advanced lessons regarding incorrect credit card transactions. Also, see our spending money category for more consumer related material. PDF Lesson Seven Understanding Credit 7-1recognize advantages, disadvantages, and responsibilities of using credit. 7-2identify ways to establish credit history. 7-3use math skills to determine a safe debt load. 7-4compare features and costs of various credit cards. 7-5identify critical actions to take when in financial trouble. understanding creditlesson outline tuition.asu.edu › contact-resources › faqFinancial Aid & Tuition FAQ | Arizona State University The same deadline to apply with the FAFSA and meet eligibility requirements applies to the TEACH Grant. The FAFSA must be received, along with the Agreement to Serve and entrance counseling, before the last day of class of the fall semester (for students not attending the following spring semester), before the last day of class of the spring semester (for students not attending the following ...

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms This credit is figured like last year's economic impact payment, EIP 3, except eligibility and the amount of the credit are based on your tax year 2021 information. See the instructions for line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount.

Understanding Credit Cards Flashcards | Quizlet The act of transferring debt from one credit card account to another. Credit Limit The maximum dollar amount that can be charged to a credit card. Interest The price of money. Introductory Rate The APR charged during the credit card"s introductory period after a credit card account is opened. Late-payment Fee

Understand Your Credit Card Statement | MyCreditUnion.gov A credit card statement is a summary of how you've used your credit card for a billing period. If you've ever looked at credit card statements, you know how difficult they can be to read. Credit card statements are filled with terms, numbers and percentages that play a role in the calculation of your total credit card balance.

Understanding credit cards unit Flashcards | Quizlet 13% because that is what the credit card company charges to use the card What are the three main steps in obtaining a credit card? 1. Shop around- find the card that fits your needs 2. Complet a credit application- this will be at a bank or online. It's easy 3. Approval- you can be pre-approved or you can be deterred because of your credit history

4.3.a Understanding a Credit Card Statement_Sierra Slade Sierra SladeFinancial Literacy Understanding a Credit Card Statement - 15 points Directions: Refer to the provided credit card statement to answer the following questions. Once you answer the questions submit a screenshot in the submit area. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 16.99% 16. 99 %

PDF Lesson Plan Package 01 Credit Scores US - CapEd Credit Union Directions: Circle the bad credit choices on this example credit card statement. SPOT THE BAD CREDIT CHOICES. 5. TRUE or FALSE Checking your credit report will negatively affect your credit score. ... ACTIVITY A ANSWER KEY Understanding Credit Scores. Directions: Go through the 'Positive Impact' and 'Negative Impact' piles of game cards ...

reading_a_credit_card_statement_wkst (1).pdf - 7.4.2.A2 Worksheet ... How will this affect future purchases?(2 points) 6. The cardholder pays the minimum payment of $53.00 this month and makes no new purchases during the next billing cycle. What will be the new credit card balance during the next billing cycle if the cardholder has a $10.27 interest charge for the month?(1 point) 7.

credit card statement worksheet answers Monthly Credit Card Statement Walkthrough credit.about.com. latoya irby. 36 Credit Card Activity Worksheet - Combining Like Terms Worksheet chripchirp.blogspot.com. 32 Credit Report Scenario Worksheet Answers - Notutahituq Worksheet notutahituq.blogspot.com. scenario consumer teachers. 31 Understanding A Credit Card Statement Worksheet Answers ...

0 Response to "39 understanding a credit card statement worksheet answers"

Post a Comment