40 nc 4 allowance worksheet

How Much Will I Owe on Self-Employment Taxes? - National Tax Reports The maximum tax rate for you is 15.3%. There's also a wage limit that applies to Social Security, introduced in 2016. It's valued at $118,500. The 2.9% of your self-employment taxes towards Medicare don't have a maximum cap. If you're a high-income taxpayer, you may have to pay an additional 0.9%. Non-financial Incentives for Retention of Health Extension Workers in ... PIM modeling is calculated using a "Preference Calculation Worksheet." 9 The worksheet involved a stepwise process. In the first step, the attribute levels for the "standard" job posting was entered in the sheet where No = 0 and Yes = 1 for each attribute.

deq.nc.gov › about › divisionsInside Fisheries | NC DEQ Raleigh, NC 27603 Map It 877-623-6748. Mailing Addresses. Work for Us. Job Opportunities at DEQ; For State Employees; DEQ Intranet; Twitter Feed. Tweets by NC DEQ ...

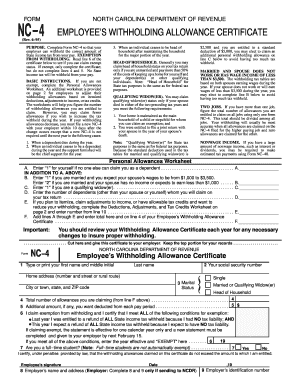

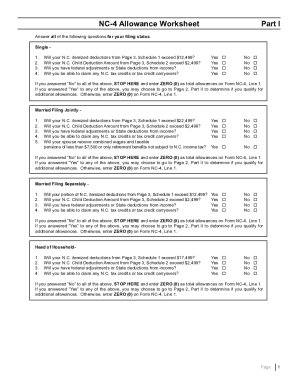

Nc 4 allowance worksheet

Civilian Permanent Change of Station (PCS) - Defense Finance and ... Relocation Income Tax Allowance (RITA) Step 4 - Submit Travel Voucher. Step 5 - Check Voucher Status. Step 6 - FAQs, Feedback and Forms. Civilian Permanent Change of Station (PCS) Current CIV PCS Voucher Processing Timeline: CSS Profile Participating Institutions and Programs - College Board 2023-24 Participating Institutions and Programs. The following colleges, universities, and scholarship programs use CSS Profile and/or IDOC as part of their financial aid process for some or all of their financial aid applicants in the populations listed below. Please check schools' websites or contact the institution for more information. How are dividends taxed? 2022 Dividend Tax Rates | The Motley Fool For single filers, if your 2021 taxable income was $40,400 or less, or $80,800 or less for married couples filing jointly, then you won't owe any income tax on dividends earned. Those numbers ...

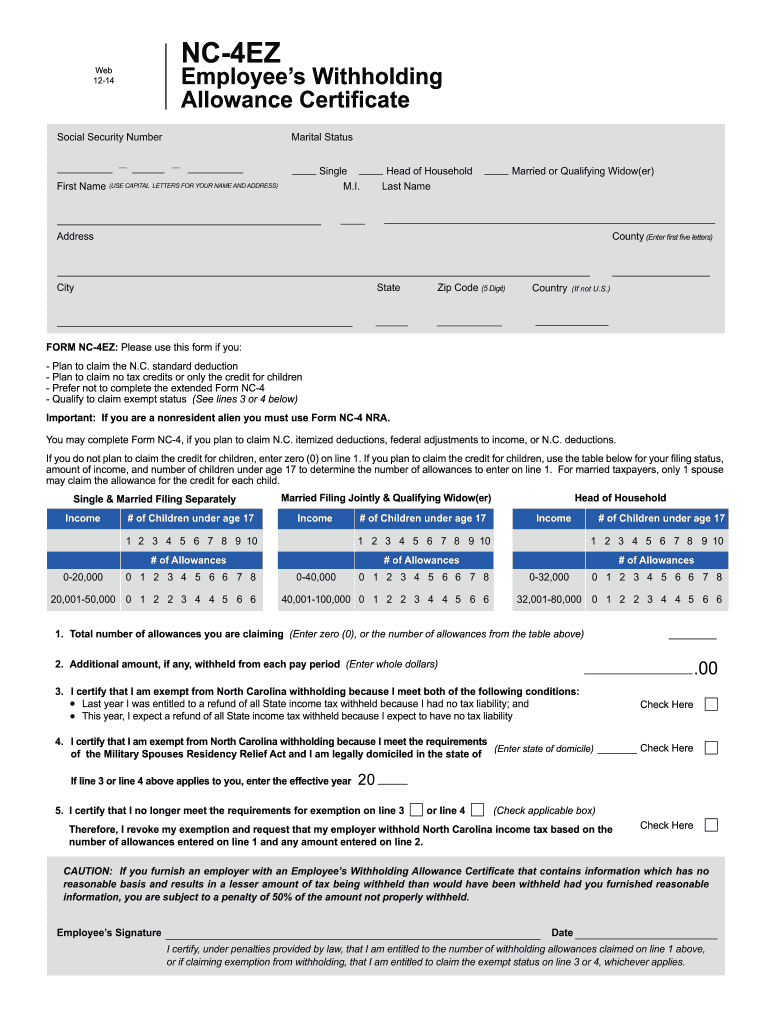

Nc 4 allowance worksheet. National School Lunch Program / Nutrition Programs / Food & Nutrition ... Training. What Is the National School Lunch Program? The National School Lunch Program is a federally assisted meal program operating in public and nonprofit private schools and residential childcare institutions. Can a 529 Plan Be Used to Pay for Room and Board? - Savingforcollege.com July 26, 2022. Room and board costs make up a large portion of a student's total college bill, second only to tuition. You can use a 529 plan to pay for room and board, but only if certain requirements are met. Room and board includes the cost of housing and the cost of a meal plan. Colleges typically have a room and board budgets for ... Credit Risk Data Analyst Job Arlington Virginia USA,Finance Provide analytical support for the Banks Allowance for Credit Loss (ACL) process. Input and/or reconcile loan and collateral information into external software used to calculate the ACL. Prepare impairment worksheet templates and Discounted Cash Flow analysis in support of impairment decisions and assist in the preparation of reports for senior ... Federal and North Carolina Paycheck Withholding Calculator NC-4 Allowance Worksheet Part II; Schedule 1 Estimated N.C. Itemized Deductions Qualifying Mortgage Interest: Real estate property taxes: Charitable Contributions (Same as allowed for federal): Medical and Dental Expenses (Same as allowed for federal): Itemized Total (after limits) Schedule 2 Estimated Child Deduction Amount

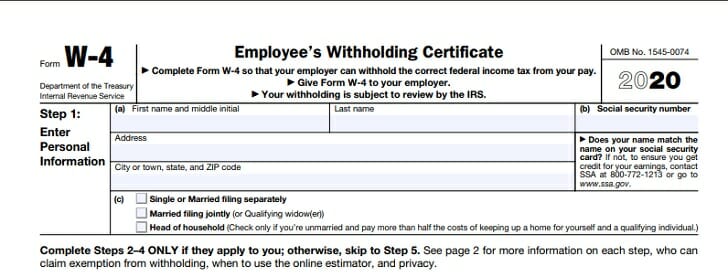

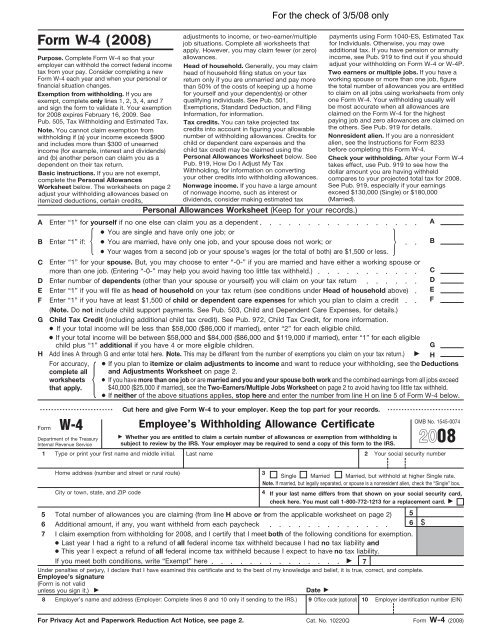

› 2021-08 › m1nc_202020 M1NC, Federal Adjustments 10 Net amount of nonbusiness income and losses. Include amounts from line 4 of Schedule KSNC, line 4 of Schedule KFNC, and line 4 of Schedule KPINC. If the total is less than zero, enter as a negative number.... 11 If step 10 is a negative number, enter it here as a positive number. If step 10 is a positive number, enter it here as a negative ... Certified Coach Program - Life Coach Training & Certification The program investment of $3,747 tuition includes everything you need to graduate and become a certified coach. No hidden charges, no extra fees for testing or certification, no cost for additional books or course software. It's all included in the Coach Certified Program. Circulars | Workers Compensation | NCRB 01/09/2022 · Item 01-NC-94 - Loss Sensitive Rating Plan - Application for Workers Compensation Insurance Revised NC WCIP Application Effective 4/1/95: C-95-5: 3/31/95: NC WCIP Policy Year 1995 Servicing Carrier Allowance Announcement of Servicing Carrier Allowance Applicable to policies effective during 1995: C-95-4: 3/31/95 › pub › irs-pdf2022 Form W-4 - IRS tax forms Complete Steps 3–4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3–4(b) on the Form W-4 for the highest paying job.) Step 3: Claim Dependents . If your total income will be $200,000 or less ($400,000 or less if married filing jointly):

myidp.sciencecareers.orgHome Page [myidp.sciencecareers.org] You have put a lot of time and effort into pursuing your PhD degree. Now it’s time to focus on how to leverage your expertise into a satisfying and productive career. Computation Tax Worksheet [BMQ5KU] worksheet to calculate your tax payable please complete from your own tax credit certificate: per year per week (if weekly paid) per month (if monthly paid) per fortnight (if fortnightly paid) tax credits € € rate band € € taxable pay 1 apply the standard rate of 20% to the income in your weekly rate band taxmann is the most reliable online … Home Page [myidp.sciencecareers.org] You have put a lot of time and effort into pursuing your PhD degree. Now it’s time to focus on how to leverage your expertise into a satisfying and productive career. How can Aid and Attendance Pension pay family caregivers? The combined gross household income is $3,000 a month. For purposes of this example let's suppose the Pension benefit for this couple with the aid and attendance allowance is $2,266 a month and the 5% deductible is $75 a month. From the section on home care services, we know that this couple needs to pay at least $3,075 a month to generate the ...

Guidance Archive : Cherry Bekaert Contractor Business Systems Series: Part 1 - Applicability. Stay Connected Join Cherry Bekaert's Government Contracting Industry team for part one of a new po... September 20, 2022.

Current Employees Nearing Retirement | My NC Retirement Teachers' and State Employees' Retirement Planning Webinar - 09/19/2022. Monday, September 19 2022, 9:30am - 11:30am. Local Government Employees' Retirement Planning Webinar - 09/19/2022. Monday, September 19 2022, 1:30pm - 3:30pm. Total Retirement Planning Conference "Planning for a Successful Retirement" - 09/21/2022.

BMW Car Depreciation By Model Calculator - TheMoneyCalculator.com 03.09.2016 Pension Advice May Soon Be Tax Free Government consulting to provide tax free advice for pension planning by creating a new Pensions Advice Allowance worth £500. 27.05.2016 Exit Charges For Pensions Capped From April 2017 FCA consultation to cap exit charges for pensions to 1 percent of the fund. 26.07.2012 How will your Pension ...

2020 M1NC, Federal Adjustments 10 Net amount of nonbusiness income and losses. Include amounts from line 4 of Schedule KSNC, line 4 of Schedule KFNC, and line 4 of Schedule KPINC. If the total is less than zero, enter as a negative number.... 11 If step 10 is a negative number, enter it here as a positive number. If step 10 is a positive number, enter it here as a negative ...

Inside Fisheries | NC DEQ NC DEQ. Search . Close Menu. Topical Navigation. Home Divisions Divisions. Back; Air Quality Coastal Management Energy, Mineral, and Land Resources Environmental Assistance and Customer Service Environmental Education and Public …

› withhold › ncFederal and North Carolina Paycheck Withholding Calculator NC-4 Allowance Worksheet Part II; Schedule 1 Estimated N.C. Itemized Deductions Qualifying Mortgage Interest: Real estate property taxes: Charitable Contributions (Same as allowed for federal): Medical and Dental Expenses (Same as allowed for federal): Itemized Total (after limits) Schedule 2 Estimated Child Deduction Amount

› ncrb › Workers-CompensationCirculars | Workers Compensation | NCRB Sep 01, 2022 · Item 01-NC-94 - Loss Sensitive Rating Plan - Application for Workers Compensation Insurance Revised NC WCIP Application Effective 4/1/95: C-95-5: 3/31/95: NC WCIP Policy Year 1995 Servicing Carrier Allowance Announcement of Servicing Carrier Allowance Applicable to policies effective during 1995: C-95-4: 3/31/95

2021 Capital Gains Tax Rates: Everything You Need to Know Here are the 2021 short-term capital gains and income tax rates: Data source: Internal Revenue Service (2020). Federal short-term capital gains/income tax rate. Single. Married filing jointly ...

Financial Consulting and CPA Firm | Aprio It's not too late to claim Employee Retention Credits. Employee Retention Credits can still be claimed retroactively and can provide up to $26,000 per employee across 2020 and 2021. Contact Aprio's nationally recognized ERC team to determine if you are eligible. Let's Connect.

› w-4-tax-withholding-forms-by-statesTax Withholding Forms by States for Employees to Submit - e-File W-4 Check: Calculate or estimate your W-4 IRS tax withholding based on your paycheck. This can then be used as guidance for your state tax withholding. W-4 Adjust: The W-4 Adjust lets you adjust or plan your current W-4 based on your last year's tax return results. You manage next year's tax refund or taxes owed now and create your W-4.

Tax Withholding Forms by States for Employees to Submit - e-File Colorado Income Tax Withholding Worksheet for Employers Form DR 1098. Connecticut. Connecticut Employee's Withholding Certificate Form CT-W4. Delaware. Employee Withholding Allowance Certificate Form W-4. Washington, D.C. DC Withholding Allowance Worksheet Form D-4. Florida. Florida does not have Income Taxes. You might have to submit a tax withholding …

2018-2021 Child Support Calculator The amount of child support a court will order for any particular case may be different from the amount estimated by the calculator. The court has the final authority to determine the amount of child support awarded. The amount yielded by this calculator is only an estimate and is not a guarantee of the amount of child support that will be awarded.

Blood Smear Basics - Google Drive: Sign-in Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.

Small Business Tax Deductions for 2022 [LLC & S Corp Write Offs] The deduction limit for 2022 is $1,040,000. Another useful deduction for small businesses is bonus depreciation. The Tax Cuts and Jobs Act of 2017 doubled bonus depreciation on specific types of property to 100% from the earlier rate of 50%.

2022 Form W-4 - IRS tax forms If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note: If more than one job has annual wages of more than $120,000 or there are more than three jobs, …

State-by-State Guide to Taxes on Middle-Class Families The map below will help you with your research. Click on any state for a detailed summary of its taxes on income, property, and items you buy on a daily basis. Also check out the tax-specific ...

Chain link fence calculator estimate - Your Fence Store.com Cost Estimator for Chain Link Fence. Lineal feet of fence. (Must be 10 or more) Height of fence. 4 feet high 5 feet high 6 feet high 8 feet high. Gauge of wire. 2" x 9 gauge 2" x 11 gauge 2 1/4" x 11 1/2 gauge. Number of end posts. Number of corner posts.

How are dividends taxed? 2022 Dividend Tax Rates | The Motley Fool For single filers, if your 2021 taxable income was $40,400 or less, or $80,800 or less for married couples filing jointly, then you won't owe any income tax on dividends earned. Those numbers ...

CSS Profile Participating Institutions and Programs - College Board 2023-24 Participating Institutions and Programs. The following colleges, universities, and scholarship programs use CSS Profile and/or IDOC as part of their financial aid process for some or all of their financial aid applicants in the populations listed below. Please check schools' websites or contact the institution for more information.

Civilian Permanent Change of Station (PCS) - Defense Finance and ... Relocation Income Tax Allowance (RITA) Step 4 - Submit Travel Voucher. Step 5 - Check Voucher Status. Step 6 - FAQs, Feedback and Forms. Civilian Permanent Change of Station (PCS) Current CIV PCS Voucher Processing Timeline:

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "40 nc 4 allowance worksheet"

Post a Comment