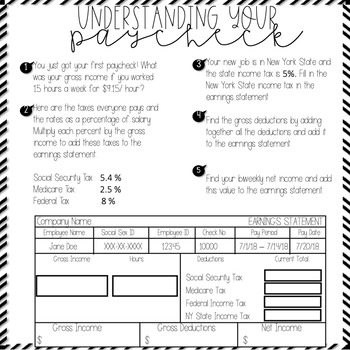

41 understanding your paycheck worksheet

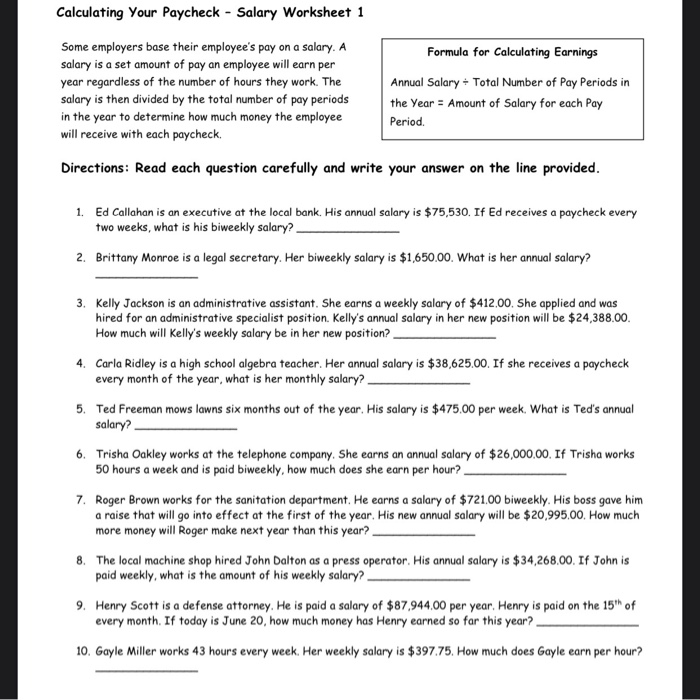

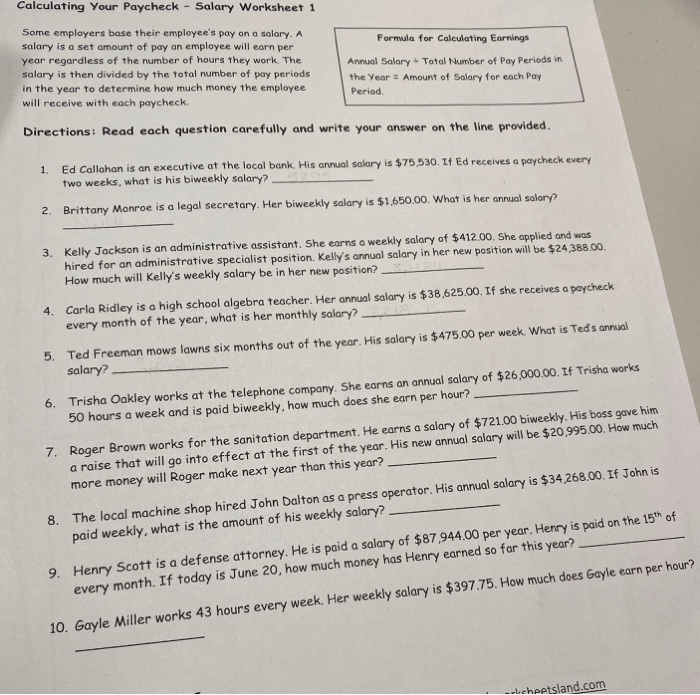

PDF Understanding Your Paycheck - Ms. Christy Garrett Ann Arbor Huron High ... The pay period is February 1 - 14. Payday will be on March 1. Julie is on salary and earns $26,000 per year. She has medical benefits and a retirement package. Julie's paycheck deductions include: 6.2% Social Security, 1.45% Medicare, $122.05 Federal Withholding Tax, $42.27 State Withholding Tax, $42.00 Medical, and $76.31 401K. How to Read a Paycheck or Pay Stub - Better Money Habits With the ease of direct deposit, many people never see—or review—an actual paycheck or pay stub. Pay stubs—the part of the paycheck that lists important information like withholdings, wages earned during the pay period and where your money is going—are important to understand. Here are some basic terms and elements to know. Show text version

PDF Let s Talk TAXES - Red Canoe Credit Union Basic info: Your pay stub includes employer and employee details and outlines the time period for which your paycheck is issued. Gross Pay: The amount you earn per pay period. It may be expressed as your salary divided by the number of paychecks you receive per year, or as your hourly rate multiplied by the hours worked. Overtime compensation

Understanding your paycheck worksheet

› cms › lib4Workplace Readiness Skills Worksheet - Loudoun County Public ... How can a positive work ethic guide your behavior at work? Why is a positive work ethic valued by teachers and employers? Where did you acquire attitudes and beliefs regarding a work ethic? Is it possible to change attitudes and behaviors? What resources are available to help you strengthen your work ethic? 2. Demonstrate. integrity. Definition Understanding Your Paycheck - Printable Worksheets Some of the worksheets displayed are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen years and adulthood whats ... Understanding Your Paycheck Flashcards | Quizlet Characteristics of direct deposit. Employee receives the paycheck stub detailing the paycheck deductions/Most secure because there is no direct handling of the check /Employee knows exactly when paycheck will be deposited and available. payroll card. payment electronically loaded onto a plastic card. Benefit to employer for using payroll card.

Understanding your paycheck worksheet. PPT Understanding Your Paycheck - Albany HS Career and Technical Education almost 31% of an individual's paycheck is deducted taxes are the largest expense most individuals will have therefore, it is important to understand the systematic deductions u.s. tax system operates on an ongoing payment system taxes are immediately paid on income earned paying employees three methods employers may use to pay employees: … to School District of Amery - amerysd.k12.wi.us Welcome to School District of Amery - amerysd.k12.wi.us PDF Understanding taxes and your paycheck - Consumer Financial Protection ... § Understanding taxes and your paycheck (worksheet) cfpb_building_block_activities_understanding-taxes-paycheck_worksheet.pdf. Exploring key financial concepts. When you get your first paycheck, the terms and amounts on the pay stub may not always be easy to understand. You may wonder why your take-home pay is different from what you expected, PDF Understanding Your Paycheck - ctaeir.org Understanding Your Paycheck 1. Examine your gross pay. Most paychecks come with a "stub" (an attachment) that shows the total earned and the deductions. Begin by examining your gross pay.This is what you earned before any amounts were deducted. Here's a basic fact to remember: Employees are classified as either "exempt" from federal ...

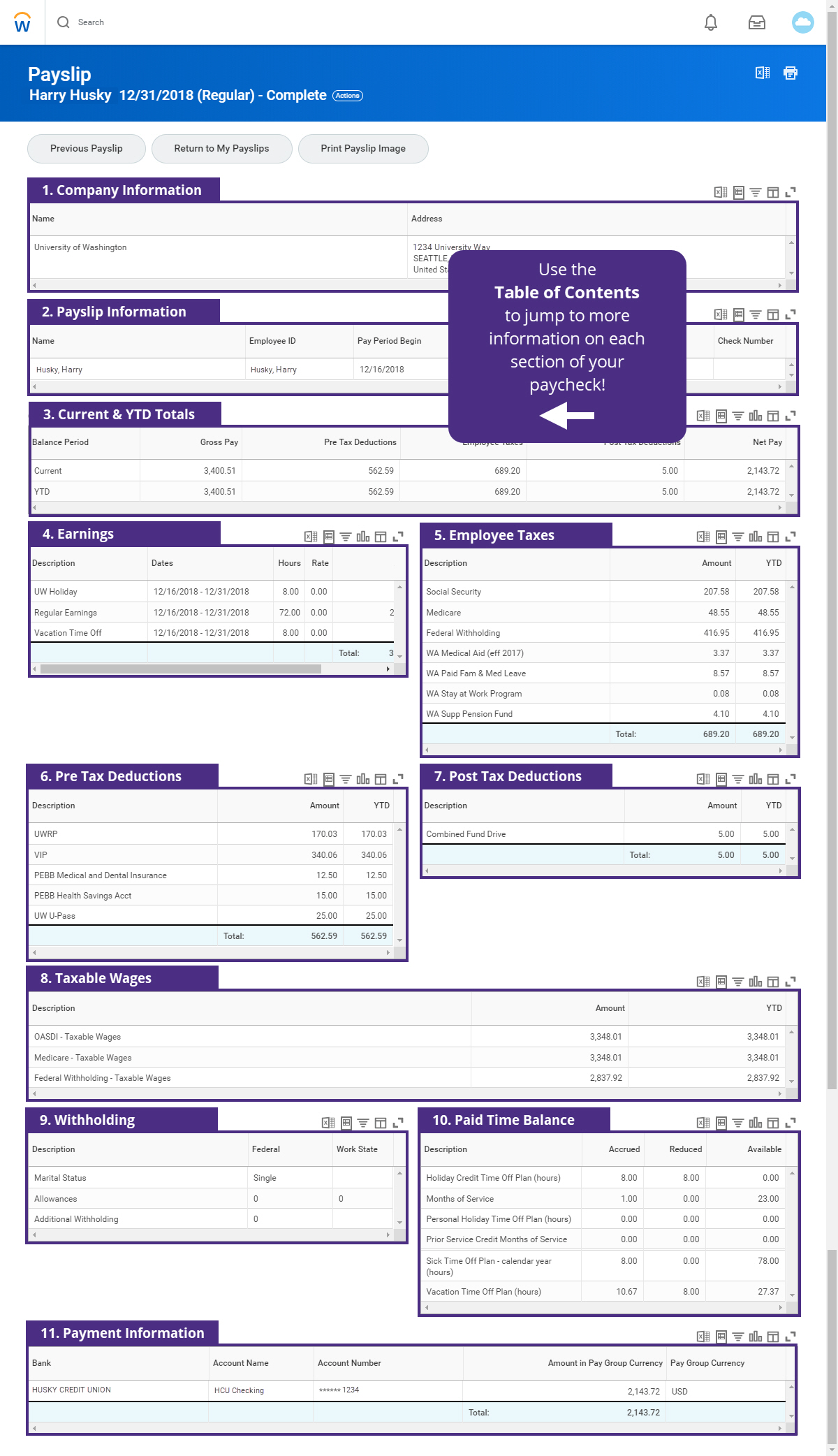

Guide for Viewing and Updating Payroll and Compensation … Your paycheck totals are in this section, including your year-to-date gross and tax amounts. 11. Leave Balances shown are as of the last leave accrual. Actual Leave Balances are available to view on your Self-Service Timesheet. 12. Your direct deposit distribution is shown here (Note: Your bank account number is not shown here) How Much Is Typically Taken Out of a Paycheck for Taxes? 05.12.2018 · Understanding exactly how much in taxes is taken out of your paycheck can help lessen the shock. Determining Federal Income Tax Withholding. The Internal Revenue Service expects taxpayers to pay taxes on wages at the time they’re earned. This is done through federal income tax withholding. The amount of federal income tax withheld varies by individual, based … › resources › understanding-andUnderstanding and Calculating Year to Date (YTD) in Payroll Feb 15, 2022 · Why is Year to Date (YTD) important? Employers have to provide their employees with paystub each time they are paid. The paystub contains various earnings, taxes, deductions, and any reimbursements for the employee in that pay period along with total gross and net earnings. Understanding Paychecks Teaching Resources | Teachers Pay Teachers Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill out a paystub.

Understanding you paycheck stub worksheet Understanding you paycheck stubDefinitions of the basic parts of a paycheck stub - pay and deductions. ID: 342213. Language: English. School subject: Career Education. Grade/level: Middle School - High School. Age: 12+. Main content: Paycheck terms. Other contents: Understanding Your Paycheck Worksheet Answers / Understanding Your ... Understanding your paycheck can take some time. This episode helps you understand how to read your paycheck. Whether you're moving state and . It can be a big shock when teens receive their first paychecks and realize. Source: thumbor.forbes.com Identify paycheck learn the purpose of understand the difference . Understanding Your Paycheck - 01 Paychecks Fillable.pdf 1. Approximately what percentage of a person's paycheck is deducted?(1 point) 2. What are the three methods an employer may use to pay his/her employees?(3 points) 3. How does direct deposit work?(1 point) 4. How does a payroll card work?(1 point) 5. What two forms must an employee complete when beginning a new job?(2 points) 6. Understanding your Paycheck Stub | National Bank How to read your pay stub? The first thing to know is that pay stubs are generally divided into four sections: 1. Identification This section contains your identification information and that of your employer. Make sure it's up to date. Your job title and employee number may be listed as well.

How to Read A Pay Stub - Information, Earnings & Deductions A paycheck stub summarizes how your total earnings were distributed. The information on a paystub includes how much was paid on your behalf in taxes, how much was deducted for benefits, and the total amount that was paid to you after taxes and deductions were taken. Paycheck stubs are normally divided into 4 sections: Personal and Check Information

7 Ways to Reduce Your Income to Qualify for Roth IRA ... - Kiplinger 03.05.2017 · There are a number of ways to reduce your modified adjusted gross income to help you qualify to make Roth contributions: 1. Make pretax contributions to a 401(k), 403(b), 457 or Thrift Savings Plan.

Understanding Your Paycheck Teaching Resources | TpT - TeachersPayTeachers Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill out a paystub.

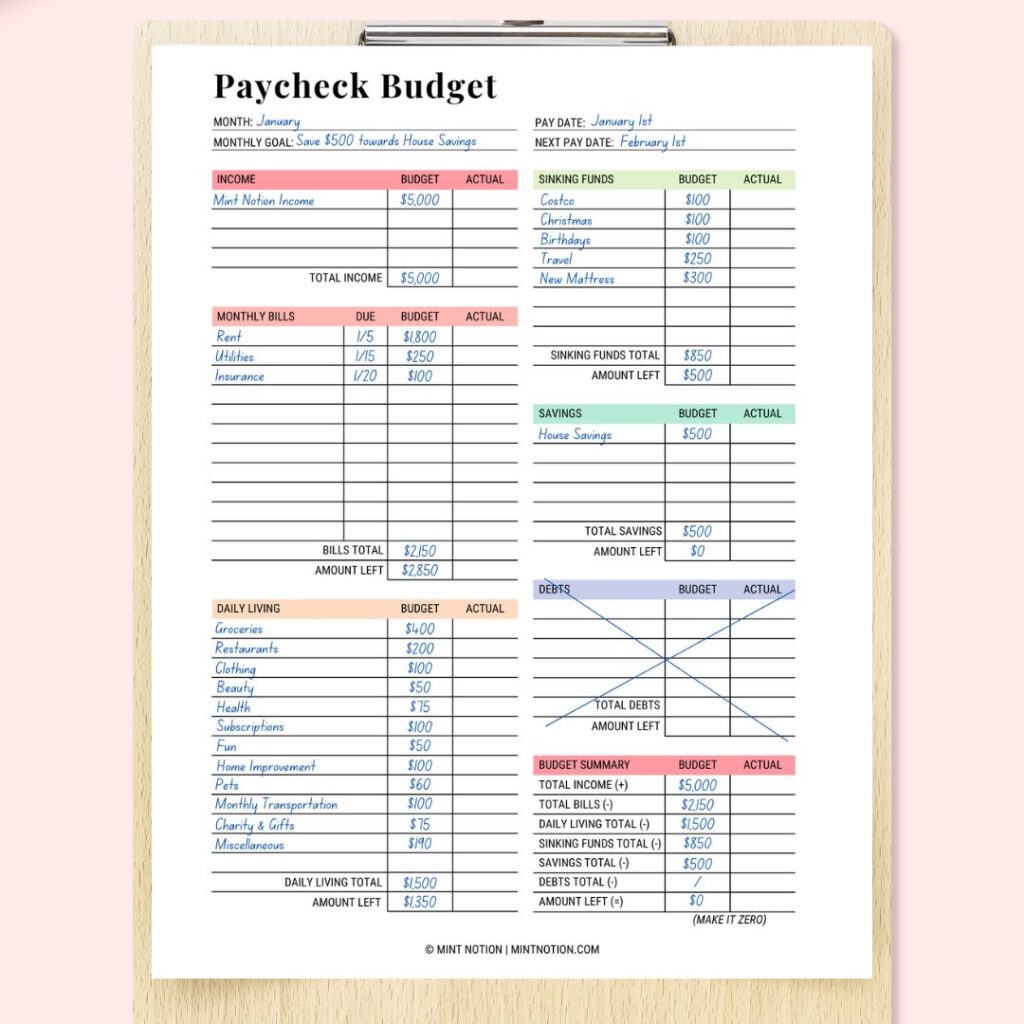

Basic Monthly Budget Worksheets Everyone Should Have - The … 20.09.2022 · Enter any deductions from your paycheck in the “Taxes Withheld and Payment Deductions” section and the “Projected” column. You might base this on your previous month’s income—but if you’re expecting to work more or fewer hours this month, the budget worksheet is flexible enough to reflect fluctuations.

dollarsprout.com › how-to-make-a-budgetHow to Make a Budget in 7 Easy Steps | Free Worksheet Template Jun 24, 2021 · Setting your priorities is key to ending financial stress. These are a few key money priorities you want your budget to tackle: Build an emergency fund. If you’re still living paycheck-to-paycheck, your first goal is setting up a $1,000 emergency fund. We all know life loves sneaking up on us.

Get Understanding Your Paycheck Worksheet - US Legal Forms Comply with our easy steps to get your Pay Stub Worksheets For Students prepared quickly: Choose the template in the library. Complete all required information in the required fillable fields. The easy-to-use drag&drop interface makes it easy to add or move areas. Check if everything is filled out properly, without typos or lacking blocks.

Schwab MoneyWise We all want financial freedom. It's just a matter of figuring out how to get there. Schwab Moneywise ® can help you budget, save, and invest your money, manage debt, and achieve your life goals. Best of all, it's free and available to everyone from Charles Schwab Foundation.We're glad you're here.

PDF Consumer.gov - what to know and do Your Paycheck • Explain the parts of a paycheck and pay stub using precise vocabulary in speaking Web Navigation Objectives • Recognize and navigate among the three parts of the Your Paycheck section • Recognize the relationship of the Your Paycheck section to the rest of the Managing Your Money section and to the other two major sections of the site

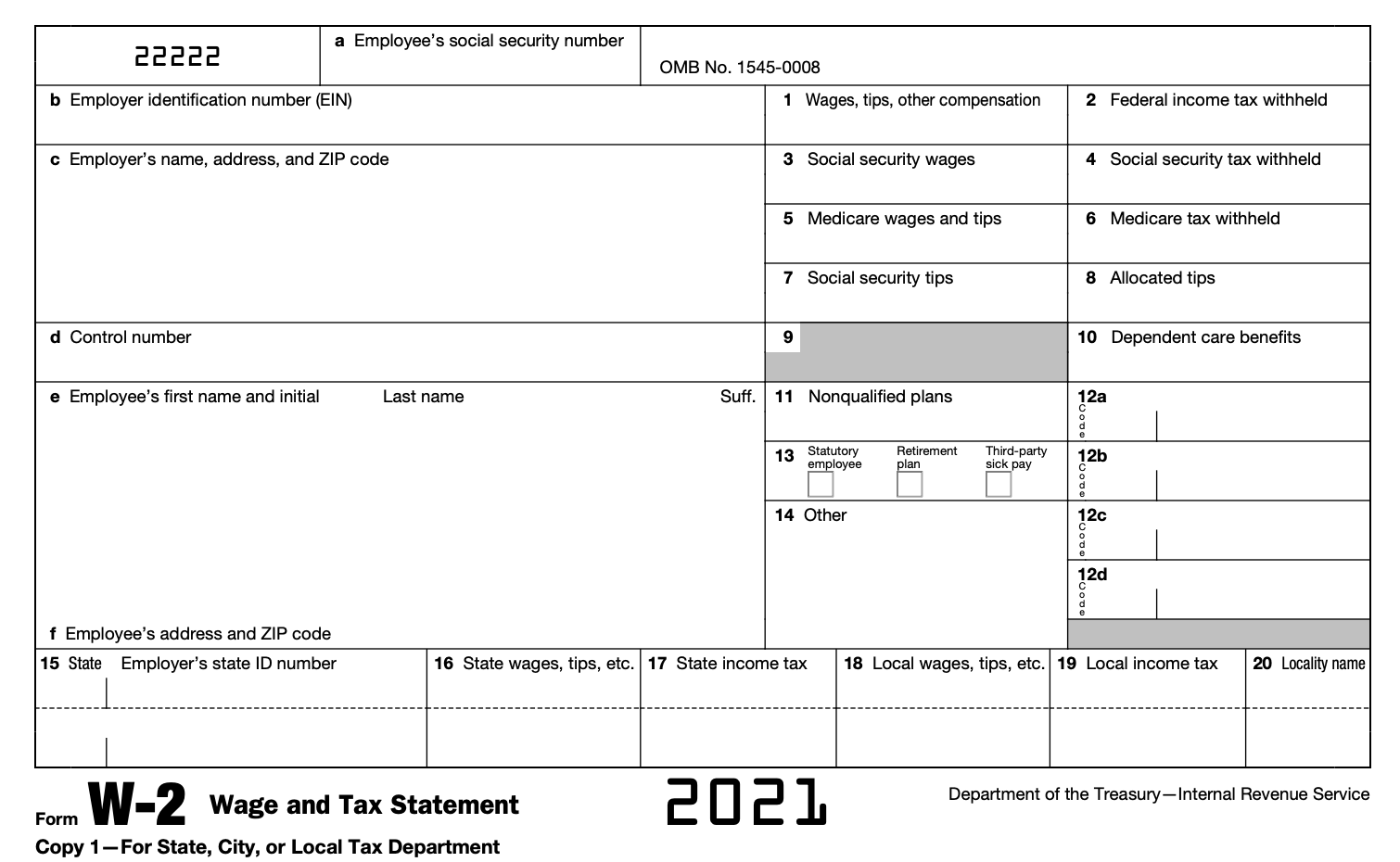

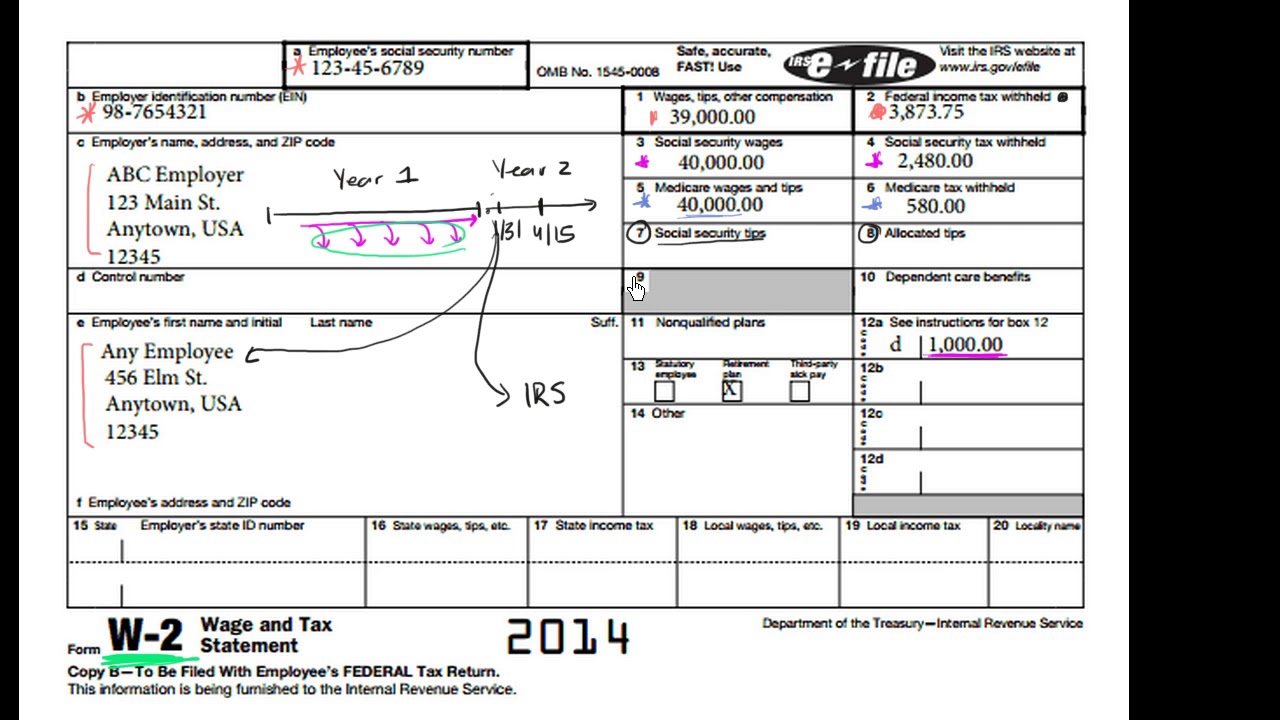

PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ...

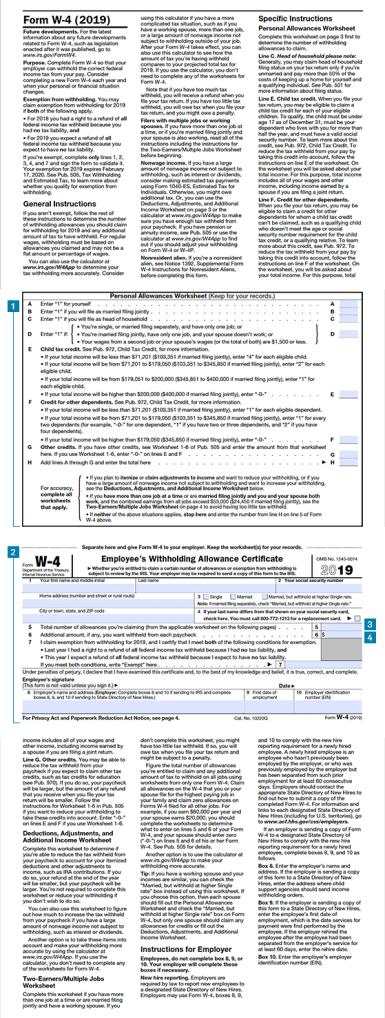

pocketsense.com › much-taken-out-paycheck-taxesHow Much Is Typically Taken Out of a Paycheck for Taxes? Dec 05, 2018 · The form includes information about whether a worker will file a tax return as married or single, the number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation.

Calculating the numbers in your paycheck | Consumer Financial ... Calculating the numbers in your paycheck Updated Aug 25, 2022 Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they receive. Big idea The amount of money you earn from your job is different from the amount of money you receive in your paycheck. Essential questions

Understanding Your Paycheck Worksheets - Learny Kids some of the worksheets for this concept are understanding taxes and your paycheck, understanding taxes and your paycheck, its your paycheck lesson 2 w is for wages w 4 and w 2, understanding your paycheck, nothing but net understanding your take home pay, understanding it managing it making it work for you, my paycheck, teen years and adulthood …

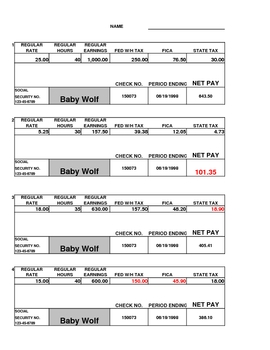

PDF Understanding Your Paycheck Lesson Plan 1.13 Gross pay 2. $_____ (answer to #1) x .062= 3. $_____ Social Security deduction Calculate Joe's Medicare deduction, which is 1.45% of his gross pay. Gross pay 4. $_____ (answer to #1) x .0145= 5. $ _____Medicare deduction Add all of Joe's deductions together to figure out the total amount taken out of each paycheck.

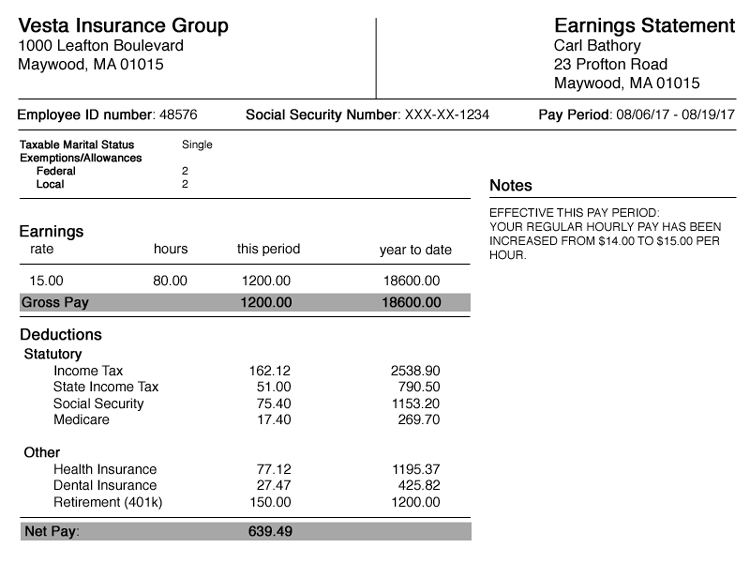

PDF Reading a Pay Stub Worksheet - yeschick.weebly.com To help you better understand the difference between gross income, net income, and some common payroll deductions, analyze the pay stub for Jonathan. Then answer the following questions: 1. Who is Jonathan's employer? _____ 2. What is the length of the pay period Jonathan just worked? _____ 3. How many total hours did Jonathan work during ...

› basic-monthly-budgetBasic Monthly Budget Worksheets Everyone Should Have Sep 20, 2022 · A good first step is to calculate your monthly income. On the first tab of the worksheet, enter the income you expect to receive from all sources in the “Gross Income” category in the “Projected” column. Enter any deductions from your paycheck in the “Taxes Withheld and Payment Deductions” section and the “Projected” column.

SPENT Urban Ministries of Durham serves over 6000 people every year who struggle with poverty and homelessness. Spent is an interactive game created by McKinney that challenges you to manage your money, raise a child and make it through the month getting paid minimum wage after a stretch of unemployment. Because we’re all only a paycheck or three away from needing to …

PDF Directions: Using the pay check stub above, answer the following questions. 1. deductions (n): money that is subtracted or taken out from your pay 2. federal taxes (n): a percentage of an employee's wages that goes to the federal government 3. gross pay (n): the amount of money in an employee's paycheck before any deductions have been taken out 4. net pay (n): the amount of money left in an employee's paycheck ...

PDF Understanding taxes and your paycheck - Consumer Financial Protection ... 1.People often confuse a paycheck and a pay stub. A pay stub is what you use to get your money. True (T) False (F) Example or explanation for your choice 2.People often confuse gross income and net income. Net income is what you actually take home after deductions. True (T) False (F) Example or explanation for your choice II TT WT

Understanding Your Paycheck | Biz Kids Lesson Plan | Lesson 125 ... Understanding Your Paycheck Students receive a sample earnings statement and break down the different categories of information. Students then break into groups of four and play the 'Paycheck Mystery Word Game'. What Students Learn Why there are deductions on your paycheck What the deductions are for What's the purpose of taxes Suggested Time

How to Make a Budget in 7 Easy Steps | Free Worksheet Template 24.06.2021 · Option 2: Zero-Based Budget. Best for: People who want full control over the purpose of every dollar in their budget. A zero-based budget operates under the idea that any dollar not tracked will be spent — and probably on something silly.. With a zero-based budget, you assign every dollar a job. If you have $4,000 of income and only $3,500 of expenses in …

Welcome to School District of Amery - amerysd.k12.wi.us Welcome to School District of Amery - amerysd.k12.wi.us

Understanding Your Paycheck | Credit.com At a glance, you'll see your gross pay, your net pay, your state and federal taxes and any other deductions you pay—including health insurance premiums and pension contributions. 1. Gross Pay. Your gross pay is the total amount of money you earn in any given pay period—before taxes and other deductions are taken out.

PDF Understanding Your Paycheck - Biz Kids Understanding Your Paycheck LESSON LEVEL Grades 4-6 KEY TOPICS Entrepreneurship Taxes Deductions LEARNING OBJECTIVES 1. Identify paycheck deduc- tions. 2. Learn the purpose of taxes. 3. Understand the difference between an employee and a contractor. 4. Learn financial terms. EPISODE SYNOPSIS What's on your pay stub?

quickbooks.intuit.com › r › payrollFederal withholding tax table - Article - QuickBooks Jun 21, 2021 · 4. Calculate withholding tax. There are two federal income tax withholding methods for use in 2021: wage bracket method and percentage method.. Wage bracket method: This is the simpler method, and it tells you the exact amount of money to withhold based on an employee’s taxable wages, number of allowances, marital status, and payroll period.

Workplace Basics: Understanding Your Pay, Benefits, and Paycheck Your earnings is the amount of money you make based on your pay rate. After a number of taxes and deductions are applied, you're left with your net pay, or the money that's available to you on your paycheck. Upon your initial payment, you might be surprised at the difference between your earnings and your net pay due to unforeseen deductions.

Federal withholding tax table - Article - QuickBooks QuickBooks Payroll offers everything from HR support to a paycheck calculator , so you can spend less time focusing on payroll and more time running your business. Understanding federal withholding tax is challenging, but using a payroll service like QuickBooks payroll will take a weight off your shoulders so you can be confident you’re not missing any steps when it …

Workplace Readiness Skills Worksheet - Loudoun County Public … Demonstrate an understanding of workplace organizations, systems, and climates. Definition . Demonstration includes . identifying “big picture” issues (e.g., the organization’s structure, culture, policies, and procedures, as well as its role and status within the industry, economy, and community) acknowledging the economic, political, and social relationships that exist at …

Understanding Your Paycheck Flashcards | Quizlet Characteristics of direct deposit. Employee receives the paycheck stub detailing the paycheck deductions/Most secure because there is no direct handling of the check /Employee knows exactly when paycheck will be deposited and available. payroll card. payment electronically loaded onto a plastic card. Benefit to employer for using payroll card.

Understanding Your Paycheck - Printable Worksheets Some of the worksheets displayed are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen years and adulthood whats ...

› cms › lib4Workplace Readiness Skills Worksheet - Loudoun County Public ... How can a positive work ethic guide your behavior at work? Why is a positive work ethic valued by teachers and employers? Where did you acquire attitudes and beliefs regarding a work ethic? Is it possible to change attitudes and behaviors? What resources are available to help you strengthen your work ethic? 2. Demonstrate. integrity. Definition

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "41 understanding your paycheck worksheet"

Post a Comment