43 calculating sales tax worksheet

Sales & Use Tax - Ohio Department of Taxation The Ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in Ohio. In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer. The state sales and use tax rate is 5.75 percent. How to Calculate LLC Taxes? (2022 Business Guide) - VentureSmarter You can use the IRS' Estimated Tax Worksheet to help you calculate your estimated taxes. Calculating Self Employment Taxes The first $106,800 of your taxes are made up of Social Security and Medicare taxes, which is estimated at 15% (for the 2019 tax year).

Alabama Tax Law Changes - Federal Income Tax Deduction Worksheet - Support Alabama tax law changes. On Wednesday, February 23, 2022 Act 2022-37 was signed into law in Alabama. Effective for the tax year ending on December 31, 2021, this act allows individual taxpayers to calculate their federal income tax deduction without consideration of certain items allowed under the American Rescue Plan Act.

Calculating sales tax worksheet

Capital Gains Tax Calculator - The TurboTax Blog Check out our free Capital Gains Interactive Calculator, that in just one screen, will answer your burning questions about your stock sales and give you an estimate of how much your stock sales will be taxed and much more. Solved: Turbo Tax doesn't calculate tax correctly - Intuit The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all worksheets to see it. For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Tax Preparation Worksheets - Lake Stevens Tax Service Lake Stevens Tax Service has several worksheets to aid you in the collection and categorization of receips to help with tax prep. Download at LSTAX.com. Call us: (425) 334-8138

Calculating sales tax worksheet. 2021 Tax Rate Calculation Worksheets - Tarrant County TX Westlake Town. Westover Hills Town. Westworth Village. White Settlement City. White Settlement ISD. Accessibility Notice: Due to the nature of these documents, they are provided as scanned images. If you require assistance in accessing the information, please contact the Tax Office at 817-884-1100. Capital Gains Tax Calculator 2021 - Forbes Advisor You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. Capital gains and losses are taxed differently from income like wages, interest, rents, or... How to Calculate Capital Gains Tax on Real Estate ... - RealWealth How long you own a rental property and your taxable income will determine your capital gains tax rate. Short-term investments held for one year or less are taxed at your ordinary income tax rate. Tax rates for short-term gains in 2020 are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Investments held long-term, more than one year, will be taxed at a ... Free Auto Loan Payment Calculator for Excel - Vertex42.com Use our free Auto Loan Calculator to estimate the overall cost of purchasing a car, including the sales price, sales tax, and the many charges and fees that creep up on you when you finally decide to make the purchase. The worksheet calculates the total Loan Amount, taking into account your down payment, trade-in, or cash rebate.

If YES, use this worksheet below to calculate the allocation of your cost basis between AT&T Inc. and WBD common stock. AT&T Inc. / WBD If you acquired your AT&T Inc. shares on or after March 20, 1998 (the date of the last stock split), your cost basis before the SpinCo Distribution is the same as the actual price paid for the shares. capital gain tax calculator 2022 & 2021 - Internal Revenue Code Simplified The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 (filing in 2023)and 2021. As you know, everything you own as personal or investments- like your home, land or household furnishings, shares, stocks or bonds- will fall under the term " capital asset". 2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet 2021 capital gains tax calculator 2022 capital gains tax rates In 2021 and 2022, the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on... Sales Tax Deduction: How It Works, What to Deduct - NerdWallet There are two ways to calculate your sales tax deduction: Pull your hair out trying to find receipts for everything you bought during the year, so you can add up the sales tax, or Just estimate...

Sales & Use Tax - Department of Revenue - Kentucky Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky. Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 and Kentucky Administrative Regulations - Title 103 . Sales Tax Overview & Examples | What are Taxable Sales? - Video ... Sales tax is an additional amount of money you pay based on a percentage of the selling price of goods and services that are purchased. For example, if you purchase a new television for $400 and ... Australian Tax Calculator Excel Spreadsheet 2022 - atotaxrates.info This free to download Excel tax calculator has been updated for the 2021-22 and later years 2022-23, 2022-24 and 2024-25 and includes the March 2022 Budget increase of $420 to the Lower and Middle Income Tax Offset for the 2021-22 year. The current version of the Excel spreadsheet (xlsx) has separate tabs for tax years 2018 to 2024-25. The ... NJ Division of Taxation - Sales and Use Tax Forms - State Sales Tax Collection Schedule - 6.625% effective 1/1/2018 : Sales and Use Tax: 2018 Jan: ST-50-EN: New Jersey Sales and Use Tax Energy Return: ... Sales and Use Tax: 2017 Feb: ST-50/51: Worksheets for Filing (or Amending) ST-50/51 by Phone - All Quarters EXCEPT 3rd Quarter 2006: Sales and Use Tax: 2017 Feb: ST-3: Resale Certificate:

Dealer TAVT Calculator Worksheets Motor Vehicle / Dealer Services / Dealer TAVT Calculator Worksheets. DMF has developed a Microsoft Excel workbook to assist dealers in the calculation of title ad valorem tax (TAVT). There are separate Excel worksheets for each type of vehicle sale: new, used, leased and directly-financed. The sheets are easy to use and include a list of ...

The Federal Sales Tax Deduction - The Balance Using the IRS Sales Tax Tables The Internal Revenue Service provides a Sales Tax Calculator for small, everyday expenditures. You can add on sales taxes you paid on big purchases, such as vehicles, boats, aircraft, or home additions. The IRS even offers a worksheet in its instructions for Schedule A to help you keep track of these figures.

Sales and Use Tax Forms - Tennessee Sales and Use Tax Forms. Online Filing - All sales tax returns must be filed and paid electronically. Please visit the Filing and State Tax section of our website for more information on this process. Taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer.

How To Calculate 1099 Taxes - TaxesTalk.net To calculate estimated taxes under the safe harbor rule, start by taking 100% of the taxes paid on last years return. Then, divide last years total taxes by four. The resultant total is your quarterly obligation under the safe harbor rule. As long as your payments cover this total, youre protected from penalties.

Sales Tax Deduction: What It Is, How To Take Advantage - Bankrate The latest changes, signed into law in late 2017 via the Tax Cuts and Jobs Act, limit the deduction to no more than $10,000, regardless of whether the taxpayer claims state income or state sales ...

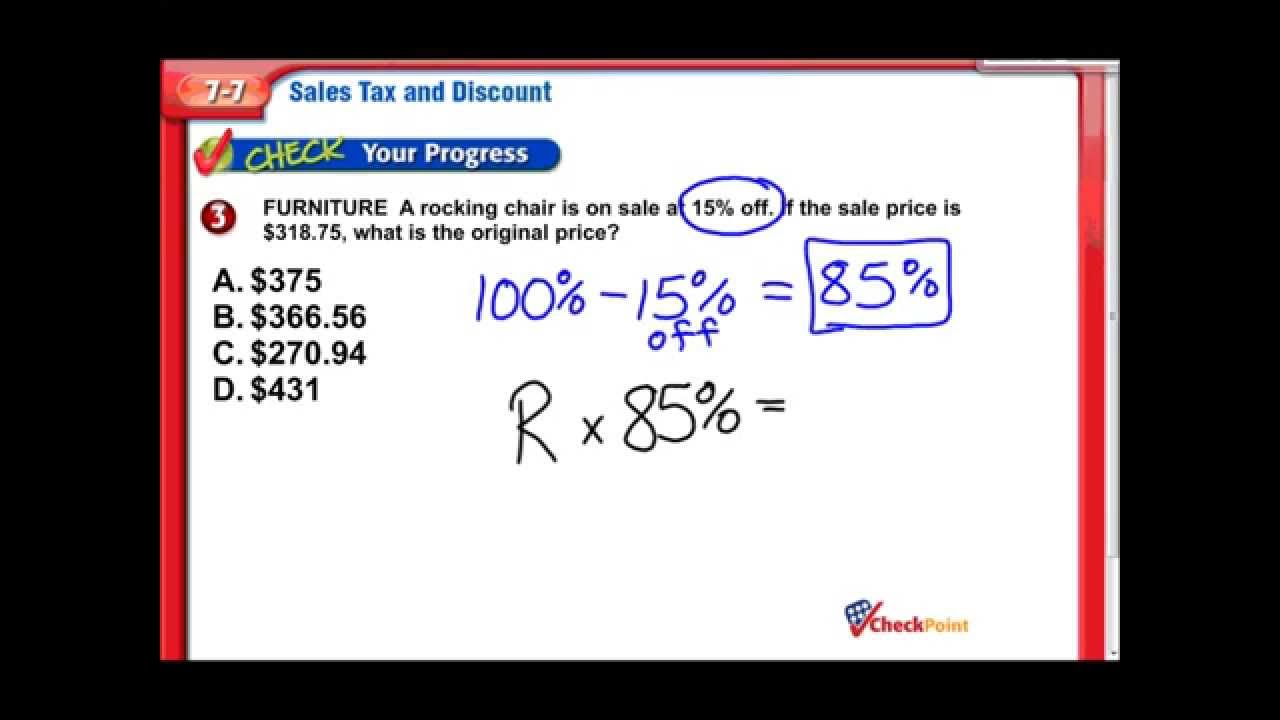

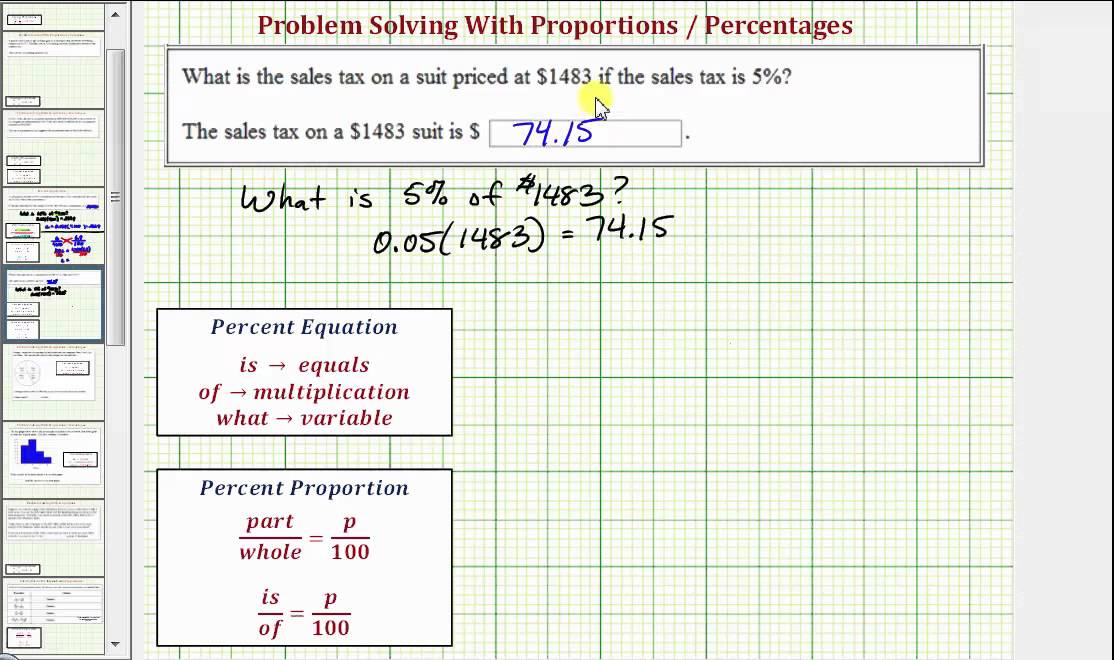

How to Calculate Sales Tax - Video & Lesson Transcript - Study.com The formula for calculating the sales tax is: Selling price x sales tax rate. For example, Melissa has purchased a blouse that has a cost of $50 and the sales tax rate is 7%. In order to calculate ...

How Do I Calculate Estimated Taxes for My Business? You can use the estimated tax calculation worksheet provided by the IRS on Form 1040-ES or using the worksheets included in Publication 505 . Corporations usually use Form 1120-W to calculate their estimated tax. Use tax preparation software to run a rough calculation of estimated taxes for the next year.

Capital Gains Tax Calculation Worksheet - The Balance Then, in the final column, we calculate the gain or loss. The positive gain here is equal to the selling price, minus the buy price, minus the buy commission, minus the sale commission: $1,400 - $1,200 - $25 - $25 = $150 The investor made a profit of $150 on this investment. Now let's move on to a more complicated scenario.

Calculating Penalty and Interest | Minnesota Department of Revenue Use the worksheet to calculate the 2021 interest you owe. We will charge interest on any unpaid tax and penalty after April 18, 2022. The interest rate is determined each year. The interest rate for 2022 is 3%. 1. Tax not paid by April 18, 2022. 1. Tax not paid by April 18, 2022. 1.

Entering local sales tax rates for Schedule A, Line 5 in Lacerte - Intuit Go to Settings > Options and select the Tax Return tab. Select Federal Tax Options from the left section menu. Enter the rate in the Local Sales Tax Rate (.xxxxxx) field. To apply a rate to a single return only: Go to Screen 25, Itemized Deductions (Sch. A). Scroll down to the Taxes section > Optional Tables.

Formulas to include or exclude tax - Excel Exercise To calculate the price including VAT, you just have to add the product price + the VAT amount. =B4+C4 Formula to add the price and the tax You can also calculate the value of your product with tax in a single formula. =75+75*16% =>87 Explanation of the calculation: First, we take the price of the product (75)

Tax Preparation Worksheets - Lake Stevens Tax Service Lake Stevens Tax Service has several worksheets to aid you in the collection and categorization of receips to help with tax prep. Download at LSTAX.com. Call us: (425) 334-8138

Solved: Turbo Tax doesn't calculate tax correctly - Intuit The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all worksheets to see it. For the Desktop version you can switch to Forms Mode and open the worksheet to see it.

Capital Gains Tax Calculator - The TurboTax Blog Check out our free Capital Gains Interactive Calculator, that in just one screen, will answer your burning questions about your stock sales and give you an estimate of how much your stock sales will be taxed and much more.

.gif)

0 Response to "43 calculating sales tax worksheet"

Post a Comment