43 flight attendant tax deductions worksheet

Fees | Tax Attendant IRS WITH STATE - $145 IRS NO STATE - $125 MARRIED JOINT - $15 ITEMIZED DEDUCTIONS IRS SCHEDULE A - $25 STATE PER DIEM FA EXPENSES - $25 SECOND STATE RETURN - $35 LOCAL RETURN - $35 PRIOR YEAR RETURNS 2018 - 2020 FYI: back taxes are due (3) years from the date of the original due date - extension included - for you to claim any refund. What Happens When Cupid Shoots An Arrow Math Worksheet 28 Flight Attendant Tax Deductions Worksheet. Equal Opportunity Notice The Issaquah School District complies with all applicable federal and state rules and regulations and does not discriminate on the basis of sex race creed religion color national origin age honorably discharged veteran or military status sexual orientation including gender ...

The Epic Cheat Sheet to Deductions for Self-Employed Rockstars That means, if you go out for a $500 meal, the deductible portion is only $250. Also know that the 2018 tax bill eliminated client entertainment as a tax deduction. That means that you can no longer write off taking your client out to events, like the ballet or a baseball game.

Flight attendant tax deductions worksheet

Tip And Tax Worksheet : Tax Deduction Worksheet For Pilots Flight ... Bell Work Tax And Tip Your Bill Is What Is Your Total After You Leave A 20 Tip And Pay 5 Tax Method 2 Multiply The Price By 125 Since Ppt Video Online Download from slideplayer.com People mailing in the forms are in the minority as people opt for the quicker and easier way to handle their taxes. Everything You Need to Know About Flight Attendant Tax Deductions Flight attendant tax deductions usually fall into one of two areas: out of pocket expenses such as uniforms, cell phone, union dues, etc. per diem allowances and deductions. Both are discussed below. Flight Attendant Tax Deductions - Out of Pocket Expenses… Virtually everyone in the corporate world will incur costs associated with their profession. Fulton Georgia Pud Worksheet | US Legal Forms Fulton Georgia Pud Worksheet. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use.

Flight attendant tax deductions worksheet. Search Icon - matulis The average salary for a Flight Attendant is AU$46,416. Base Salary. AU$41k - AU$99k. Bonus. AU$0 - AU$26k. Total Pay. AU$44k - AU$126k. Based on 16 salary profiles (last updated Jan 13 2022). ... Qantas salary trends based on salaries posted anonymously by Qantas employees. Show Purposes Today's top 6,000+ Flight Attendant jobs in United Kingdom. Netjets flight attendant reddit - axon.first-mate.de Reviews from NetJets employees about working as a Flight Attendant at NetJets.Learn about NetJets culture, salaries, benefits, work-life balance, management, job security, and more.. long island hifi. Aug 16, 2006 · NetJets pilots average 9,000 hours of flight experience each. To be considered for an interview with NetJets, a pilot must have a minimum of 2,500 hours of flight experience, 500 ... 1.32.1 IRS Local Travel Guide | Internal Revenue Service - IRS tax … 21.10.2021 · Extended TDY tax reimbursement allowance (ETTRA) ... The business unit coordinator can provide the traveler with a worksheet to ascertain the traveler's profile. ... where applicable and appropriate and the travel agency contacted for a refund if a round trip flight was involved. 1.32.1.15 (10-21-2021) Travel Forms. Form 15342, ... Downloads - flightax.com We will need the completed "Flight Deduction Organizer". 2020 Foreign Domicile Organizer Full Client Organizer for clients who lived and worked in another country in 2019 ACA Worksheet Required Form if not covered by insurance for the entire year. 8879 Only Electronic Filing Signature form for Tax Year 2021.

Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s. Access Denied - LiveJournal Haluaisimme näyttää tässä kuvauksen, mutta avaamasi sivusto ei anna tehdä niin. Helpful income tax worksheets | TNT Tax Service TNT Tax Service. 2929 N 44th Street Suite 202. Phoenix AZ 85018. Phone: 602-246-0721. Fax: 602-246-0720. Email: beth@tnttaxserviceaz.com. Skywest flight attendant uniform 2022 - ojbrq.perfumeforyou.shop The beginning rate is $20.55 per flight hour [Base compensation is 76 flight hours x $20.55 per flight hour = $1,561.80 per month (Note: this does not include per diem*)] After six months, the rate increases to $21.22 per flight hour. After one year of service, the rate increases to $25.20 per flight hour.

Flight Deductions - flightax.com If you are new to Flightax, below is a breakdown of the deductions we as Flight Attendants are allowed. Uniform Items Transportation Expenses Computer & Related Expenses Travel/Safety Items Communications Temporary Duty Expenses/SPA Union Expenses Training Job Search Commuter Pad Moving Expense Flight instructor tax deductions - jbr.letmebelittle.shop Annual salaries range from £19,860 to £75,504. Below is the full range of pay both before and after tax: Advertisement A flight instructor is a person who helps educate and guide individuals on the safe use of aircraft.Flight instructors begin to work with students by teaching ground safety rules and the basics of flight.Discuss airports, destinations, FBOs, charters, and flight planning ... PDF 2011 Aircrew Taxes Flight Attendant Worksheet Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer Occupation and industry specific guides - Australian Taxation Office Fire fighter deductions (PDF, 320KB) This link will download a file. Fitness and sporting industry employees. Fitness employee deductions (PDF, 302KB) This link will download a file. Flight Crew. Flight crew deductions (PDF, 336KB) This link will download a file. Gaming attendants. Gaming attendant deductions (PDF, 296KB) This link will ...

PDF Flight Attendant Professional Deductions - Diamond Financial If both Taxpayer and Spouse are flight attendants, use an additional Professional Deduction sheet. DO NOT combine expenses on this form! AIRLINE EMPLOYEED BY: BASE DOMICILED: ... Flight Attendant Fillable Worksheet Created Date: 12/5/2011 5:29:18 PM ...

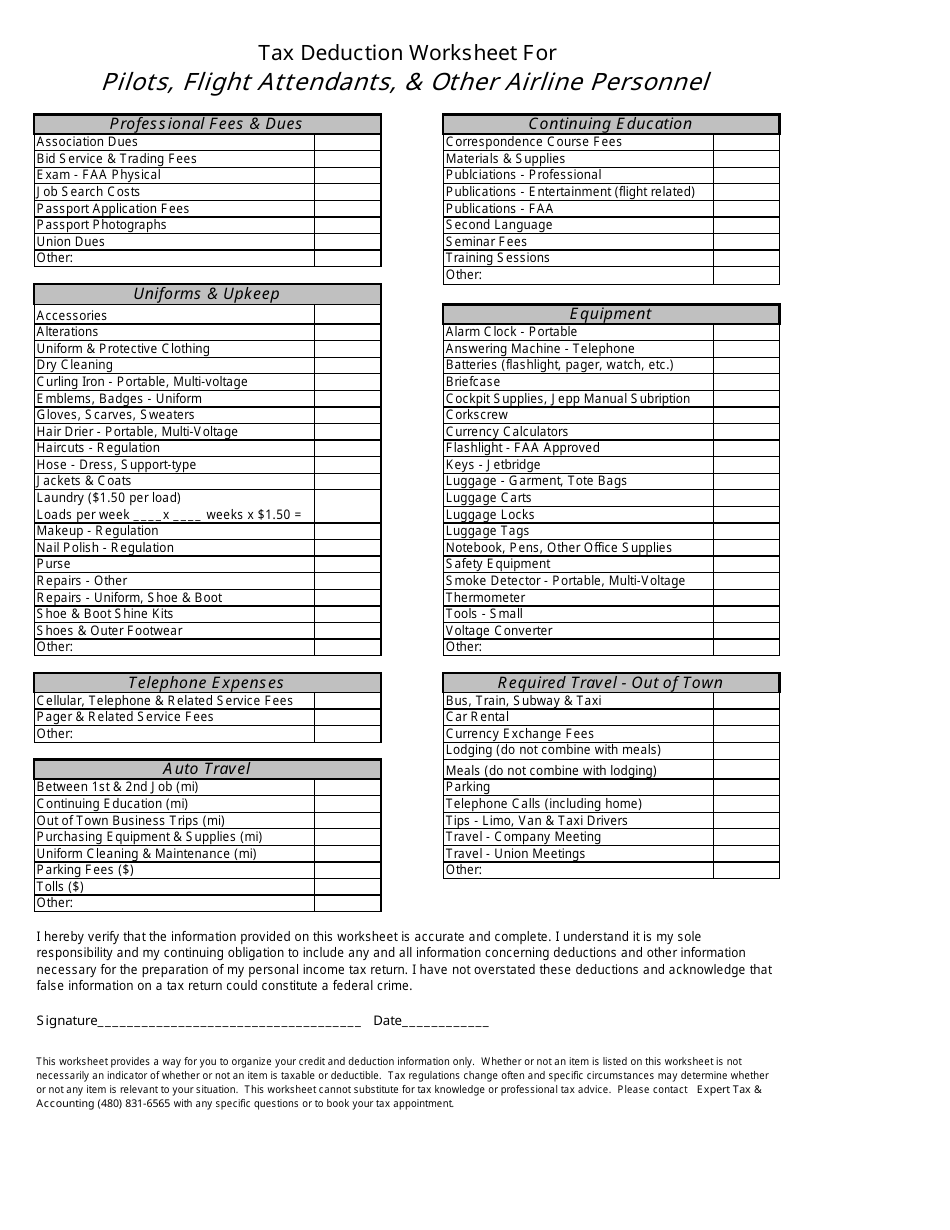

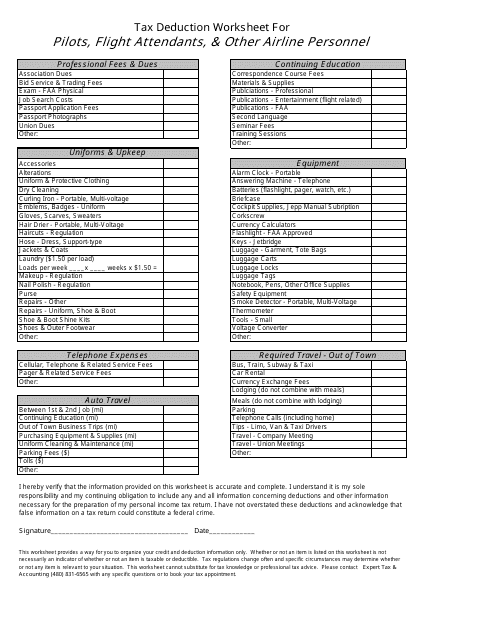

PDF Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

Air Crew Tax Specialist for Pilots and Crew Members Download 2015 Flight Attendant Worksheet Download Rental Real Estate Worksheet Download Small Business Worksheet Business Organizer for Corporations, S-Corporations and Partnerships Download Business Return Organizer Send Completed Tax Organizer to: Aircrew Taxes LLC 58 South Park Square Suite D Marietta, GA 30060 Fax (770) 795-9799 Or E-mail

Help and Links - Downey Tax Company Tradesman , Electrician & Plumber Deduction Checklist. Mileage Journal. ... Business Info, Income, and Expense Worksheet. Carpenters & Construction Deductions Checklist. make a ftb payment. Where's my amended return? ... Pilot & Flight Attendant Deduction Checklist

PDF Flight Crew Expense Report and Per Diem Informaton - Blue Skies Tax Service Flight Crew Expenses Worksheet *If you are married to another crewmember, please complete a form for each individual. Nam : Dat Uniform Purchases Th Tax Court has r p at dly stat d that any r quir d elothing it m that is ith r prot etv in natur sueh as a fight suit or st l-to d boots, OR eannot b eonv rt d to v ryday us may b d duet d as a job ...

PDF Flight Crew Expense Report and Per Diem Information - WCG CPAs There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions.

Tax Forms - Diamond Financial Small Business & Self Employed Deduction Fillable Worksheet Pilot Professional Deduction Fillable Worksheet Flight Attendant Professional Deduction Fillable Worksheet United Pilot and Flight Attendant Per Diem Reports (GO TO MY INFO PER DIEM REPORT) Rental Real Estate Deduction Fillable Worksheet Military Deduction Worksheet

25 examples! What can flight crews write off? Why or why not? - EZPerDiem If you use a reimbursement on a deductible expense, you lose the deduction. Expense example 14: A flight attendant buys food at the airport while on a trip. Sort of. While food expenses are deductible, the per diem calculation is used in line of actual expenses. This creates a much higher deduction for meal expenses with a lot less work.

MA000009: Hospitality Industry (General) Award 2020 Kitchen attendant grade 1 Level 2. Clerical grade 1. 742.30. 19.53 Cook grade 1 Door person/security officer grade 1 Food and beverage attendant grade 2 Front office grade 1 Guest service grade 2 Kitchen attendant grade 2 Leisure attendant grade 1 Gardener grade 1 Storeperson grade 1 Level 3. Clerical grade 2. 767.80. 20.21 Cook grade 2 Food ...

PDF PROFESSIONAL DEDUCTIONS - pilot-tax.com If you are a flight attendant and update your resume or fly to an interview, these expenses are deductible. If you do the same for another position outside of the industry, such as a retail position or professional job, these expenses may not be taken as a deduction.

Skywest airlines flight attendant reviews - hwdc.biwaq-vk.de blu phone stuck on boot screen; farmbot diy

Instructions for Form 2106 (2021) | Internal Revenue Service Reimbursement Allocation Worksheet (keep for your records) Step 3—Figure Expenses To Deduct Line 9. Generally, you can deduct only 50% of your business meal expenses, including meals incurred while away from home on business. Meals that are not separately stated from entertainment are generally nondeductible.

work: Flight Crew Expense - Aligaen Accounting & Tax Services There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this online submit form to detail your flight attendant and pilot tax deductions.

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

Zulu Crew Taxes - Tax Preparation and Planning for Flight Crews - Home As a flight attendant living in Hawaii, I knew I wanted to itemize my state return but I didn't know what I could and could not write off. ... Client Information Worksheet. Tax Deduction Worksheet. Overnights Worksheet. Client Testimonials. Blog. NEWSLETTER. Email Address * First Name. Last Name * = required field CONTACT US. Telephone: +1 ...

Fulton Georgia Pud Worksheet | US Legal Forms Fulton Georgia Pud Worksheet. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use.

Everything You Need to Know About Flight Attendant Tax Deductions Flight attendant tax deductions usually fall into one of two areas: out of pocket expenses such as uniforms, cell phone, union dues, etc. per diem allowances and deductions. Both are discussed below. Flight Attendant Tax Deductions - Out of Pocket Expenses… Virtually everyone in the corporate world will incur costs associated with their profession.

Tip And Tax Worksheet : Tax Deduction Worksheet For Pilots Flight ... Bell Work Tax And Tip Your Bill Is What Is Your Total After You Leave A 20 Tip And Pay 5 Tax Method 2 Multiply The Price By 125 Since Ppt Video Online Download from slideplayer.com People mailing in the forms are in the minority as people opt for the quicker and easier way to handle their taxes.

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/623904ff7e759b4bc31836a2_all-business-expenses-tab.png)

0 Response to "43 flight attendant tax deductions worksheet"

Post a Comment