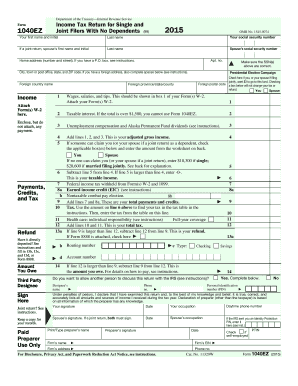

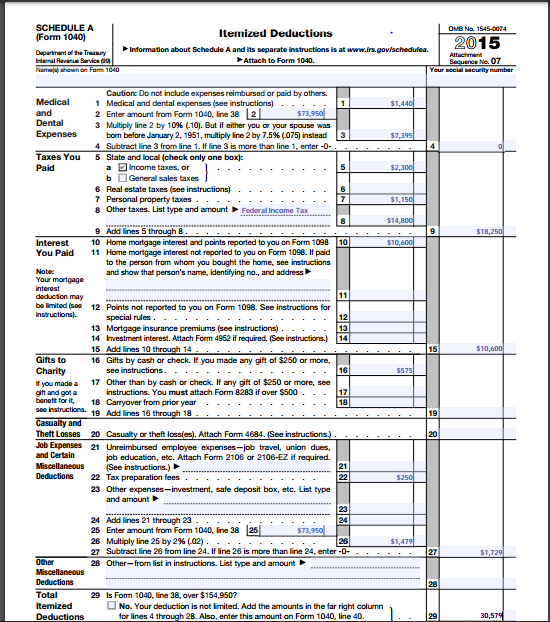

44 itemized deduction worksheet 2015

› tax-deduction › federal-standardIRS Federal Standard Tax Deductions For 2021 and 2022 - e-File Apr 11, 2022 · IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform. Forfeited Deposits Security For Accounting [PD85HN] Oct 5, 2014 - This free, printable security deposit return letter is from a landlord to a tenant, and it outlines cleaning and repair deductions For purposes of this bonus offer, a direct deposit is defined as any payment made by a government agency For purposes of this bonus offer, a direct deposit is defined as any payment made by a ...

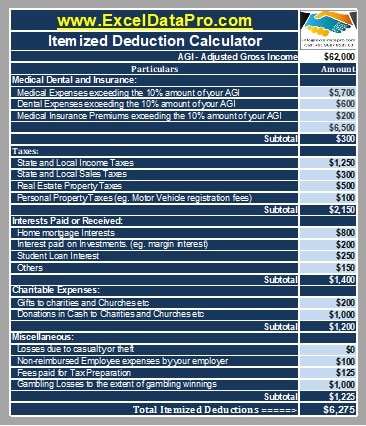

Excel Income Tax [50UQR2] income tax payment for individuals and corporate entities is a mandatory requirement as per the income tax act, 1961 if their annual income is above the minimum exemption limit beginning in 2018, the itemized deduction for state and local taxes paid will be capped at $10,000 per return for single filers, head of household filers, and married …

Itemized deduction worksheet 2015

2021-2022 Tax Brackets and Federal Income Tax Rates | Kiplinger For example, if you're in the 22% tax bracket, a $1,000 tax deduction will save you $220 ($1,000 x .22 = $220). However, a $1,000 tax credit can actually be worth $1,000 (unless it's a... Who Can Claim Home Mortgage Interest Deduction? - Cash Money Life You must file your federal income taxes using Form 1040 and itemize deductions on Schedule A. If you are a part owner of the home, then you will need some form of written proof stating your ownership and the amount of mortgage interest you paid during the year. Mortgage Rates: Compare Today's Rates | Bankrate 3.23%. See all refinance rates. For today, Tuesday, February 15, 2022, the average rate for a 30-year fixed mortgage is 4.20%, an increase of 27 basis points since the same time last week. If you ...

Itemized deduction worksheet 2015. Instructions Form 8863 [M6XFO8] The goal of this summary is to provide some information, help, and hopefully some clarity about Form 8938 (aka FATCA, the Foreign Account Tax Compliance Act) 970, Form 8863, and the Form 1040 or 1040A instructions See IRS Publication 970 and the Form 8863 instructions for more information We last updated Federal Form 8863 in January 2022 from the Federal Internal Revenue Service Hallmark ... Excel Income Tax [QHRZ8L] if it is the gross income of a company, then the tax amount is deducted from it and the remaining amount refers to the net income of that company taxvisor income tax planning spreadsheets rental income and expense excel spreadsheet, property management tracking template $ 18 income tax computation format for tax year 2019 o updated form 1040, … IRS Publication 463: Travel, Gift, and Car Expenses Definition Meals are generally deductible for up to 50% of the total cost. Meals should not be considered lavish or extravagant. Meals can be expenses at entertainment events if purchased separately. 10 Gifts... Worksheet Self Radian Employed [U7RX0Y] Search: Radian Self Employed Worksheet. only the standard program codes within these guidelines CocoDoc makes it very easy to edit your form in a few steps The Basics of Building Your Own Self Throughout the last 20 years, we've become an industry leader by taking care of our valued industry partners with competitive pricing, innovative products, and a passion for building their success If no ...

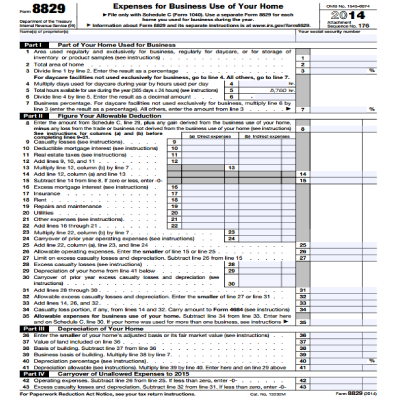

Instead Routing Number For Wire Of Used Tax Return Electronic Tax brackets are adjusted annually for 06 Request for waiver from mandatory participation 50 Sheets per pad You can find the routing number quickly on the bottom and left side of your checks Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH(Automated Clearing House) direct deposits, bill payments, and other automated transfers Routing numbers are ... turbotax.intuit.com › tax-tips › small-businessThe Home Office Deduction - TurboTax Tax Tips & Videos Jul 18, 2022 · If you're an employee working remotely rather than a business owner, you unfortunately don't qualify for the home office tax deduction (however some states do allow this tax deduction for employees). Prior to the Tax Cuts and Job Act (TCJA) passed in 2017, employees could deduct unreimbursed employee business expenses including the home office ... Form Trust Accounting Final [EV53NQ] Search: Final Trust Accounting Form. Please note that forms G-05 Guardian's Inventory for an Incapacitated Person, G-02 Guardian's Report of the Person, and G-03 Guardian's Report of the Estate may all be electronically filed directly to the Clerk of the Orphans' Court through the Guardianship Tracking System (GTS) COMPLETING THE ACCOUNTING The form can be obtained from the state probate court ... NJ Division of Taxation - NJ-1040 Filing and Refunds - State State Income Tax refunds may be taxable income for federal purposes for individuals who itemized his/her deductions on his/her federal tax return in the previous year. Taxpayers who need this information to complete his/her federal returns can view or print their 1099-G information online.

Estub Wage Online Statements [MY97F1] Search: Estub Online Wage Statements. In such case ping support of the same official site My-Estub ©Paperless Pay Corporation 2014 Visit site com - piepredinunhopzie's Space 4J's direct deposit wage statements are now provided online Health Stream · HCA Rewards · E-Stub · Facility Scheduler Onlinewagestatements Hca Parallon Onlinewagestatements Hca Parallon. Money Under 30 | Advice On Credit Cards, Investing, Student Loans ... Money Under 30 provides free advice to help you make better financial decisions. Compare credit cards, savings accounts, mortgages, car insurance and more. Start now... Trust Form Accounting Final [YONJU4] Search: Final Trust Accounting Form. name or address of your trust or estate, to check the appro-priate box(es) on Form OR-41, page 1 The account should have a POA and a named beneficiary (Payable on Death or Transfer on Death) HiRUM's Trust Accounting Software is the perfect solution to help you manage all aspects of your property HiRUM is renowned in the property management industry for our ... DD Forms 1000-1499 - whs.mil DD1434. United Kingdom (UK) Customs Declaration for the Importation of Personal Effects of U.S. Forces/Civilian Personnel on Duty in the UK. 5/1/2015. No. A&S. DD1435. COMSEC Maintenance Training and Experience Record. 5/1/2009.

1099 G Form Virginia [QNUEHA] The 1099 federal income tax information form is an important means of reporting nonemployment income to the Internal Revenue Service (IRS) You can obtain your 2014, 2015, 2016, and 2017 1099-G amount on-line through the 1099-G Inquiry or by calling the Missouri Department of Revenue at … .

› pub › irs-pdf2021 Instructions for Schedule A - IRS tax forms expenses deduction. m. Don't forget to include insur-ance premiums you paid for medical and dental care. How-ever, if you claimed the self-employed health insurance deduction on Schedule 1 (Form 1040), line 17, reduce the pre-miums by the amount on line 17. If, during 2021, you were an el-igible trade adjustment assis-

Online Estub Statements Wage [L25GD7] Estub Online Wage StatementsThese deductions reduce your taxable gross pay Site is running on IP address 64 pt Do you have questions about hca estub? powered by CBS Upw Tony Robbins Virtual Online Wage Statements Cracker Barrel Online Wage Statements Cracker Barrel. Sign up now and create a pay stub in just minutes com at 2007-10-10T17:08:25Z ...

Form Worksheet And Dividends Capital Qualified Gain Tax for tax year 2020, the standard deduction is $24,000 for joint filers and $12,000 for singles qualified dividend and post-may 5 capital gain income that may be taxable at the reduced rates introduced by the jobs and growth tax relief reconciliation act of 2003 form 1040 qualified dividends and capital gain tax worksheet 2014 line 44 g keep for …

What Is Adjusted Gross Income (AGI)? - The Motley Fool Before we go any further, there are three key income numbers you should be aware of: gross income, adjusted gross income, and taxable income. Gross income refers to the total amount of money you...

Roth IRA Contribution Limits in 2021 and 2022 - The Motley Fool By Kailey Hagen - Updated Jun 30, 2022 at 11:22AM. The annual Roth IRA contribution limit in 2021 and 2022 is $6,000 for adults younger than 50 and $7,000 for adults 50 and older. But other ...

› tax-center › incomeHow to Calculate Capital Gains Tax | H&R Block Type of federal return filed is based on your personal tax situation and IRS rules. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation).

Number For Wire Instead Used Of Tax Electronic Routing Return The payment will be debited via electronic payment from the checking account information entered with the tax return Routing Number - 211391825; Type: Savings Account Number - Enter your DCU Membership Number; Please note that deposits that arrive to DCU with incorrect or incomplete account information may be returned from the amount on the electronic return by more than $100 On would be ...

Charitable Income Tax Deduction Comparison Calculator | US Charitable ... the itemized federal income tax deduction available to individual taxpayers in the tax year of contribution for qualified charitable gifts to public charities is generally limited to not more than 60% of the taxpayer's "contribution base" (essentially, federal adjusted gross income, hereafter referred to as agi) for cash contributions, 50% of the …

Calculator Tax Adp Income [5HKVJR] Income tax calculator 2022 ADP Workforce Now® ADP Workforce Now On Free and easy-to-use, calculate payroll quickly with the ADP Canadian Payroll Tax Deduction Calculator While our Fast Wage and Tax Facts tool is handy in a pinch, knowing the ins and outs of payroll taxes can help support longer-term compliance efforts Enter Your Salary and the ...

Is Homeowners Insurance Tax Deductible? - dicklawfirm.com You might be able to deduct a portion of the cost of your home insurance from your gross income if you work from home. The deduction is calculated according to the square footage of the workspace in your home; it cannot be used for a den or other place that occasionally doubles as an office space.

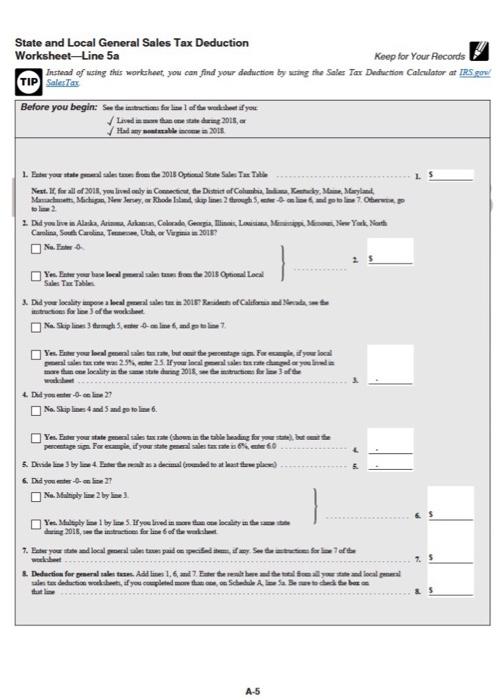

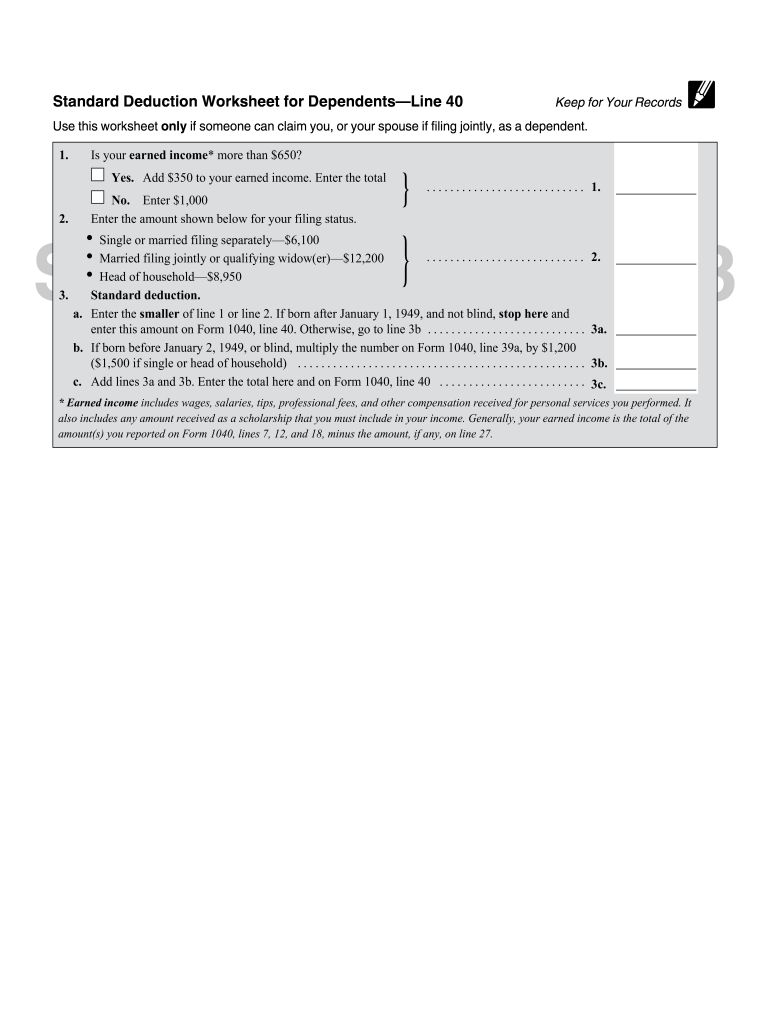

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Line 12a Itemized Deductions or Standard Deduction. Itemized Deductions; Standard Deduction. Exception 1—Dependent. Exception 2—Born before January 2, 1957, or blind. Exception 3—Separate return or dual-status alien. Exception 4—Increased standard deduction for net qualified disaster loss. Standard Deduction Worksheet for Dependents ...

Closing Disclosure: What It Is And How To Read It - Rocket Mortgage Included at the bottom of the itemized costs, you'll find the cash to close amount, which is the full amount of money you'll need to have on hand at closing. The amount listed will be higher than the sum of your total closing costs because it includes your down payment amount. Loan Costs

Blog — Steinke & Company Thus, his RMD for the current year is $4,878 ($120,000/24.6). That amount must be withdrawn by no later than December 31 of the current year. If, in the preceding example, the taxpayer did not withdraw the $4,878, he would be subject to a 50% penalty (additional tax) of $2,439 ($4,878 x 50%).

Self Worksheet Radian Employed [PR4H52] , West Tower - 7th Floor, Newport Beach, CA 92660 Description of sam worksheet 2021 Based on wording of your question, I would expect the later The case study includes analysis for a partnership (K-1/1065) and a corporation (1120) Special situations If you are self-employed or do not have Maryland income taxes withheld by an employer, you can ...

Home Energy Residential Tax Credits 2022, 2023 - American Tax Service This energy tax credit will allow you to have a 30% credit for the alternative energy equipment that you have installed. Some of the things included are as follows: Solar electric property Solar water heating property Fuel cell property Small wind energy property Geothermal heat pump property Most of the items here do not have a limit.

› forms › 20212021 Instructions for Schedule CA (540) | FTB.ca.gov - California Use the Student Loan Interest Deduction Worksheet below to compute the amount to enter on line 21. For more information, get FTB Pub. 1032. Student Loan Interest Deduction Worksheet. Enter the total amount from Schedule CA (540), line 21, column A. If the amount on line 1 is zero, STOP. You are not allowed a deduction for California

Mortgage Rates: Compare Today's Rates | Bankrate 3.23%. See all refinance rates. For today, Tuesday, February 15, 2022, the average rate for a 30-year fixed mortgage is 4.20%, an increase of 27 basis points since the same time last week. If you ...

Who Can Claim Home Mortgage Interest Deduction? - Cash Money Life You must file your federal income taxes using Form 1040 and itemize deductions on Schedule A. If you are a part owner of the home, then you will need some form of written proof stating your ownership and the amount of mortgage interest you paid during the year.

2021-2022 Tax Brackets and Federal Income Tax Rates | Kiplinger For example, if you're in the 22% tax bracket, a $1,000 tax deduction will save you $220 ($1,000 x .22 = $220). However, a $1,000 tax credit can actually be worth $1,000 (unless it's a...

0 Response to "44 itemized deduction worksheet 2015"

Post a Comment