38 dave ramsey student budget worksheet answers

How to Improve Your Credit Score Fast - Experian However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well. How to Make a Will - Ramsey - Ramsey Solutions 24/10/2022 · 6. Sign your will in front of witnesses. This is the important bit! A written will is not valid in most states unless it’s signed and dated by the one who’s writing the will (yep, that’s you) and two witnesses. Surely you have two friends willing to watch you sign a piece of paper.

Tools and Resources - Ramsey See Ramsey’s latest apps, calculators, guides, books and more to help you get out of debt, save money, and build wealth.

Dave ramsey student budget worksheet answers

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; How to Plan for Retirement - Ramsey - Ramsey Solutions 22/12/2021 · So, make sure to factor in LTC insurance as you estimate your retirement budget. It’s a necessity! Also, until you’re self-insured, term life insurance needs to be part of your plan to cover those who depend on you. Step 4: Work With a Financial Advisor or Investment Professional. Investing isn’t a solo activity. You need someone who can ... View SFL_260_ - gofj.tischlerei-vechelde.de View SFL_260_Dave_Ramsey_on_Budgeting_Transcript.pdf from SFL 260 at Brigham Young University. SFL 260: Dave Ramsey on Budgeting Transcript [00:00:00] When you do a written budget, on paper, on. 1.0 out of 5 stars Not the full program - Call Dave Ramsey 's Military team if you want to purchase Reviewed in the United States on April 2, 2015 This is only a preview …

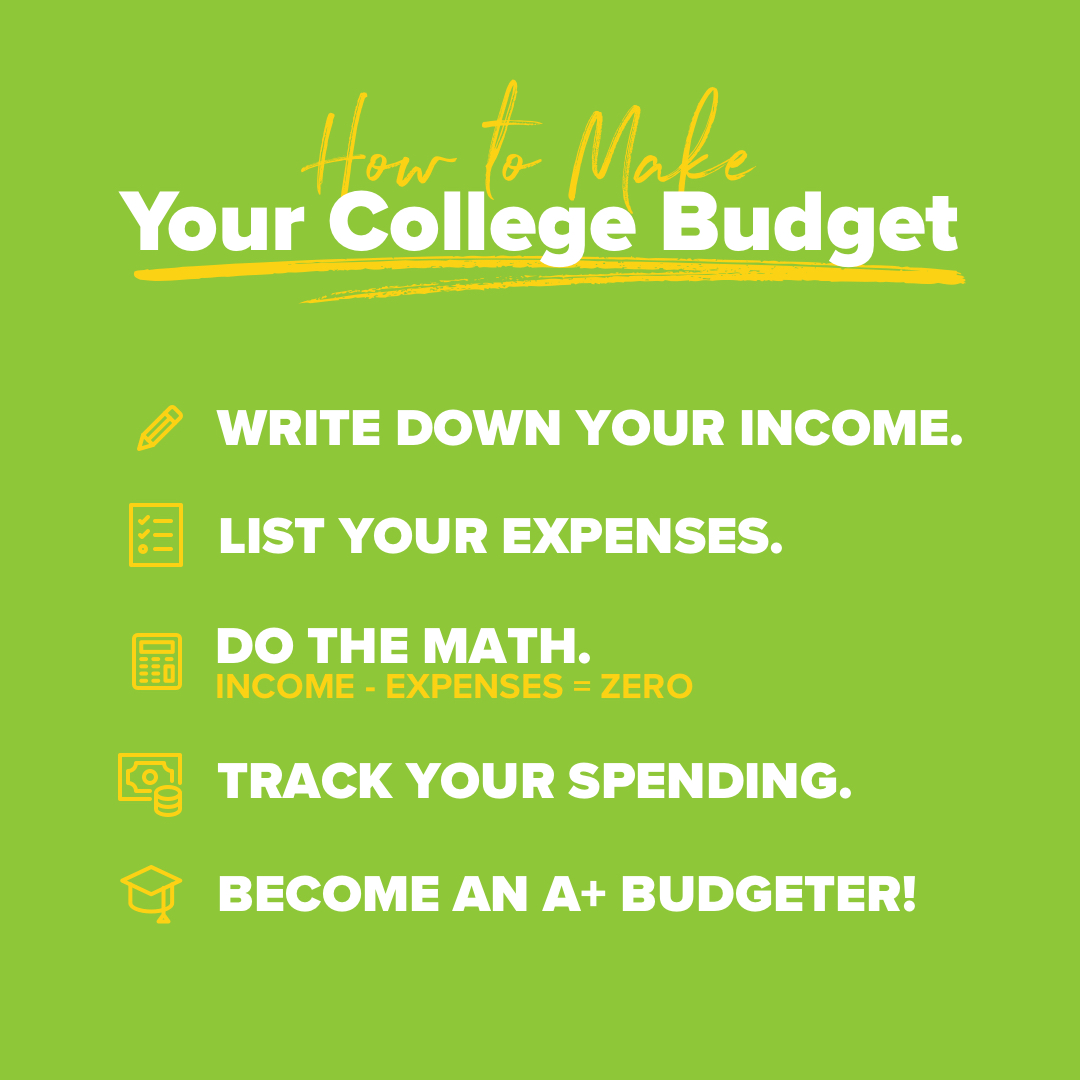

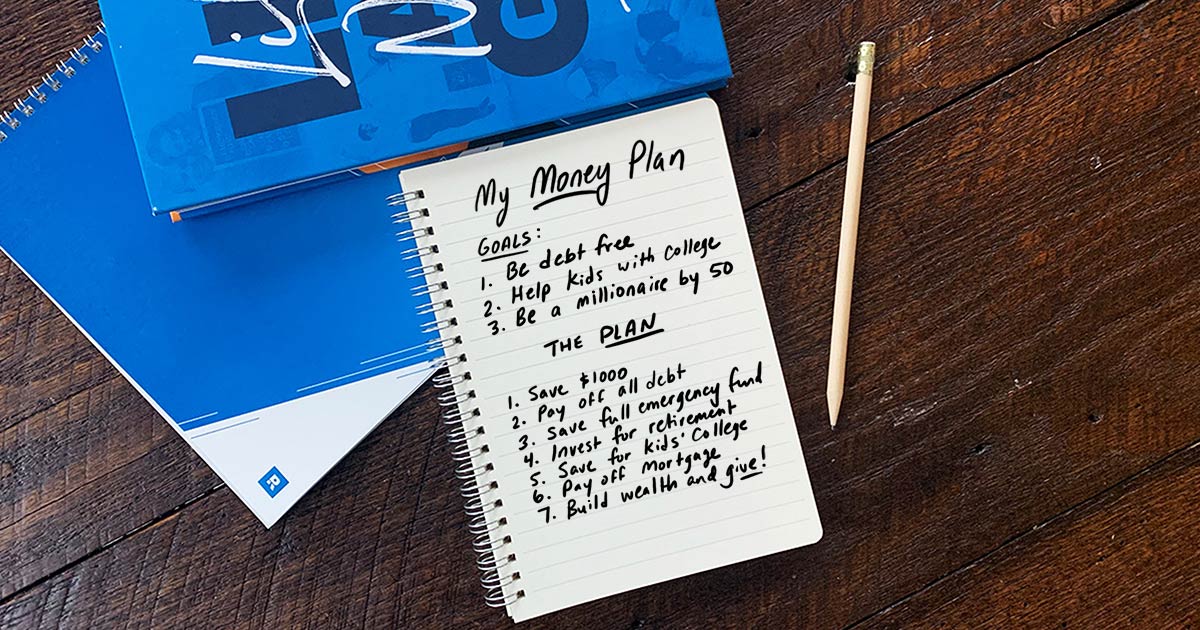

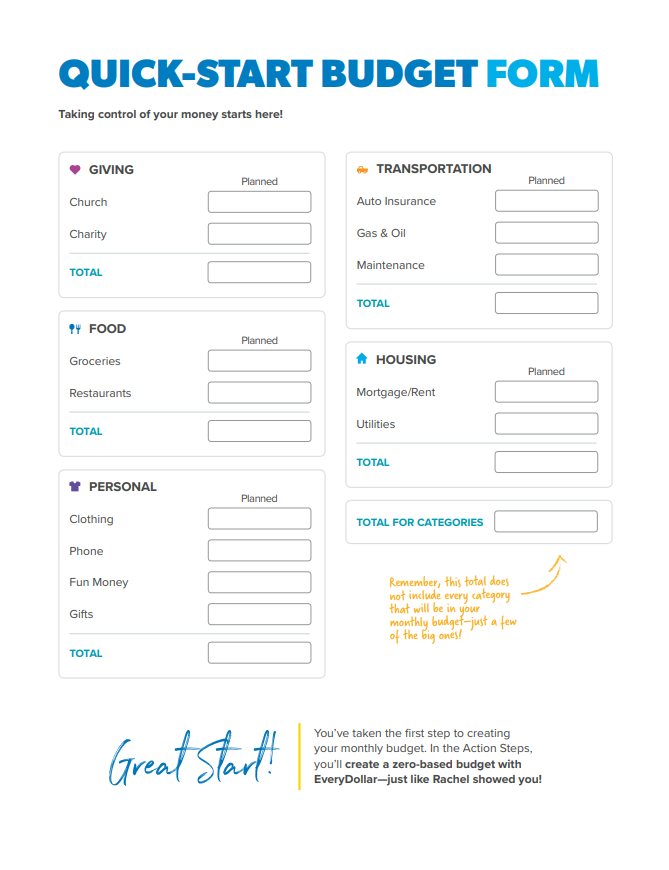

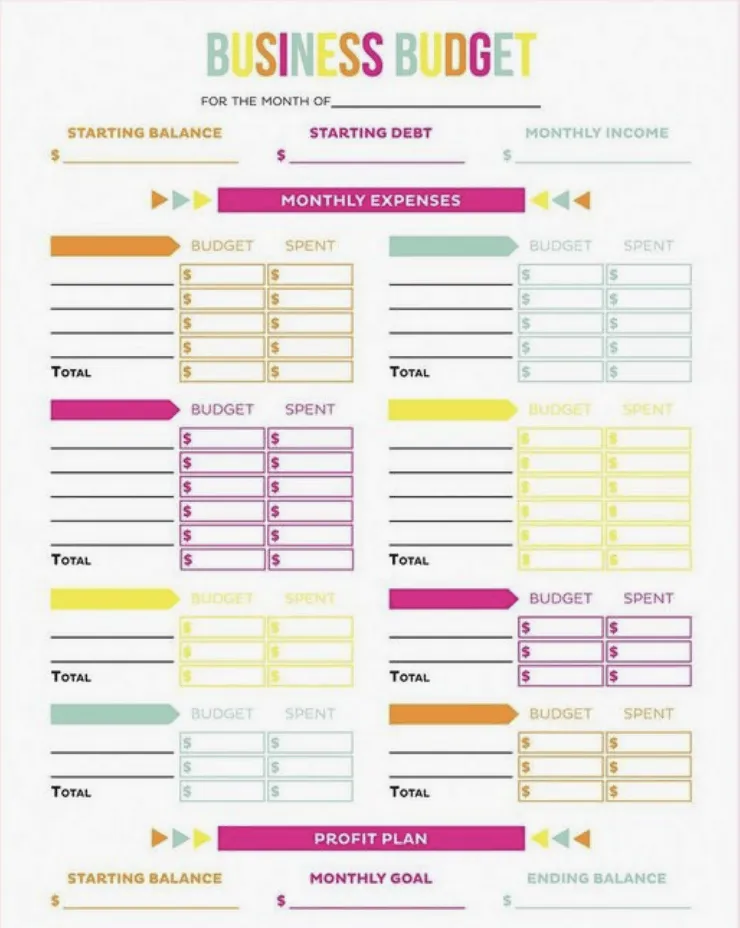

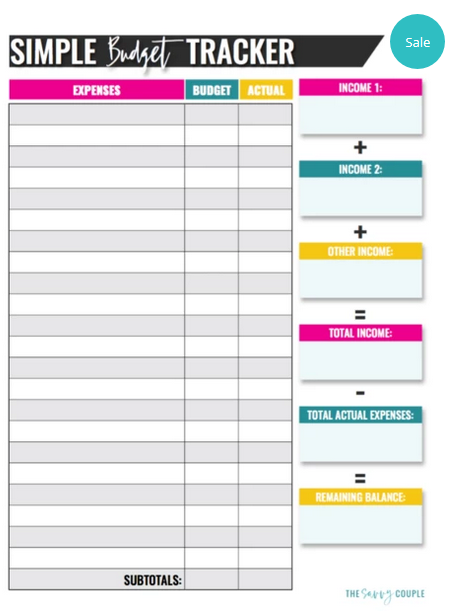

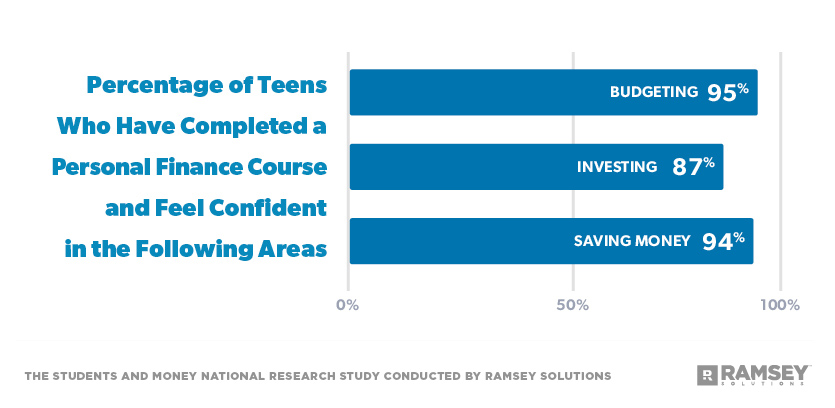

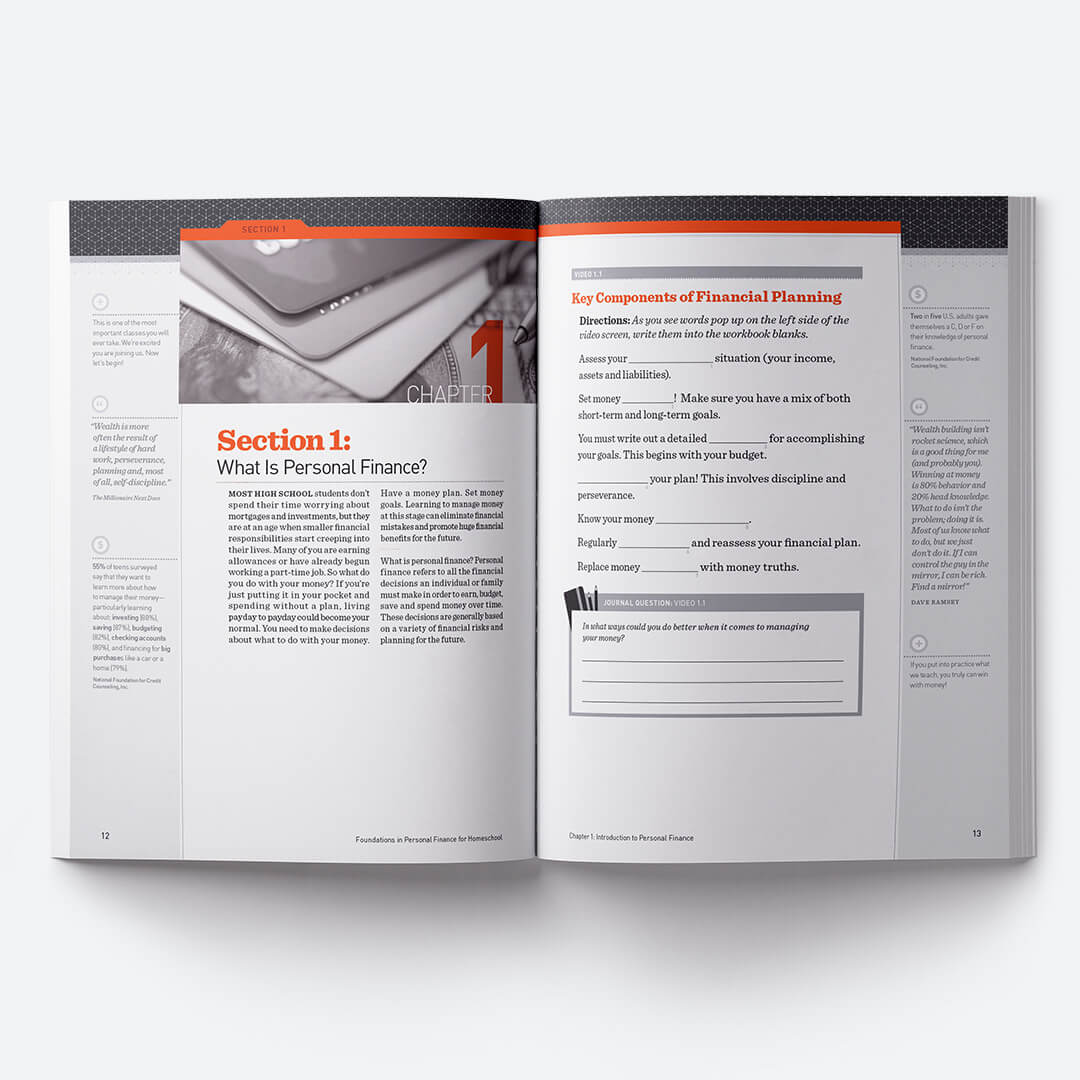

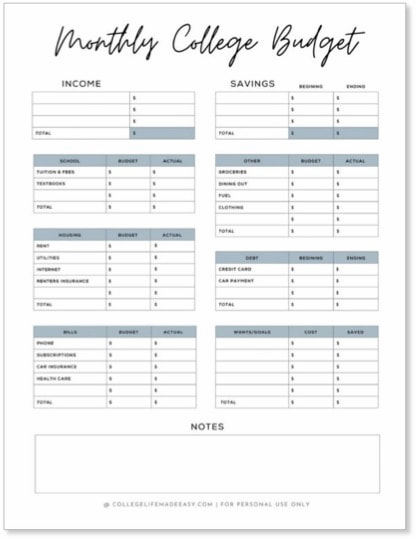

Dave ramsey student budget worksheet answers. How to Budget - Ramsey - Ramsey Solutions A budget is a plan for how you’re going to spend your money. It puts you in charge and in control of every dollar that you earn or spend. Dave recommends telling every dollar where it should go—before the month begins—using a zero-based budget. This means that your income minus your expenses equals zero. Useful Forms - Ramsey Dave Ramsey Rachel Cruze ... Planning is the secret to a college education without student loans. This form helps you determine how much you'll need to plan. Download Irregular Income Planning Many of us have irregular incomes. If you're self-employed or work on commission, this form will help you plan for your expenses. Download Recommended Percentages How much do you … Foundations in Personal Finance College Edition - Ramsey EveryDollar Budget App ... Dave Ramsey Rachel Cruze Ken Coleman ... College Edition curriculum including videos, student textbook and lesson plans! Download Samples "Foundations is so practical. Students are not going to forget what they learn in this class. This is stuff they can use right now." Dr. Christi Wann, UC Foundation Professor of Finance, University of Tennessee at … The 50/30/20 Budget Rule Explained With Examples - Investopedia Sep 17, 2022 · The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt ...

View SFL_260_ - gofj.tischlerei-vechelde.de View SFL_260_Dave_Ramsey_on_Budgeting_Transcript.pdf from SFL 260 at Brigham Young University. SFL 260: Dave Ramsey on Budgeting Transcript [00:00:00] When you do a written budget, on paper, on. 1.0 out of 5 stars Not the full program - Call Dave Ramsey 's Military team if you want to purchase Reviewed in the United States on April 2, 2015 This is only a preview … How to Plan for Retirement - Ramsey - Ramsey Solutions 22/12/2021 · So, make sure to factor in LTC insurance as you estimate your retirement budget. It’s a necessity! Also, until you’re self-insured, term life insurance needs to be part of your plan to cover those who depend on you. Step 4: Work With a Financial Advisor or Investment Professional. Investing isn’t a solo activity. You need someone who can ... Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

![Dave Ramsey's Household Budget Percentages [2022 Edition]](https://cdn-alkia.nitrocdn.com/pYhxgXnSfZKoVDcmKIiZcCHPcRVbhqvl/assets/static/optimized/rev-01a21f9/wp-content/uploads/2019/10/Dave-Ramsey-Household-Budget-Percentages-800x400.jpg)

![Dave Ramsey's Household Budget Percentages [2022 Edition]](https://cdn-alkia.nitrocdn.com/pYhxgXnSfZKoVDcmKIiZcCHPcRVbhqvl/assets/static/optimized/rev-01a21f9/wp-content/uploads/2022/10/dave-ramseys-percentages-480x720.jpg)

0 Response to "38 dave ramsey student budget worksheet answers"

Post a Comment