40 clergy tax deductions worksheet

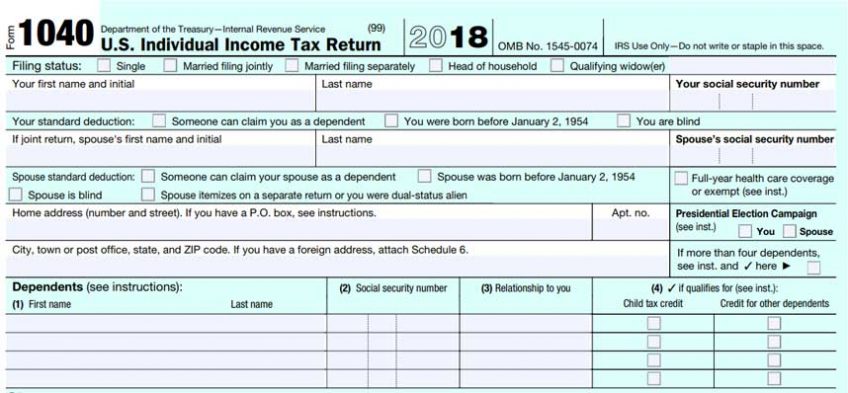

› publications › p571Publication 571 (01/2022), Tax-Sheltered Annuity Plans (403(b ... Retirement income accounts. Division O, section 111 of P.L. 116-94 clarifies that employees described in section 414(e)(3)(B) (which include ministers, employees of a tax-exempt church-controlled organization (including a nonqualified church-controlled organization), and employees who are included in a church plan under certain circumstances after separation from the service of a church) can ... › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Form 1040 and 1040-SR Helpful Hints. Form 1040 and 1040-SR Helpful Hints. For 2021, you will use Form 1040 or, if you were born before January 2, 1957, you have the option to use Form 1040-SR.

Tax Calculators - Dinkytown.net Clergy Housing Allowance Worksheet: Use this calculator to help determine the amount that a member of the clergy can claim as a housing allowance. Earned Income Credit (EIC) Calculator : Use this calculator to determine if you qualify for the Earned Income Credit and if so, how much it might be worth. Estate Tax Planning Calculator: Knowing your potential estate tax liability is a …

Clergy tax deductions worksheet

› taxtopics › tc417Topic No. 417 Earnings for Clergy | Internal Revenue Service Oct 04, 2022 · See Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers for limited exceptions from self-employment tax. Exemption from Self-Employment Tax You can request an exemption from self-employment tax for your ministerial earnings, if you're opposed to certain public insurance for religious or ... 2020-2021 FAFSA on the Web Worksheet, English FAFSA on the Web Worksheet provides a preview of the questions that you may be asked while completing the Free Application for Federal Student Aid (FAFSA ®) online at . fafsa.gov . or via the myStudentAid mobile app. You must complete and submit a FAFSA form to apply for federal student aid and for most state and college aid. Write down notes to help you easily complete … › products_ttTaxTools - CFS Tax Software, Inc. - Software for Tax ... Small Business Health Care Tax Credit Worksheet; Social Security: Take It at Age 62 or Later? Social Security Benefits - Joint Survivor Options; Social Security/RRB Taxability and Lump Sum Wksht; Social Security Optimization; Special Avg for Lump Sum Distrib. Statement of Account; State Sales Tax Ded. Calc. & Comp. to Inc. Tax Ded. Tax Benefit Rule

Clergy tax deductions worksheet. Publication 530 (2021), Tax Information for Homeowners For more information, see Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers, and Pub. 3, Armed Forces' Tax Guide. Nondeductible payments. You can’t deduct any of the following items. Insurance (other than mortgage insurance premiums), including fire and comprehensive coverage, and title insurance. Wages you pay for domestic … › publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Topic No. 417 Earnings for Clergy | Internal Revenue Service 04.10.2022 · Topic No. 417 Earnings for Clergy. A licensed, commissioned, or ordained minister is generally the common law employee of the church, denomination, sect, or organization that employs him or her to provide ministerial services. However, there are some exceptions, such as traveling evangelists who are independent contractors (self-employed) under the common law. … › publications › p54Publication 54 (2021), Tax Guide for U.S. Citizens and ... See the Instructions for Form 1040 and complete the Foreign Earned Income Tax Worksheet to figure the amount of tax to enter on Form 1040 or 1040-SR, line 16. If you must attach Form 6251, Alternative Minimum Tax—Individuals, to your return, use the Foreign Earned Income Tax Worksheet provided in the Instructions for Form 6251.

› pub › irs-pdfWorkers Religious Clergy and and Other - IRS tax forms income that are subject to Medicare tax are subject to a 0.9% Additional Medicare Tax to the extent they exceed the applicable threshold for an individual's filing status. Medicare wages and self-employment income are combined to determine if income exceeds the threshold. A self-employment loss isn't considered for pur-poses of this tax. › products_ttTaxTools - CFS Tax Software, Inc. - Software for Tax ... Small Business Health Care Tax Credit Worksheet; Social Security: Take It at Age 62 or Later? Social Security Benefits - Joint Survivor Options; Social Security/RRB Taxability and Lump Sum Wksht; Social Security Optimization; Special Avg for Lump Sum Distrib. Statement of Account; State Sales Tax Ded. Calc. & Comp. to Inc. Tax Ded. Tax Benefit Rule 2020-2021 FAFSA on the Web Worksheet, English FAFSA on the Web Worksheet provides a preview of the questions that you may be asked while completing the Free Application for Federal Student Aid (FAFSA ®) online at . fafsa.gov . or via the myStudentAid mobile app. You must complete and submit a FAFSA form to apply for federal student aid and for most state and college aid. Write down notes to help you easily complete … › taxtopics › tc417Topic No. 417 Earnings for Clergy | Internal Revenue Service Oct 04, 2022 · See Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers for limited exceptions from self-employment tax. Exemption from Self-Employment Tax You can request an exemption from self-employment tax for your ministerial earnings, if you're opposed to certain public insurance for religious or ...

0 Response to "40 clergy tax deductions worksheet"

Post a Comment