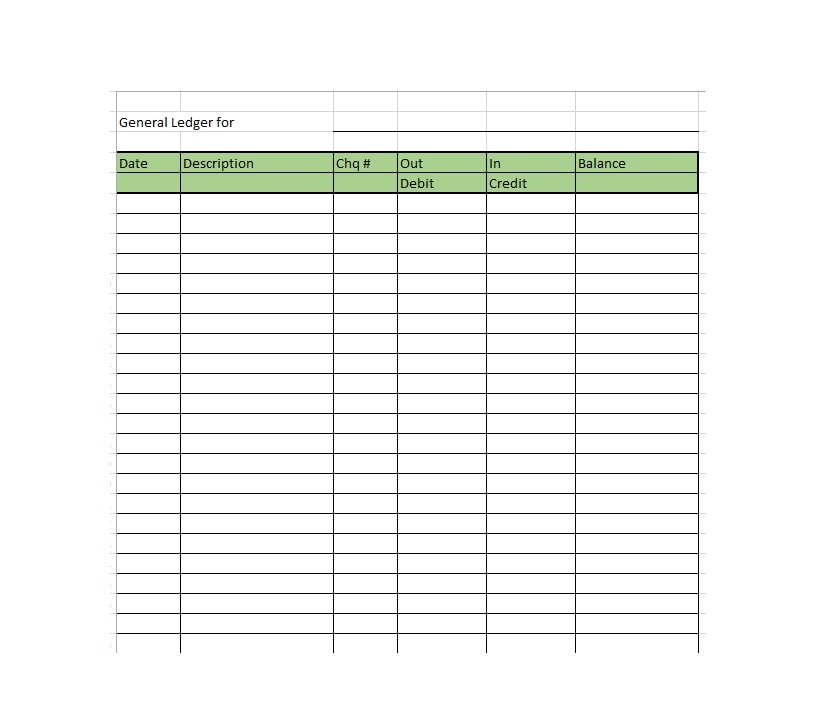

40 self employed expense worksheet

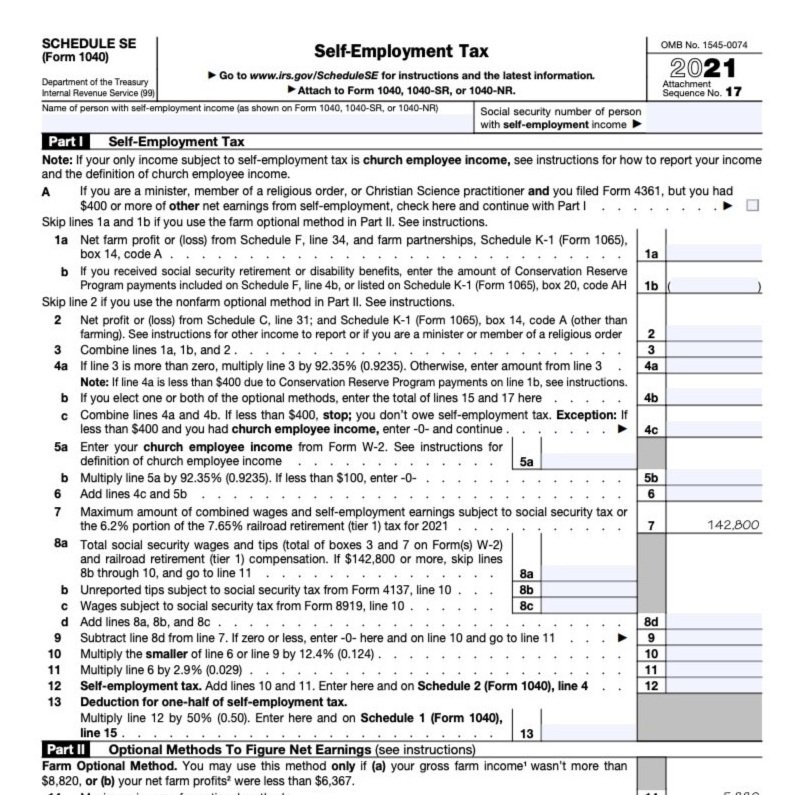

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 17 (2021), Your Federal Income Tax | Internal ... Self-employed individuals. If you are self-employed, your gross income includes the amount on line 7 of Schedule C (Form 1040), Profit or Loss From Business; and line 9 of Schedule F (Form 1040), Profit or Loss From Farming. See Self-Employed Persons, later, for more information about your filing requirements. .

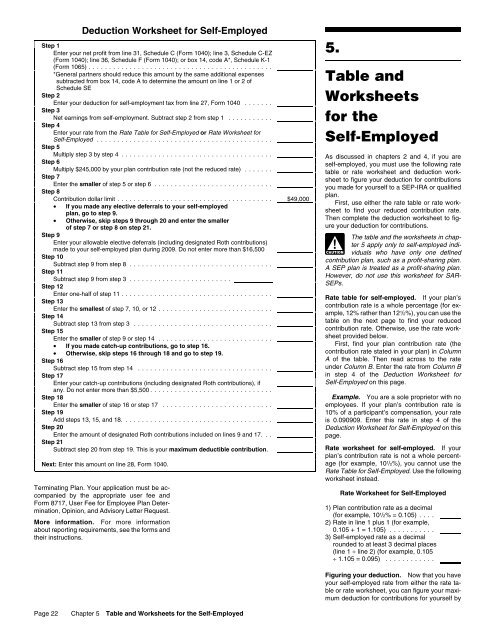

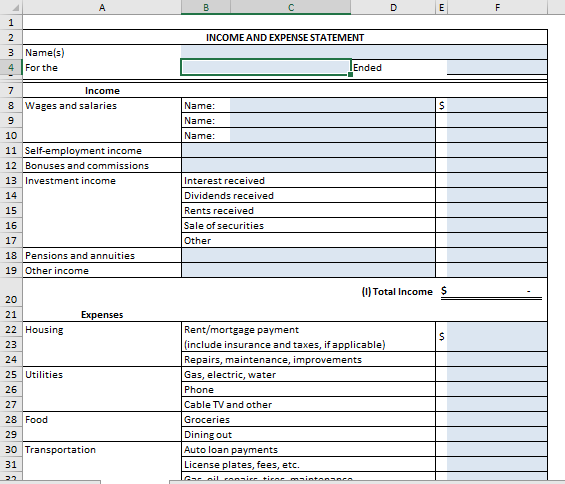

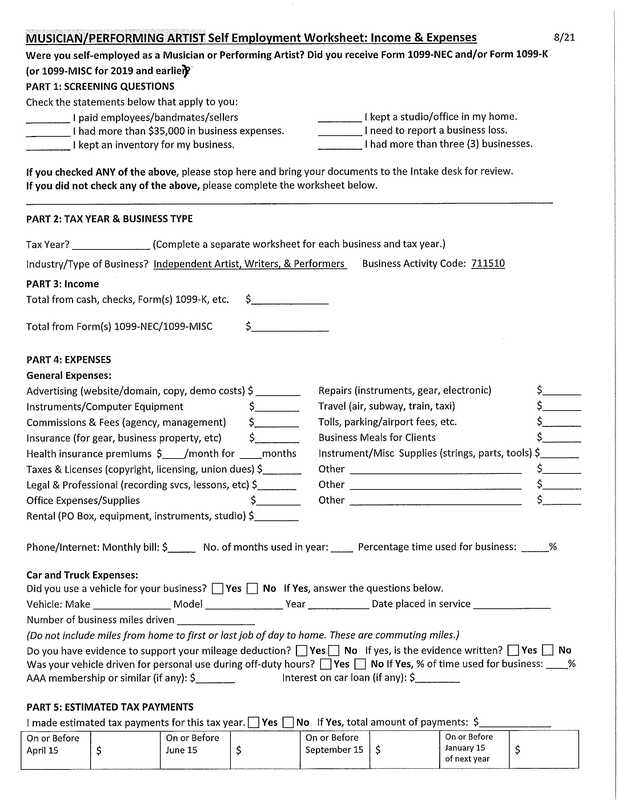

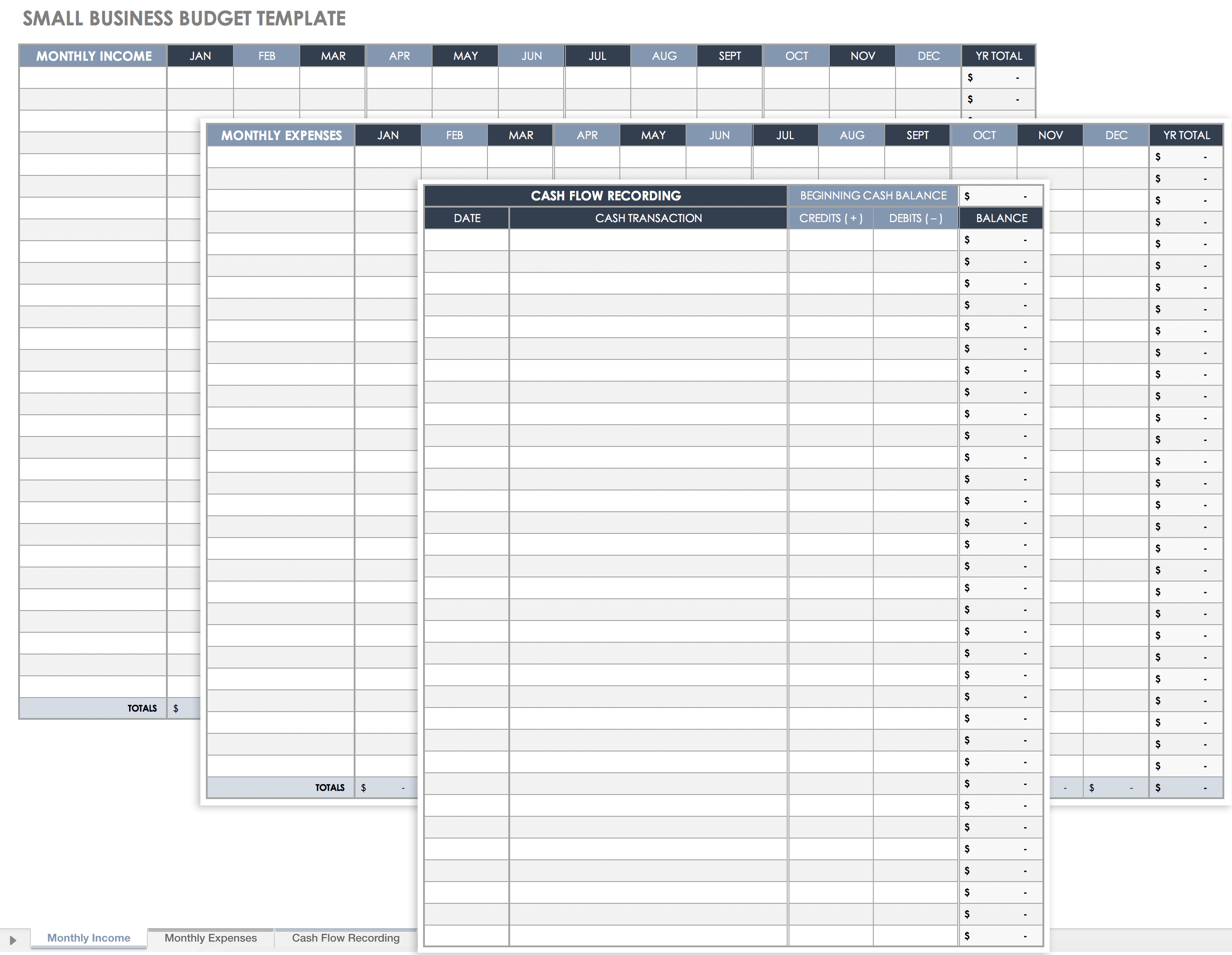

IRS Business Expense Categories List [+Free Worksheet] Mar 19, 2020 · 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040, Schedule 1, line 16 as an adjustment to income.

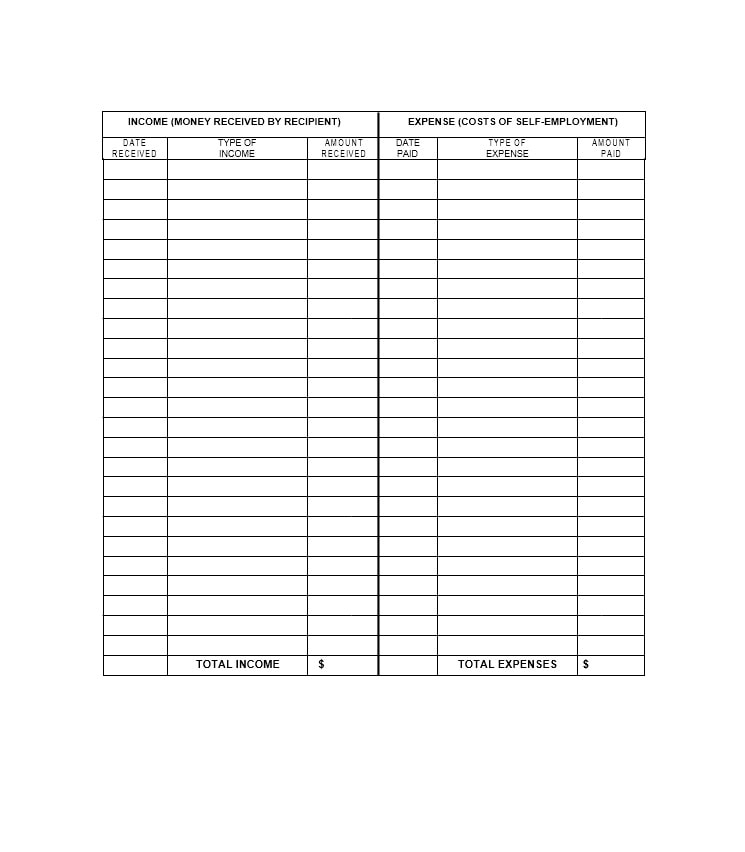

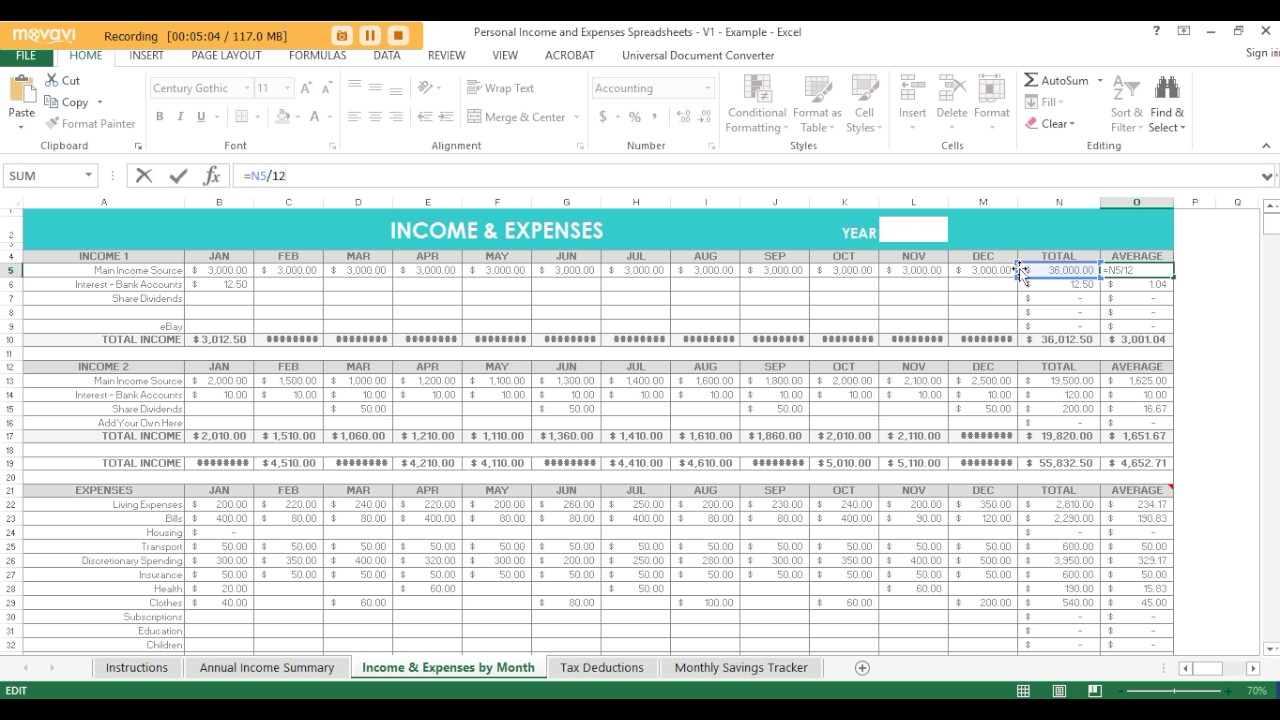

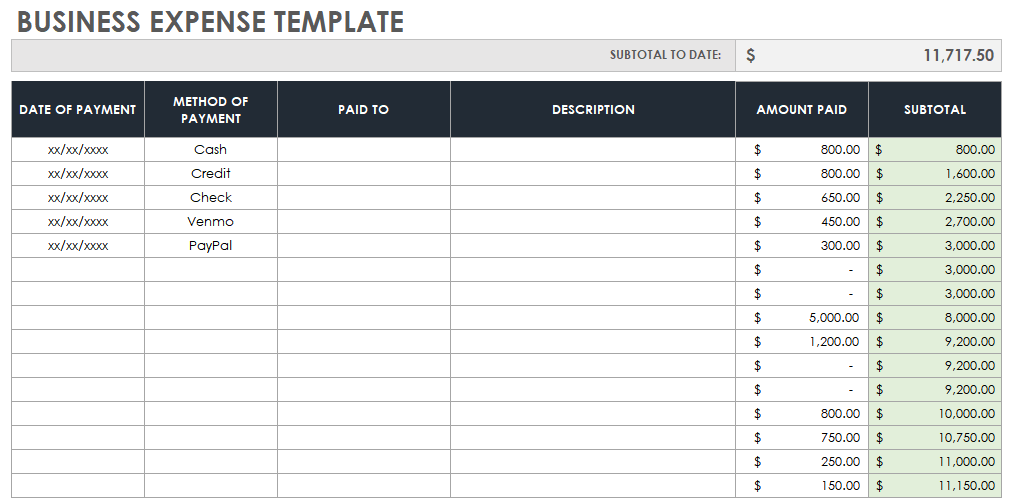

Self employed expense worksheet

Tips on Rental Real Estate Income, Deductions and ... 2 days ago · When you include the fair market value of the property or services in your rental income, you can deduct that same amount as a rental expense. You may not deduct the cost of improvements. A rental property is improved only if the amounts paid are for a betterment or restoration or adaptation to a new or different use. 2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... 15 Tax Deductions and Benefits for the Self-Employed Jul 31, 2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

Self employed expense worksheet. Self-Employed 401k Plan from Fidelity - Fidelity Investments Complete a Self-Employed 401(k) Account Application for yourself and each participating owner (including the business owner's spouse, if applicable). Fidelity Investments PO Box 770001 Cincinnati, OH 45277-0003; Once you have established your Self-Employed 401(k) Plan and any new account(s), the next step is to contribute to your 401(k). 4. 15 Tax Deductions and Benefits for the Self-Employed Jul 31, 2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ... 2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... Tips on Rental Real Estate Income, Deductions and ... 2 days ago · When you include the fair market value of the property or services in your rental income, you can deduct that same amount as a rental expense. You may not deduct the cost of improvements. A rental property is improved only if the amounts paid are for a betterment or restoration or adaptation to a new or different use.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

0 Response to "40 self employed expense worksheet"

Post a Comment