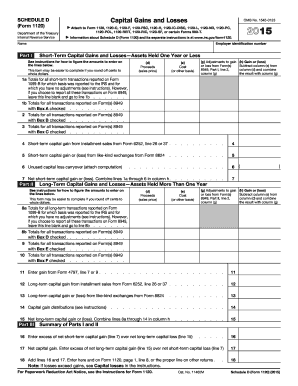

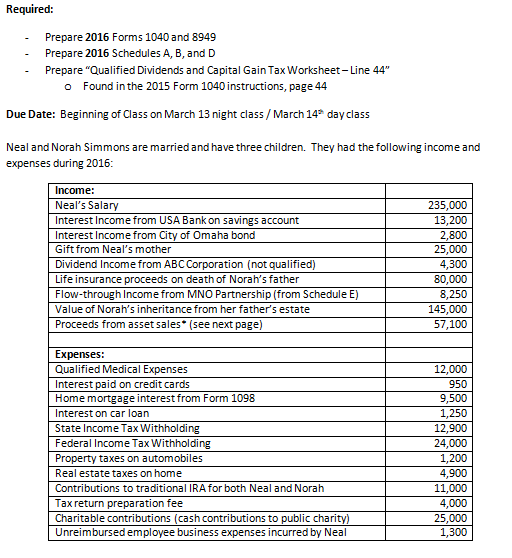

41 capital gain worksheet 2015

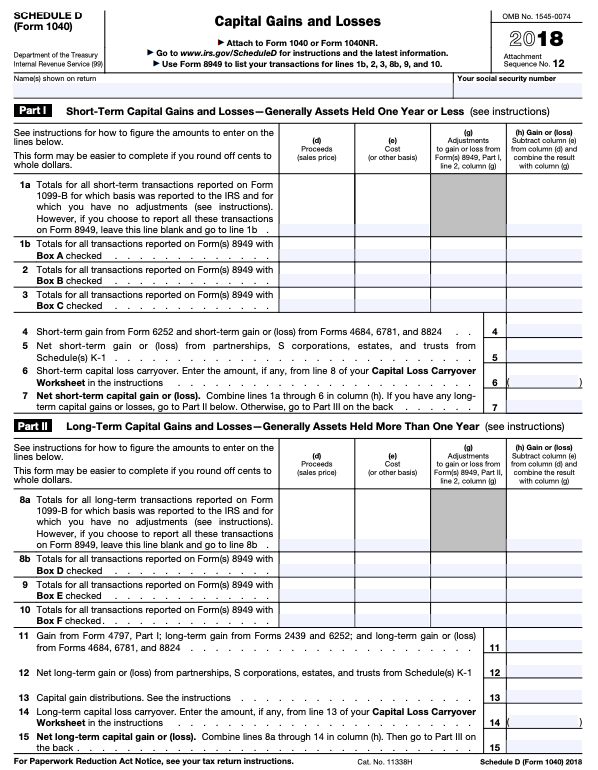

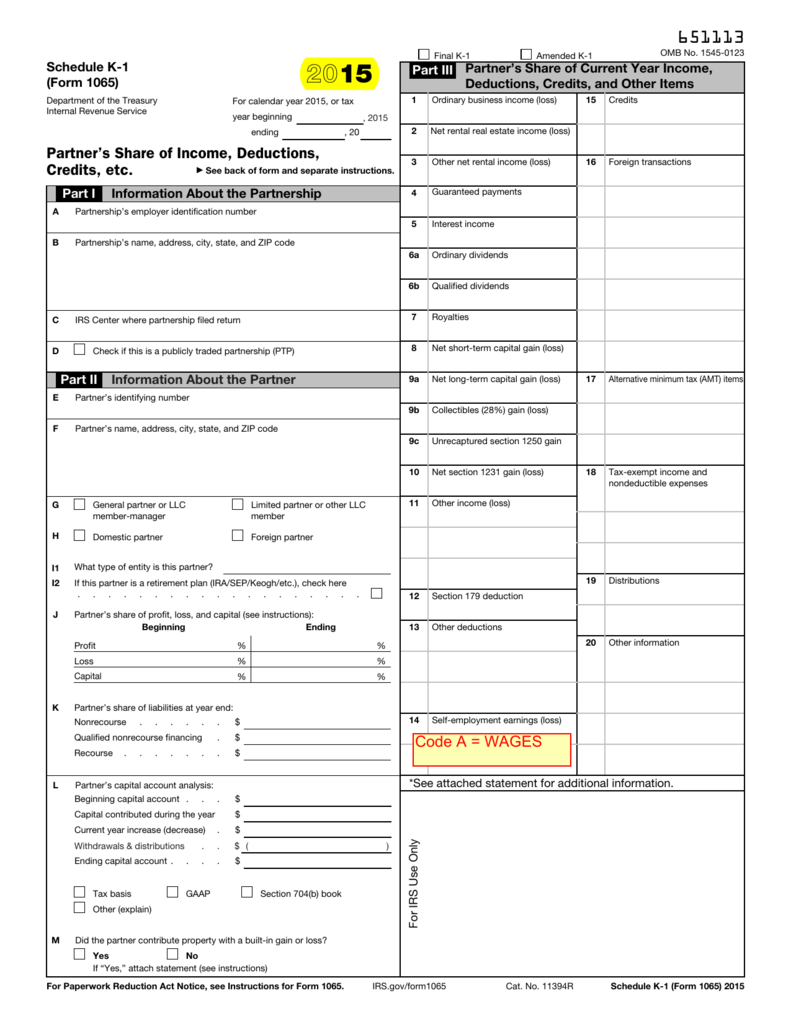

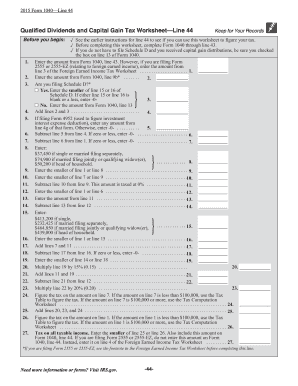

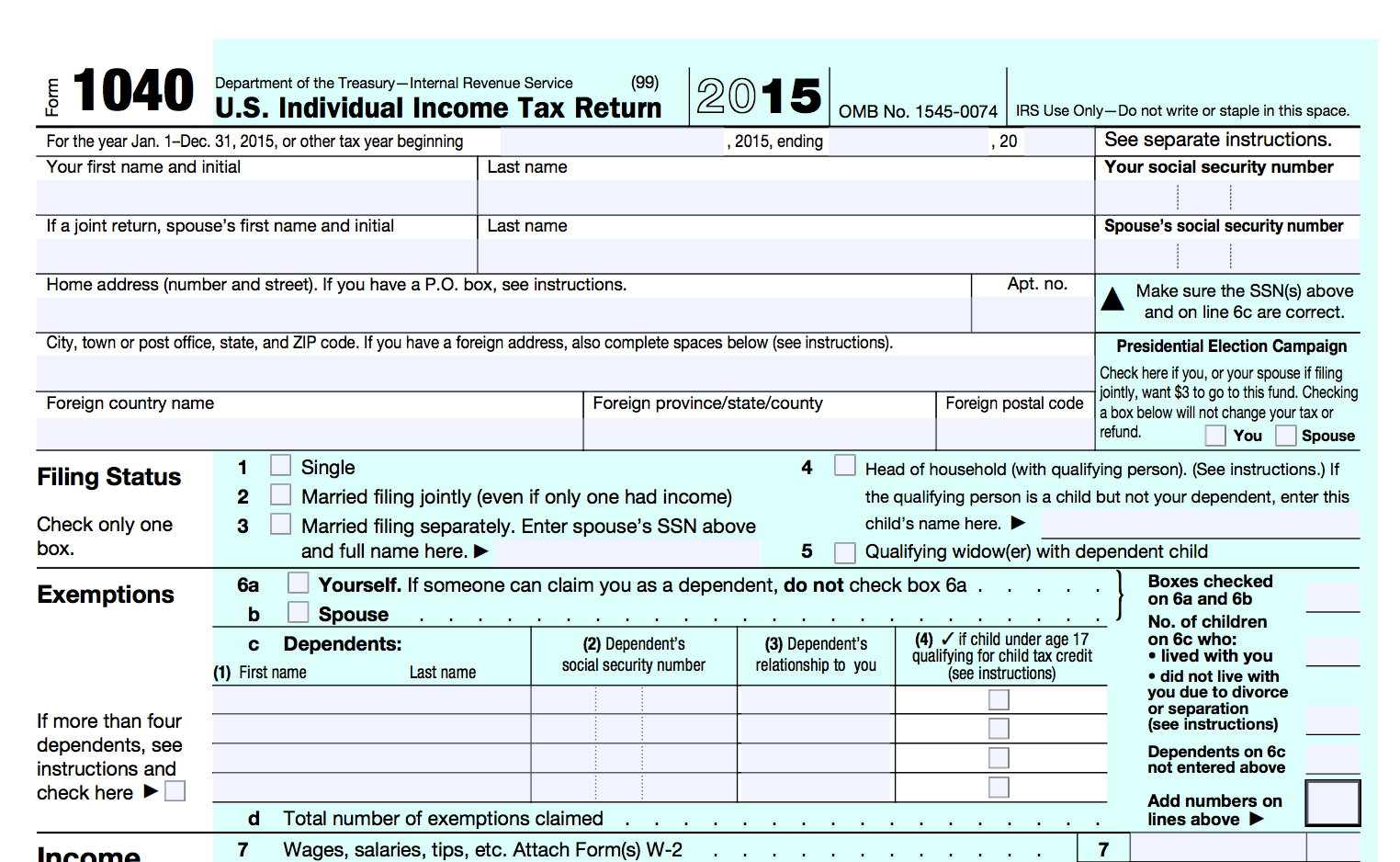

Publication 550 (2021), Investment Income and Expenses ... Undistributed capital gains (Form 2439, boxes 1a–1d) Schedule D: Gain or loss from sales of stocks or bonds : Line 7; also use Form 8949, Schedule D, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet: Gain or loss from exchanges of like-kind investment property qualified dividends and capital gain tax worksheet 2020 - pdfFiller Easily complete a printable IRS Instruction 1040 Line 44 Form 2015 online. Get ready for this year's Tax Season quickly and safely with pdfFiller!

Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Capital gain worksheet 2015

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet The difference between your capital gains and your capital losses for the tax year is called a “net capital gain.” But if your losses exceed your gains, you have what's called a "net capital ... Schedule D Long-Term Capital Gains and Losses ... - Mass.gov 2015. LONG-TERM CAPITAL GAINS AND LOSSES, EXCLUDING COLLECTIBLES. 1 Enter amounts included in U.S. Schedule D, lines 8a and 8b, col. h. Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Capital gain worksheet 2015. 2020 Instructions for California Schedule D (540) | FTB.ca.gov In general, for taxable years beginning on or after January 1, 2015, California law ... Use California Schedule D (540), California Capital Gain or Loss ... 2015 Form 1040 (Schedule D) - IRS Capital Gains and Losses. ▷ Attach to Form 1040 or Form 1040NR. ▷ Information about Schedule D and its separate instructions is at . CGT SUMMARY WORKSHEET FOR 2015 TAX RETURNS *If you have total capital losses from collectables (including current year and prior year losses) greater than your current year capital gains from ... Tax Year 2015 Forms & Instructions - Vermont Department of Taxes IN-151 (2015), Application For Extension Of Time To File Form IN-111 ... IN-153 (2015) · Instructions, Capital Gain Exclusion Calculation. IN-155 (2015).

2015 Instructions for Schedule D - Capital Gains and Losses - IRS Dec 28, 2015 ... These instructions explain how to complete Schedule D (Form 1040). Complete Form. 8949 before you complete line 1b, 2, 3, 8b, 9, ... Publication 501 (2021), Dependents, Standard Deduction, and ... Your child had gross income only from interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends). The interest and dividend income was less than $11,000. Your child is required to file a return for 2021 unless you make this election. Your child doesn't file a joint return for 2021. Self Assessment: Capital gains summary (SA108) - GOV.UK Use supplementary pages SA108 to record capital gains and losses on your SA100 Tax Return. Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ...

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... How to make an eSignature for the Qualified Dividends Tax Worksheetpdffillercom 2015 2019 Form on iOS capital gains worksheet 2021reate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. 2015 Schedule D (565) -- Capital Gain or Loss - CA.gov 1 Enter line 1, column (f) totals here. 1. 2 Short-term capital gain from installment sales, from form FTB 3805E, line 26 or line 37. Form CG1 – Capital Gains Tax Return 2021 - Revenue Form CG1. Capital Gains Tax Return and Self-Assessment 2021. YOU MUST SIGN THIS DECLARATION. I DECLARE that, to the best of my knowledge and belief, ... Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Schedule D Long-Term Capital Gains and Losses ... - Mass.gov 2015. LONG-TERM CAPITAL GAINS AND LOSSES, EXCLUDING COLLECTIBLES. 1 Enter amounts included in U.S. Schedule D, lines 8a and 8b, col. h.

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet The difference between your capital gains and your capital losses for the tax year is called a “net capital gain.” But if your losses exceed your gains, you have what's called a "net capital ...

0 Response to "41 capital gain worksheet 2015"

Post a Comment