43 applicable large employer worksheet

Determining if an Employer is an Applicable Large Employer Sep 29, 2022 · This is solely for the purpose of determining whether an employer is an “applicable large employer” subject to the employer shared responsibility rules of § 4980H. For more information, see IRC § 4980H(c)(2) subparagraph (F) “Exemption for Health Coverage Under Tricare or the Veterans Administration.” PAPPG Chapter II - NSF Jun 01, 2020 · NSF 20-1 June 1, 2020 Chapter II - Proposal Preparation Instructions. Each proposing organization that is new to NSF or has not had an active NSF assistance award within the previous five years should be prepared to submit basic organization and management information and certifications, when requested, to the applicable award-making division within the Office of Budget, Finance & Award ...

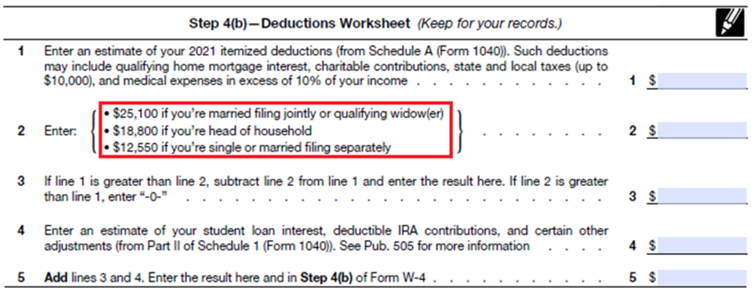

Publication 970 (2021), Tax Benefits for Education | Internal … Employer-provided educational assistance benefits. Employer-provided educational assistance benefits include payments made after March 27, 2020, and before January 1, 2026, for principal or interest on any qualified education loan you incurred for your education. ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your ...

Applicable large employer worksheet

Publication 560 (2021), Retirement Plans for Small Business Increase in credit limitation for small employer plan startup costs. The Further Consolidated Appropriations Act, 2020, P.L. 116-94, also amended section 45E. ... A qualified birth or adoption distribution is any distribution from an applicable eligible retirement plan if made during the 1-year period beginning on the date on which your child ... Salary.com - Salary Calculator, Salary Comparison, Compensation … Know your worth. Inform your career path by finding your customized salary. Find out what you should earn with a customized salary estimate and negotiate pay with confidence. Publication 969 (2021), Health Savings Accounts and Other Tax … Your employer’s contributions should be shown on Form W-2, box 12, code R. Follow the Instructions for Form 8853 and complete the Line 3 Limitation Chart and Worksheet in the instructions. Report your Archer MSA deduction on Form 1040, 1040-SR, or 1040-NR.

Applicable large employer worksheet. Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Achiever Papers - We help students improve their academic … Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. The EU Mission for the Support of Palestinian Police and Rule of … Aug 31, 2022 · EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ... May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Publication 969 (2021), Health Savings Accounts and Other Tax … Your employer’s contributions should be shown on Form W-2, box 12, code R. Follow the Instructions for Form 8853 and complete the Line 3 Limitation Chart and Worksheet in the instructions. Report your Archer MSA deduction on Form 1040, 1040-SR, or 1040-NR. Salary.com - Salary Calculator, Salary Comparison, Compensation … Know your worth. Inform your career path by finding your customized salary. Find out what you should earn with a customized salary estimate and negotiate pay with confidence. Publication 560 (2021), Retirement Plans for Small Business Increase in credit limitation for small employer plan startup costs. The Further Consolidated Appropriations Act, 2020, P.L. 116-94, also amended section 45E. ... A qualified birth or adoption distribution is any distribution from an applicable eligible retirement plan if made during the 1-year period beginning on the date on which your child ...

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "43 applicable large employer worksheet"

Post a Comment