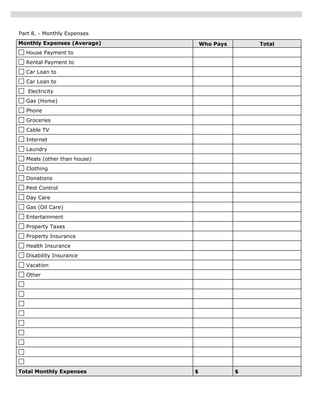

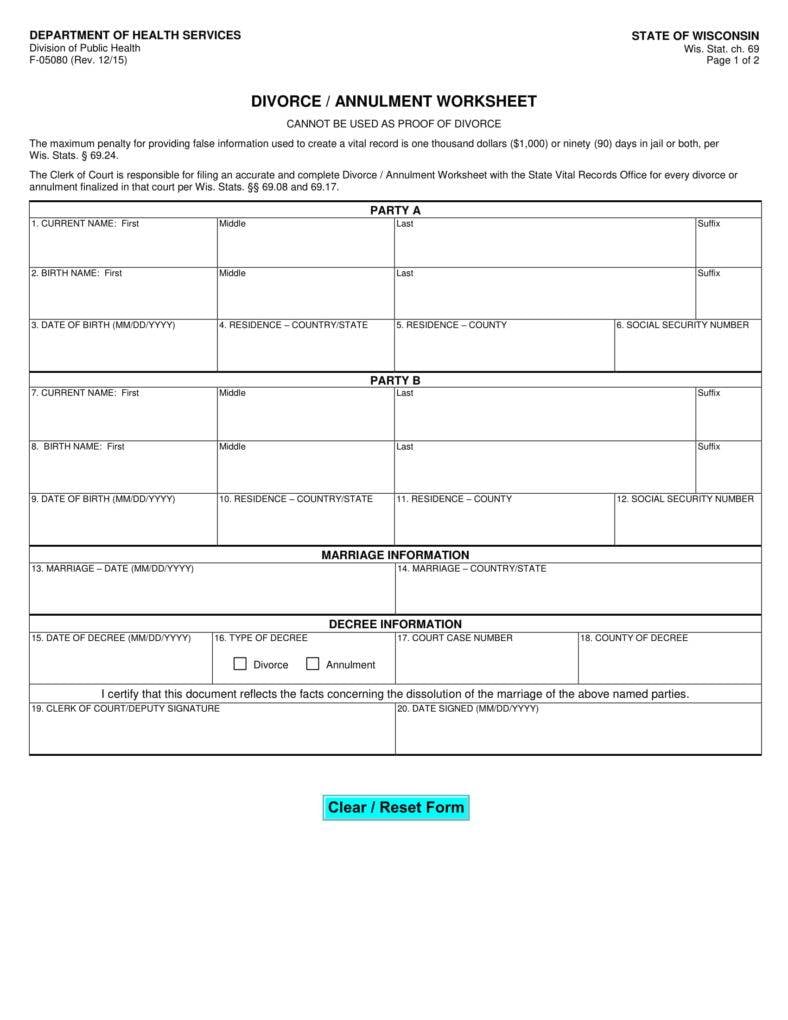

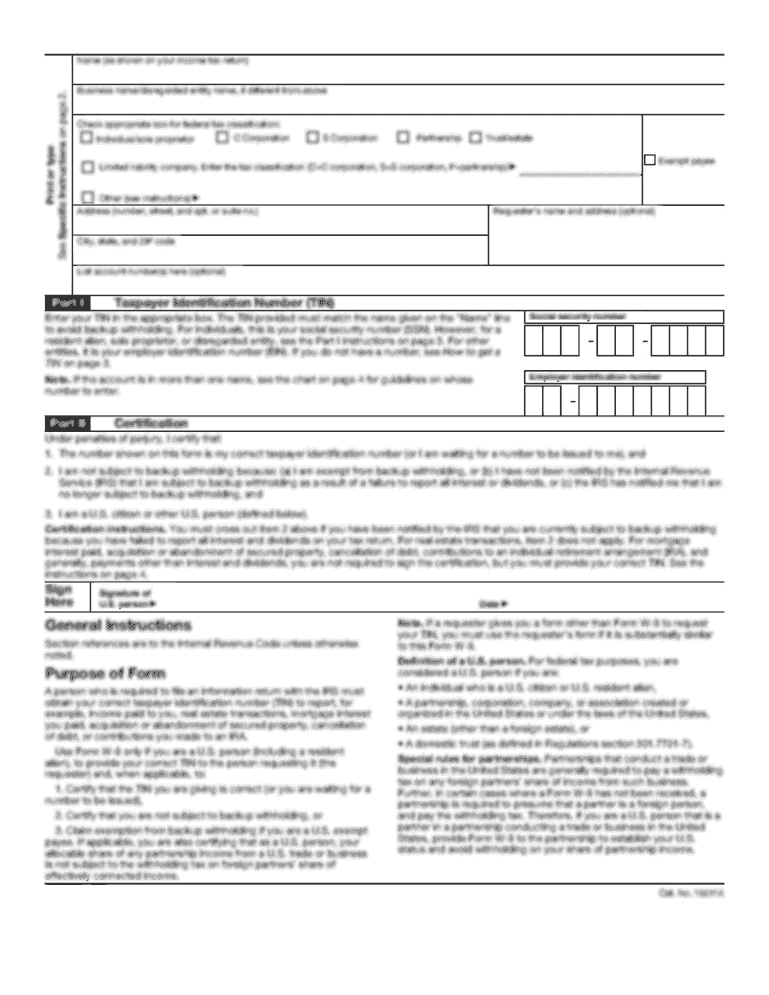

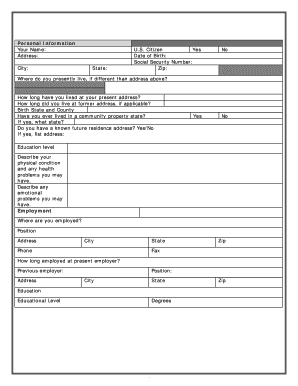

43 divorce property settlement worksheet

Free Divorce Settlement Agreement | Rocket Lawyer Divorce is never easy, but you and your spouse have both agreed to this divorce and you've reached an agreement on how to divide your property, accounts, debts, and/or child custody. You can create a Divorce Settlement Agreement to clearly define the terms of the settlement with your spouse. Use the Divorce Settlement Agreement document if: Publication 504 (2021), Divorced or Separated Individuals Property received before July 19, 1984. Your basis in property received in settlement of marital support rights before July 19, 1984, or under an instrument in effect before that date (other than property for which you and your spouse (or former spouse) made a “section 1041 election”) is its fair market value when you received it.

Publication 575 (2021), Pension and Annuity Income Because his annuity is payable over the lives of more than one annuitant, he uses his and Kathy's combined ages and Table 2 at the bottom of Worksheet A in completing line 3 of the worksheet. His completed worksheet is shown later. Bill's tax-free monthly amount is $100 ($31,000 ÷ 310) as shown on line 4 of the worksheet.

Divorce property settlement worksheet

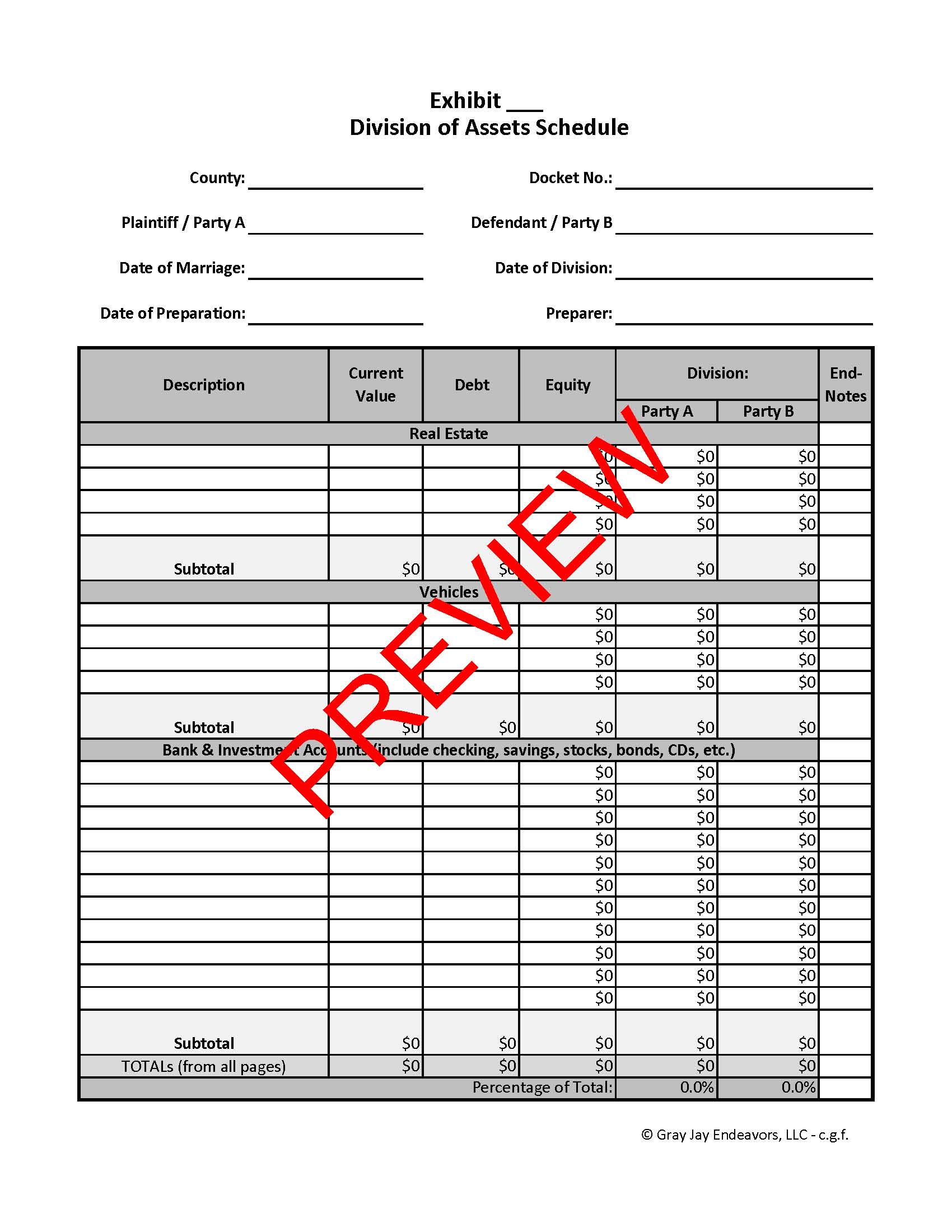

Filing for Divorce in Nebraska - No Children and No Disputed ... It is best to gather all of the information you will need before you begin the process. Use the Divorce Worksheet to gather your information: Worksheet: Divorce With No Children Hoja de trabajo: Divorcio sin hijos. Introduction. A divorce can be complicated, and disputes over children and property make them even more complicated. Publication 525 (2021), Taxable and Nontaxable Income However, any income from the property, or the right to use the property, is included in your income as additional compensation in the year you receive the income or have the right to use the property. When the property becomes substantially vested, you must include its FMV, minus any amount you paid for it, in your income for that year. Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

Divorce property settlement worksheet. Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). Publication 525 (2021), Taxable and Nontaxable Income However, any income from the property, or the right to use the property, is included in your income as additional compensation in the year you receive the income or have the right to use the property. When the property becomes substantially vested, you must include its FMV, minus any amount you paid for it, in your income for that year. Filing for Divorce in Nebraska - No Children and No Disputed ... It is best to gather all of the information you will need before you begin the process. Use the Divorce Worksheet to gather your information: Worksheet: Divorce With No Children Hoja de trabajo: Divorcio sin hijos. Introduction. A divorce can be complicated, and disputes over children and property make them even more complicated.

0 Response to "43 divorce property settlement worksheet"

Post a Comment