43 qualified dividends and capital gain tax worksheet calculator

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience. Tax Calculator - Estimate Your Income Tax for 2022 - Moneychimp 1040 page 1, Regularly Taxed Income: (salary, interest, regularly-taxed dividends, · Qualified Dividends and. Long Term Capital Gains: · Adjustments: ( ...

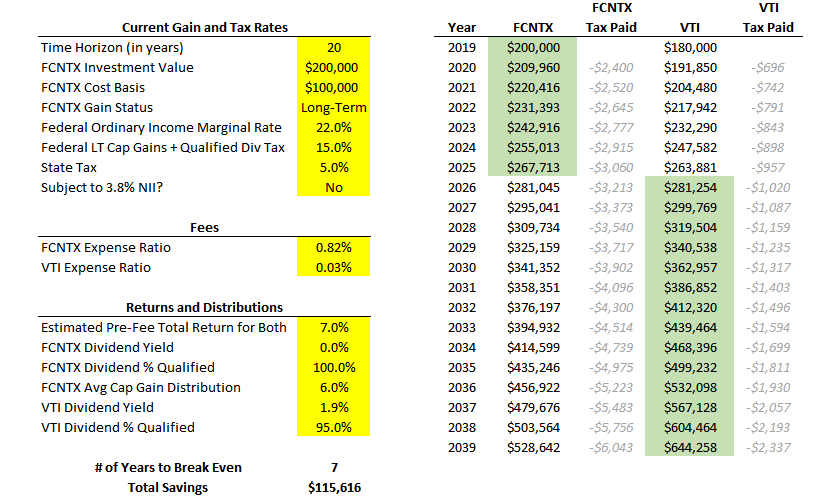

2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year (also known as a long term investment). The long-term capital gains tax rate is 0%, 15% or 20% ...

Qualified dividends and capital gain tax worksheet calculator

Tax Loss Harvesting with Vanguard: A Step by Step Guide * Use rest of the short-term loss $18000 to offset that amount from my long-term gain and save roughly $3600 tax (based on 20% long-term gain tax). * Total Tax saved in this case is roughly $12400. Question: Capital Gains Tax Calculator 2021 – Forbes Advisor Jul 9, 2022 ... Forbes Advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate ... Qualified Dividends and Capital Gain Tax - TaxAct If the tax was calculated on either of these worksheets, you should see "Tax computed on Qualified Dividend Capital Gain WS" as one of the items listed. Go to ...

Qualified dividends and capital gain tax worksheet calculator. Qualified Dividends and Capital Gain Tax Worksheet—Line 11a - IRS Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this ... 1040 Income Tax Calculator | Ameriprise Financial Qualified dividends are the portion of your total ordinary dividends subject to the lower capital gains tax rate. Qualified dividends are typically ... 2021 Federal Income Tax Calculator - HighPoint Advisors, LLC Use this calculator to estimate your 2021 federal income tax liability. ... taxable income (as reduced by long-term capital gains and qualified dividends). 2022 Capital Gains Tax Calculator - See What You'll Owe - SmartAsset According to the IRS, net investment income includes interest, dividends, capital gains, rental income, royalty income, non-qualified annuities, income from ...

Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return. Publication 929 (2021), Tax Rules for Children and Dependents If line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet. How Your Tax Is Calculated: Qualified Dividends and Capital Gains ... Sep 24, 2021 ... Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at ...

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Capital Gains Tax Calculation Worksheet - The Balance Feb 23, 2022 ... Here are the steps to build a worksheet to calculate capital gains. See how the math works and ways to organize your investment data for tax ... Qualified Dividends and Capital Gain Tax - TaxAct If the tax was calculated on either of these worksheets, you should see "Tax computed on Qualified Dividend Capital Gain WS" as one of the items listed. Go to ... Capital Gains Tax Calculator 2021 – Forbes Advisor Jul 9, 2022 ... Forbes Advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate ...

Tax Loss Harvesting with Vanguard: A Step by Step Guide * Use rest of the short-term loss $18000 to offset that amount from my long-term gain and save roughly $3600 tax (based on 20% long-term gain tax). * Total Tax saved in this case is roughly $12400. Question:

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

:max_bytes(150000):strip_icc()/GettyImages-907066380-0867bbed74914d3eab8d7d0c318a7577.jpg)

0 Response to "43 qualified dividends and capital gain tax worksheet calculator"

Post a Comment