43 student loan interest deduction worksheet 1040a

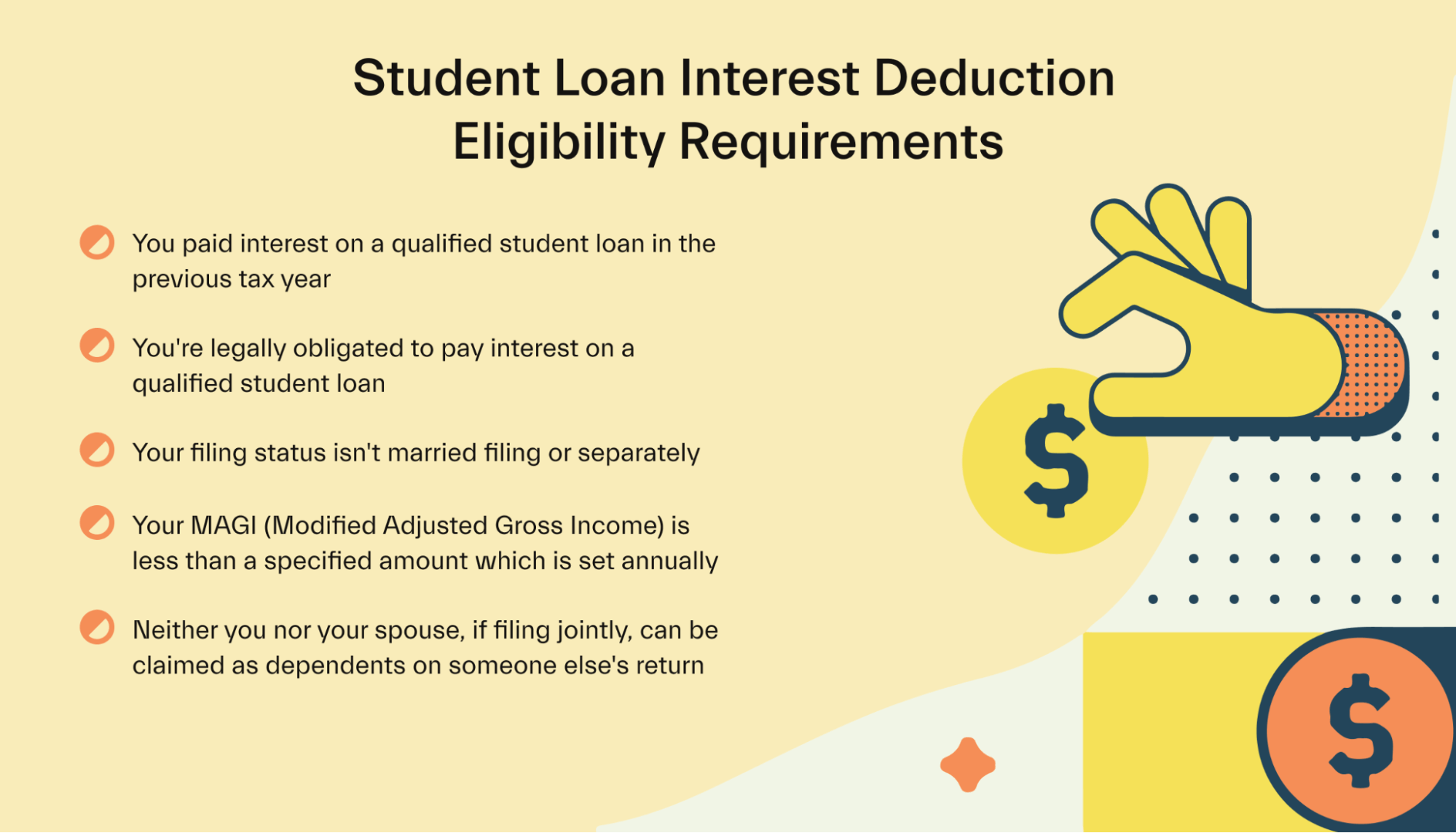

How to Deduct Student Loan Interest - Tax Guide - 1040.com The max deduction is $2,500 for your 2021 tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. Note: Since federal student loan interest was waived in 2021, the interest deduction will only apply to non-federal loans that continued to charge interest. Gross Compensation - Pennsylvania Department of Revenue Compensation (ordinary) deduction equal to income amount recognized by employee. The fair market value of the stock less any amount paid for the stock will be taxed as compensation. Compensation deduction equal to income subject to withholding or federal Form 1099 issued to employee or independent contractor. Stock Disposition Date

How do I calculate my student loan interest deduction for ... - Intuit Locate your federal student loan interest amount, and any other numbers you need, and use them to fill out your California worksheet. Third, return to the TurboTax California program and input the amount from Line 10 (or Line 11, if any) into the question field asking for your California student loan interest amount.

Student loan interest deduction worksheet 1040a

Form 1040: Your Complete 2021 & 2022 Guide - Policygenius 22.12.2021 · Common examples include alimony payments, educator expenses, the deduction for IRA contributions, and the student loan interest deduction. Line 11 requires you to subtract your income adjustments (line 10) from your total income (line 9) to find your adjusted gross income (AGI). AGI is simply your income after factoring in adjustments, and it’s the value used to … Your 1098-E and Your Student Loan Tax Information - My Great Lakes If you have more than one account, you'll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return. If you want a physical copy of your 1098-E for your records, just print it out from our website. It's as easy as that! 2017 Instructions for Schedule CA (540NR) | FTB.ca.gov Enter on line 31a the same amount entered on federal Form 1040, line 31a. Enter on line 31b the social security number (SSN) or individual taxpayer identification number (ITIN) and last name of the person to whom you paid alimony. Line 36 Add line 23 through line 31a and line 32 through line 35.

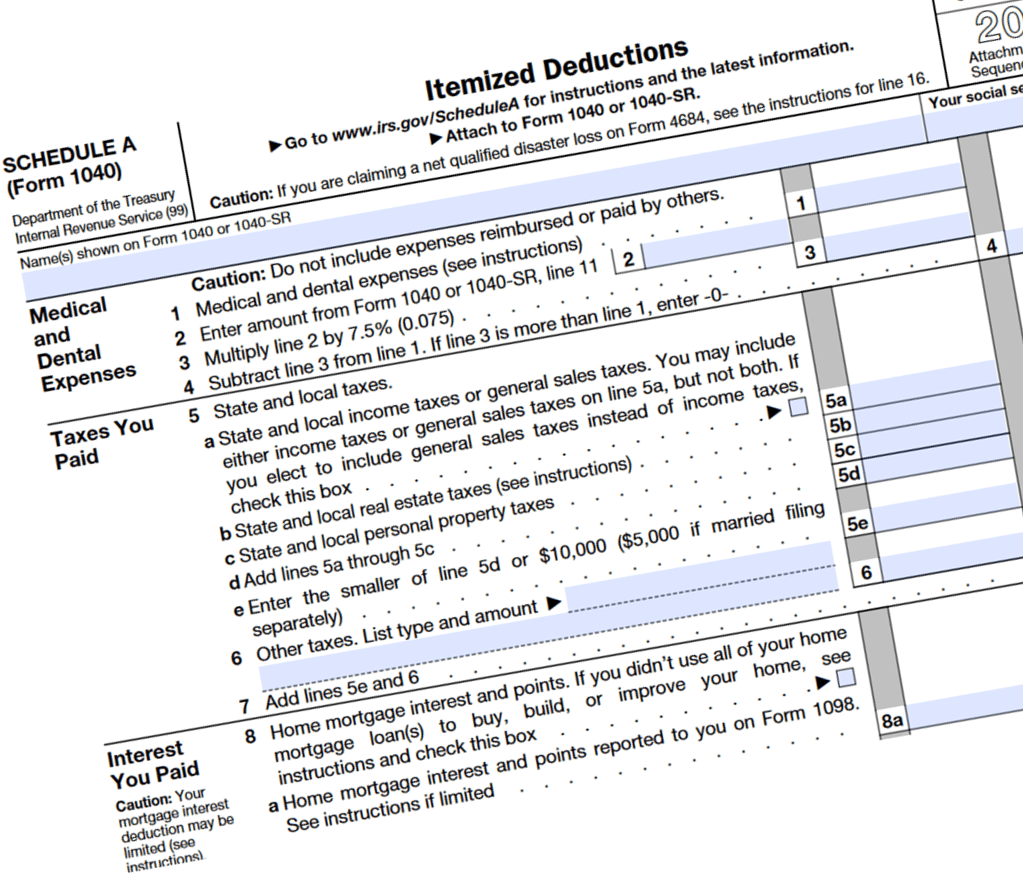

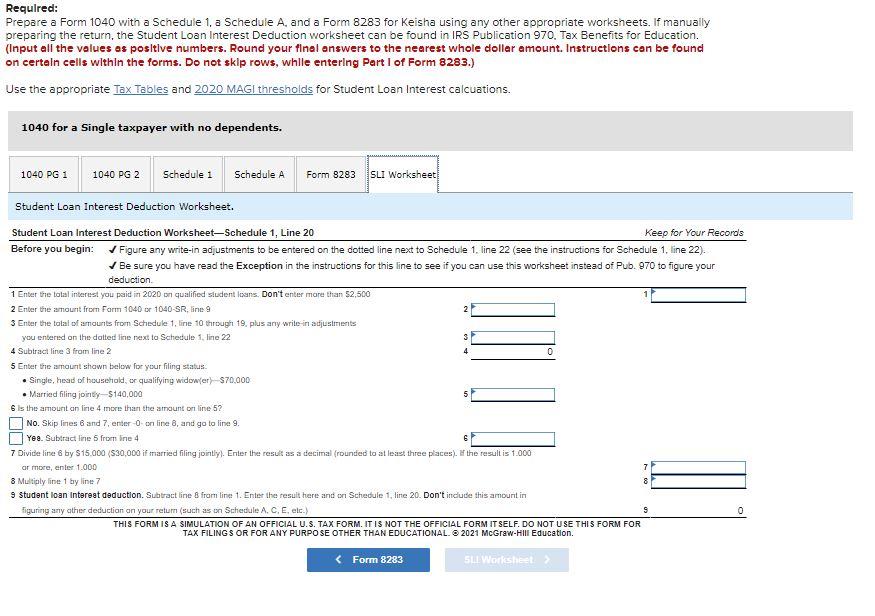

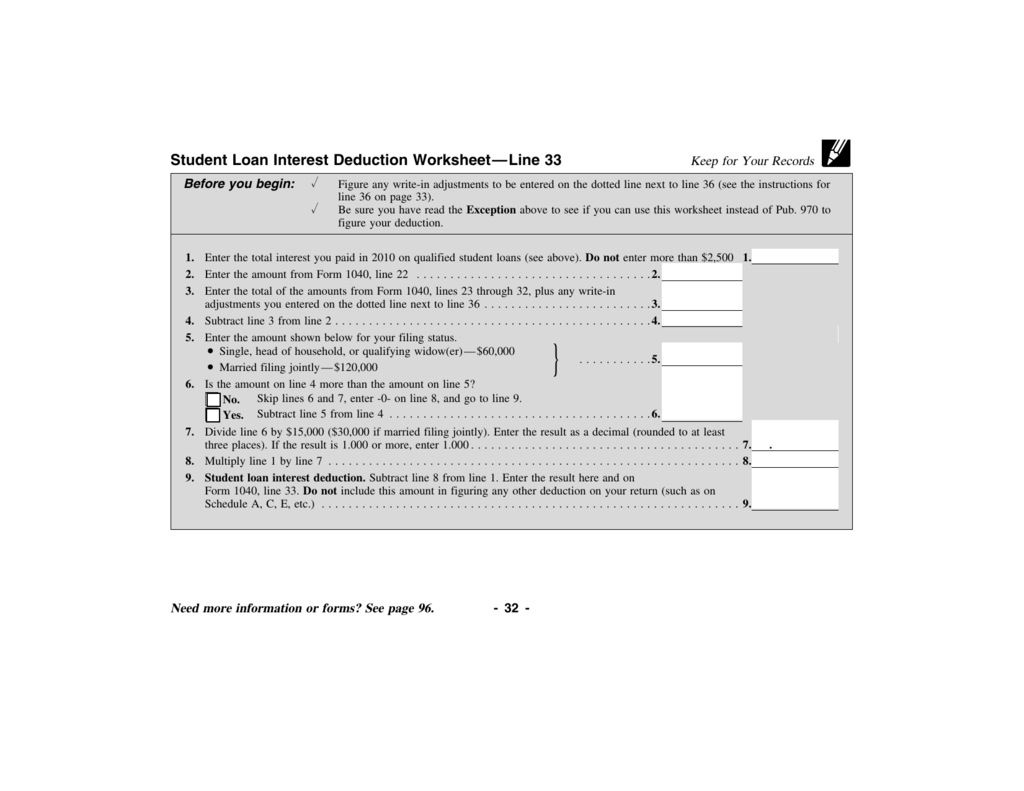

Student loan interest deduction worksheet 1040a. Where To Put Student Loan Interest On 1040 - UnderstandLoans.net If you paid less than $2,500 in student loan interest, the amount of your deduction is based on the total amount you paid. For example, if you only paid $1,500 in interest for a given tax year, your deduction is $1,500. That means your taxable income will be reduced by $1,500. Does Refinancing Affect My Student Loan Interest Deduction It depends. How Student Loan Interest Deduction Works | VSAC Here's how to calculate your student loan interest tax deduction: Get your 1098-E. If you paid $600 or more in interest on a qualified student or parent loan over the course of the year, your lender or servicer should send you an IRS Form 1098-E. They should also submit a copy of your 1098-E to the IRS. This form reports the amount of ... Student Loan Interest Deduction - Uncle Fed This deduction can reduce the amount of your income subject to tax by up to $2,500 in 2003. The student loan interest deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A (Form 1040). This chapter explains: What type of loan interest you can deduct, Tax Forms and Reporting - University of Illinois Extension Form 1098-E, provided by the bank or governmental agency to which you made loan payments that included $600 or more of interest. You may have deductible interest for which you do not receive a 1098-E. Form 1040, line 33. Calculate using Student Loan Interest Deduction Worksheet found in Form 1040 or 1040A instructions.

Student Loan Interest Deduction - Uncle Fed The student loan interest deduction can reduce the amount of your income subject to tax by up to $2,500 in 2001. This deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A (Form 1040). What Is Student Loan Interest? What is a 1098-E: Student Loan Interest - TurboTax What Form 1098-E tells you. Your student loan lenders are required to send you Form 1098-E only if you paid at least $600 in student loan interest during the year. If you have several student loans with the same lender, the financial institution applies the $600 threshold amount to the total interest paid on all of your loans; you may get a ... About Form 1040, U.S. Individual Income Tax Return Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses. THEN USE. Schedule 1 PDF. Schedule 2 (Form 1040), Additional Taxes USE IF... Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an … PDF Latricia B Student Loan Interest Deduction Worksheet Qualified student loan interest deductions are reported on Form 1040, Schedule 1. DO NOT FILE July 11, 2019 DRAFT AS OF SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income

6+ Creative Student Loan Interest Deduction Worksheet Form 1040 2018 Student Loan Interest Deduction Worksheet. Average student loan interest deduction worth 188. Deduction can reduce the amount of your income subject to tax by up to 2500 in 2009. Do not enter more than 2500 Enter the amount from Form 1040 line 22 or Form 1040A line 15. Taxable income less than 100000. PDF Student Loan Interest Deduction Worksheet - IRS tax forms Student Loan Interest Deduction Worksheet—Schedule 1, Line 33. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). Be sure you have read the . Exception in the instructions for this line to see if you can use this worksheet instead of Pub. Student Loan Tax Forms - Information & Tax Deductions | Sallie Mae Student loan interest tax deductions. According to IRS Publication 970, Tax Benefits for Education, you can generally reduce your taxable income by up to $2,500 if: Your student loan was taken out solely to pay qualified education expenses and it can't be from a relative or made under a qualified employer plan. The student is you, your spouse, or your dependent. The student is … Tax Form 1040 Student Loan Interest - Frank Financial Aid Although the student loan deduction is only open to people who fall between a certain MAGI, you need to keep in mind that if your MAGI is between $65,000 and $80,000 single or $130,000 and $160,000 joint, your maximum deduction gets reduced. For example, if you're a couple filing jointly with $145,000 in MAGI, your deduction is $1,250.

Entering Form 1098-E in ProSeries - Intuit Enter the information from Form 1098-E on the Student Loan Interest Deduction Worksheet in ProSeries: Press F6 to bring up Open Forms. Type STU and press Enter. Enter the information from your client's form (s) 1098-E in Part I. Amount you enter in Part I, column (e) will flow to Part II, line 1 for the Computation of the Student Loan Interest ...

Solved: Student Loan Deduction - Intuit I used the "Student Loan Interest Deduction Worksheet" from IRS.gov and confirmed the 1040 was correct. View solution in original post. 0 2,734 Reply. 4 Replies Lisa995. ... (Line 21 of the 1040 or Line 15 of the 1040A) ♪♫•*¨*•.¸¸♥Lisa♥ ¸¸.•*¨*•♫♪ 0 1 2,738 Reply. zmclell. Returning Member March 27, 2018 11:16 AM.

2013 Federal Income Tax Forms : Free Printable Form 1040EZ, Form 1040A ... Printable 2013 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2013 tax tables, and instructions for easy one page access. ... Student Loan Interest Deduction Worksheet All of the 2013 federal income tax forms listed above are in the PDF file format. The IRS ...

2021 Instruction 1040 - IRS tax forms Have any deductions to claim, such as student loan inteest, r self-employment tax, or educator expenses. Can claim a efundable cr redit (other than the eaned income r credit, American opportunity cedit, refundable child tax credit, r additional child tax cedit, or recovery rebate credit), such as the r net premium tax credit, health coverage tax credit, or quali ed sick and family …

2012 Federal Income Tax Forms : Free Printable Form 1040EZ, Form 1040A ... Printable 2012 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2012 tax tables, and instructions for easy one page access. ... Student Loan Interest Deduction Worksheet All of the 2012 federal income tax forms listed above are in the PDF file format. The IRS ...

2021 1040 Form and Instructions (Long Form) - Income Tax Pro 01.01.2021 · IRA Deduction Worksheet; Qualified Dividends and Capital Gain Tax Worksheet; Recovery Rebate Credit Worksheet (Line 30) Simplified Method Worksheet; Social Security Benefits Worksheet; Standard Deduction Worksheet for Dependents (Line 12a) Student Loan Interest Deduction Worksheet; Form 1040 is generally published in December of each year by …

PDF Student Loan Interest Deduction Worksheet Form 1040, Line 33, or Form ... Enter the total interest you paid in 2016 on qualified student loans (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 or from Form 1040A ...

Stratus Financial Blog - Managing Your Student Loan Tax Benefits and ... Form 1098-E: Student Loan Interest Statement. ... Review the Student Loan Interest Deduction Worksheet in the 1040 or 1040A instructions. Related Blogs. Competitors seek pilots from distressed airlines. The Shortage of Pilots Around the World is a Big Concern. Airlines have Doubled Pay, and There's No Better Time to Becoming a Pilot ...

How to Use Form 1098-E for My Taxes - The Nest Step 4. Complete the "Student Loan Interest Deduction Worksheet" in the form's instructions to calculate the amount of your deduction. The amount listed in Box 1 of Form 1098-E is the total interest you paid on your student loan. If you paid interest to more than one lender and received more than one Form 1098-E, enter the total amount ...

How the Student Loan Interest Tax Deduction Works That's why the Federal government introduced the student loan interest tax deduction to help ordinary students out. If you made interest rate payments on your student loans during the tax year, you could deduct up to $2,500 in interest paid. If you happen to qualify for the 22% tax rate, you have the best deal because your maximum deduction ...

Student Loan Interest Deduction Worksheet Student Loan Interest Deduction Worksheet Form 1040, Line ... Hot 2016 on qualified (see instructions). (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any student loans write-in adjustments

3.11.3 Individual Income Tax Returns | Internal Revenue Service 3.11.3.15.21 Schedule 1 Line 21 - Student Loan Interest Deduction; 3.11.3.15.22 Schedule 1 Line 22 ; 3.11.3.15.23 Schedule 1 Line 23 - Archer MSA Deduction; 3.11.3.15.24 Schedule 1 Lines 24a through Line 24z - Other Adjustments (Not Transcribed) 3.11.3.15.25 Schedule 1 Line 25 - Total Other Adjustments

Publication 915 (2021), Social Security and Equivalent ... Complete Worksheet 1 and Worksheets 2 and 3 as appropriate before completing this worksheet. 1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099 for 2021, minus the lump-sum payment for years before 2021: 1. $9,000 Note. If line 1 is zero or less, skip lines 2 through 18, enter -0- on line 19, and go to line 20.

21.4.6 Refund Offset | Internal Revenue Service - IRS tax forms See IRM 20.2.4.7.5.2, 45-Day Rule and All Original Tax Returns, for the dates of systemically generated refunds. The 45-day interest-free charts (located here) may also be used for determining what date your adjustment must be input to meet the 45-day interest-free period for a systemically generated refund.

Form 1098-E | Cornell University Division of Financial Affairs Each student receiving a 1098-E form is responsible for determining whether he or she is eligible to deduct the interest in accordance with IRS regulations. See IRS Forms and Publications for more details. For other questions about the 1098-E form, contact the Student Loan office, (607) 255-7234. What is a 1098-E form?

PDF Illinois Department of Revenue Nonresident and Part-Year Resident 2016 ... 6 Taxable interest (federal Form 1040 or 1040A, Line 8a; 1040EZ, Line 2) ... 32 Student loan interest deduction (federal Form 1040, Line 33; or 1040A, Line 18) ... Worksheet on Page 10. The IAF Worksheet allows you to figure the Illinois portion of your business or farm income. Be sure to keep a copy of this worksheet with your income tax records.

Can I Deduct Student Loan Interest? | College Ave You can claim the student loan tax interest deduction when you file your tax return. If you paid $600 or more in interest on any of your student loans, your student loan servicer will send you Form 1098 E-Student Loan Interest Statement. You'll either receive the form in the mail, or you can download it online from your student loan account.

Publication 525 (2021), Taxable and Nontaxable Income Forms 1040A and 1040EZ no longer available. Forms 1040A and 1040EZ aren't available to file your 2021 taxes. If you used one of these forms in the past, you’ll now file Form 1040 or 1040-SR. Qualified equity grants.

Publication 970 (2021), Tax Benefits for Education | Internal Revenue ... Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. Reporting ...

PDF for Education Tax Benefits - IRS tax forms Student loan interest deduction. • For 2021, the amount of your student loan interest de-duction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can't claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). •

2017 Instructions for Schedule CA (540NR) | FTB.ca.gov Enter on line 31a the same amount entered on federal Form 1040, line 31a. Enter on line 31b the social security number (SSN) or individual taxpayer identification number (ITIN) and last name of the person to whom you paid alimony. Line 36 Add line 23 through line 31a and line 32 through line 35.

Your 1098-E and Your Student Loan Tax Information - My Great Lakes If you have more than one account, you'll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return. If you want a physical copy of your 1098-E for your records, just print it out from our website. It's as easy as that!

Form 1040: Your Complete 2021 & 2022 Guide - Policygenius 22.12.2021 · Common examples include alimony payments, educator expenses, the deduction for IRA contributions, and the student loan interest deduction. Line 11 requires you to subtract your income adjustments (line 10) from your total income (line 9) to find your adjusted gross income (AGI). AGI is simply your income after factoring in adjustments, and it’s the value used to …

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

:max_bytes(150000):strip_icc()/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

0 Response to "43 student loan interest deduction worksheet 1040a"

Post a Comment