44 sale of rental property worksheet

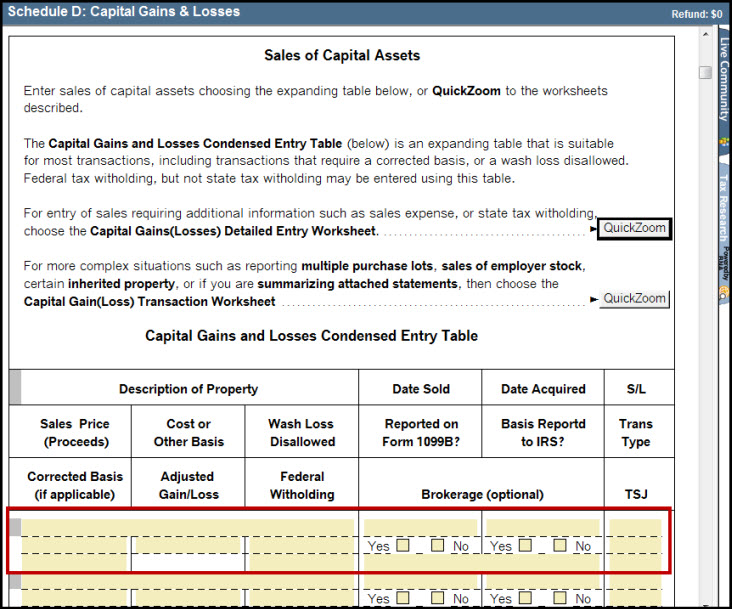

Publication 523 (2021), Selling Your Home | Internal Revenue ... For more information about using any part of your home for business or as a rental property, see Pub. 587, Business Use of Your Home, and Pub. 527, Residential Rental Property. Gain from the sale or exchange of your main home isn’t excludable from income if it is allocable to periods of non-qualified use. Publication 17 (2021), Your Federal Income Tax | Internal ... Community property states. Community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. If you and your spouse lived in a community property state, you must usually follow state law to determine what is community property and what is separate income.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

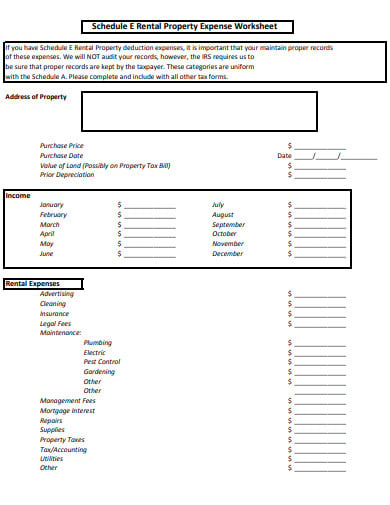

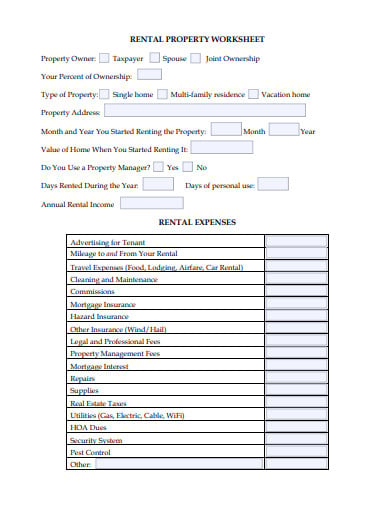

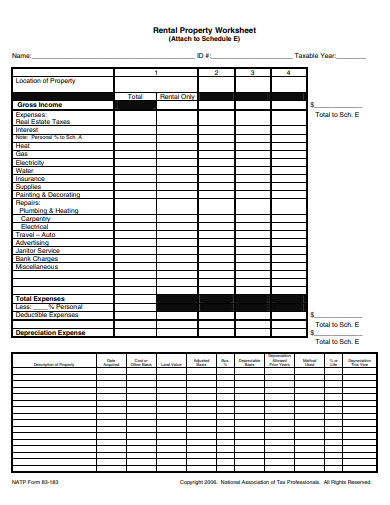

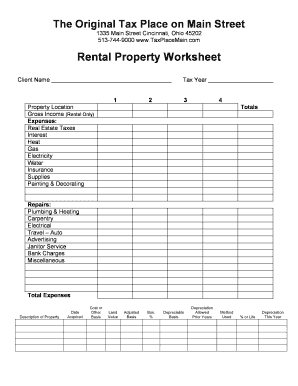

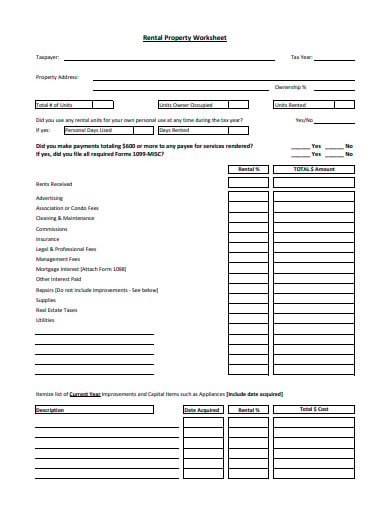

Sale of rental property worksheet

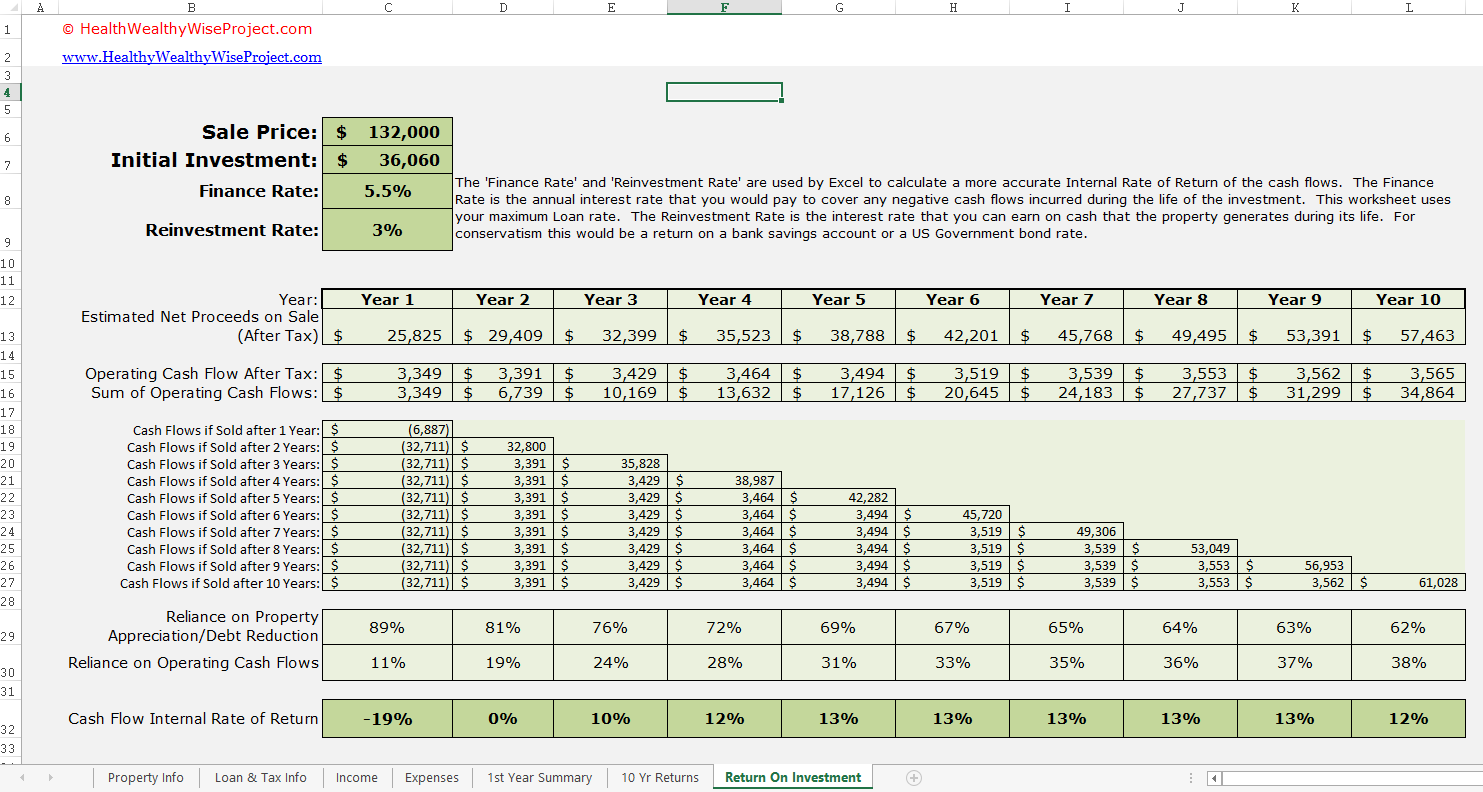

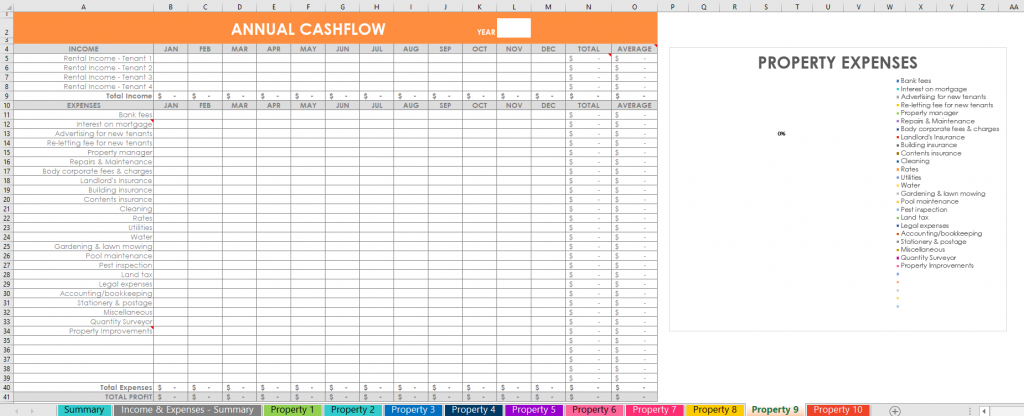

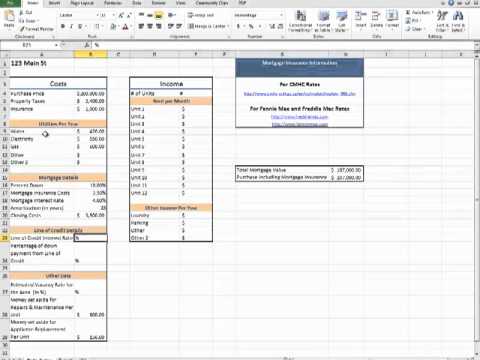

Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Real property used in a trade or business doesn’t include real property developed and held primarily for sale to customers in the ordinary course of business. It is secured by that real property. As long as certain other requirements are met, indebtedness that is secured by 100% of the ownership interest in a disregarded entity holding real ... Cash Flow Analysis Worksheet for Rental Property - Vertex42.com Aug 18, 2021 · Real Estate Tax and Rental Property at turbotax.intuit.com - A good summary of tax issues related to rental property. How to Figure Cap Rate at wikihow.com - This article provides a pretty good explanation of how the capitalization rate (cap rate) is calculated and how it can be used. Capitalization Rate at wikipedia.org - For a general definition.

Sale of rental property worksheet. Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Cash Flow Analysis Worksheet for Rental Property - Vertex42.com Aug 18, 2021 · Real Estate Tax and Rental Property at turbotax.intuit.com - A good summary of tax issues related to rental property. How to Figure Cap Rate at wikihow.com - This article provides a pretty good explanation of how the capitalization rate (cap rate) is calculated and how it can be used. Capitalization Rate at wikipedia.org - For a general definition. Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Real property used in a trade or business doesn’t include real property developed and held primarily for sale to customers in the ordinary course of business. It is secured by that real property. As long as certain other requirements are met, indebtedness that is secured by 100% of the ownership interest in a disregarded entity holding real ... Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

0 Response to "44 sale of rental property worksheet"

Post a Comment