45 worksheet for foreclosures and repossessions

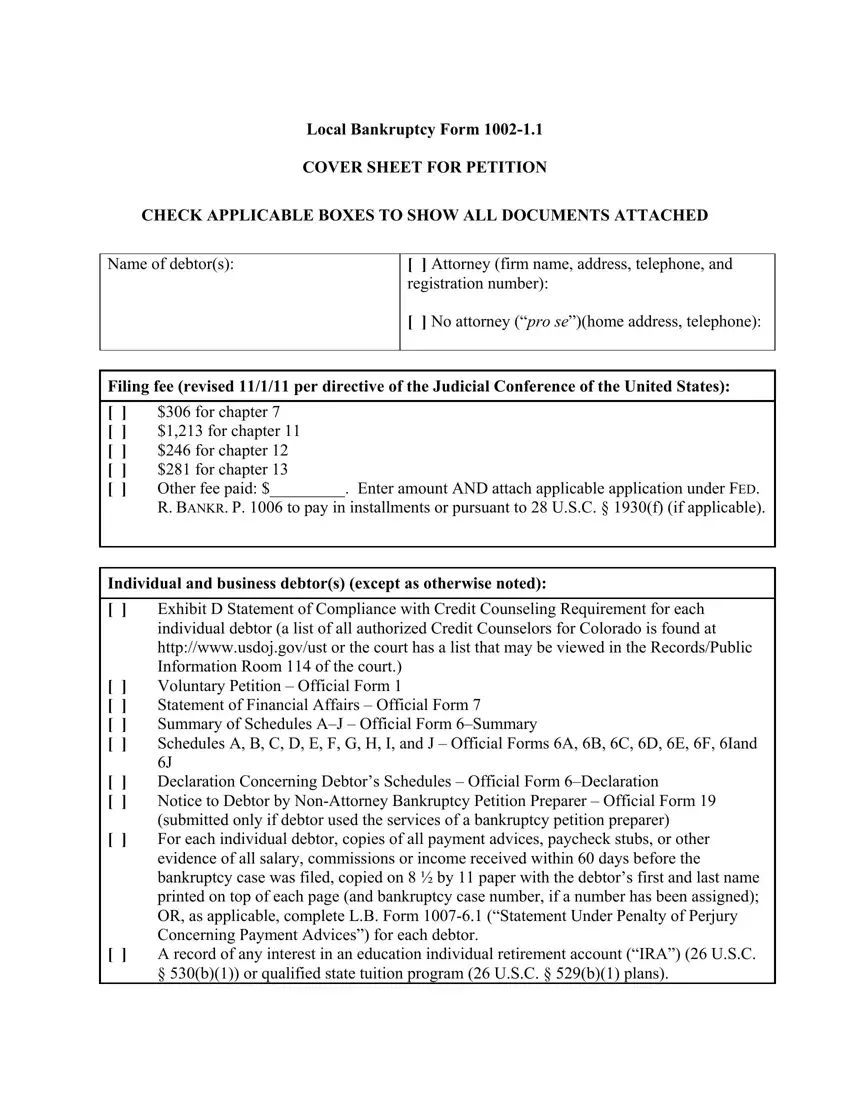

Your Home Page 1 of 22 10:39 - 18-Jan-2022 - IRS tax forms 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments. Form (and Instructions) Schedule A (Form 1040) Itemized Deductions Schedule B (Form 1040) Interest and Ordinary Dividends Schedule D (Form 1040) Capital Gains and Losses 982 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment) Abandonments and Repossessions, Canceled Debts, - IRS tax forms Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....14 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

Old Age Security Return of Income Guide for Non-Residents Use the worksheet on the back of your return to calculate your interest income, taxable dividend income, and capital gains (or losses). Interest and taxable dividend income Report all Canadian and foreign-source interest paid or credited to you in 2021 inlcuding interest income from bank accounts, term deposits, guaranteed investment ...

Worksheet for foreclosures and repossessions

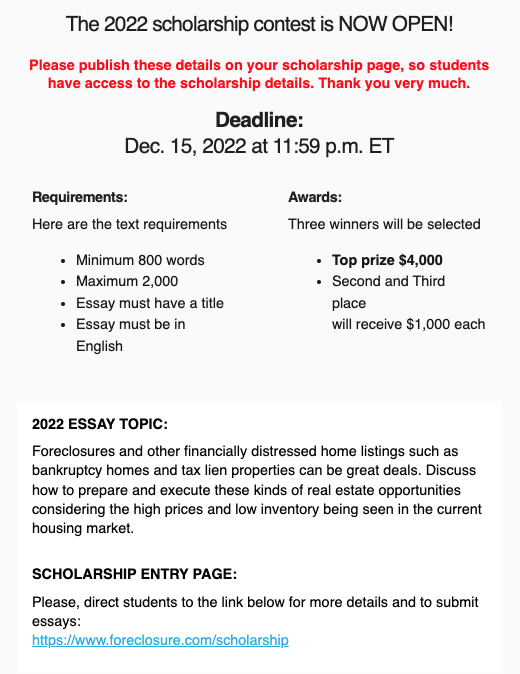

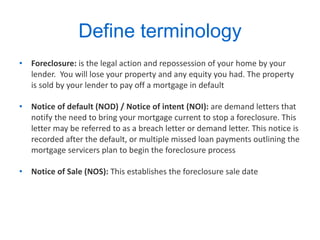

Topic No. 431 Canceled Debt – Is It Taxable or Not? See Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Caution: If property secured your debt and the creditor takes that property in full or partial satisfaction of your debt, you're treated as having sold that property to the creditor. Your tax treatment depends on whether you were personally ... Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Sales or Other Dispositions (Such as Foreclosures and Repossessions) Recourse debt. If you owned property that was subject to a recourse debt in excess of the FMV of the property, the lender's foreclosure or repossession of the property is treated as a sale or disposition of the property by you and may result in your realization of gain or loss. 21.6.6 Specific Claims and Other Issues | Internal Revenue ... Refer to Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Debt forgiven on second homes, rental property, business property, credit cards or car loans does not qualify for the tax-relief provision.

Worksheet for foreclosures and repossessions. Publication 523 (2021), Selling Your Home | Internal Revenue ... If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. See Pub. 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. 544, for examples of how to figure gain or loss. 21.6.6 Specific Claims and Other Issues | Internal Revenue ... Refer to Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Debt forgiven on second homes, rental property, business property, credit cards or car loans does not qualify for the tax-relief provision. Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Sales or Other Dispositions (Such as Foreclosures and Repossessions) Recourse debt. If you owned property that was subject to a recourse debt in excess of the FMV of the property, the lender's foreclosure or repossession of the property is treated as a sale or disposition of the property by you and may result in your realization of gain or loss. Topic No. 431 Canceled Debt – Is It Taxable or Not? See Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Caution: If property secured your debt and the creditor takes that property in full or partial satisfaction of your debt, you're treated as having sold that property to the creditor. Your tax treatment depends on whether you were personally ...

:max_bytes(150000):strip_icc():gifv()/173843942-56a067943df78cafdaa16dcb.jpg)

0 Response to "45 worksheet for foreclosures and repossessions"

Post a Comment