38 qualified dividends and capital gain tax worksheet line 44

qualified dividends and capital gains worksheet 2020 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends. Qualified Dividends And Capital Gains Worksheet 2019 Irs Worksheet . worksheet dividends gains. 32 Qualified Dividends And Capital Gain Tax Worksheet 2015 - Worksheet dontyou79534.blogspot.com. dividends gain fillable Publication 525 (2021), Taxable and Nontaxable Income WebAlthough you held the stock for more than a year, less than 2 years had passed from the time you were granted the option. In 2021, you must report the difference between the option price ($10) and the value of the stock when you exercised the option ($12) as wages. The rest of your gain is capital gain, figured as follows.

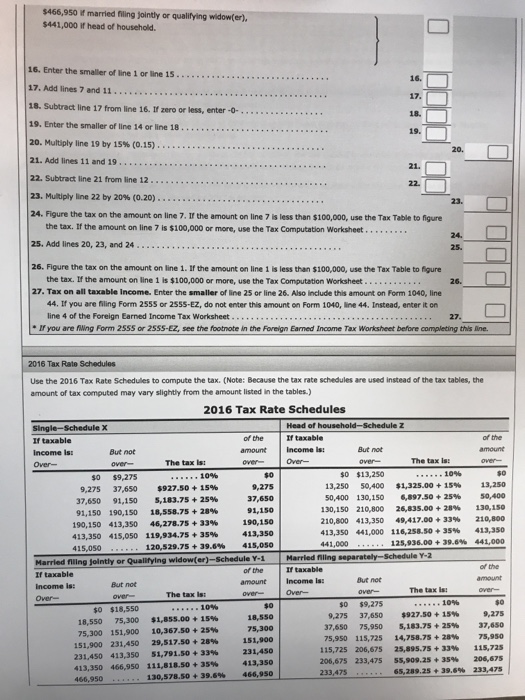

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Qualified dividends and capital gain tax worksheet line 44

Instructions for Form 8615 (2022) | Internal Revenue Service WebNet capital gain and qualified dividends on line 8. If neither the child, nor the parent, nor any other child has net capital gain, the net capital gain on line 8 is zero. (The term “other child” means any other child whose Form 8615 uses the tax return information of the parent identified on lines A and B of Form 8615.) If neither the child, nor the parent, nor any … PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. 2014 Qualified Dividends and Capital Gain Tax Worksheet 2014 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

Qualified dividends and capital gain tax worksheet line 44. › fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing. How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Qualified Dividends And Capital Gain Tax W0rksheet Line 44 *Click on Open button to open and print to worksheet. 1. Line 44 the Tax Computation Worksheet on if you are filing ... ReloadOpenDownload 2. Capital Gains and Losses ReloadOpenDownload 3. Qualified Dividends and Capital Gain Tax Worksheet -Line ... ReloadOpenDownload 4. Form 1040Lines 42 and 44 You must complete and attach ... ReloadOpenDownload How to Download Qualified Dividends and Capital Gain Tax Worksheet ... A qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. These tax rates are lower than the income tax rate on ordinary or unqualified dividends. The tax rates on ordinary dividends are the same as the tax rates on income from salary or wages. How Are Qualified Dividends Described For Tax Purposes?

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields Country of origin: US File type: PDF Publication 550 (2021), Investment Income and Expenses - IRS tax … WebLine 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Use Part II if you held the shares more than 1 year. Use Part I if you held your mutual fund shares 1 year or less. For details on Form … PDF Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Do not : complete lines 21 and 22 below. No. ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ...

Qualified dividends and capital gain tax worksheet | Chegg.com Question: Qualified dividends and capital gain tax worksheet line 44 This question hasn't been solved yet Ask an expert Ask an expert Ask an expert done loading 1040 (2021) | Internal Revenue Service - IRS tax forms WebQualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents . Form 8862, who must file. Payments. Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099; Line 25c—Other Forms; Line 26. 2021 Estimated Tax Payments. Divorced taxpayers. … Publication 929 (2021), Tax Rules for Children and Dependents WebIf line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet. But ... Qualified Dividends And Capital Gain Tax Worksheet 2021 WebQualified Dividends and Capital Gain Tax Worksheet 2015-2022: get and sign the form in seconds Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Get form. Checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43. However, if you are filing Form …

Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon 2017 Qualified Dividends and capital gain tax worksheet—line 44 • See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. • Before completing this worksheet, complete Form 1040 through line 43.

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Qualified dividends: Line 3a (See the instructions there.) Ordinary dividends: Line 3b (See the instructions there.) Capital gain distributions: Line 7, or, if required, Schedule D, line 13. (See the instructions of Form 1040 or 1040-SR.) Section 1250, 1202, or collectibles gain (Form 1099-DIV, box 2b, 2c, or 2d) Form 8949 and Schedule D

I need to see the calculation for Qualif. Div. and Cap Gain Tax ... Working onForm 1040 Line 44 "Qualified Dividends and Capital Gains Worksheet" I'm on Line 24 and it says to "use the Tax Computation Worksheet" (if line 7 is over $100k, which mine is). Turbo Tax has made a calculation and I REALLY MUST REVIEW THE CALCULATION but I can't find it within TurboTax. Thanks TurboTax Premier Online 1 1 1,373 Reply

en.wikipedia.org › wiki › Capital_gains_tax_in_theCapital gains tax in the United States - Wikipedia The capital gain that is taxed is the excess of the sale price over the cost basis of the asset. The taxpayer reduces the sale price and increases the cost basis (reducing the capital gain on which tax is due) to reflect transaction costs such as brokerage fees, certain legal fees, and the transaction tax on sales. Depreciation

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. It's Line 11a of Form 1040. You can check the sample of the worksheet here: ... No taxpayer entitled to the dividend income on stocks or mutual funds held is exempt from filing the Qualified Dividends and Capital Gain Tax Worksheet.

What is a Qualified Dividend Worksheet? - Money Inc All about the qualified dividend worksheet. If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a."In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10.

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 44 - Tax Guru Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

2022 Instructions for Schedule D (2022) - IRS tax forms WebComplete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16, (or in the …

› instructions › i1041siInstructions for Schedule I (Form 1041) (2021) | Internal ... line 2 of an AMT Qualified Dividends Tax Worksheet in the Instructions for Form 1041; line 23 of an AMT Schedule D (Form 1041); or line 2 of an AMT Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1041), whichever applies. C: line 5, column (h), of an AMT Schedule D (Form 1041). D: line 12, column (h), of an AMT Schedule D ...

2012 Qualified Dividends Worksheets - K12 Workbook Worksheets are 44 of 107, 2014 qualified dividends and capital gain tax work, 43 of 107 fileid ionsi10402017axmlcycle16, 2012 pennsylvania telefile work, Capital gains and losses, Line 44 the tax computation work on if you are filing, 2018 form 6251, Form 1040 es payment voucher 1. *Click on Open button to open and print to worksheet.

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return.

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet Tax on all taxable income. Enter the smaller of line 25 or line 26. Also include this amount on Form 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28).

Qualified Dividends And Capital Gain Tax Worksheet Line 44 [PDF] - 50 ... We come up with the money for Qualified Dividends And Capital Gain Tax Worksheet Line 44 and numerous book collections from fictions to scientific research in any way. among them is this Qualified Dividends And Capital Gain Tax Worksheet Line 44 that can be your partner. Business Taxpayer Information Publications 2004 Tele-tax United States.

› pub › irs-pdfIRS tax forms IRS tax forms

Capital gains tax in the United States - Wikipedia WebIn the United States of America, individuals and corporations pay U.S. federal income tax on the net total of all their capital gains.The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less …

capital gain worksheet Qualified Dividends and Capital Gain Tax Worksheet—Line 44. 15 Images about Qualified Dividends and Capital Gain Tax Worksheet—Line 44 : Capital Raising Worksheet - Eloquens, Capital Gains Worksheet Part 3 Line 1 Worksheet : Resume Examples and also Capitalization worksheet for Kindergarten (1 page) by Joanne McFarland.

Qualified Dividends and Capital Gains Worksheet - StuDocu Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet ..... 26. 27. Tax on all taxable income. Enter the smaller of line 25 or 26. Also include this amount on the entry space on Form 1040 or 1040 ...

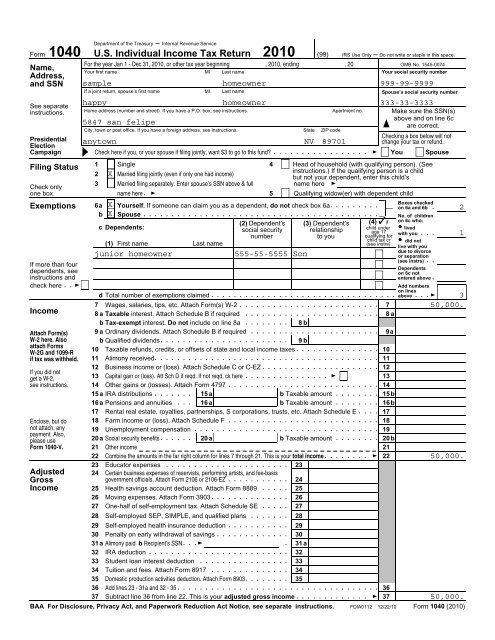

Free Microsoft Excel-based 1040 form available Line 42 - Deductions for Exemptions Worksheet; Line 44 - Qualified Dividends and Capital Gain Tax Worksheet; Line 52 - Child Tax Credit Worksheet; Lines 64a and 64b - Earned Income Credit (EIC) Six additional worksheets round out the tool: W-2 input forms that support up to 4 employers for each spouse; 1099-R Retirement input forms for ...

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

Publication 17 (2021), Your Federal Income Tax - IRS tax forms WebIf a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return. If this election is …

capital gain tax worksheet 2015 2020 Form IRS Instruction 1040 Line 44 Fill Online | 1040 Form. 14 Pics about 2015 2020 Form IRS Instruction 1040 Line 44 Fill Online | 1040 Form : Qualified Dividends and Capital Gain Tax Worksheet—Line 44, Irs Form 1040 Capital Gains Worksheet Form : Resume Examples and also 1040 Qualified Dividends And Capital Gains Worksheet - Promotiontablecovers.

IRS tax forms WebIRS tax forms

› instructions › i8615Instructions for Form 8615 (2022) | Internal Revenue Service Figure the tax on the amount on line 8 using the Tax Table, the Tax Computation Worksheet, the Qualified Dividends and Capital Gain Tax Worksheet (in the Instructions for Form 1040, or the Instructions for Form 1040-NR), the Schedule D Tax Worksheet (in the Schedule D instructions), or Schedule J (Form 1040), as follows.

Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.This document is locked as it has been sent for signing. Web form 1040 qualified dividends and capital gain tax worksheet. ... Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, qualified ...

PDF Line 44 the Tax Computation Worksheet on if you are filing Form 2555 or ... subtract Form 1040, line 43, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet). If the result is more than zero, that amount is your capital gain excess. If you do not have a capital gain excess, complete the rest of either of those worksheets according to the worksheet's ...

Qualified Dividends and Capital Gain Tax Worksheet." - Intuit For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the "Forms In My Return" list and open the Qualified Dividends and Capital Gain Tax Worksheet.. The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet.

Qualified Dividends and Capital Gain Tax Worksheet 2016.pdf... Ratings 100% (19) This preview shows page 1 out of 1 page. View full document 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 43.

2014 Qualified Dividends and Capital Gain Tax Worksheet 2014 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1.

Instructions for Form 8615 (2022) | Internal Revenue Service WebNet capital gain and qualified dividends on line 8. If neither the child, nor the parent, nor any other child has net capital gain, the net capital gain on line 8 is zero. (The term “other child” means any other child whose Form 8615 uses the tax return information of the parent identified on lines A and B of Form 8615.) If neither the child, nor the parent, nor any …

0 Response to "38 qualified dividends and capital gain tax worksheet line 44"

Post a Comment