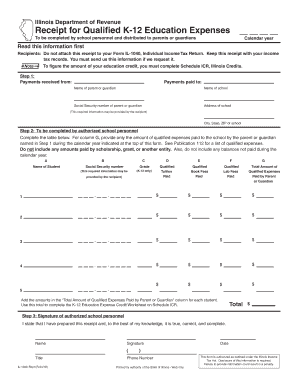

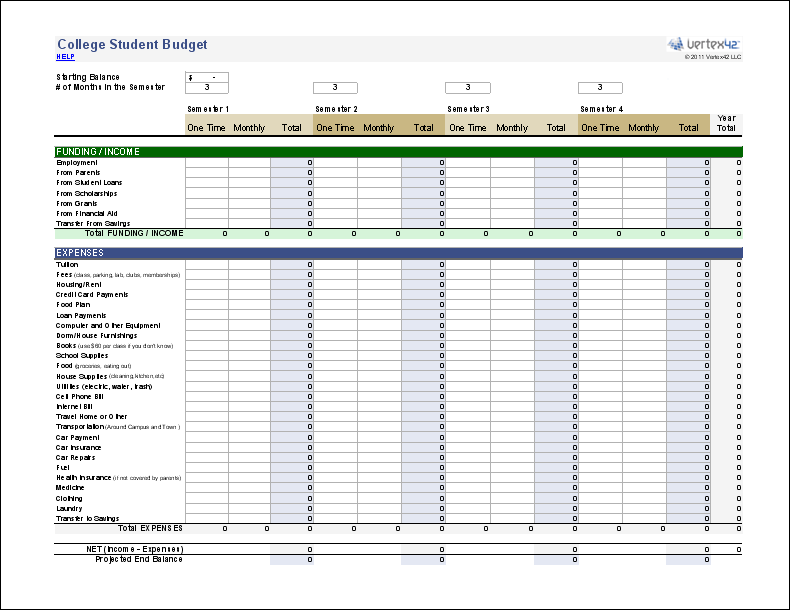

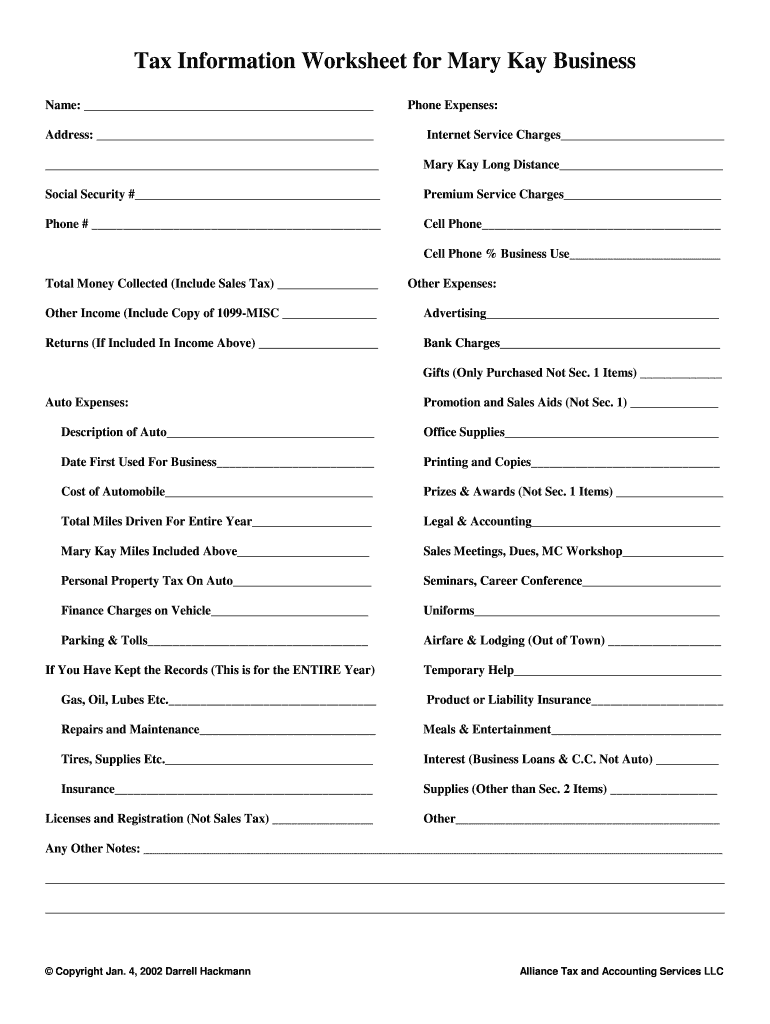

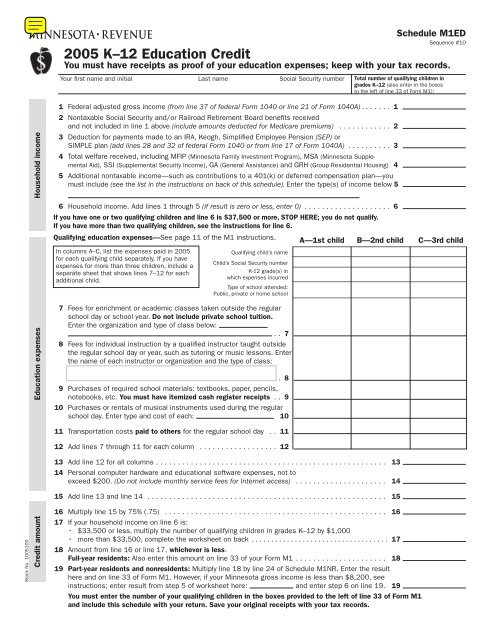

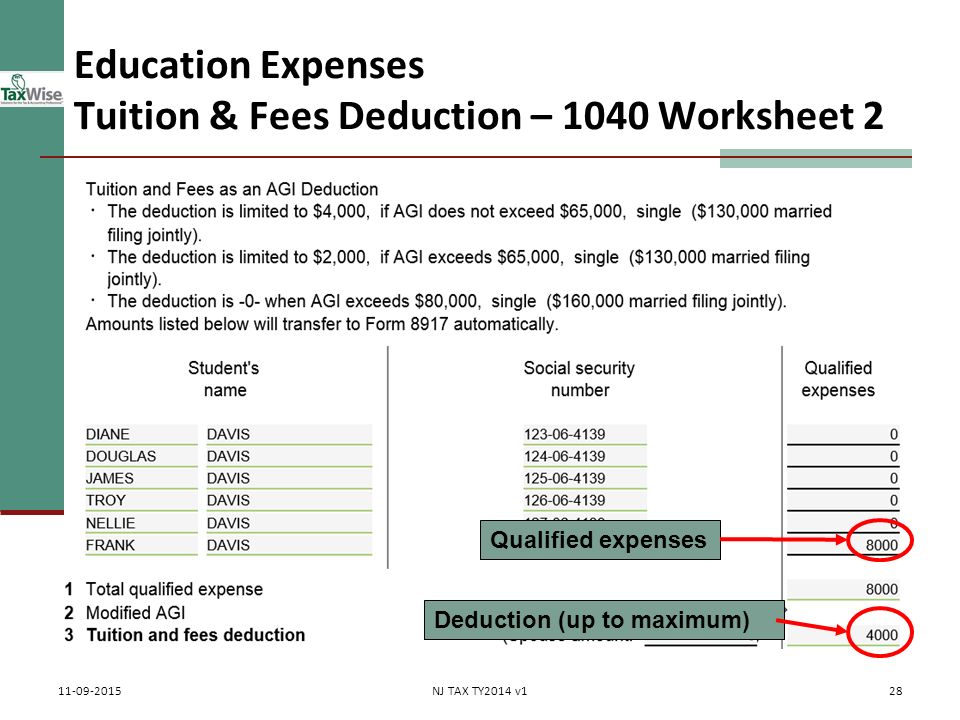

38 qualified education expenses worksheet

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income Qualified Medicaid waiver payments. Certain payments you receive for providing care to an eligible individual in your home under a state's Medicaid waiver program may be excluded from your income under Notice 2014-7. See also Instructions for Schedule 1 (Form 1040), line 8z. Qualified settlement income. IRS tax forms IRS tax forms

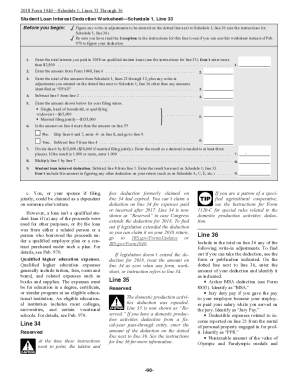

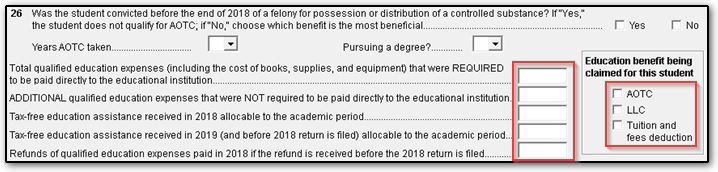

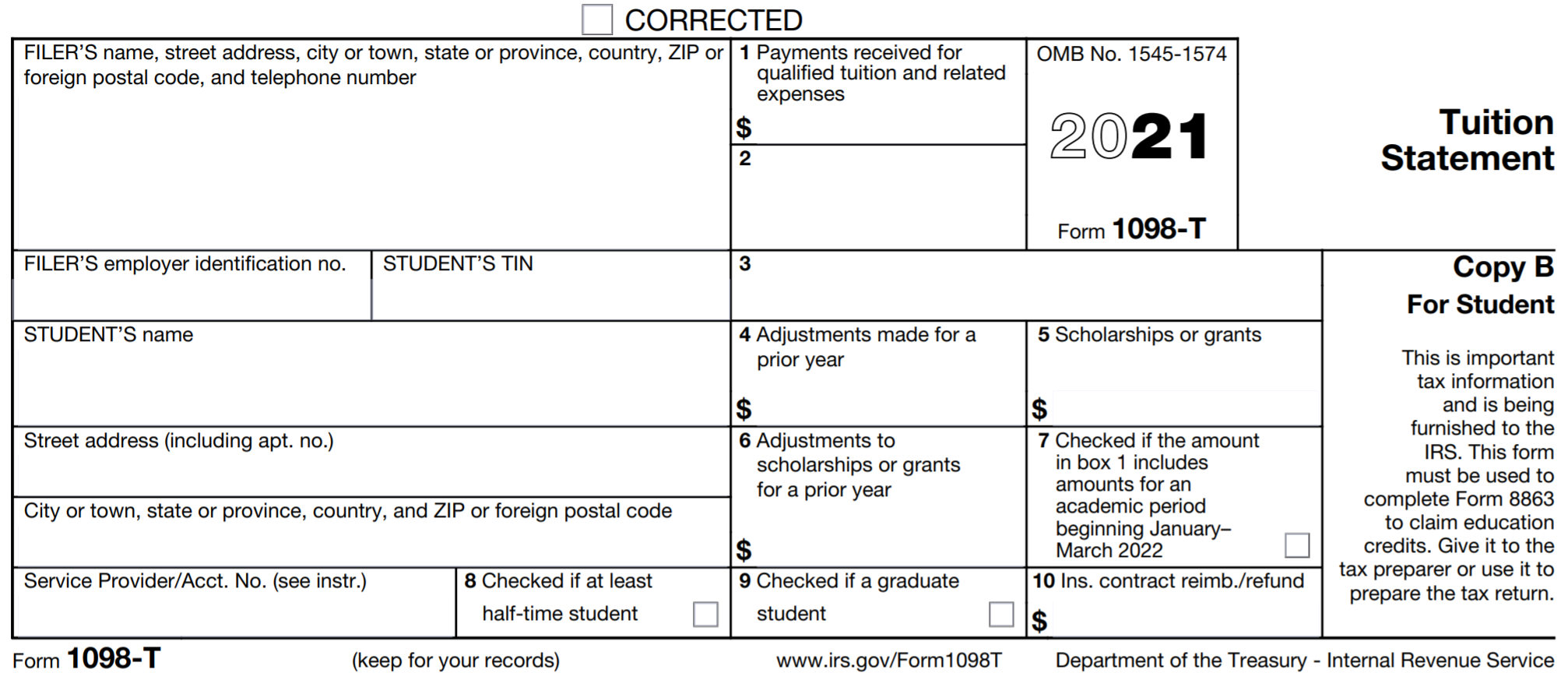

› pub › irs-pdf21 Internal Revenue Service Department of the Treasury Expenses paid by a third party. Qualified education expenses paid on behalf of the student by someone other than the student (such as a relative) are treated as paid by the student. However, qualified education expenses paid (or treated as paid) by a student who is claimed as a dependent on your tax return are treated as paid by you.

Qualified education expenses worksheet

Instructions for Form 5695 (2020) | Internal Revenue Service Complete the following worksheet to figure the amount to enter on line 14. If you are claiming the child tax credit or the credit for other dependents for 2020, the amount you enter on line 4 of the worksheet depends on whether you are filing Form 2555. If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents … › publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... › publications › p526Publication 526 (2021), Charitable Contributions | Internal ... Qualified cash contributions for 2021 plus qualified contributions for relief efforts in a qualified disaster area, declared prior to February 26, 2021, subject to the limit based on 100% of AGI. Deduct the contributions that don't exceed 100% of your AGI minus all your other deductible contributions.

Qualified education expenses worksheet. › publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021.. › news-and-insightsNews and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more › ohrp › regulations-and-policy45 CFR 46 | HHS.gov The HHS regulations for the protection of human subjects in research at 45CFR 46 include five subparts. Subpart A, also known as the Common Rule, provides a robust set of protections for research subjects; subparts B, C, and D provide additional protections for certain populations in research; and subpart E provides requirements for IRB registration. › publications › p526Publication 526 (2021), Charitable Contributions | Internal ... Qualified cash contributions for 2021 plus qualified contributions for relief efforts in a qualified disaster area, declared prior to February 26, 2021, subject to the limit based on 100% of AGI. Deduct the contributions that don't exceed 100% of your AGI minus all your other deductible contributions.

› publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... Instructions for Form 5695 (2020) | Internal Revenue Service Complete the following worksheet to figure the amount to enter on line 14. If you are claiming the child tax credit or the credit for other dependents for 2020, the amount you enter on line 4 of the worksheet depends on whether you are filing Form 2555. If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents …

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "38 qualified education expenses worksheet"

Post a Comment