38 realtor tax deduction worksheet

Tax Deduction Worksheet Realtors Form - signNow Follow the step-by-step instructions below to design your tax worksheet rEvaltors: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Realtor Tax Deductions And Tips You Must Know - Easy Agent PRO If a Realtor uses part of their home exclusively and regularly for business, some mortgage, utility, tax and insurance expenses may also be deductible. For the second year, taxpayers can use a new and simpler calculation of $5 per square foot for a maximum of 300 square feet.

PDF Realtor - Tax Deduction Worksheet This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax & Accounting (480) 831-6565 with any specific questions or to book your tax appointment. Other: Other: Rent Repairs to Sell Listed Property Shipping Stationery FAX Machine. Title: Realtor - Tax Deduction Worksheet.xls

Realtor tax deduction worksheet

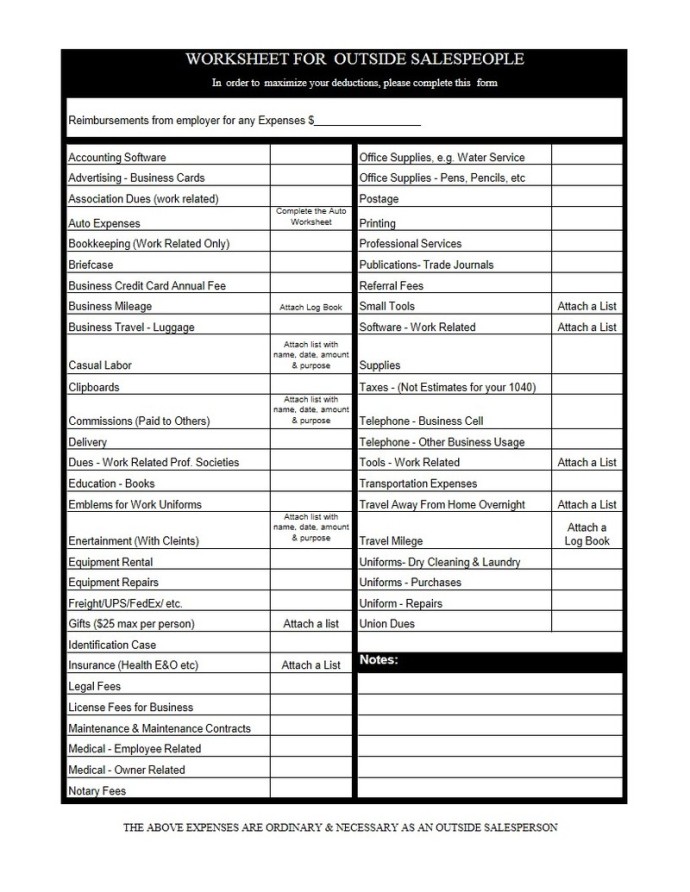

Real Estate Agent Tax Deductions PDF Form - FormsPal real estate agent tax deduction spreadsheet, real estate agent tax deductions worksheet 2020, real estate agent tax deductions worksheet excel, realtor deductions worksheet: 1 2. Form Preview Example. Realtors Tax Deductions Worksheet. AUTO TRAVEL. Your auto expense is based on the number of qualified business miles you drive. Expenses for ... Create a Realtor Expense Spreadsheet (+Template) | Kyle Handy In addition to tax deductions and expenses, there are also spreadsheets for real estate investing, house flipping, rental properties, and more. The type of expense spreadsheet you need depends on the type of expenses that you're tracking. Here are a few types of spreadsheets you might need: Real estate investment. Real Estate Agent Tax Deductions Worksheet 2021 - Fill Online ... document the costs you claim for all of these items using a specific, detailed statement in your records (using a mileage or other rate or rate-period basis) indicating the dates of the deductions (for each item), the purpose for which the deduction is made, and the total of all deductions (including any adjustments), whether made directly from …

Realtor tax deduction worksheet. Tax Deduction Worksheets - K12 Workbook Worksheets are Tax deduction work, Realtor, Truckers work on what you can deduct, Small business tax work, Itemized deduction work tax year, Small business work, Work to estimate federal tax withholding year 2019, Alabama d irc section 965 20. *Click on Open button to open and print to worksheet. 1. Tax Deduction Worksheet ReloadOpenDownload 2. Realtors Tax Deductions Worksheet | Golfnrealtor Publication 17 - Your Federal Income Tax (For Individuals) - Part D. Figuring and Claiming the EIC. EIC Worksheet B. Use EIC Worksheet B if you were self-employed at any time in 2017 or are a member of the. 16 Real Estate Tax Deductions for 2019 | 2019 Checklist Hurdlr - In fact, nearly all of the real estate agents we polled want to ... Real Estate Agent Tax Deduction Wordsheet - Google Sheets Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers Real Estate Agent Tax Deductions Worksheet Excel - Fill Online ... 1. In your personal income tax return for the year, enter the amount of the actual deduction, including any related amounts such as depreciation and other special depreciation allowances. Include all regular and nonregular deductions as well as any other applicable tax credits and items. 2.

Your Home Tax Deduction Checklist: Did You Get Them All? - realtor.com The upside: It's tax-deductible as long as your adjusted gross income is less than $100,000. (For each $1,000 you make after that, you can deduct 10% less of your PMI, up to $109,000.) PMI is ... Realtor Deduction Worksheets - Printable Worksheets Showing top 8 worksheets in the category - Realtor Deduction. Some of the worksheets displayed are Realtor, Realtors tax deductions work, Realtor deductions, Real estate income expense work, Rental property work, Cheat for real estate investors, Tax work for self employed independent contractors, 2020 deductions work small business tax. 51 Real Estate Agent Tax Deductions You Should Know Smaller services and fee items can be a great source of tax deductions, which you must keep track of. They include: 21. Online business registration fees (registration fees for online realtors) 22. Inspection Fees 23. Professional Development Fee (NAR membership fee) 24. Business Bank Fees 25. Book Keeping fees Realtor Tax Deduction Lists Worksheets - Learny Kids Realtor Tax Deduction Lists Worksheets - total of 8 printable worksheets available for this concept. Worksheets are Real estate income expense work, I...

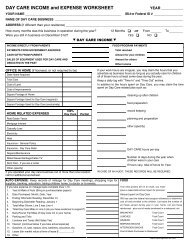

PDF REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET - Tax Goddess REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ... Tax Deductions Worksheets - K12 Workbook Worksheets are Tax deduction work, Truckers work on what you can deduct, Realtors tax deductions work, Realtor, Schedule a tax deduction work, Rental property tax deduction work, Day care income and expense work year, Work to estimate federal tax withholding year 2019. *Click on Open button to open and print to worksheet. 1. Tax Deduction Worksheet Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction. Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling

PDF Realtors Tax Deduction Worksheet - FormsPal Realtors Tax Deduction Worksheet Due to the overwhelming response to last month's Realtor "tax tip" article, Daszkal Bolton LLP has created this Realtors' ... If you have any questions or need specific advice on a particular Real Estate issue, please contact Jeff Bolton, CPA at 561-367-1040. Advertising, Signs, Flag & Banners Appraisal ...

Real Estate Professional Expense Worksheet - atmTheBottomLine Below are forms and worksheets to help you keep track of your expenses: Real Estate Professional Expense Worksheet (.xls) Real Estate Professional Expense Worksheet (.pdf) Real Estate Professional Expenses Spreadsheet (.xls) Copyright © 2022. atmTheBottomLine.com Desktop Version

Realtors Worksheet Deductions Tax - Kyrealestatebyzip This deduction began on Jan. 1, 2018 and is scheduled to last through Dec. 31, 2025. For more information on deductions and other tax issues for real estate agents and brokers, refer to the Business Tax & Deductions section of the Nolo website.. mobility tax · Mortgage recording tax · Real estate transfer tax.

10 Tax Deductions for Real Estate Agents & Realtors in 2022 After all, it's not what you make, but how much you keep that matters! So, here are ten common tax deductions for real estate agents: 1. Commissions Paid Out Have you paid a portion of your commission to referring agents or a buyer's agent on your team? Those are deductible! 2. Broker and Desk Fees Are broker fees tax deductible?

Tax Deductions for Real Estate Agents 2022: Ultimate Guide 6 Real Estate Agent Car Tax Deduction 6.1 Simple Method (Standard Mileage Deduction) 6.2 Actual Method 7 Business Travel & Meals 8 Home Office Deduction 8.1 Simplified Method for Realtors 8.2 Detailed Method for Realtors 9 Office Rent And Utilities 10 Business Gifts ($25 Deduction Limit) 11 Expenses Paid on Clients Behalf

Get the free tax deduction worksheet realtors form - pdfFiller We encourage you to go through and watch the videos in order to learn more about your options. Also, you will be able to print out our 2012 Tax Deductible and Adjusted Gross Income Worksheets which will help you to determine your taxable income. Get started! 4.0. Satisfied.

16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Deduction #4 Show Detail Advertising Expense The IRS allows you to deduct reasonable advertising expenses that are directly related to your business activities. Deduction #5 Show Detail Home Office Deduction

Licensed Real Estate Agents - Real Estate Tax Tips Statutory Nonemployees. Licensed real estate agents are statutory nonemployees and are treated as self-employed for all Federal tax purposes, including income and employment taxes, if: Substantially all payments for their services as real estate agents are directly related to sales or other output, rather than to the number of hours worked ...

115 Popular Tax Deductions For Real Estate Agents For 2022 - Kyle Handy Meal Tax Deductions For Real Estate Agents If you discuss work with a coworker, client, or friend while purchasing a meal, it's a write-off of 50%. Be sure to document who you ate the meal with and a sentence or two about what you discussed. Meals (50%) Home Office Deduction

Cheat Sheet Of 100+ Legal Tax Deductions For Real Estate Agents Such a cheat sheet is exactly what's below, thanks to two folks: 1) Fred Podris of Podris Tax Service who compiled the list, and REALTOR® Brenda Douglas who kindly posted it to Facebook for all to benefit from. One problem, though. This cheat sheet, which was originally intended as a print-out, isn't legible in digital format (see below).

tax worksheet realtors: Fill out & sign online | DocHub Click on New Document and choose the form importing option: add tax deduction worksheet realtors from your device, the cloud, or a secure link. Make changes to the template. Use the top and left panel tools to modify tax deduction worksheet realtors.

Real Estate Agent Tax Deductions Worksheet 2021 - Fill Online ... document the costs you claim for all of these items using a specific, detailed statement in your records (using a mileage or other rate or rate-period basis) indicating the dates of the deductions (for each item), the purpose for which the deduction is made, and the total of all deductions (including any adjustments), whether made directly from …

Create a Realtor Expense Spreadsheet (+Template) | Kyle Handy In addition to tax deductions and expenses, there are also spreadsheets for real estate investing, house flipping, rental properties, and more. The type of expense spreadsheet you need depends on the type of expenses that you're tracking. Here are a few types of spreadsheets you might need: Real estate investment.

Real Estate Agent Tax Deductions PDF Form - FormsPal real estate agent tax deduction spreadsheet, real estate agent tax deductions worksheet 2020, real estate agent tax deductions worksheet excel, realtor deductions worksheet: 1 2. Form Preview Example. Realtors Tax Deductions Worksheet. AUTO TRAVEL. Your auto expense is based on the number of qualified business miles you drive. Expenses for ...

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "38 realtor tax deduction worksheet"

Post a Comment