39 income tax deduction worksheet

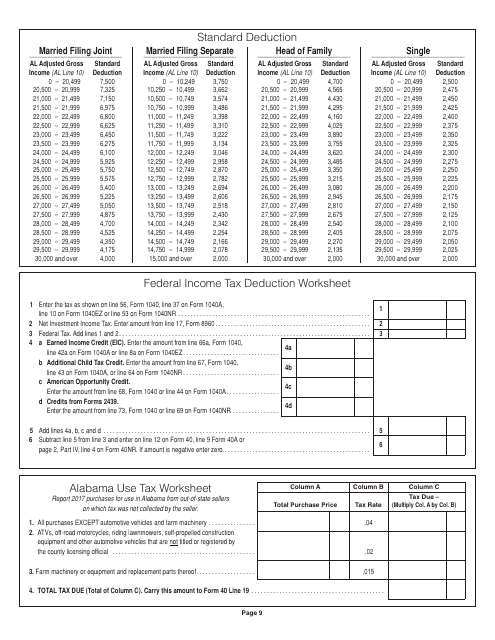

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates Nov 14, 2019 · An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Hawaii Form N-15 (Individual Income Tax Return ... - TaxFormFinder Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed. While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms must be completed, depending on the taxpayer's individual situation, to …

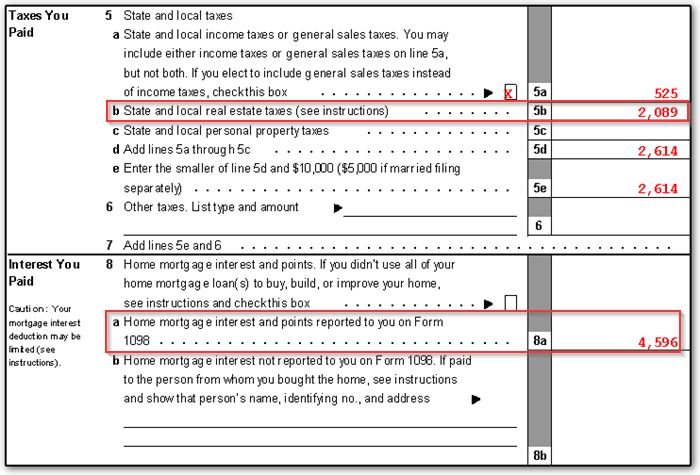

How to Calculate Federal Income Tax - Rates Table & Tax Brackets 27/04/2022 · The tables only go up to $99,999, so if your income is $100,000 or higher, you must use a separate worksheet (found in the Form 1040 Instructions) to calculate your tax. To illustrate, let’s say your taxable income (Line 15 on Form 1040) is $41,049.

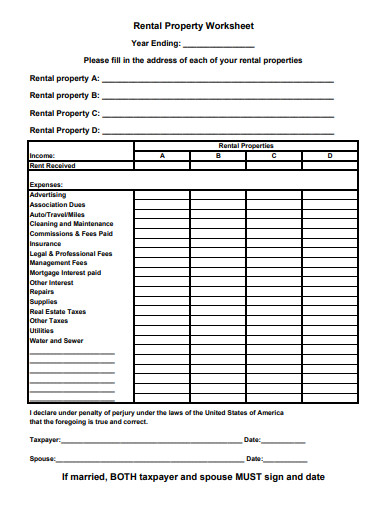

Income tax deduction worksheet

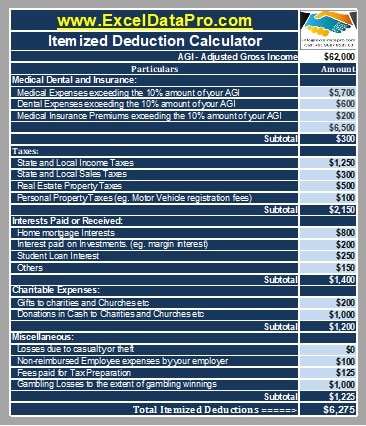

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 18/10/2022 · Your adjusted gross income (AGI) is your total income subject to tax from your tax return minus any adjustments to income, such as contributions to a traditional IRA and deductible student loan interest. As a result of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has nearly doubled from where it was in 2016. For 2022, the ... Tax Preparation Checklist. Collect Your Forms Before you e-File. 25/10/2022 · 2022 Tax Return Checklist in 2023. Taxes are difficult enough, preparing them shouldn't be. We at eFile.com striving to remove the Tax Mumbo Jumbo from you as much as possible, thus we strongly suggest you prepare to prepare your income tax returns, as too many taxpayers rush into this to get their refunds, only to realize later that they missed a W-2 or 1099, … View Massachusetts personal income tax exemptions | Mass.gov You must itemize deductions on your Form 1040 - U.S. Individual Income Tax Returns. For 2020, if you itemize on U.S. Schedule A (Line 4) and have medical/dental expenses greater than 7.5% of federal AGI, you may claim a medical and dental exemption in Massachusetts equal to the amount you reported on U.S. Schedule A, line 4.

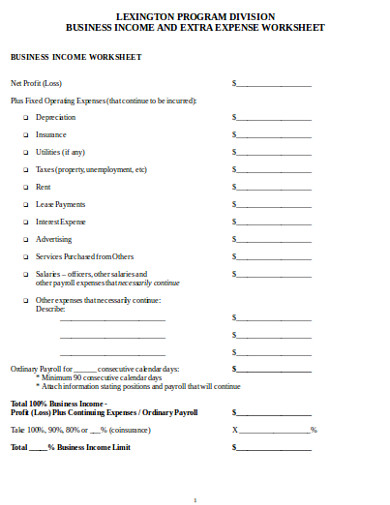

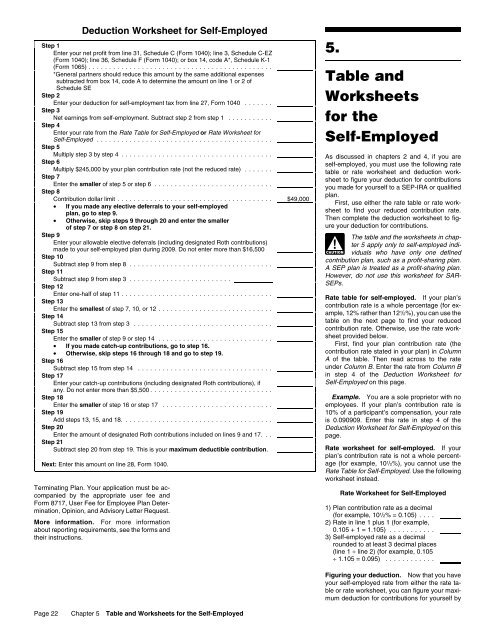

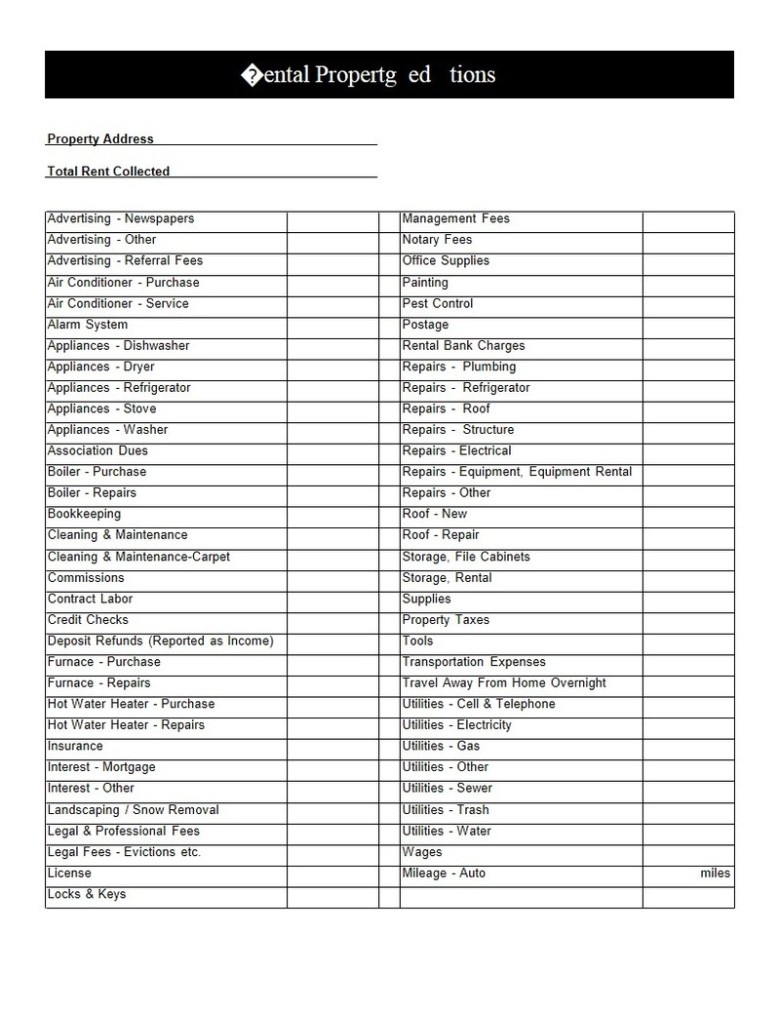

Income tax deduction worksheet. Publication 17 (2021), Your Federal Income Tax - IRS tax forms Qualified business income deduction. The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. If you don't meet the requirements to file Form 8995, use Form 8995-A, Qualified Business Income Deduction. For more information, see each form's instructions. Alternative … Individual Income Tax- FAQ - South Carolina File & Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund status View South Carolina's Top Delinquent Taxpayers Federal Income Tax and Benefit Guide – 2021 – Completing your ... You can claim a deduction on line 25600 of your return for the part of your foreign pension income that is tax-free in Canada because of a tax treaty. United States Social Security Report, on line 11500 of your return, the full amount in Canadian dollars of your U.S. Social Security benefits and any U.S. Medicare premiums paid on your behalf. View Massachusetts personal income tax exemptions | Mass.gov You must itemize deductions on your Form 1040 - U.S. Individual Income Tax Returns. For 2020, if you itemize on U.S. Schedule A (Line 4) and have medical/dental expenses greater than 7.5% of federal AGI, you may claim a medical and dental exemption in Massachusetts equal to the amount you reported on U.S. Schedule A, line 4.

Tax Preparation Checklist. Collect Your Forms Before you e-File. 25/10/2022 · 2022 Tax Return Checklist in 2023. Taxes are difficult enough, preparing them shouldn't be. We at eFile.com striving to remove the Tax Mumbo Jumbo from you as much as possible, thus we strongly suggest you prepare to prepare your income tax returns, as too many taxpayers rush into this to get their refunds, only to realize later that they missed a W-2 or 1099, … Are Medical Expenses Tax Deductible? - TurboTax Tax Tips 18/10/2022 · Your adjusted gross income (AGI) is your total income subject to tax from your tax return minus any adjustments to income, such as contributions to a traditional IRA and deductible student loan interest. As a result of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has nearly doubled from where it was in 2016. For 2022, the ...

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "39 income tax deduction worksheet"

Post a Comment