39 ocip insurance cost worksheet

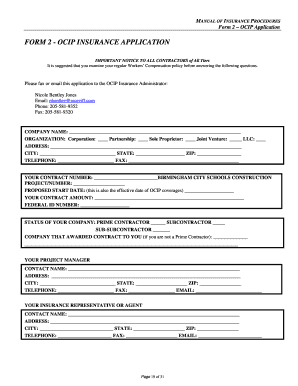

PDF OWNER CONTROLLED INSURANCE PROGRAM - California New Sonora Courthouse Tuolumne -OCIP Manual AIG 20150717 . COURTHOUSE CONSTRUCTION PROGRAM . NEW SONORA COURTHOUSE . OWNER CONTROLLED INSURANCE . PROGRAM MANUAL . PREPARED BY: Willis Insurance Services of California, Inc. 801 S. Figueroa Street, 8th Floor . Los Angeles, CA 90017) Phone: (213) 607-6300, Fax: (213) 607-6295 . CA License # 0371719 TO: All Planholders SUBJECT: ADDENDUM NO. 5 Contract No.: T-0212-0840R ... This addendum adds the Insurance Cost Worksheet to the contract solicitation. The Bidder shall acknowledge receipt of this addendum by completing and returning this form with the ... Controlled Insurance Program (OCIP) for this construction project. What is an OCIP? The MTA OCIP will provide General Liability, Workers' Compensation, and Excess ...

PDF OCIP Insurance Manual - Broward County, Florida An Owner Controlled Insurance Program (OCIP) is a coordinated insurance program providing certain insurance coverages as generally described in this Manual for Work at the Project Site(s). The Work is operations fully described in the Contract, performed at or emanating directly from the Project Site(s).

Ocip insurance cost worksheet

OCIP Workers Compensation Claims and Managing Them - Metropolitan Risk This drives the ultimate cost of your worker's compensation insurance premiums in the form of either surcharges or credits. If your EMR exceeds 1.2 you may not be eligible to bid on certain federal contracts which has an "opportunity cost." Some General Contractors may set a maximum allowable EMR of 1.0. CCIP & OCIP: A Guide to Controlled Insurance Programs in Construction How much does CIP cost? The cost for CCIP and OCIP coverage typically varies from 2% to 12% of construction costs. The actual premium is based on various risk factors, including the policy limits, types of coverage, project location, type of construction, and value of the project. Contract Clauses | FTA - Federal Transit Administration On the other hand, if the prime contract is a cost-type contract, where the prime is only promising a "best-efforts" performance, and the actual cost of the subcontractor’s performance will be passed on to the grantee, then the grantee has an important stake and a real risk in the subcontractor selection process because the subcontractor’s ...

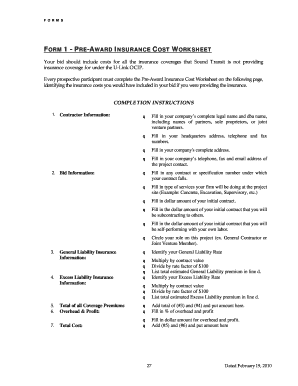

Ocip insurance cost worksheet. Premium Audit - Utica National As your insurance company we rate risks, based on uniform industry classifications found in a common coding database governed by the Insurance Services Office’s (ISO) Commercial Lines Manual. Depending on your business operations, your premium basis – sometimes called an exposure basis – is based on a value per $1,000 of gross sales ... Contractor's Guide to CIPs - CIP Insurance Cost | IRMI.com The original insurance cost calculated by the contractor is based on estimated payroll and contract value, and some CIP sponsors like to perform a "true-up" or "closeout" calculation using the actual or final payroll and contract value. Contractor Controlled Insurance Program (CCIP): Cost & Providers The "ccip insurance cost worksheet" is a spreadsheet that can be used to calculate the cost of different types of insurance. It also has a list of providers for each type of insurance. ... (CCIP) functions similarly to the Owner Controlled Insurance Plan (OCIP) (OCIP). The fundamental distinction is that, although both plans are acquired ... How to Calculate Insurance Credits for Time and Material Contracts Using the payroll estimate and the contractor's policy rating pages, you can calculate the insurance cost for a $1,000 contact. This will give you an insurance cost % to use going forward. Example: Initial Contract Value = $1,000, Insurance Cost = $30 (3%); Final Contract Value = $25,000, Final Insurance Cost = $750 (3%)

Owner Controlled Insurance Program (OCIP) — Colorado Department of ... Owner Controlled Insurance Program (OCIP) Project Insurance Manual Exhibit x At the time of award, CDOT will determine which Lines of Insurance Coverage will be covered in the OCIP, and which will be covered by the Contractor. Insurance Calculation Worksheet Form OCIP-A Insurance Worksheet Summary Form OCIP-B Instructions to Proposers Owner-Controlled Insurance Programs (OCIP) | Alliant OCIPs offer significant savings by enabling an owner to purchase insurance at a lower cost than its contractors. This removes contractors' insurance costs—which can range from 2% to 4% of construction costs. And by managing losses effectively, OCIP sponsors typically save between .5% and 1.2% of construction costs. SCHOOL DISTRICT CONSTRUCTION OWNER CONTROLLED INSURANCE PROGRAM OCIP or ... OWNER CONTROLLED INSURANCE PROGRAM OCIP or WRAP-UP CM Regent Insurance Company Insurance Cost Worksheet Program Administrator: Willis Towers Watson Project Insurance Group th One PPG Place, 10 floor Pittsburgh, PA 15222 Gary Meinen 412-863-4749 . What is an OCIP? An OCIP is a single insurance program covering specific job site risks of the ... How to Calculate Savings to an OCIP or CCIP - CR Solutions A standard OCIP feasibility study would compare the costs associated with the OCIP (fixed costs + variable costs, both at max and at loss pick) to the traditional costs of insurance carried by the general contractor and all of the trade contractors. It is best to start with projecting the trade contractors' traditional costs.

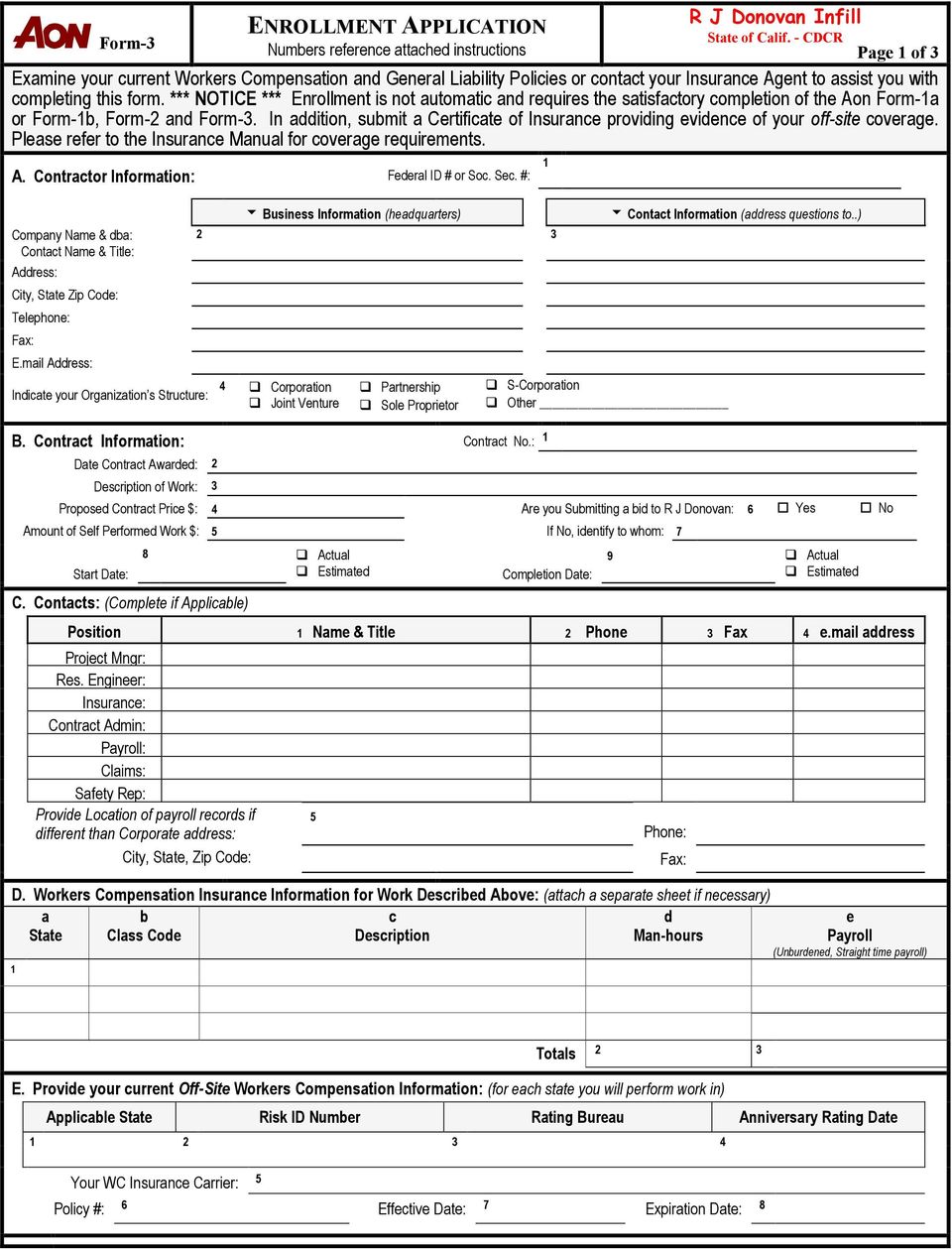

Operational Property Damage Insurance Sample Clauses Operational Property Damage Insurance. On or prior to the Substantial Completion Date or the expiration of the Construction All Risks insurance, whichever comes first, property damage insurance on an ... PDF Owner Controlled Insurance Program (OCIP) Insurance Manual Owner Controlled Insurance Program (OCIP) Insurance Manual . 4/24/14 edition . 12867927-v2 . Yale University ... Insurance Cost Worksheet (B) Form 1a: Loss Funding Calculation Worksheet (C) Form 1b: Insurance Cost Summary (D) Form 2: Enrollment (E) Form 3: Assignment Contractor Controlled Insurance Program: What to Know CCIP insurance is not for every contractor. In order for a CCIP to be appropriate, the contractor must be able to assume significant risk. These programs often have high deductibles, from $500,000 to $1 million per claim. Aon Wrap-Up Insurance Programs. Construction Wrap Up Policy AonWrap handles all aspects of wrap-up program administration and processing, including: Contractor enrollment and policy issuance Loss forecasting and budget modifications Cost allocations by contractor or contract Contract performance monitoring Change order monitoring Tracking of actual premiums versus contractor credits

The Owner-Controlled Insurance Program (OCIP) | ExpertLaw An OCIP is an Owner-Controlled Insurance Program, a type of insurance plan also known as a construction wrap-up insurance program. As a wrap-up plan, the OCIP replaces the traditional model under which the parties to a construction project would each obtain their own separate insurance coverage.

What is an OCIP - wrapinsurance.com What Is An OCIP? An Owner Controlled Insurance Program (OCIP) or "wrap-up program" is a coordinated insurance program for construction projects. An OCIP, unlike traditional construction insurance coverage, provides eligible participants of a construction project with general liability coverage under one policy.

Construction | Insurance Broking & Risk Management | Marsh The construction industry is characterized by multiple risk variables that impact on safety, timing, completion, and profitability. Marsh's globally-aligned team of construction industry specialists can work with you to create tailored risk and insurance solutions. Construction is an essential industry for the global economy and activity in ...

PDF Owner Controlled Insurance Program (OCIP) Manual - California insurance costs due to eligibility for OCIP Coverages, as determined by using the Alliant WrapX system which includes the Enrollment Form and the Insurance Cost Worksheet. Instructions for access to Alliant WrapX are located in Section 8 of this Insurance Manual. The Cost of OCIP Coverages includes reduction in insurance premiums,

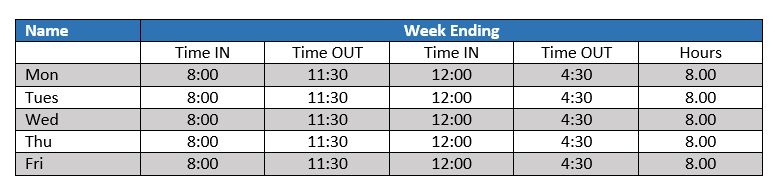

Gross Payroll vs. Reportable Payroll - Turner Surety and Insurance ... Reportable Payroll. In most states, Reportable payroll is simply the straight time wage for the number of hours worked. There are no f ringe benefits, (i.e. health insurance, 401 (k) benefits, etc.) and no overtime rates included in the Reportable Payroll. For example, if your employee works 50 hours on a jobsite and is paid $20 per hour ...

SCHOOL DISTRICT CONSTRUCTION OWNER CONTROLLED INSURANCE PROGRAM OCIP or ... OWNER CONTROLLED INSURANCE PROGRAM OCIP or WRAP-UP CM Regent Insurance Company Insurance Cost Worksheet Program Administrator: Willis of Pennsylvania, Inc. Project Insurance Group One PPG Place, 10th floor Pittsburgh, PA 15222 Gary Meinen 412-863-4749

Owner-controlled insurance program - Wikipedia An owner controlled insurance program (OCIP) is an insurance policy held by a property owner during the construction or renovation of a property, which is typically designed to cover virtually all liability and loss arising from the construction project (subject to the usual exclusions).. Although an OCIP may be set up in a variety of ways, a policy package usually contains, at a minimum ...

PDF Owner Controlled Insurance Programmes (OCIPs) - Marsh on costs, we estimate that you could save a minimum of 20% on the insurance costs by taking an OCIP approach, but we have evidence of contractors charging the owner more than 200% of the original transacted insurance costs through the contract. An OCIP provides full transparency of cost to the owner and puts you in charge of procurement.

What You Need To Be Tracking When You're In An OCIP/CCIP OCIP's and CCIP's (also known as "Wrap Ups") may eliminate the need for individual contractors and subcontractors to obtain their own specific coverage for the project, ensuring adequate insurance coverage is in place and protecting against unknown lapses, exclusions, or limitations of coverage.

What is an Owner-Controlled Insurance Program (OCIP)? | Construction ... OCIPs are a relatively new type of insurance product that were first introduced to provide cost savings an administrative efficiencies for large commercial construction projects with budgets exceeding $50-100 million. However, in recent years, these insurance programs have become more popular and widely used for smaller projects as well.

PDF FORM 1 Insurance Cost Information Worksheet - Yale University OWNER CONTROLLED INSURANCE PROGRAM INSURANCE COST INFORMATION WORKSHEET . All Contractors, Subcontractors, and Sub‐subcontractors of every tier, are required to complete this worksheet and submit as part of your bid. ... The cost of the premiums for the non‐OCIP insurance specified in the Contract will be paid for by the Contractor. 5. Any ...

Wrap-Up Insurance: What Are OCIPs & CCIPs? | Embroker Wrap-up insurance is a policy for either very large construction projects that cost upwards of $10 million ($3-5 million in California) or for a string of smaller but related construction projects that are just as expensive in total. ... When a workers comp policy is added to the OCIP, the insurance provider will evaluate the owner's vetting ...

XLSX Homepage — Colorado Department of Transportation Insurance Calculation Worksheet (Y/N) OCIP Insurance Calculation (B) Payroll Estimate % of Payroll to CV Excess (Umbrella) Liability Workers' Compensation Instructions: a. General Liability: Multiply your classification rate times per $1,000 of payroll or construction value. b. c. Workers' Compensation:

Contract Clauses | FTA - Federal Transit Administration On the other hand, if the prime contract is a cost-type contract, where the prime is only promising a "best-efforts" performance, and the actual cost of the subcontractor’s performance will be passed on to the grantee, then the grantee has an important stake and a real risk in the subcontractor selection process because the subcontractor’s ...

CCIP & OCIP: A Guide to Controlled Insurance Programs in Construction How much does CIP cost? The cost for CCIP and OCIP coverage typically varies from 2% to 12% of construction costs. The actual premium is based on various risk factors, including the policy limits, types of coverage, project location, type of construction, and value of the project.

OCIP Workers Compensation Claims and Managing Them - Metropolitan Risk This drives the ultimate cost of your worker's compensation insurance premiums in the form of either surcharges or credits. If your EMR exceeds 1.2 you may not be eligible to bid on certain federal contracts which has an "opportunity cost." Some General Contractors may set a maximum allowable EMR of 1.0.

0 Response to "39 ocip insurance cost worksheet"

Post a Comment