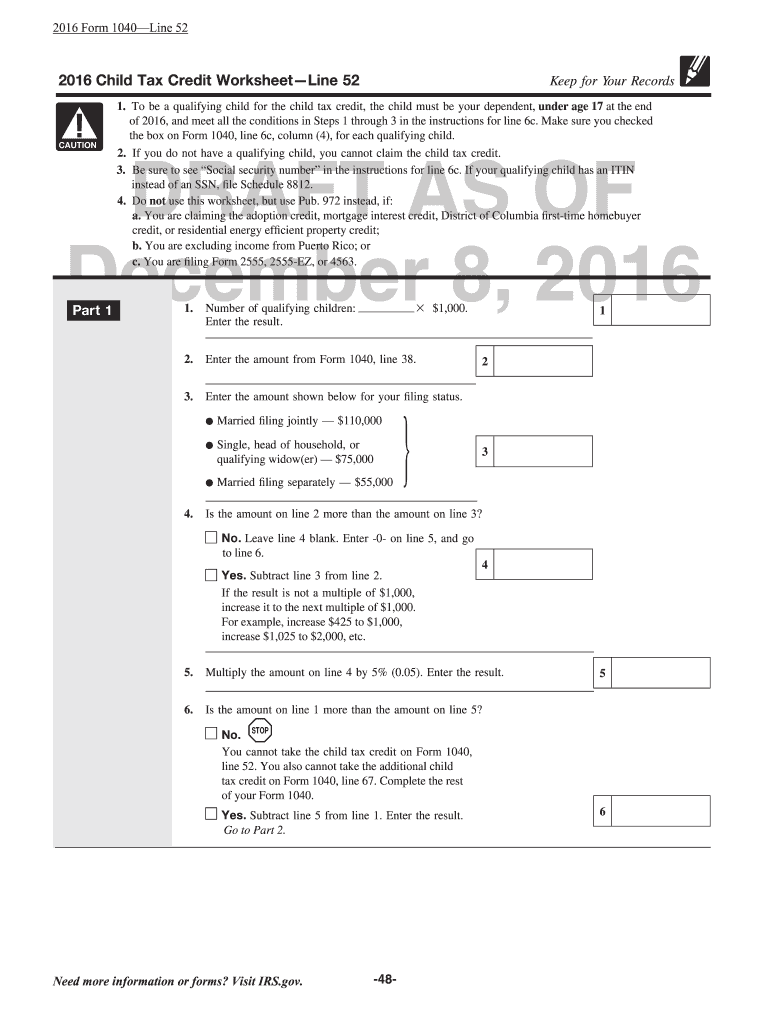

40 child tax credit worksheet 2016

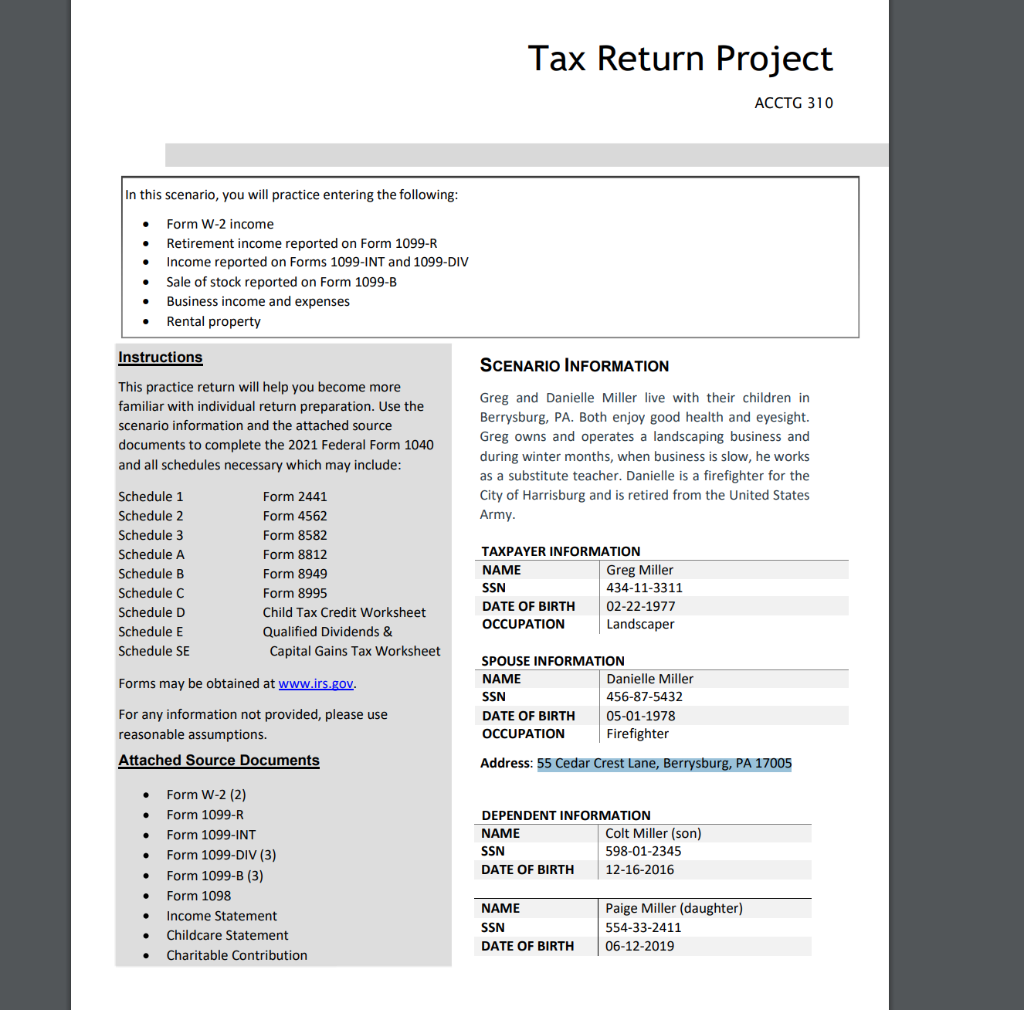

PDF 2016 Instruction 1040 Schedule 8812 - IRS tax forms 2016 Instructions for Schedule 8812Child Tax Credit Use Part I of Schedule 8812 to document that any child for whom you entered an ITIN on Form 1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c; and for whom you also checked ... the end of the Child Tax Credit Worksheet, complete Parts II-IV of this schedule to fig-ure the amount of ... Publication 537 (2021), Installment Sales - IRS tax forms 2017 453A additional tax $121,800 2018 Deferred Tax Liability calculation: 2017 Deferred Obligation: 14,000,000 – 2018 Payment received (5,000,000) 2018 Deferred Obligation: 9,000,000 x Gross Profit Percentage: 96.6670% The amount of gain that has not been recognized: 8,700,030 x Maximum capital gains tax rate: 21% 2018 Deferred Tax Liability ...

Opportunity Maine – Tax Credit for Student Loans You earned a Bachelors or Associates degree after 2007 and before 2016 from a Maine school, OR. ... Complete & submit the Educational Opportunity Tax Credit Worksheet when you file your Maine income tax return. » 2021 Individual Worksheet » 2020 Individual Worksheet » …

Child tax credit worksheet 2016

› publications › p502Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... PDF Forms 1040, 1040A, Child Tax Credit Worksheet 1040NR 2016 child tax credit. 13. (Keep for your records) Figure the amount of any credits you are claiming on Form 5695, Part II, line 30; Form 8910; Form 8936; or Schedule R. To be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other › publications › p503Publication 503 (2021), Child and Dependent Care Expenses Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

Child tax credit worksheet 2016. Publication 501 (2021), Dependents, Standard Deduction, and … Use the Single column of the Tax Table, or Section A of the Tax Computation Worksheet, to figure your tax. ... $14,000, is more than your AGI, $12,000. If you claimed the refundable child tax credit for your son, the IRS will disallow your claim to this credit. If you don't have another qualifying child or dependent, the IRS will also disallow ... PDF SCHEDULE 8812 OMB No. 1545-0074 Child Tax Credit 2016 - 1040.com If you file Form 2555 or 2555-EZ stop here, you cannot claim the additional child tax credit. If you are required to use the worksheet in Pub. 972, enter the amount from line 8 of the Child Tax Credit Worksheet in the publication. Otherwise: Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040 ... Publication 972 (2020), Child Tax Credit and Credit for Other ... Summary: This is the Line 14 Worksheet used to determine the amount to be entered on line 14 of the Child Tax Credit and Credit for Other Dependents Worksheet. Before you begin: Complete the Earned Income Worksheet, later in this publication, 1040 and 1040-SR filers. › publications › p571Publication 571 (01/2022), Tax-Sheltered Annuity Plans (403(b ... Retirement income accounts. Division O, section 111 of P.L. 116-94 clarifies that employees described in section 414(e)(3)(B) (which include ministers, employees of a tax-exempt church-controlled organization (including a nonqualified church-controlled organization), and employees who are included in a church plan under certain circumstances after separation from the service of a church) can ...

› opportunity-maineOpportunity Maine – Tax Credit for Student Loans $2,500 refundable tax credit value per year, or $25,000 lifetime value. Simpler worksheet to fill out with your tax return each year. More details are being worked out by State Government - we'll post details as we get them to this webpage! › publications › p972Publication 972 (2020), Child Tax Credit and Credit for Other ... Summary: This is the Line 14 Worksheet used to determine the amount to be entered on line 14 of the Child Tax Credit and Credit for Other Dependents Worksheet. Before you begin: Complete the Earned Income Worksheet, later in this publication, 1040 and 1040-SR filers. Child Tax Worksheet: Fillable, Printable & Blank PDF Form for Free ... Are you considering to get Child Tax Worksheet to fill? CocoDoc is the best place for you to go, offering you a convenient and easy to edit version of Child Tax Worksheet as you desire. ... 2016-2017 bApplicationb Form - Danville Area Community College - dacc. Feb 22, 2016 remove the scholarship application form from this booklet or call (217 ... Publication 936 (2021), Home Mortgage Interest Deduction Enter your qualified mortgage insurance premiums on line 1 of the Mortgage Insurance Premiums Deduction Worksheet in the Instructions for Schedule A (Form 1040) to figure the amount to enter on Schedule A (Form 1040), line 8d. ... The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that ...

Publication 503 (2021), Child and Dependent Care Expenses Worksheet for 2020 expenses paid in 2021. We moved Worksheet A, Worksheet for 2020 Expenses Paid in 2021 from Pub. 503 to the Instructions for Form 2441. ... The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. PDF 2016 Form 3514 California Earned Income Tax Credit 2016 California Earned Income Tax Credit FORM ... Was the child under age 24 at the end of 2016, a student, and younger than you (or your ... Enter amount from California Earned Income Tax Credit Worksheet, Part III, line 6. This amount should also be entered on Form 540, line 75; Form 540NR Long, Line 85; Form 540NR Short, ... Child Tax Credit | Internal Revenue Service - IRS tax forms You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than: $150,000 if you are married and filing a joint return, or if you are filing as a qualifying widow or widower; $112,500 if you are filing as a head of household; or Publication 571 (01/2022), Tax-Sheltered Annuity Plans (403(b) … Use this worksheet to figure the cost of incidental life insurance included in your annuity contract. This amount will be used to figure includible compensation for your most recent year of service. ... Based on Revenue Procedure 2016-47, 2016-37 I.R.B. 346, ... Advance child tax credit payments. From July through December 2021, advance ...

Publication 929 (2021), Tax Rules for Children and Dependents Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

› publications › p501Publication 501 (2021), Dependents, Standard Deduction, and ... The nonrefundable child tax credit, credit for other dependents, refundable child tax credit, or additional child tax credit . Head of household filing status. The credit for child and dependent care expenses. The exclusion from income for dependent care benefits. The earned income credit.

Forms and Instructions (PDF) - IRS tax forms Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2021 12/17/2021 Form 13424-J: Detailed Budget Worksheet 0518 05/13/2020 Form 14453: Penalty Computation Worksheet 1215 01/06/2016 Form 15110: Additional Child Tax Credit Worksheet 0321

Forms and Instructions (PDF) - IRS tax forms Additional Child Tax Credit Worksheet (Spanish Version) 0122 06/02/2022 Form 13424-J: Detailed Budget Worksheet 0518 05/13/2020 Form 15111: Earned Income Credit Worksheet (CP 09) ... Penalty Computation Worksheet 1215 01/06/2016 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table 2021 ...

U.S. appeals court says CFPB funding is unconstitutional - Protocol Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law …

› publications › p929Publication 929 (2021), Tax Rules for Children and Dependents Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

2016 Child Tax Credit Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Income Tax Credits Information and Worksheets 2. GAO-16-475, Refundable Tax Credits: Comprehensive ... 3. 2016 Form W-4 4. Dependent Care Tax Credit Worksheet 5. INSTRUCTIONS & WORKSHEET FOR COMPLETING WITHHOLDING FORMS ... 6. Form W-4 (2016) 7. 2019 Publication 972 8. 2018 Publication 972

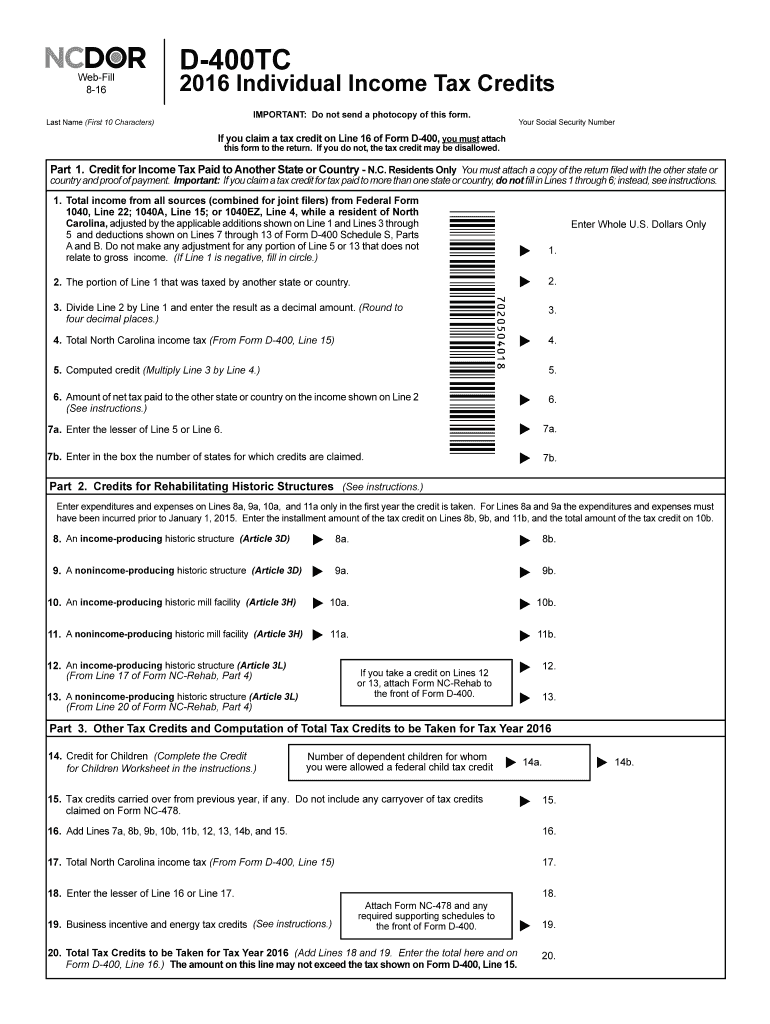

Credit For Children | NCDOR An individual may claim a child tax credit for each dependent child for whom a federal child tax credit was allowed under section 24 of the Code. The amount of credit allowed for the taxable year is equal to the amount listed in the table below based on the individual's adjusted gross income, as calculated under the Code, Form D-400, Line 6.

PDF Page 48 of 105 13:09 - 5-Jan-2016 CAUTION - Best Collections 2015 Child Tax Credit Worksheet Line 52 Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end ... 5-Jan-2016 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. 2015 Form 1040—Line 52 2015 Child ...

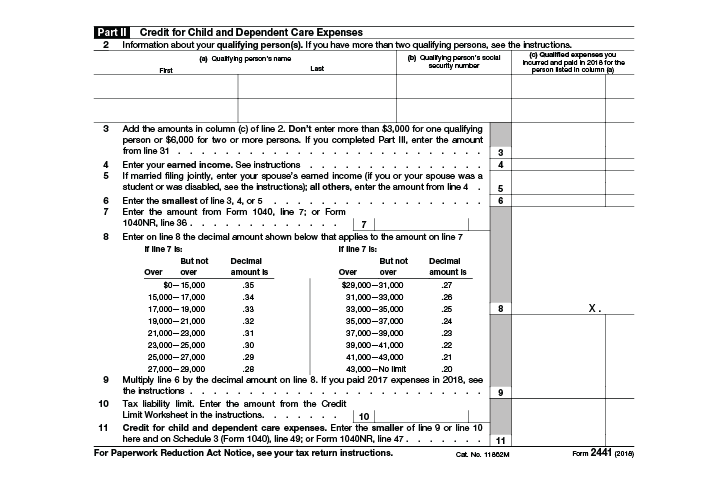

Dependent Care Tax Credit Worksheet - FSAFEDS The IRS allows a maximum of $3,000 for one child or $6,000 for two or more children when determining your tax credit. For more information, see IRS Publication 503, ... Dependent Care Tax Credit Worksheet Author: WageWorks Inc. Created Date: 10/28/2016 8:43:34 AM ...

2016 Child Tax Credit2016 Child Tax Credit - IRS Tax Break 2016 Child Tax Credit This credit is for people who have a qualifying child. It can be claimed in addition to the Credit for Child and Dependent Care expenses. Ten Facts about the 2016 Child Tax Credit The Child Tax Credit is an important tax credit that may be worth as much as $1,000 per qualifying child depending upon your income.

Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established, under your business was obtained through the Health Insurance Marketplace and you are claiming the premium tax credit. ... The advance child tax credit payments were ...

Child Tax Credit Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Credit Page 1 of 14 14:53 2. Child Tax Credit WorksheetLine 51 Keep for Your Records 3. WorksheetLine 12a Keep for Your Records Draft as of 4. Forms 1040, 1040A, Child Tax Credit Worksheet 1040NR 2016 5. Introduction Objectives Topics

Free Child Tax Credit Worksheet and Calculator (Excel, Word, PDF) Child tax credit worksheet is a document used to provide a helpful lift to the income of parents or guardians who have dependents or children. The child tax credit received usually based on your income. It is just a tax credit not a deduction on taxes. This tax is directly subtracted from the total amount of taxes you would have to pay.

PDF 2016 Child Tax Credit Worksheet—Line 35 - Taxes Are Easy 2016 Child Tax Credit Worksheet—Line 35 r Single, head of household, or qualifying widow(er) — $75,000 Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end of 2016, and meet all the conditions in Steps 1 through 3 in the instructions for line 6c.

› publications › p503Publication 503 (2021), Child and Dependent Care Expenses Advance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

PDF Forms 1040, 1040A, Child Tax Credit Worksheet 1040NR 2016 child tax credit. 13. (Keep for your records) Figure the amount of any credits you are claiming on Form 5695, Part II, line 30; Form 8910; Form 8936; or Schedule R. To be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other

› publications › p502Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ...

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-05.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-06.jpg)

0 Response to "40 child tax credit worksheet 2016"

Post a Comment