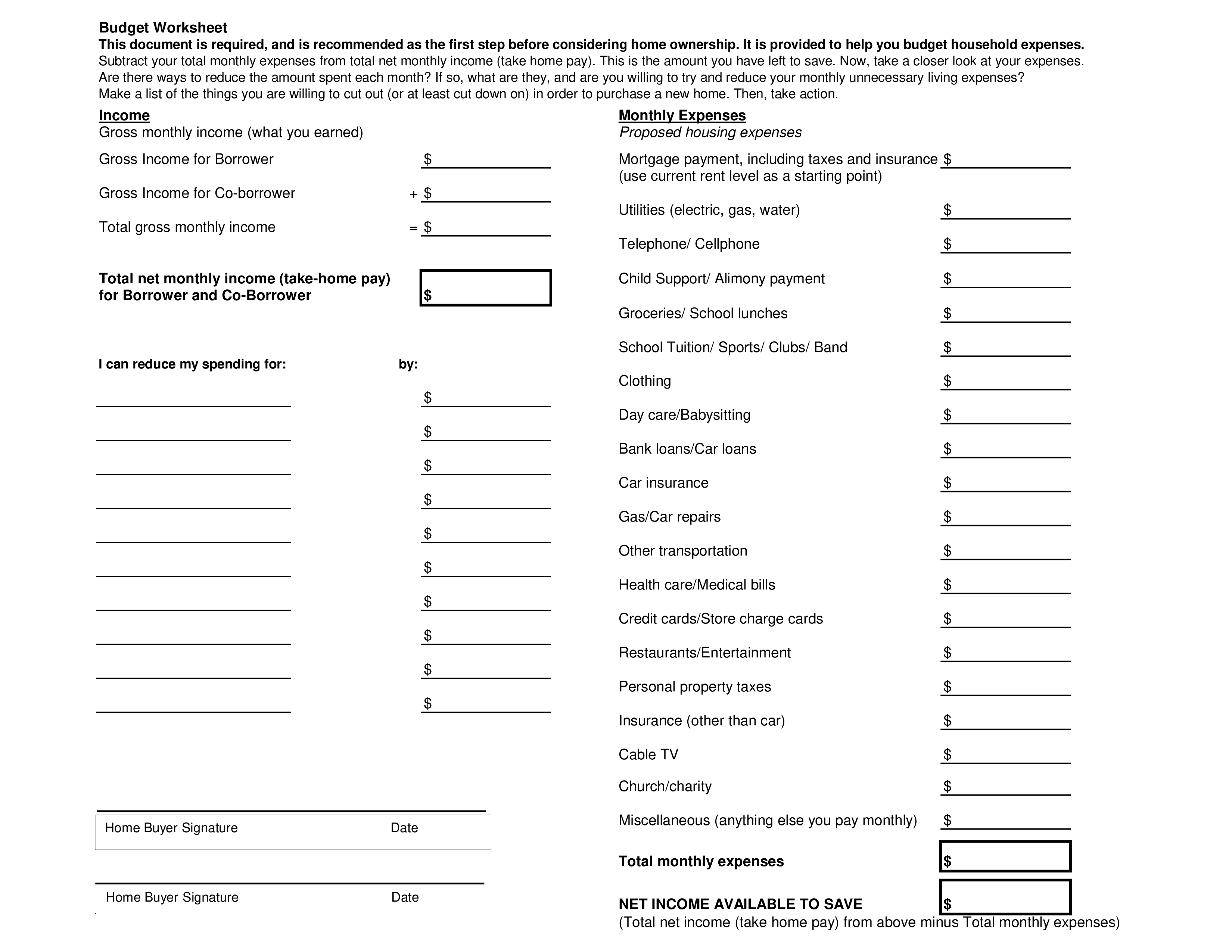

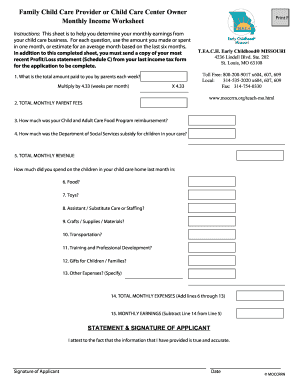

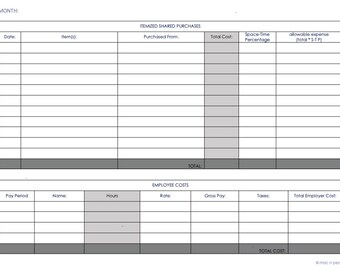

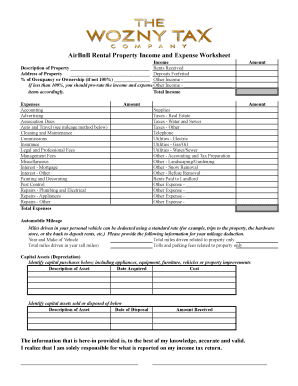

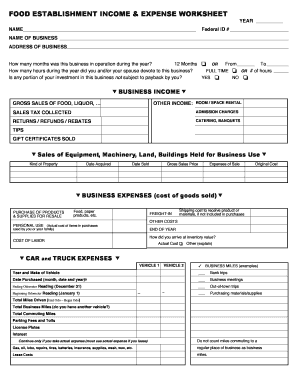

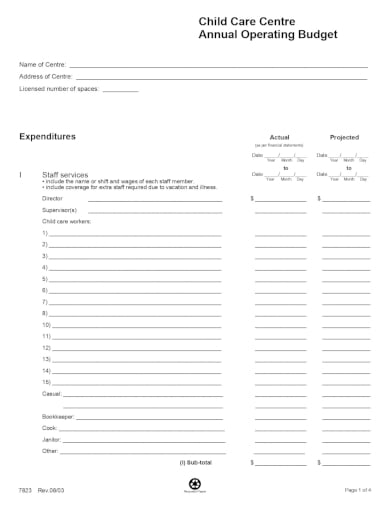

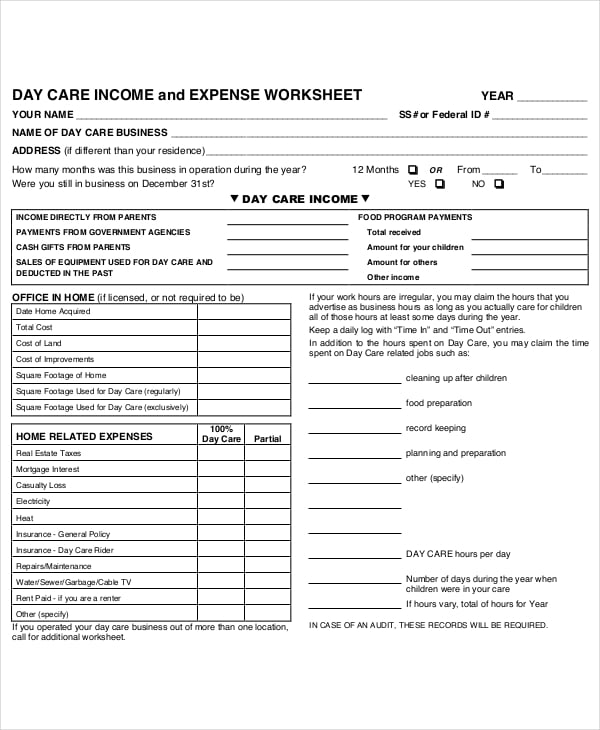

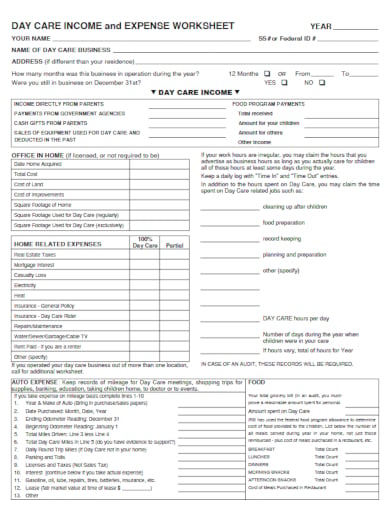

40 daycare income and expense worksheet

› publications › p334Publication 334 (2021), Tax Guide for Small Business Your excess business loss will be included as income on line 8o of Schedule 1 (Form 1040) and treated as a net operating loss that you must carry forward and deduct in a subsequent tax year.For more information about the excess business loss limitation, see Form 461 and its instructions. Business meal expense. › instructions › i8829Instructions for Form 8829 (2022) | Internal Revenue Service If you file more than one Form 8829, include only the income earned and the deductions attributable to that income during the period you owned the home for which Part I was completed. If some of the income is from a place of business other than your home, you must first determine the part of your gross income (Schedule C, line 7, and gains from ...

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

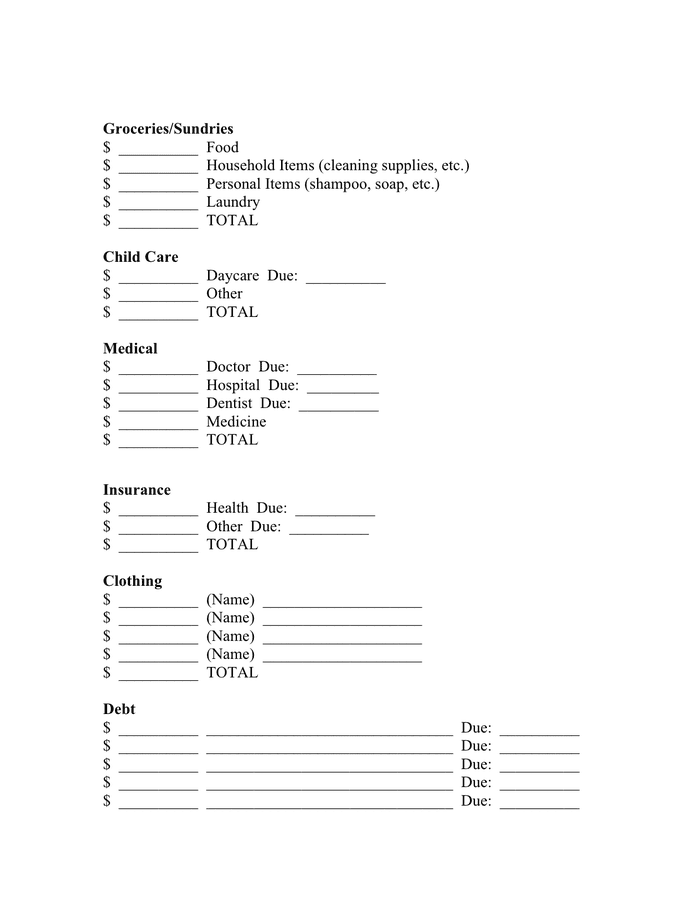

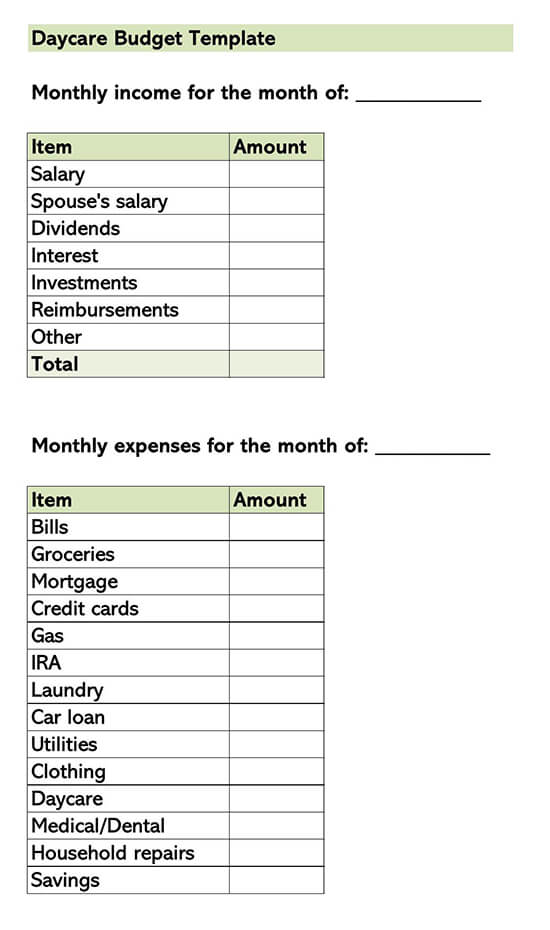

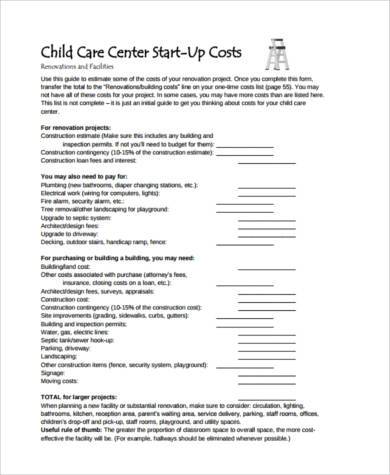

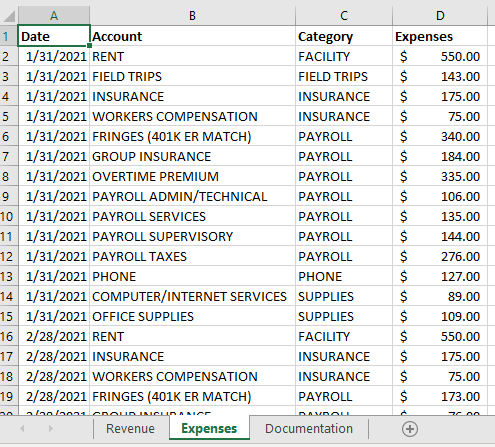

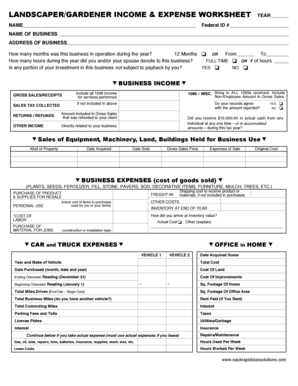

Daycare income and expense worksheet

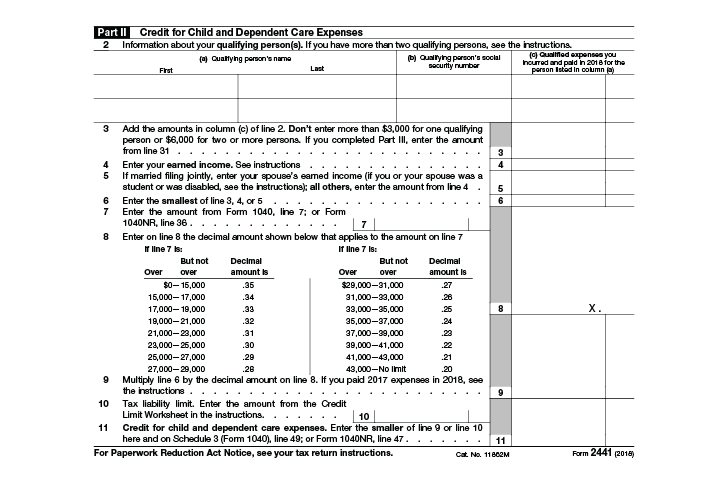

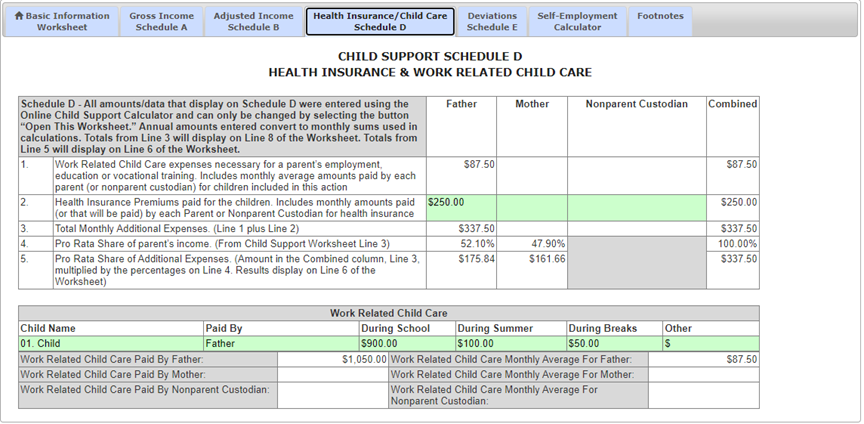

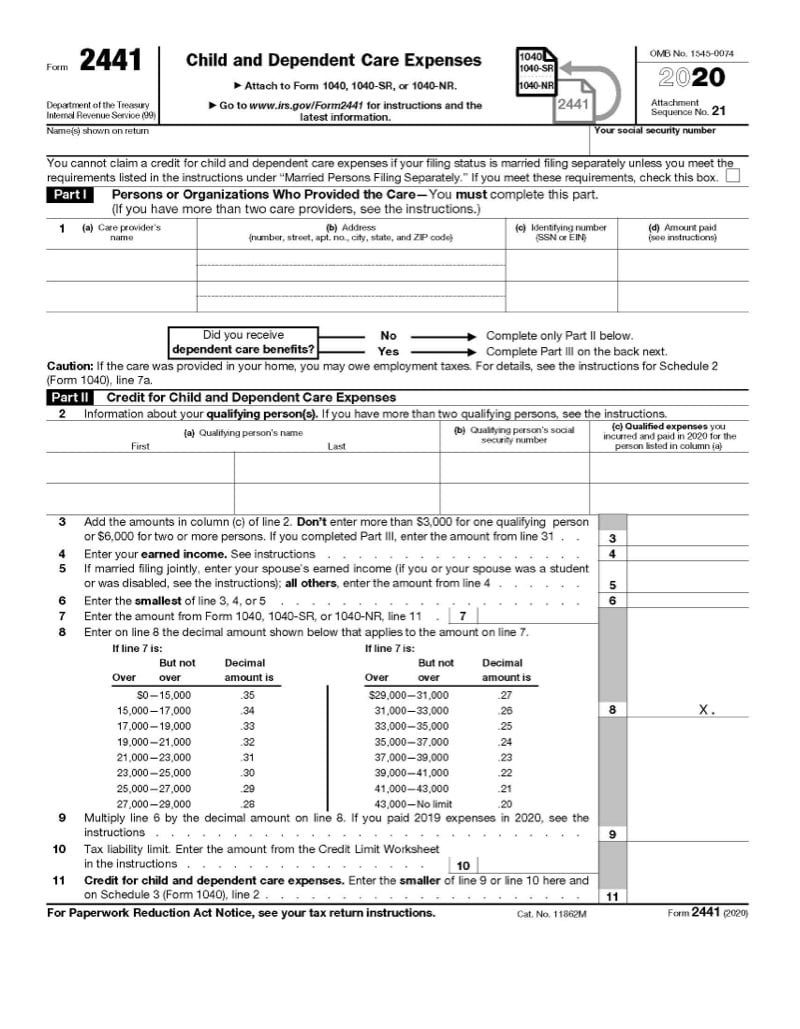

PlayStation userbase "significantly larger" than Xbox even if every … 12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised… › publications › p503Publication 503 (2021), Child and Dependent Care Expenses Changes to the credit for child and dependent care expenses for 2021. For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating ... Publication 334 (2021), Tax Guide for Small Business If you are a U.S. citizen who has business income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt from tax under U.S. law. If you live outside the United States, you may be able to exclude part or all of your foreign-source business income. For details, see Pub. 54, Tax Guide for U.S. Citizens and …

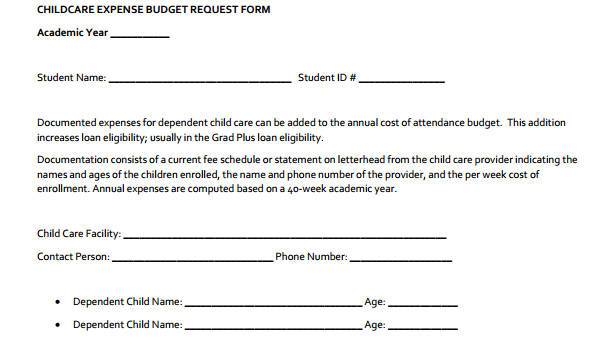

Daycare income and expense worksheet. successessays.comSuccess Essays - Assisting students with assignments online Each paper writer passes a series of grammar and vocabulary tests before joining our team. Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in … Instructions for Form 8829 (2022) | Internal Revenue Service If you file more than one Form 8829, include only the income earned and the deductions attributable to that income during the period you owned the home for which Part I was completed. If some of the income is from a place of business other than your home, you must first determine the part of your gross income (Schedule C, line 7, and gains from Form 8949, Schedule D, … Publication 503 (2021), Child and Dependent Care Expenses Worksheet for 2020 expenses paid in 2021. We moved Worksheet A, Worksheet for 2020 Expenses Paid in 2021 from Pub. 503 to the Instructions for Form 2441. See Payments for prior-year expenses, later, for more information about the credit for 2020 expenses paid in 2021. Reminders. Personal exemption suspended. For 2021, you can’t claim a personal exemption …

Achiever Papers - We help students improve their academic standing All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism. › publications › p529Publication 529 (12/2020), Miscellaneous Deductions Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 525 (2021), Taxable and Nontaxable Income The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employee's income through a dependent care assistance program. For 2021, the amount is increased to $10,500 (previously $5,000). For married filing separate returns, the amount is increased to $5,250 (previously $2,500). See Dependent Care Benefits, later. Temporary … Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

› publications › p587Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ... Publication 535 (2021), Business Expenses | Internal Revenue … File Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year in the course of your trade or business at least $600 in rents, prizes and awards, other income payments, medical and health care payments, and crop insurance proceeds. See the Instructions for Forms 1099-MISC and 1099-NEC for more information and additional reporting … › playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Publication 334 (2021), Tax Guide for Small Business If you are a U.S. citizen who has business income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt from tax under U.S. law. If you live outside the United States, you may be able to exclude part or all of your foreign-source business income. For details, see Pub. 54, Tax Guide for U.S. Citizens and …

› publications › p503Publication 503 (2021), Child and Dependent Care Expenses Changes to the credit for child and dependent care expenses for 2021. For 2021, the American Rescue Plan Act of 2021 (the ARP) increases the amount of the credit for child and dependent care expenses. It also makes the credit refundable for taxpayers that meet certain residency requirements, increases the percentage of employment-related expenses for qualifying care considered in calculating ...

PlayStation userbase "significantly larger" than Xbox even if every … 12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised…

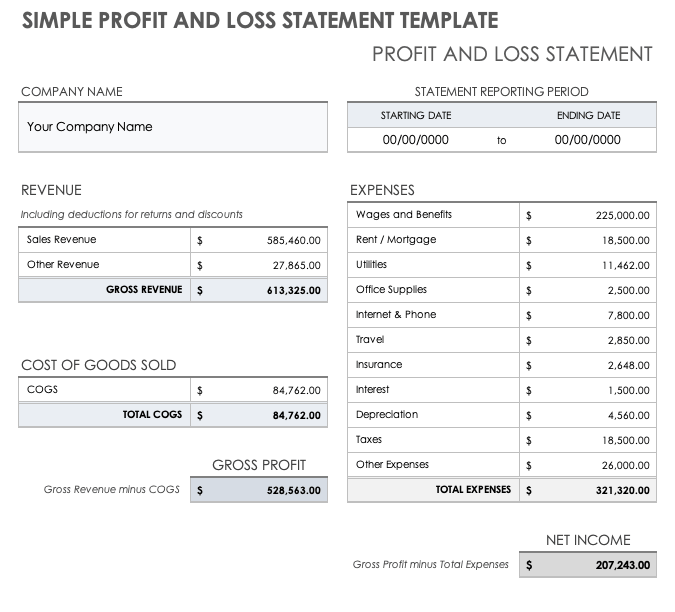

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Hotel-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)

0 Response to "40 daycare income and expense worksheet"

Post a Comment