41 at&t cost basis worksheet

NCR Tax Basis Worksheet - smkinfo.com Shareholders of AT & T received 6 shares of NCR common stock for every 100 shares of AT & T owned. Since this special distribution (of NCR stock) was a tax-free distribution, the tax basis allocation of the spin-off should be: AT & T Corp 95.23%. NCR Corporation 4.77%. (Based upon the cost basis of AT & T stock purchased or owned prior to 12/13 ... Cost Basis Calculator for Investors | About Verizon The cost basis needs to be calculated for each company. Select December 31, 1983 as your acquisition date. Indicate original cost basis per AT&T share. If you acquired Verizon Communications Inc. shares starting July 1, 2010, your current cost basis is the same as when you bought the stock. Consult your tax adviser.

PDF cost basis worksheet - Denver Tax Cost Basis Worksheet Investor Relations Company Profile Business Segments Corporate Governance Financial Performance Fixed Income Stock Information SEC Filings ... Original tax basis per AT&T share _____ (A) Adjust for AT&T Divestiture and three stock splits Divide (A) by 7.62631 _____ New Basis Original tax basis per Bell

At&t cost basis worksheet

A T & T - Cost Basis Starting from your own acquisition date, apply the spinoffs, splits, and name changes in order of occurrence to arrive at your cost basis today. You can use the excellent calculators provided on the AT&T website at to compute each successive step. Free Real Estate Cost Basis Worksheet Template Get a hold of our ready-made Real Estate Cost Basis Worksheet Template! With its sample content, you'll know what to include in your calculations. Our 100% editable template has an easy-to-personalize feature. You can easily replace the sample contents with your details. Get your copy either through your PC or mobile gadgets. what is the verizon stock cost basis from original AT&T spinoff… Cost basis of spinoff of Lucent tech. from AT&T Corp. on Sept. 30, 1996 How much a share was Lucent Tech. when it was spinoff from AT&T Corp. on Sept. 30, 1996. I got(NNN) NNN-NNNNshares. … read more

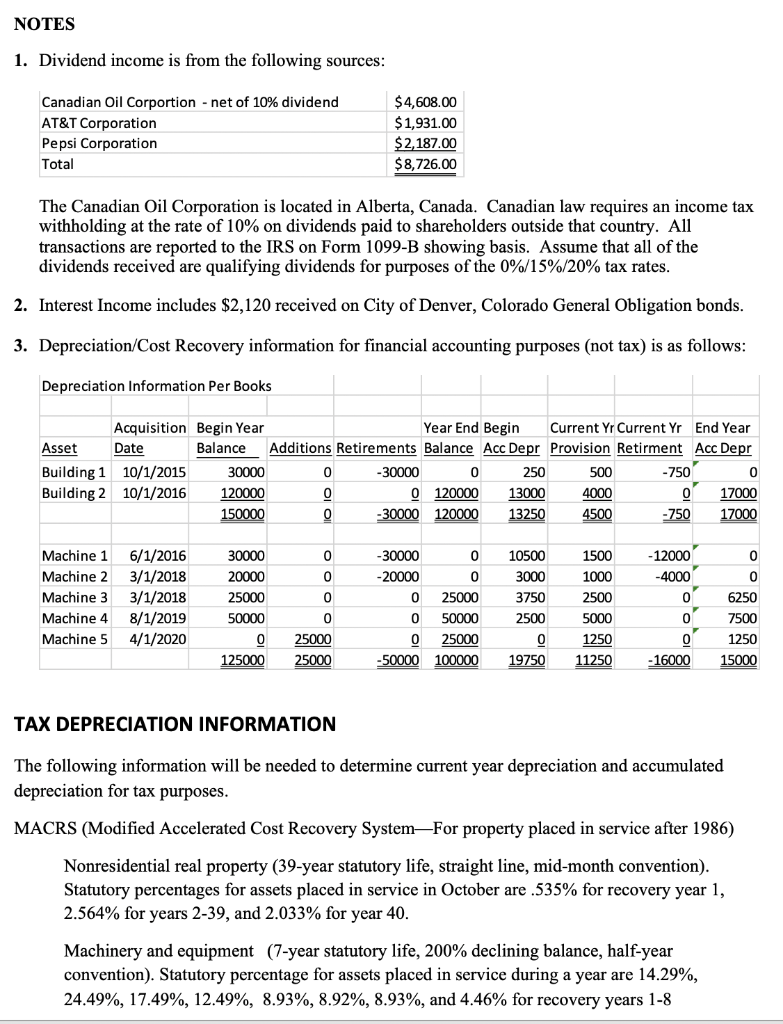

At&t cost basis worksheet. The cost basis is how much you paid for your shares after you take into account stock splits, acquisitions and other events. In general, your taxable gain or loss is the difference between your cost basis and the price you receive when you sell the shares, minus brokerage fees. What You Need to Know to Calculate Your Cost Basis? Stay In Touch Worksheet - AT&T Official Site Thus, the post-spin-off aggregate tax basis of the AT&T shares is $448.80. To determine your post-AT&T Broadband spin-off tax basis per share of AT&T stock, divide your aggregate post-spin-off tax basis ($448.80) by the number of AT&T shares you hold (100). This results in a post-spin-off tax basis of $4.49 per AT&T share. If YES, use this worksheet below to calculate the allocation of your cost basis between AT&T Inc. and WBD common stock. AT&T Inc. / WBD If you acquired your AT&T Inc. shares on or after March 20, 1998 (the date of the last stock split), your cost basis before the SpinCo Distribution is the same as the actual price paid for the shares. NCR - Teradata Chart - cost-basis-charts.com more whole shares to their original position." Teradata Corporation. 1/21/2005 2 for 1 Stock Split. Type: Spin-off. Shares: 1 share of Teradata for each 1 share of NCR held on 9/14/2007. Basis Allocation: 47.63% NCR, 52.37% Teradata. Due to spin-off of Lucent, AT&T basis now diluted. to 72.01% of previous basis.

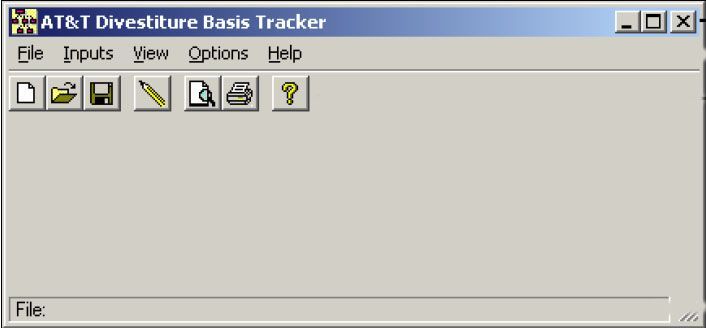

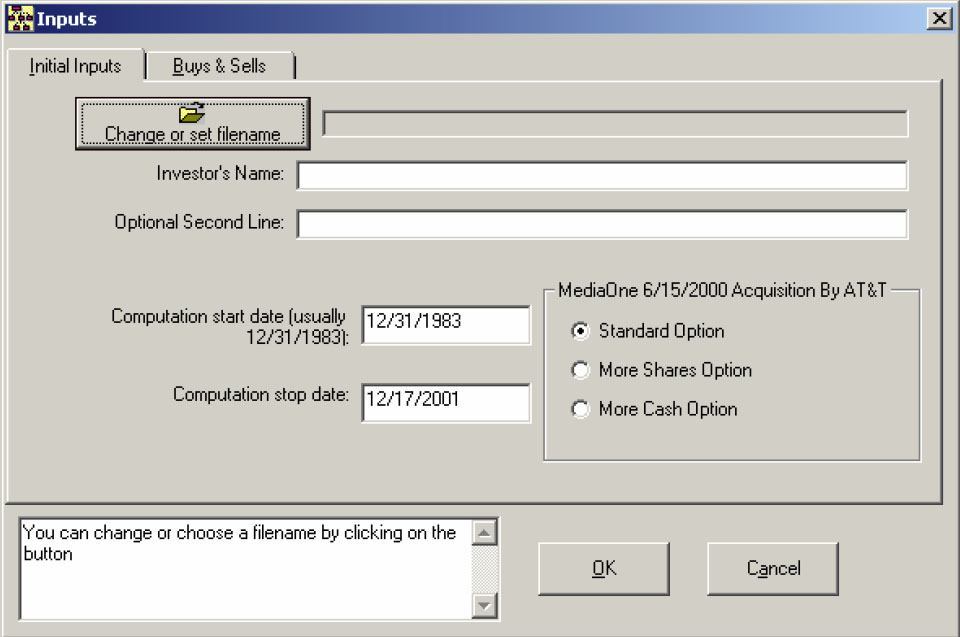

At&T Tax Basis Worksheet - smkinfo.com distribution (of Lucent stock) was a tax-free distribution, the tax basis allocation of the spin-off should be: A T & T Corp 72.01% Lucent Technologies 27.99% (Based upon the cost basis of AT & T stock purchased or owned prior to 9/17/96) Tax Basis Update New Comcast and AT & T PDF Verizon Cost Basis Worksheet This worksheet describes some of the information needed to computer gain or loss, for income tax purposes, if you sell or otherwise dispose of your Verizon Communications Inc. ("Verizon") common ... Original tax basis per AT&T share _____ (A) Adjust for AT&T Divestiture, Divide (A) by 8.47916 _____ New Basis three stock splits and spin-offs ... If you owned AT&T common stock (T) as of the close of business on April 5, 2022, the record date for distribution of shares of SpinCo, first calculate your AT&T Cost Basis using the worksheet below and then use that output for the AT&T Inc. / WBD allocation. BellSouth Corporation (BLS) How to compute AT&T and "family" cost basis by yourself. - Denver Tax Simple - Once you understand how time consuming it is to make these computations with your own worksheet without using the AT&T Divestiture Basis Tracker you will want to buy our software. AT&T Divestiture Basis Tracker - Order & Download Software Now! Special discounted price through 4/30/2022 $ 79.

If you owned AT&T common stock (T) as of the close of business on April 5, 2022, the record date for distribution of shares of SpinCo, first calculate your AT&T Cost Basis using the worksheet below and then use that output for the AT&T Inc. / WBD allocation. AT&T Corp. Additional details on AT&T Corp. stock events: Enter Original Cost Per Share : $ (The Time Warner share basis allocation percentage at Time Inc. divestiture was 0.9595.) If you originally acquired your Time Warner Inc. shares prior to December 9, 2009 (spin-off of AOL Inc.), see links below for documents to aid you in calculating your cost basis. Time Warner Inc. Corporate Actions AT&T Corp Flowchart - cost-basis-charts.com Basis Allocation: AT&T - 37.4%, AT&T Broadband- 62.6%. All shares of AT&T Broadband were converted into shares of Comcast shortly after the distribution as result of the merger of a wholly owned subsidiary of Comcast Corporation with and into AT&T Broadband. Fractional shares received cash payments. SBC AT&T Merger Merger. To determine your post-spin-off tax basis per AT&T share, divide your aggregate post-spin-off tax basis in the AT&T shares ($1,553.20) by the number of AT&T shares you hold (100). This results in a post- split-off tax basis of $15.53 per AT&T share.

TRACKING COST BASIS OF AT&T, OFFSPRING - Hartford Courant The cost basis for your original shares of AT&T; would have been about $5,700 (before broker commissions). That original $5,700 purchase price, however, must be divided into many parts. Here's why ...

If you owned AT&T common stock (T) as of the close of business on April 5, 2022, the record date for distribution of shares of SpinCo, first calculate your AT&T Cost Basis using the worksheet below and then use that output for the AT&T Inc. / WBD allocation. Ameritech Corporation (AIT)

How to calculate worth of AT&T stock after splits - SFGATE Out of curiosity, I went through the worksheets, using the information you supplied, and found that your original 100 AT&T shares have dwindled to 30 (thanks to the reverse split), and that your ...

s corp basis worksheet Att basis worksheet cost stem leading institute. Att cost basis worksheet. Random Posts. rna worksheet answer key; printable number sheets; schedule c worksheet 2021; secondary math 2 module 4 answer key; reading log 2nd grade; proportional vs non proportional worksheet; spiral math work answer key;

PDF calculate your cost basis in your AT&T shares as well as other stock ... basis and other tax consequences of the Exchange. Step 2 - Stock Split In July 2000, GMH split 3:1 - this tripled the number of GMH shares you owned and reduced the per share cost basis you calculated above by two-thirds. Example: Original Shares 100 New Shares 300 Original per share cost basis $18 New per share cost basis $6

Worksheet - AT&T Official Site New AT&T, Inc. cost basis per share (in dollars) Example On November 18, 2005, you owned 100 AT&T Corp. shares and had an aggregate tax basis of $1,500, or a per share cost basis of $15.00. After the merger with SBC was completed, you received 77.94 shares of new AT&T, Inc.

If you owned AT&T common stock (T) as of the close of business on April 5, 2022, the record date for distribution of shares of SpinCo, first calculate your AT&T Cost Basis using the worksheet below and then use that output for the AT&T Inc. / WBD allocation. AT&T Inc. (formerly SBC Communications Inc.) Stay In Touch

Figuring the Basis of AT&T Shares | Kiplinger Your basis should be allocated 28.5% to ATT and the remaining 71.5% split among the seven baby bells, with each at a different rate -- from 8.94% for US West to 13.53% for Bell South. (See the...

AT&T Cost Basis - Denver Tax AT&T Divestiture Cost Basis Calculator Quickly computes the tax basis for AT&T, the Baby Bells and the other companies that the Baby Bells merged into. Special discounted price through 4/30/2022 $79. Regular Price $119. Includes Verizon & Frontier Communications cost basis changes. Order licenses for additional machines.

If you acquired your AT&T, Inc. shares prior to March 20, 1998 (date of last stock split) or through a previous acquisition or merger transaction, determining your cost basis is a TWO-STEP process -- first calculate your AT&T Cost Basis per share on one of the worksheets click here and then use that output for the allocation below.

Cost Basis Guide | Comcast Corporation Your AT&T Corp. common stock cost basis prior to the acquisition should be allocated at 37.4% to your AT&T Corp. common stock and 62.6% to your new Comcast common stock, including any fractional shares you were entitled to receive. You are responsible for knowing your beginning cost basis from your own records.

what is the verizon stock cost basis from original AT&T spinoff… Cost basis of spinoff of Lucent tech. from AT&T Corp. on Sept. 30, 1996 How much a share was Lucent Tech. when it was spinoff from AT&T Corp. on Sept. 30, 1996. I got(NNN) NNN-NNNNshares. … read more

Free Real Estate Cost Basis Worksheet Template Get a hold of our ready-made Real Estate Cost Basis Worksheet Template! With its sample content, you'll know what to include in your calculations. Our 100% editable template has an easy-to-personalize feature. You can easily replace the sample contents with your details. Get your copy either through your PC or mobile gadgets.

A T & T - Cost Basis Starting from your own acquisition date, apply the spinoffs, splits, and name changes in order of occurrence to arrive at your cost basis today. You can use the excellent calculators provided on the AT&T website at to compute each successive step.

-png.png?width=575&name=image%20(18)-png.png)

0 Response to "41 at&t cost basis worksheet"

Post a Comment