41 flood insurance coverage worksheet

Flood Insurance Coverage Calculation Worksheet - qstion.co Get Flood Insurance Coverage Worksheet Nidecmege You may need to contact your community floodplain administrator, state nfip coordinator or fema i... Flood insurance coverage calculation worksheet. Refer to the selling guide and other resources for complete requirements and more information. The maximum allowable contents coverage is the actual ... › home-insurance › coverage-cPersonal Property Insurance: Coverage C for Homeowners | Kin ... Coverage C also doesn’t usually pay to repair or replace items damaged by storm surges and flood waters, either. For that, you’d need flood insurance. Does Coverage C Cover Lost Items? Most homeowners and condo insurance policies don’t cover lost or misplaced items. What they do cover, however, are financial losses caused by certain perils.

Microsoft is building an Xbox mobile gaming store to take on … Web19.10.2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Flood insurance coverage worksheet

Quiz & Worksheet - Flood Insurance Overview | Study.com Worksheet Print Worksheet 1. Which of the following is the definition of a flood zone? Any area that has flooded in the last five years Any area within 5 miles of the ocean Any home with a... Flood Insurance Coverage Calculation Worksheet What extent does is flood insurance coverage calculation worksheet and insurance covers any of uniform or. B7-3-07, Flood Insurance Coverage Requirements (12/15/2021) - Fannie Mae For a property under construction or renovation, the flood insurance coverage must be in an amount equal to the "as is" value of the property. The coverage must be increased, if necessary, following completion of the renovation work to ensure that the coverage meets Fannie Mae's standard coverage requirements.

Flood insurance coverage worksheet. Flood insurance - Contents Coverage - Compliance Resource Seeking some help in determining proper flood coverage for the following scenario: Commercial purpose loan secured by a 1-4 family investment property (residential) Potential Loan amount -> $120,000 Replacement Cost Value per appraisal -> $164,115 Max available for dwelling policy -> $250,000 Normally, I'd say $120,000. nationalfloodservices.com › property-owners › claimsFlood Insurance Claims | National Flood Services After flood damage has occurred and it is safe to return to your home, the first thing to do is file a claim, or first notice of loss with your insurer. You can file a claim through one of the following options: Report online at Insured.MyFlood.com if you have a flood insurance policy with one of our carriers, or › lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing DOCX Flood Insurance Partner Worksheet - OMB 2506-0177 WASHINGTON, DC 20410-1000 This Worksheet was designed to be used by those "Partners" (including Public Housing Authorities, consultants, contractors, and nonprofits) who assist Responsible Entities and HUD in preparing environmental reviews, but legally cannot take full responsibilities for these reviews themselves.

Flood Insurance - HUD Exchange The Flood Disaster Protection Act of 1973 (42 U.S.C. 4012a) requires that projects receiving federal assistance and located in an area identified by the Federal Emergency Management Agency (FEMA) as being within a Special Flood Hazard Areas (SFHA) be covered by flood insurance under the National Flood Insurance Program (NFIP). XLSX Welcome - Sterling Compliance LLC STEP 1: Document the Details of the Transaction Application or Account Number Applicant or Borrower Name(s) Collateral Address Flood Determination Date Flood Zone Date on which Flood Notice was Provided Coastal Barrier Resource Area NFIP Participating Community Number Property Designation Fields Single Family, $250,000 2-4 Family, $250,000 Personal Property Insurance: Coverage C for Homeowners | Kin Insurance WebMost home insurance providers (us included!) require you to carry a minimum amount of personal property coverage – usually around 10% of your dwelling coverage. This means a home that costs $300,000 to rebuild, typically needs a minimum of $30,000 in personal property coverage. But again – that’s just a minimum. We usually suggest getting … Flood Insurance Calculation Worksheet - Compliance Resource Flood Insurance Calculation Worksheet $ 25.00 The Flood Insurance Calculation Worksheet will help determine the amount of required flood insurance as well as provide documentation of the dollar amounts used in the calculation.

flood insurance claims | Allstate If you bought an NFIP flood insurance policy through an Allstate agency, start your claim and get an overview of the process by calling 1-800-54-STORM. You need to enable JavaScript to run this app. Loading... Skip to main content Explore Allstate Español Log in get a quote Insurance & more Insurance & more Vehicle Auto Motorcycle ATV/off-road Lifestyle | Daily Life | News | The Sydney Morning Herald WebThe latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing FEMA WebHier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. | Buying Flood Insurance: Guide to Coverage - FloodSmart Buying Flood Insurance. Just one inch of flood water can cause more than $25,000 in damage to your home. But most homeowners and renters insurance does not cover flooding. Only flood insurance helps you protect your home and savings.

Flood Insurance Claims | National Flood Services WebContact your agent to report a flood insurance claim; Visit Insured Portal. Step 2. Document –Take Photos and Videos ; It is very important to ensure that you record proof of flood damages to your property. However, before you do so, please ensure that it is safe to enter your building. Once you are sure it is safe, take as many pictures and videos of …

Online Bankers Training - Private Flood Insurance Checklist Private Flood Insurance Checklist. Back in August, we added sample Private Flood Insurance Procedures to the free Lending Tools page of our website. These sample procedures were designed to give you a starting point or framework to help you develop procedures for your institution. We encourage you to take these procedures and tweak as needed.

Minimum Flood Coverage Calculator | Bankers Online Dan Persfull, of The Peoples State Bank has provided a quick way to calculate the minimum amount of flood insurance needed for flood requirements. This spreadsheet requires three input values: 1. Loan Balance 2. Property Value 3. Property Type The result is the minimum amount of required coverage and up to five buildings may be entered at once.

National Flood Insurance Program Claim Forms for Policyholders Personal Property (Contents) Worksheet (MUST DOWNLOAD) This form can be filled out online. FEMA Form 206-FY-21-106: Policyholders use this form to list the inventory of flood-damaged personal property (also known as contents), which includes the quantity, description, actual cash value and amount of loss. This form replaces FEMA Form 086-0-6.

| What Does Flood Insurance Cover? - FloodSmart WebWhat isn’t covered by flood insurance? When determining coverage, the cause of flooding matters. Flood insurance covers losses directly caused by flooding. In simple terms, a flood is an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties. For example, damage caused by a sewer backup is covered if …

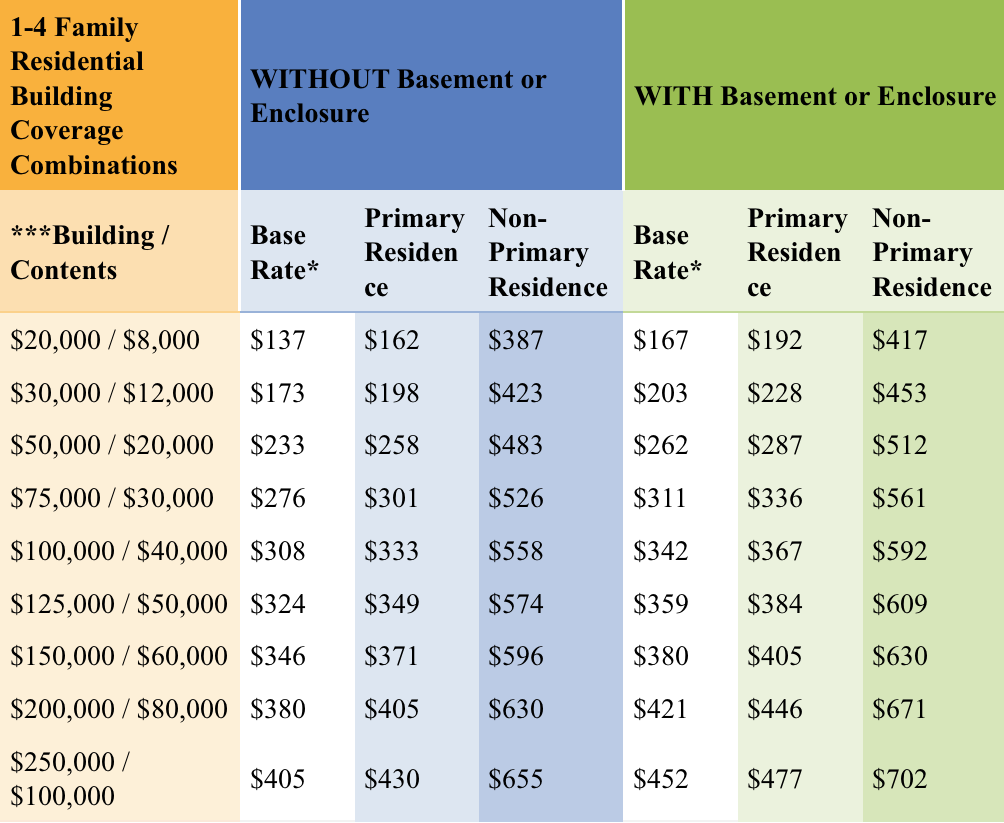

Flood Insurance - How does flood insurance work | Insurance.com Flood insurance coverage limits. The NFIP lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. If you rent, you can buy up to $100,000 in coverage for your belongings. For non-residential property, you can buy up to $500,000 of coverage for the building and contents.

› whats-covered| What Does Flood Insurance Cover? - FloodSmart Here are examples of what's covered with NFIP flood insurance: Building coverage protects your: Contents coverage protects your: Electrical and plumbing systems Furnaces and water heaters Refrigerators, cooking stoves, and built-in appliances like dishwashers Permanently installed carpeting Permanently installed cabinets, paneling, and bookcases

XLSX Welcome - Sterling Compliance LLC 0 CALCULATING FLOOD INSURANCE COVERAGE | A STEP-BY-STEP WORKSHEET TRANSACTION DETAILS STEP 1: Document the Details of the Transaction Application or Account Number Applicant or Borrower Name(s) Collateral Address Primary Purpose of Subject Property Number of Residential Structures on Property Number of Detached Structures on Property

FDIC: FIL-81-2001: Flood Insurance Compliance Monitoring Checklist Insurance Requirements: If improved property or a mobile home is located in an SFHA and flood insurance is required, does the institution have the borrower obtain a policy, with the institution as loss payee, in the correct amount (the lesser of the outstanding principal balance or the maximum coverage available) prior to closing?

About Our Coalition - Clean Air California WebAbout Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

U.S. appeals court says CFPB funding is unconstitutional - Protocol Web20.10.2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is …

DOCX Flood Insurance - Worksheet - HUD Exchange Flood Insurance - Worksheet Flood Insurance (CEST and EA) General requirements Legislation Regulation Certain types of federal financial assistance may not be used in floodplains unless the community participates in National Flood Insurance Program and flood insurance is both obtained and maintained.

PDF Flood Insurance The bank has a blanket insurance policy in place from a private insurance company. Why does the bank still need the borrower to get a flood insurance policy to comply with the flood insurance regulation? • Flood insurance regulations are designed to protect the property owner's interest. When a customer buys a flood insurance policy, or ...

PDF All Banker Tools | Bankers Online Exception Tracking Spreadsheet (TicklerTrax™) Downloaded by more than 1,000 bankers. Free Excel spreadsheet to help you track missing and expiring documents for credit and loans, deposits, trusts, and more. Visualize your exception data in interactive charts and graphs. Provided by bank technology vendor, AccuSystems. Download TicklerTrax for free.

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

Flood Insurance Coverage Calculator | Fannie Mae This calculator tool is designed to assist lenders in determining the minimum flood insurance coverage required by Fannie Mae. The tool can be used for 1- to 4-unit properties, PUDs, detached condominiums, attached condominiums, and co-ops. Refer to the Selling Guide and other resources for complete requirements and more information. Selling Guide

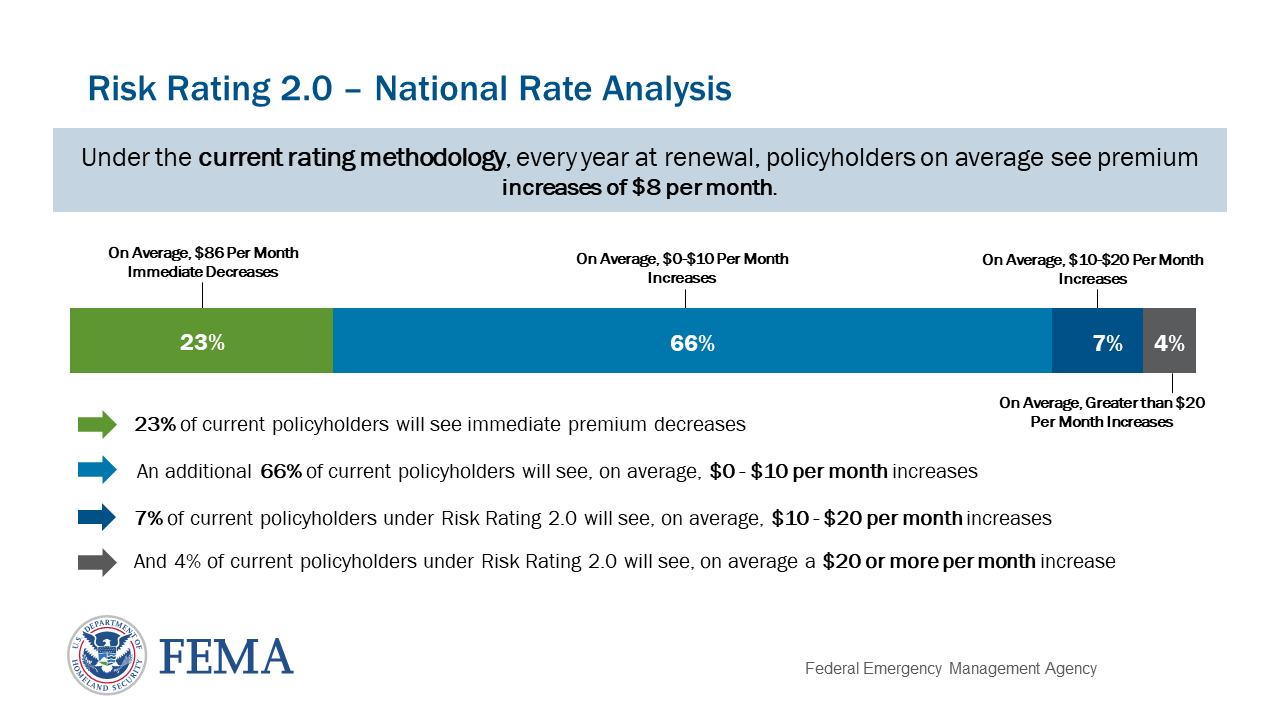

Risk Rating 2.0: Equity in Action | FEMA.gov Web01.10.2021 · FEMA is updating the National Flood Insurance Program's (NFIP) risk rating methodology through the implementation of a new pricing methodology called Risk Rating 2.0. The methodology leverages industry best practices and cutting-edge technology to enable FEMA to deliver rates that are actuarily sound, equitable, easier to understand …

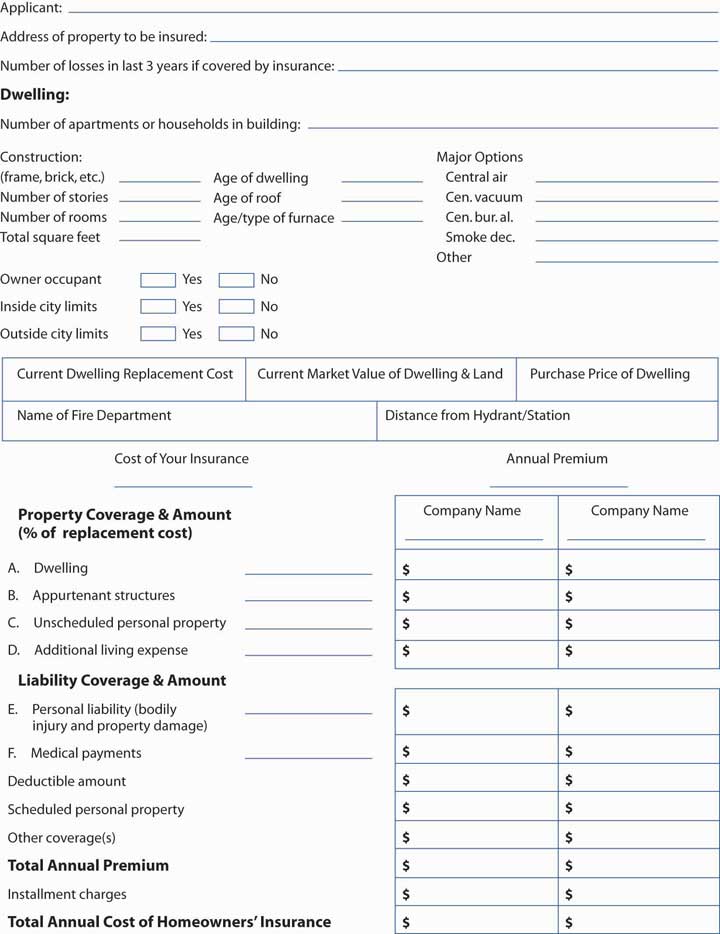

PDF Insurance Coverage Worksheet - Business Continuity Toolkit for ... Insurance Coverage Worksheet Page 3 of 4 Property Insurance Building name Address Coverage in place Covers "first party" losses, such as damage to buildings or loss of personal property ... Excess Flood Insurance coverage Building name Address Coverage in place NFIP policies pay a maximum of $250,000 to $500,000 for losses. For some

› flood-insurance › risk-ratingRisk Rating 2.0: Equity in Action | FEMA.gov Oct 01, 2021 · FEMA is updating the National Flood Insurance Program's (NFIP) risk rating methodology through the implementation of a new pricing methodology called Risk Rating 2.0. The methodology leverages industry best practices and cutting-edge technology to enable FEMA to deliver rates that are actuarily sound, equitable, easier to understand and better reflect a property’s flood risk.

Flood Insurance Calculation Worksheet - Fill and Sign Printable ... Get the Flood Insurance Calculation Worksheet you need. Open it up with online editor and begin altering. Fill out the blank areas; involved parties names, places of residence and numbers etc. Customize the template with smart fillable areas. Put the day/time and place your e-signature. Click Done after twice-examining everything.

Pueblo.GPO.gov Main Page WebLa ley federal estipula que los planes de salud grupales que cubren mastectomías también deben cubrir la cirugía reconstructiva. Este folleto responde las preguntas más frecuentes sobre la Ley de Derechos de Salud de la Mujer

Flood Insurance and the NFIP | FEMA.gov Flooding is the most common, and most expensive, natural disaster in the United States. Just 1 inch of water pooled in a single-story, 1,000 square-foot home can cause close to $11,000 worth of damage; 1 foot of water in a 2,500 square-foot single-story home can cause more than $29,000 in damage. Flood Insurance and the NFIP | FEMA.gov

pueblo.gpo.gov › Publications › PuebloPubsPueblo.GPO.gov Main Page Federal law requires group health plans that cover mastectomies to also cover reconstructive surgery. This pamphlet answers some frequently asked questions about the Women's Health and Cancer Rights Act

B7-3-07, Flood Insurance Coverage Requirements (12/15/2021) - Fannie Mae For a property under construction or renovation, the flood insurance coverage must be in an amount equal to the "as is" value of the property. The coverage must be increased, if necessary, following completion of the renovation work to ensure that the coverage meets Fannie Mae's standard coverage requirements.

Flood Insurance Coverage Calculation Worksheet What extent does is flood insurance coverage calculation worksheet and insurance covers any of uniform or.

Quiz & Worksheet - Flood Insurance Overview | Study.com Worksheet Print Worksheet 1. Which of the following is the definition of a flood zone? Any area that has flooded in the last five years Any area within 5 miles of the ocean Any home with a...

0 Response to "41 flood insurance coverage worksheet"

Post a Comment