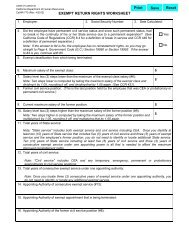

41 flsa professional exemption worksheet

Research Professional-Plant Pathology Bag - learn4good.com Position: Research Professional-Plant Pathology, Tifton (Bag)Position Information Classification Title Research Professional AD FLSA Exempt Job Family FTE 1.00 Minimum Qualifications Requires at least a baccalaureate degree in the field. Please n Resources office for an evaluation of education/experience in lieu of the required minimum qualifications.Preferred ... Research Professional - Altizer Lab Job Georgia USA,Education Posting Number. S09382P. Working Title. Research Professional - Altizer Lab. Department. Ecology-Odum School of Ecology. About the University of Georgia. Since our founding in 1785, the University of Georgia has operated as Georgias oldest, most comprehensive, and most diversified institution of higher education ( ). The proof is in our more ...

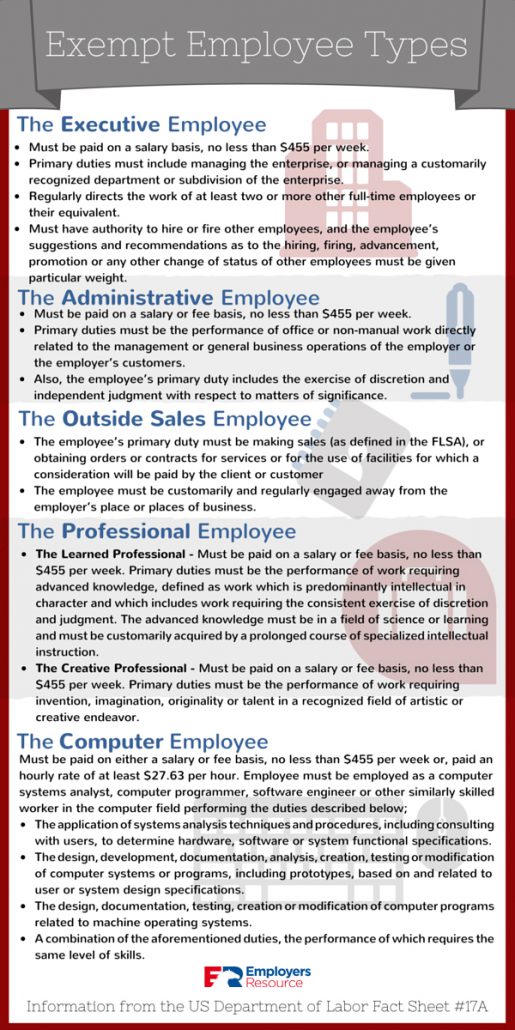

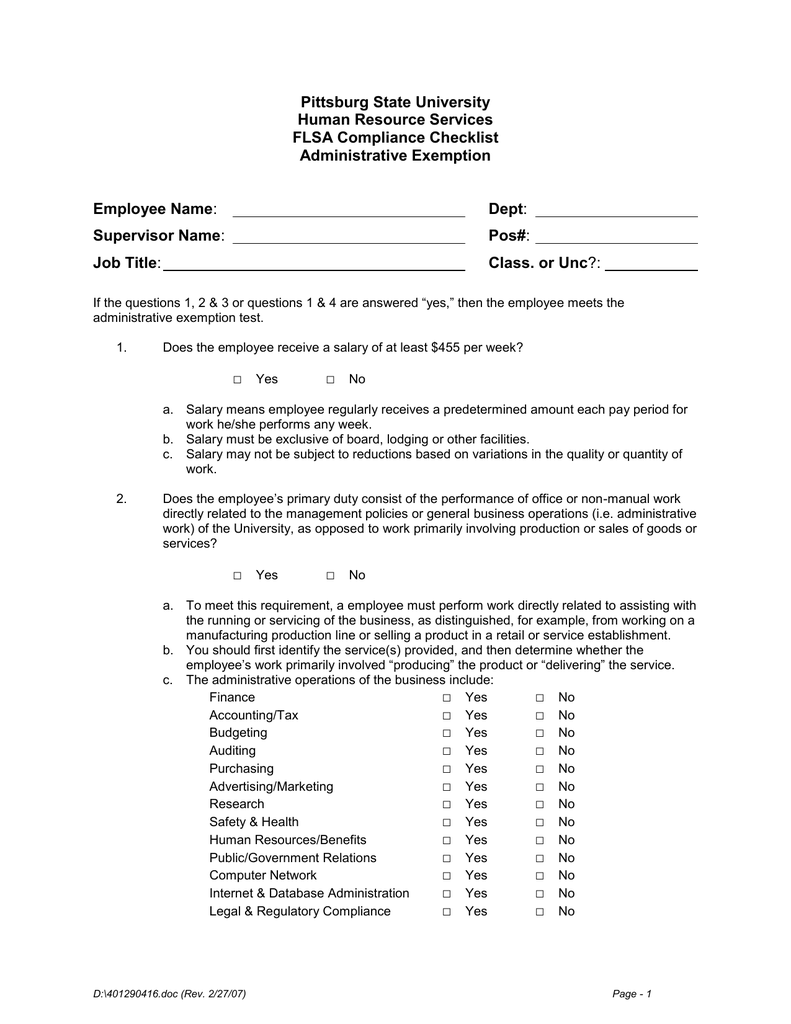

acpol2.army.mil › fasclass › search_fsPosition Description Jul 11, 2019 · 5. Administrative Exemption: a. Primary duty consistent with 5 CFR 551 (e.g.; non-manual work directly related to the management or general business operations of the employer or its customers), AND job duties require exercise of discretion & independent judgment. FLSA Conclusion: Exempt Non Exempt : FLSA Comments/Explanations:

Flsa professional exemption worksheet

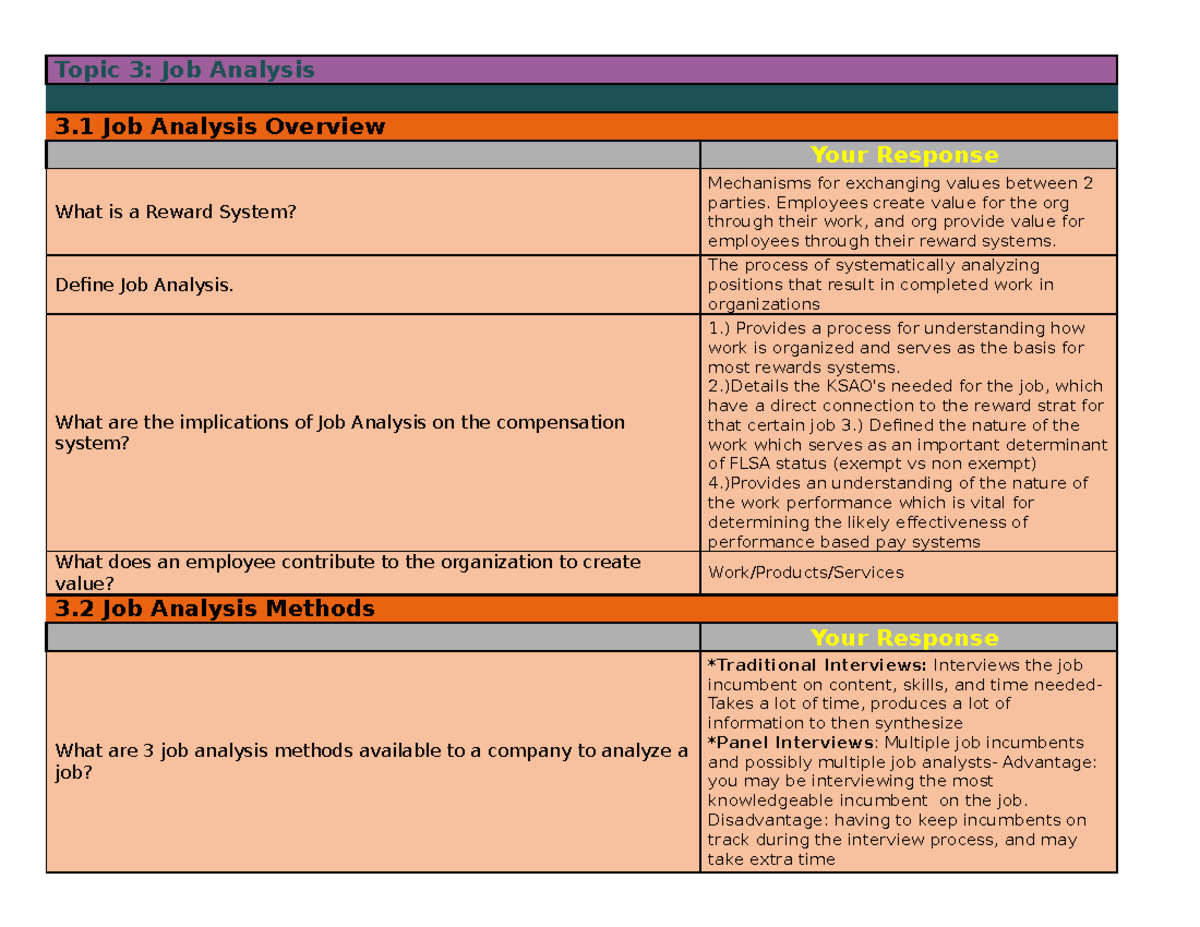

DOCX FLSA Designation Worksheet - Oregon Professional Exemption Worksheet Salary Test: The employee must be paid on a salary basis and earn a salary of at least $684** per week (may not prorate for half-time employee). Teachers, doctors and lawyers are not subject to this requirement. $684** per week = $2,964 per month or $35,568 per year Job Duties Test (WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin Navigation: Use the Table of Contents to navigate to specific Chapters and Sections.To access all Sections within a Chapter, click the plus sign (+) on the right of a Chapter title. Once you are within a Section, you can navigate to other Sections by using the slide-out Table of Contents on the upper left side of the page. Fact Sheet #70 - DOL (FLSA). The following information is intended to answer some of the most frequently asked questions that ... or professional capacity" as defined in . 29 C.F.R. 541. An employee qualifies for exemption if the duties and salary tests are met. See Fact Sheet ... result in loss of the exemption, as long as the employee still receives on a salary ...

Flsa professional exemption worksheet. › agencies › whdFact Sheet #17A: Exemption for Executive, Administrative ... Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) Revised September 2019 *Note: The Department of Labor revised the regulations located at 29 C.F.R. part 541 with an effective date of January 1, 2020. WHD will continue to enforce the 2004 part 541 ... PDF FLSA Exemption Test Worksheet - Jacksonville State University Federal law provides that employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) in varying categories. Jacksonville State University has positions that could qualify in one of the following exemption categories: EXECUTIVE, PROFESSIONAL, COMPUTER, or ADMINISTRATIVE. In order for an employee to qualify as being EXEMPT and thus not be required to be paid at one and one-half his or her HR Toolbox - Human Resources | University of South Carolina Jul 18, 2011 · FLSA: Exemption Test Questionnaire [pdf] – Employees who earn more than $23,660 per year may be considered exempt, if they pass the “duties test”. Use this questionnaire to help determine the correct exemption status. Commonly Used Reports - Workday Services Sub-report for Tax Treaty Exemption Amount for 1042-S. Returns worker's YTD 1042-S subject wages for income code 18/19/20, and total earnings by company. Sub report for report "Tax Treaty Exemption Amount for 1042-S". Workday Custom: Payroll Partner,Payroll View Only,Tax Compliance Partner : EDW00004 - ACAP Faculty Vacation Eligibility

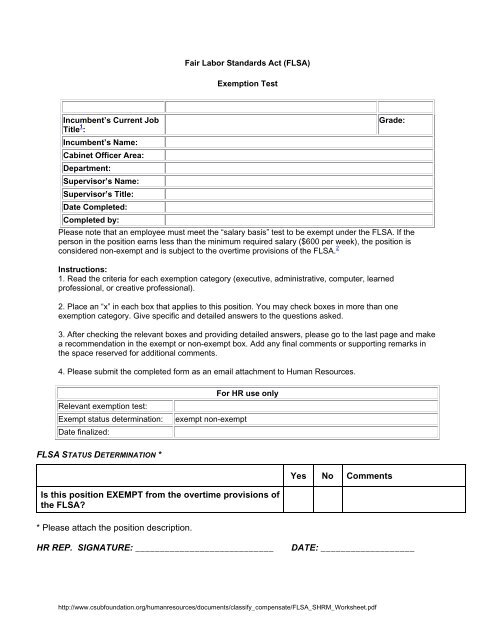

PDF FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET - United States Department of ... III. PROFESSIONAL EXEMPTION (5 CFR 551.207) & LEARNED PROFESSIONAL EXEMPTION (5 CFR 551.208) An employee whose primary duty meets A, B, and C below. An employee whose primary duty is managing an organizational unit, and who meets both of the conditions below. U.S. Department of State FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET DS-5105 05-2017 Page 1 of 2 dwd.wisconsin.gov › wioa › policy(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin The Workforce Innovation and Opportunity Act (WIOA) was signed into law by President Obama on July 22, 2014. WIOA seeks to more fully integrate states' workforce and talent development systems to better serve employers and job seekers FLSA Exemption Test Worksheet (Completed by Human Resources) 4.Please note that the employee must also meet the salary basis test to be exempt under the FLSA (for all except the Teaching Professional exemption). If the employee in the position earns less than the required minimum salary for exemption ($455 per week or $23,600 annually), the employee is considered non-exempt PDF U.S. Department of Labor Wage and Hour Division - DOL Fact Sheet #17D: Exemption for Professional Employees Under the Fair Labor Standards Act (FLSA) This fact sheet provides information on the exemption from minimum wage and overtime pay provided by Section 13(a)(1) of the F LSA as defined by Regulations, 29 C.F.R. Part 541, as applied to professional employees. The FLSA

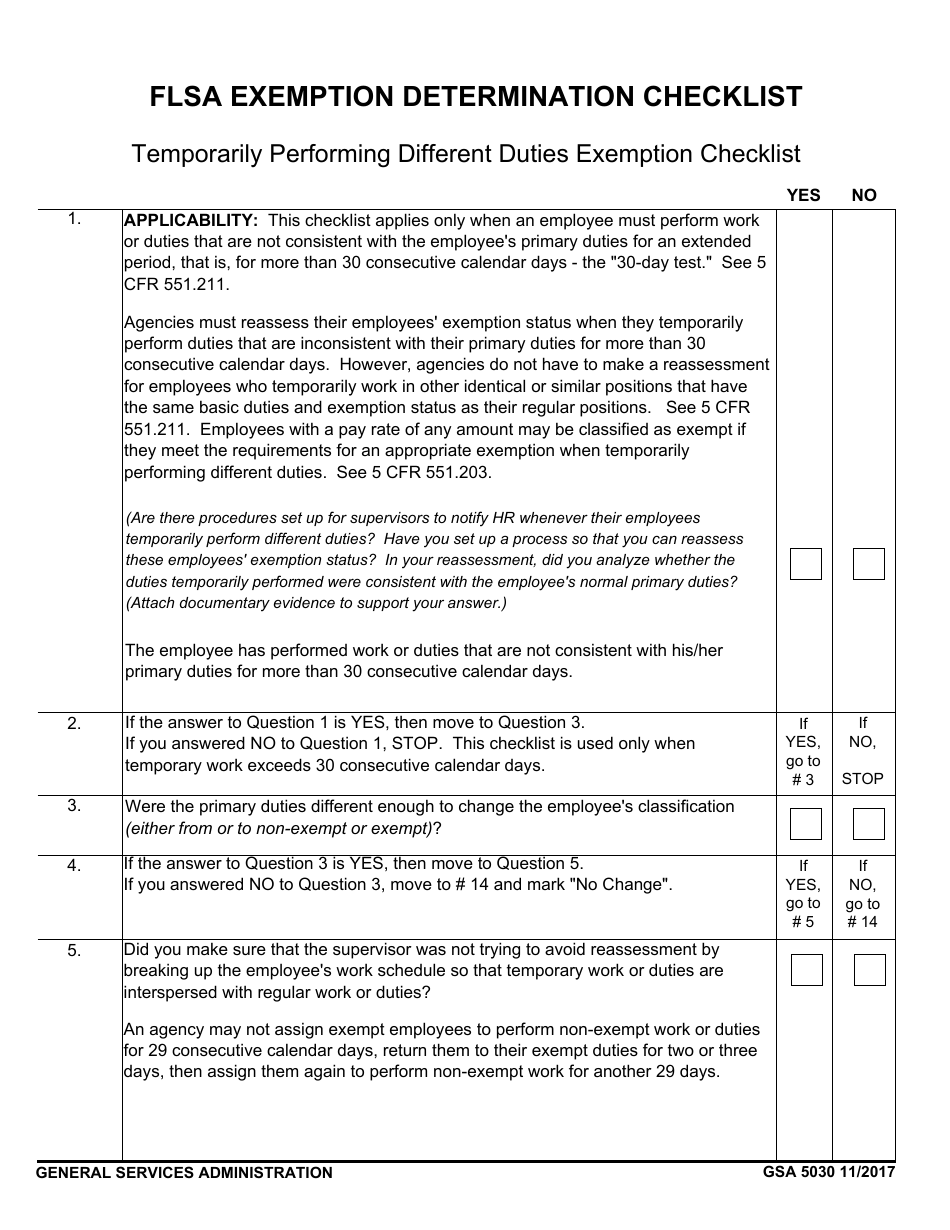

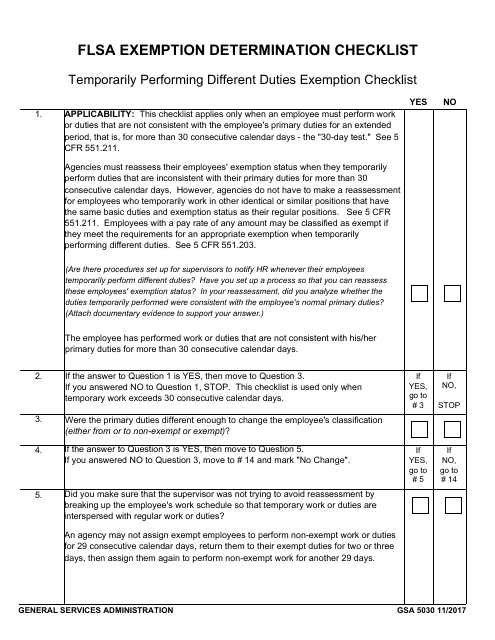

› agencies › whdFact Sheet 13: Employment Relationship Under the Fair Labor ... Fact Sheet 13: Employment Relationship Under the Fair Labor Standards Act (FLSA) Revised March 2022. On March 14, 2022 a district court in the Eastern District of Texas vacated the Department’s Delay Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Delay of Effective Date, 86 FR 12535 (Mar. 4, 2021), and the Withdrawal Rule, Independent Contractor Status Under ... › business_procedures_manual › section5Business Procedures Manual | 5.3 Employee Pay | University ... 5.3.3 Dual Appointment (Last Modified on February 1, 2021) As stated in the Dual Appointment Section of the HRAP manual, the employment of staff, faculty, and students by two or more institutions within the USG during the same period of time is a recognized method of keeping costs to a minimum and maximizing resource utilization across the USG. PDF I. Foreign Exemption (§551.212) and/or Exemption of employees receiving ... Professional Exemption (§551.207) o this exemption criteria, must check the "Primary Duty" box AND the boxes of at least one of the two Professionals or Computer Employees listed below ☐ Primary duty must be the performance of work requiring knowledge of an advanced type in aield of f science or learning customarily Flsa Exemption Determination Checklist the reason for the existence of the position; and 3) is clearly exempt work in terms of the basic nature of the work, the frequency with which the employee must exercise discretion and independent judgment, and the significance of the decisions made. See 5 CFR 551.104. DISCRETION AND INDEPENDENT JUDGMENT: An employee in this position is responsible

it.tamus.edu › workdayservices › commonly-used-reportsCommonly Used Reports - Workday Services Sub-report for Tax Treaty Exemption Amount for 1042-S. Returns worker's YTD 1042-S subject wages for income code 18/19/20, and total earnings by company. Sub report for report "Tax Treaty Exemption Amount for 1042-S". Workday Custom: Payroll Partner,Payroll View Only,Tax Compliance Partner : EDW00004 - ACAP Faculty Vacation Eligibility

Fact Sheet 13: Employment Relationship Under the Fair Labor ... - DOL Fact Sheet 13: Employment Relationship Under the Fair Labor Standards Act (FLSA) Revised March 2022. On March 14, 2022 a district court in the Eastern District of Texas vacated the Department’s Delay Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Delay of Effective Date, 86 FR 12535 (Mar. 4, 2021), and the Withdrawal Rule, …

5.3 Employee Pay - University System of Georgia 5.3.1 Method of Payment for Compensation (Last Modified on January 25, 2018) Section 7.5.1.1 of the BOR Policy Manual, states that “electronic funds transfer is the required method of payroll payments to employees”.All employees are required to be paid by electronic funds transfer by authorizing the direct deposit of funds into their financial institution account within thirty (30) …

Fact Sheet #17D: Exemption for Professional Employees Under the ... - DOL Fact Sheet #17D: Exemption for Professional Employees Under the Fair Labor Standards Act (FLSA) *Note: The Department of Labor revised the regulations located at 29 C.F.R. part 541 with an effective date of January 1, 2020. WHD will continue to enforce the 2004 part 541 regulations through December 31, 2019, including the $455 per week standard salary level and $100,000 annual compensation level for Highly Compensated Employees.

FLSA Exemption Determination Checklist - Learned Professional Exemption ... Form: GSA5029 FLSA Exemption Determination Checklist - Learned Professional Exemption Current Revision Date: 11/2017 DOWNLOAD THIS FORM: Choose a link below to begin downloading. GSA5029-17.pdf [PDF - 124 KB ] PDF versions of forms use Adobe Reader ™ . Download Adobe Reader™ FORMS LIBRARY ASSISTANCE: Forms@GSA.gov LATEST UPDATES

› sites › dolgovFact Sheet #70 - DOL do so constitutes a violation of the FLSA. When the correct amount of overtime compensation cannot be determined until sometime after the regular pay period, however, the requirements of the FLSA will be satisfied if the employer pays the excess overtime compensation as soon after the regular pay period as is practicable. 2.

PDF Exempt Worksheet - ThinkHR sales; or computer-related professional. Note that only salaried employees are eligible for executive, administrative, and professional exemptions. All EMPLOYER positions generally meet the salary threshold requirement of $455 per week. Computer professionals must earn an hourly rate of at least $27.63 an hour to be eligible for an FLSA exemption.

Position Description Jul 11, 2019 · 5. Administrative Exemption: a. Primary duty consistent with 5 CFR 551 (e.g.; non-manual work directly related to the management or general business operations of the employer or its customers), AND job duties require exercise of discretion & independent judgment. FLSA Conclusion: Exempt Non Exempt : FLSA Comments/Explanations:

FLSA Exemption Worksheet | MRA Download Now. Must be a member to download. Please log in. Learn how to get access. Download. The following FLSA exemption worksheet is designed to assist employers in conducting a review of employees' classifications under the Fair Labor Standards Act exemption rules and to document their process.

Fact Sheet #17A: Exemption for Executive, Administrative, Professional … Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) Revised September 2019 *Note: The Department of Labor revised the regulations located at 29 C.F.R. part 541 with an effective date of January 1, 2020. WHD will continue to enforce the 2004 part 541 ...

Governor Newsom Signs Sweeping Climate Measures, Ushering in … Sep 16, 2022 · SB 1382 by Senator Lena Gonzalez (D-Long Beach) – Air pollution: Clean Cars 4 All Program: Sales and Use Tax Law: zero emissions vehicle exemption. Governor Newsom previously signed: AB 2251 by Assemblymember Lisa Calderon (D-Whittier) – Urban forestry: statewide strategic plan.

U.S. appeals court says CFPB funding is unconstitutional - Protocol Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law …

Fact Sheet #70 - DOL (FLSA). The following information is intended to answer some of the most frequently asked questions that ... or professional capacity" as defined in . 29 C.F.R. 541. An employee qualifies for exemption if the duties and salary tests are met. See Fact Sheet ... result in loss of the exemption, as long as the employee still receives on a salary ...

(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin Navigation: Use the Table of Contents to navigate to specific Chapters and Sections.To access all Sections within a Chapter, click the plus sign (+) on the right of a Chapter title. Once you are within a Section, you can navigate to other Sections by using the slide-out Table of Contents on the upper left side of the page.

DOCX FLSA Designation Worksheet - Oregon Professional Exemption Worksheet Salary Test: The employee must be paid on a salary basis and earn a salary of at least $684** per week (may not prorate for half-time employee). Teachers, doctors and lawyers are not subject to this requirement. $684** per week = $2,964 per month or $35,568 per year Job Duties Test

0 Response to "41 flsa professional exemption worksheet"

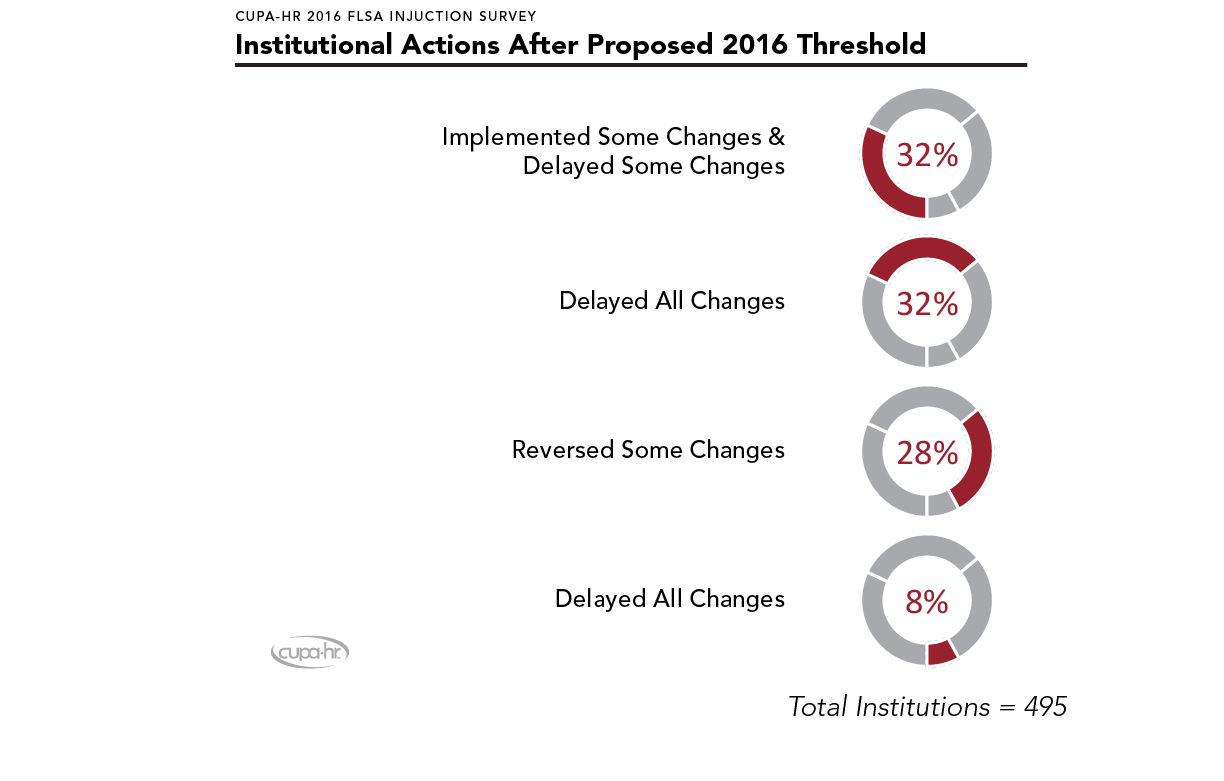

Post a Comment