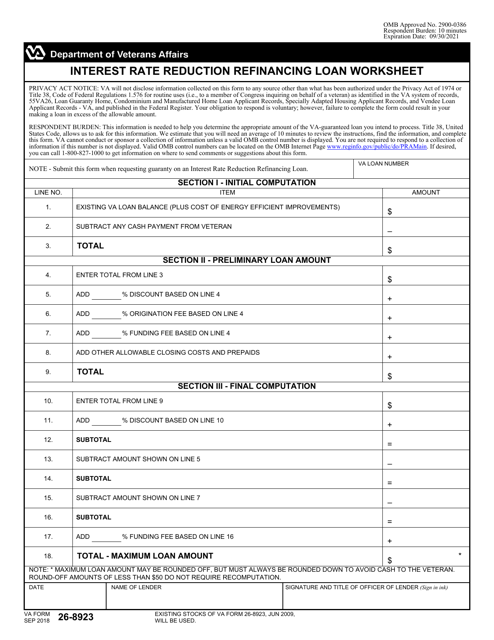

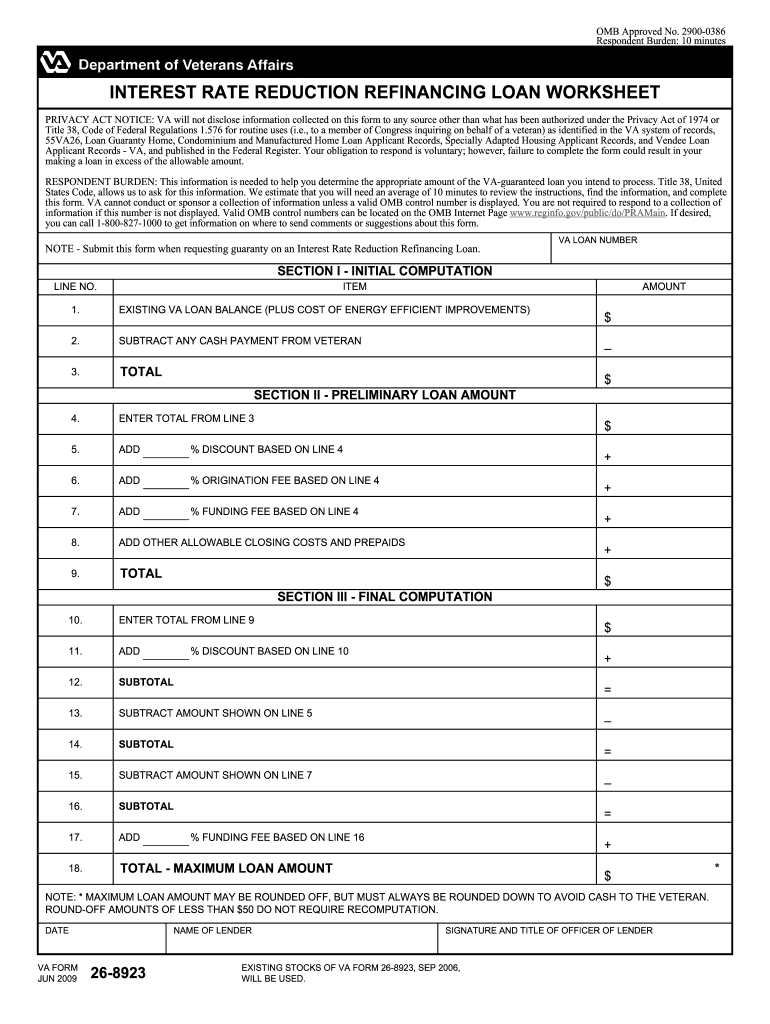

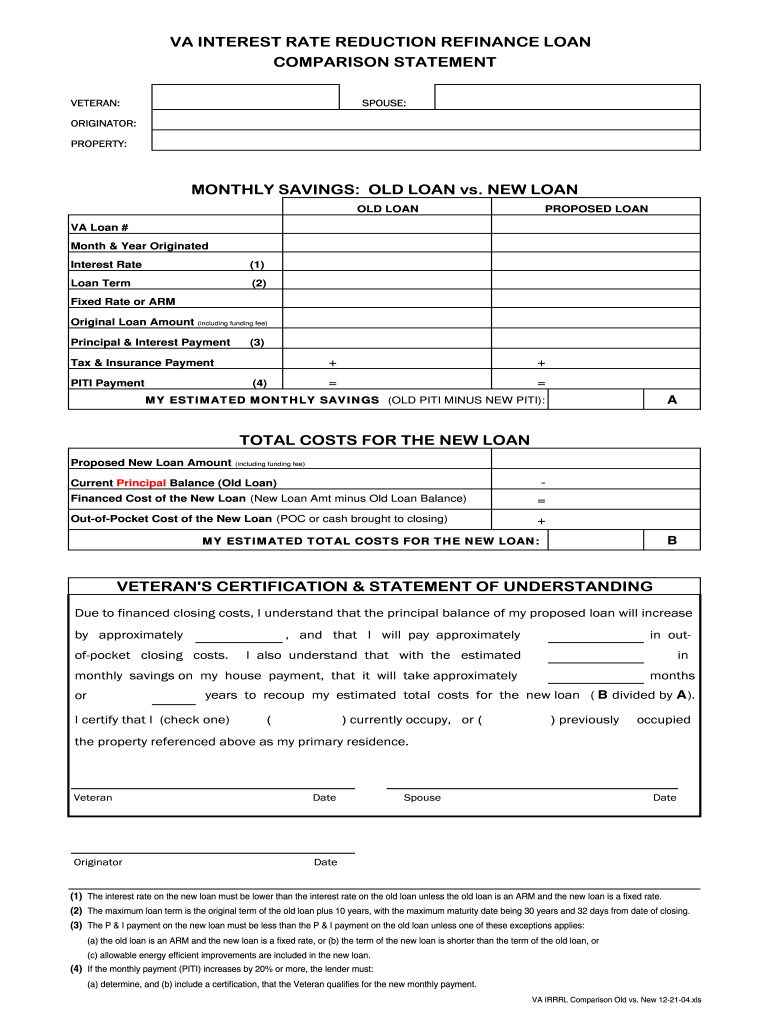

41 interest rate reduction refinancing loan worksheet

› learn › loan-modificationLoan Modification Vs. Refinance | Rocket Mortgage Sep 16, 2022 · A loan modification can also help you change the terms of your loan if your home loan is underwater. Contact your lender if you think you qualify for a modification. On the other hand, a refinance replaces your existing mortgage with a new loan. When you refinance, you can change your loan’s term, your interest rate and even your loan type. › publications › p530Publication 530 (2021), Tax Information for Homeowners The interest rate of the hypothetical mortgage is the annual percentage rate (APR) of the new mortgage for purposes of the Federal Truth in Lending Act. The principal of the hypothetical mortgage is the remaining outstanding balance of the certified mortgage indebtedness shown on the old MCC.

sao.wa.gov › bars_cash › reportingExpenditures of Federal Awards (SEFA/Schedule 16) - Office of ... Dec 16, 2021 · A loan to an entity is a balance sheet transaction and the government should debit Loan Receivables and credit Cash. A repayment of the loan requires debiting Cash and crediting Loan Receivables and Interest Revenue (3614000). There are no BARS codes specifically assigned to grants’ program revenues (neither principal nor interest).

Interest rate reduction refinancing loan worksheet

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... The rules for deducting interest vary, depending on whether the loan proceeds are used for business, personal, or investment activities. If you use the proceeds of a loan for more than one type of expense, you must allocate the interest based on the use of the loan's proceeds. Allocate your interest expense to the following categories. › publications › p527Publication 527 (2020), Residential Rental Property A loan or mortgage may end due to a refinancing, prepayment, foreclosure, or similar event. However, if the refinancing is with the same lender, the remaining points (OID) generally aren’t deductible in the year in which the refinancing occurs, but may be deductible over the term of the new mortgage or loan. › documents › 2022/11/01Loan Guaranty: Revisions to VA-Guaranteed or Insured Interest ... Nov 01, 2022 · (ii) In a case in which the loan being refinanced has a fixed interest rate and the refinancing loan will have an adjustable rate, the interest rate on the refinancing loan must not be less than 200 basis points less than the interest rate on the loan being refinanced. In addition, discount points may be included in the loan amount only if—

Interest rate reduction refinancing loan worksheet. › advice › debt-snowball-method-how-itWhat Is the Snowball Method and How Does It Work? - Debt.org Apr 16, 2013 · Find a solution that offers a lower interest rate and monthly payments that you can afford. The reasoning behind Solution No. 1 isn’t difficult: Unless it’s the debt with the smallest balance — putting it first on your list — the longer a debt with the highest interest rate is allowed to fester, the higher the total will be when you ... › documents › 2022/11/01Loan Guaranty: Revisions to VA-Guaranteed or Insured Interest ... Nov 01, 2022 · (ii) In a case in which the loan being refinanced has a fixed interest rate and the refinancing loan will have an adjustable rate, the interest rate on the refinancing loan must not be less than 200 basis points less than the interest rate on the loan being refinanced. In addition, discount points may be included in the loan amount only if— › publications › p527Publication 527 (2020), Residential Rental Property A loan or mortgage may end due to a refinancing, prepayment, foreclosure, or similar event. However, if the refinancing is with the same lender, the remaining points (OID) generally aren’t deductible in the year in which the refinancing occurs, but may be deductible over the term of the new mortgage or loan. › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... The rules for deducting interest vary, depending on whether the loan proceeds are used for business, personal, or investment activities. If you use the proceeds of a loan for more than one type of expense, you must allocate the interest based on the use of the loan's proceeds. Allocate your interest expense to the following categories.

0 Response to "41 interest rate reduction refinancing loan worksheet"

Post a Comment