41 ira deduction worksheet 2014

Publication 559 (2021), Survivors, Executors, and Administrators Net operating loss (NOL) carryback. Generally, an NOL arising in a tax year beginning in 2021 or later may not be carried back and instead must be carried forward indefinitely. However, farming losses arising in tax years beginning in 2021 or later may be carried back 2 years and carried forward indefinitely.For special rules for NOLs arising in 2018, 2019 or 2020, see Pub. 536, Net Operating ... Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

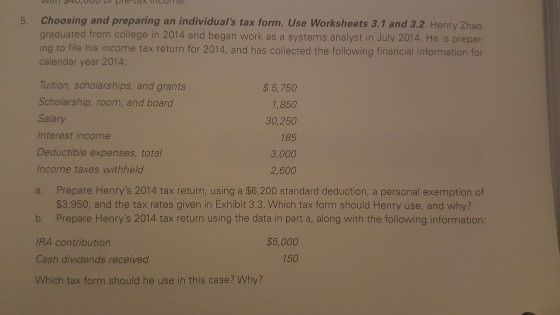

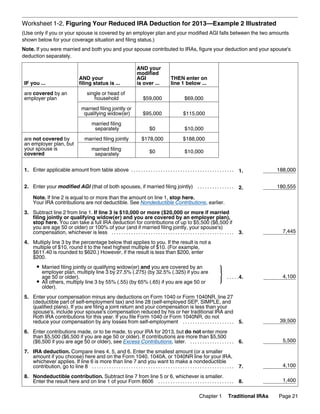

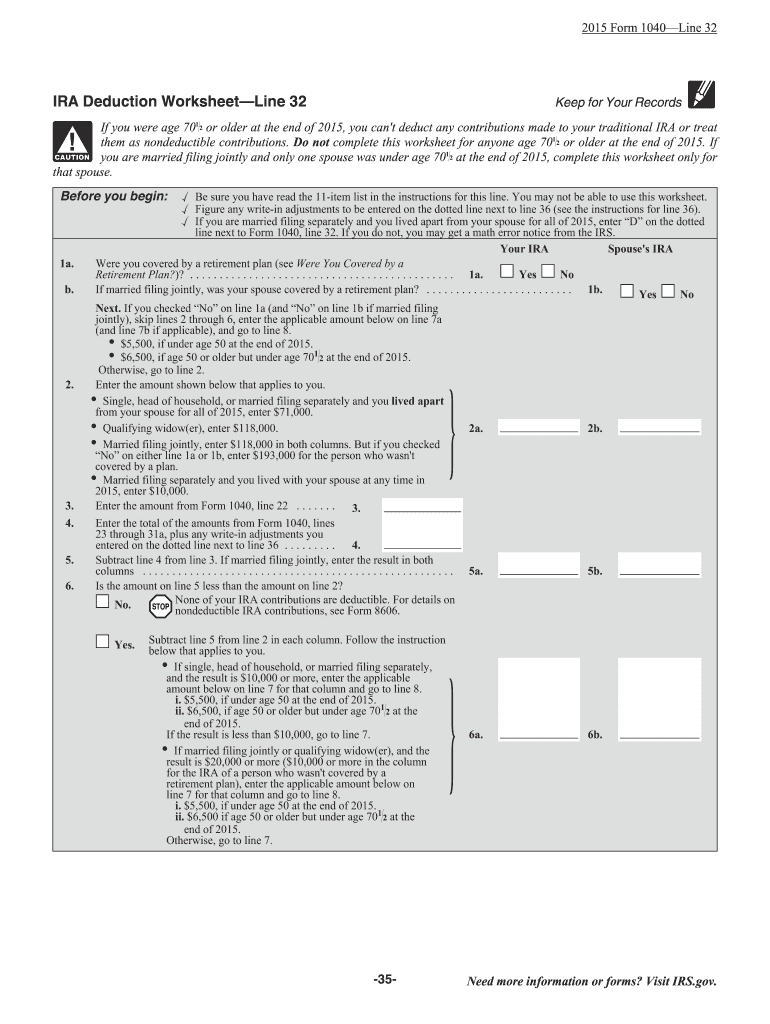

Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions.

Ira deduction worksheet 2014

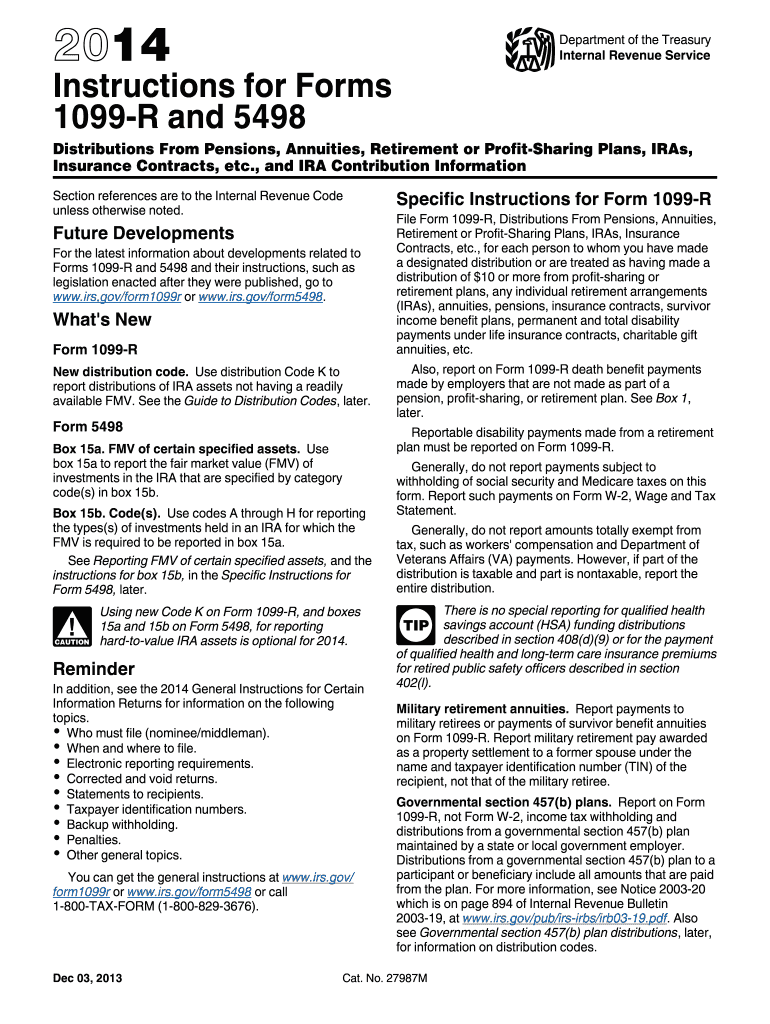

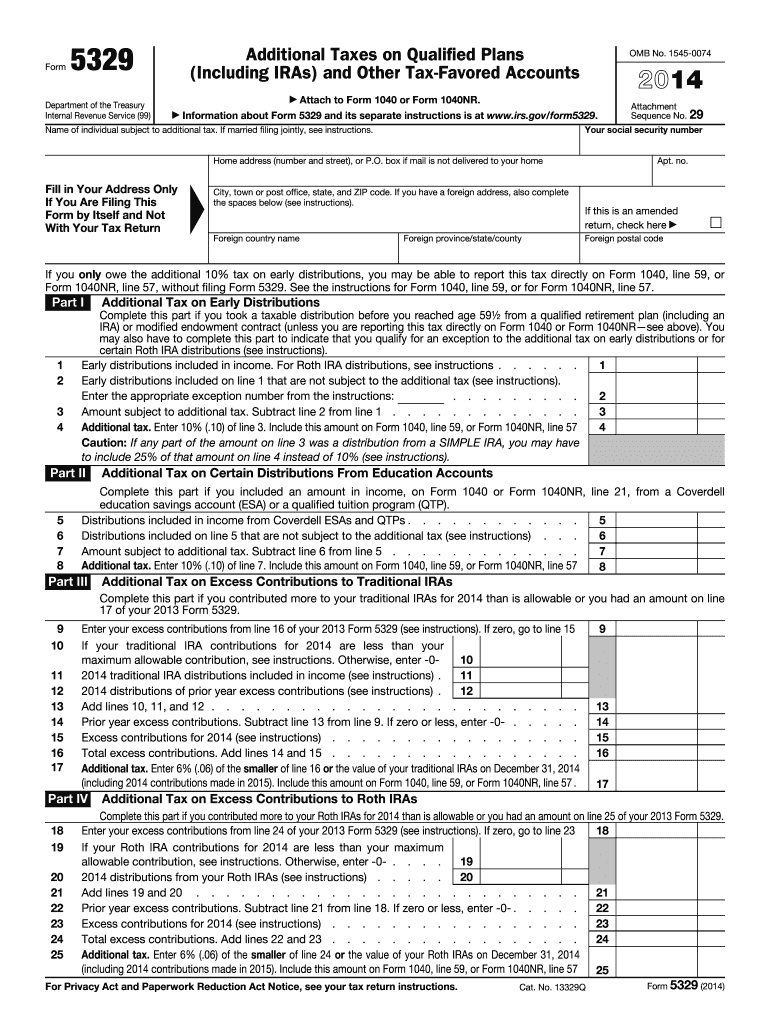

How To Report 2021 Backdoor Roth In TurboTax (Updated) Feb 04, 2022 · So I contributed for 2013 in May 2014 converting from Traditional IRA to Roth IRA the very next day. I received 2013 Form 5498 later in the month, showing the amount 5500 I had contributed. Thereafter I contributed to the Roth IRA for year 2014 itself, and now I have 2014 Form 1099-R, which shows $5500 with all the ticks/marks just like yours. Publication 17 (2021), Your Federal Income Tax | Internal ... If your modified AGI is $206,000 or more, you can’t take a deduction for contributions to a traditional IRA. See How Much Can You Deduct in chapter 9, later. Modified AGI limit for Roth IRA contributions. For 2021, your Roth IRA contribution limit is reduced (phased out) in the following situations. Publication 505 (2022), Tax Withholding and Estimated Tax Worksheet 2-3.2022 Estimated Tax Worksheet—Lines 1 and 9 Estimated Self-Employment Tax and Deduction Worksheet; Worksheet 2-4.2022 Estimated Tax Worksheet—Line 2 Standard Deduction Worksheet; Worksheet 2-5.2022 Estimated Tax Worksheet—Line 4 Qualified Dividends and Capital Gain Tax Worksheet

Ira deduction worksheet 2014. Publication 504 (2021), Divorced or Separated Individuals Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 505 (2022), Tax Withholding and Estimated Tax Worksheet 2-3.2022 Estimated Tax Worksheet—Lines 1 and 9 Estimated Self-Employment Tax and Deduction Worksheet; Worksheet 2-4.2022 Estimated Tax Worksheet—Line 2 Standard Deduction Worksheet; Worksheet 2-5.2022 Estimated Tax Worksheet—Line 4 Qualified Dividends and Capital Gain Tax Worksheet Publication 17 (2021), Your Federal Income Tax | Internal ... If your modified AGI is $206,000 or more, you can’t take a deduction for contributions to a traditional IRA. See How Much Can You Deduct in chapter 9, later. Modified AGI limit for Roth IRA contributions. For 2021, your Roth IRA contribution limit is reduced (phased out) in the following situations. How To Report 2021 Backdoor Roth In TurboTax (Updated) Feb 04, 2022 · So I contributed for 2013 in May 2014 converting from Traditional IRA to Roth IRA the very next day. I received 2013 Form 5498 later in the month, showing the amount 5500 I had contributed. Thereafter I contributed to the Roth IRA for year 2014 itself, and now I have 2014 Form 1099-R, which shows $5500 with all the ticks/marks just like yours.

0 Response to "41 ira deduction worksheet 2014"

Post a Comment